- Home

- »

- Clothing, Footwear & Accessories

- »

-

Jewelry Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Jewelry Market Size, Share & Trends Report]()

Jewelry Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Necklace, Ring), By Material (Platinum, Gold), By Distribution Channel (Offline Retail Stores, Online Retail Stores), By End-user (Men, Women, Children), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-106-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Jewelry Market Summary

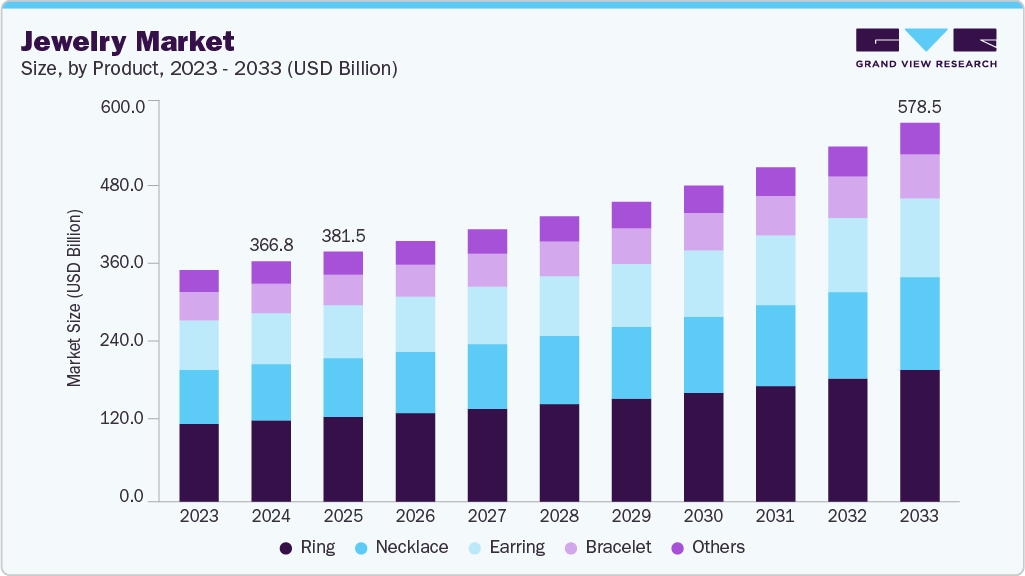

The global jewelry market size was estimated at USD 366.79 billion in 2024 and is projected to reach USD 578.45 billion by 2033, growing at a CAGR of 5.3% from 2025 to 2033. The global jewelry industry’s growth is primarily driven by rising disposable incomes, evolving fashion trends, and increasing demand for luxury and personalized accessories.

Key Market Trends & Insights

- Asia Pacific held the largest share of the global jewelry market in 2024, accounting for 60.2%.

- The U.S. led the North America jewelry industry in 2024 with a revenue share of 92.6%.

- By product, the ring segment held the largest market share, with 33.8% in 2024.

- By material, the gold jewelry segment accounting for a largest share of 54.9% in 2024.

- By distribution channel, the offline retail stores segment led the market with a share of 84.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 366.79 Billion

- 2033 Projected Market Size: USD 578.45 Billion

- CAGR (2025-2033): 5.3%

- Asia Pacific: Largest market in 2024

As consumer spending power increases and fashion-conscious populations grow, the demand for fine and fashion jewelry continues to rise. Additionally, there is a growing emphasis on sustainability and ethical sourcing, prompting consumers to choose jewelry made from responsibly sourced materials. These trends, along with the influence of digital platforms and e-commerce, are reshaping the global jewelry market and driving its ongoing evolution.

The global jewelry market growth is driven by a combination of rising consumer demand for luxury and personalized items, along with rapid technological advancements. Innovations such as 3D printing and smart jewelry are drawing interest from tech-savvy consumers, offering new levels of customization and functionality. For instance, in June 2025, Platinum Guild International announced the introduction of its first 3D printed platinum jewelry collection under the ‘Tùsaire’ collection. The product line will feature jewelry made from platinum and titanium, including necklaces, bracelets, rings, and earrings.

Moreover, collaborations between renowned designers and major fashion brands are enhancing brand value and market visibility. Additionally, social media platforms and influencer marketing are playing a pivotal role in shaping consumer preferences and boosting online sales. Leading companies are increasingly adopting sustainable practices and digital tools to cater to evolving consumer expectations and remain competitive in the dynamic global market.

Product Insights

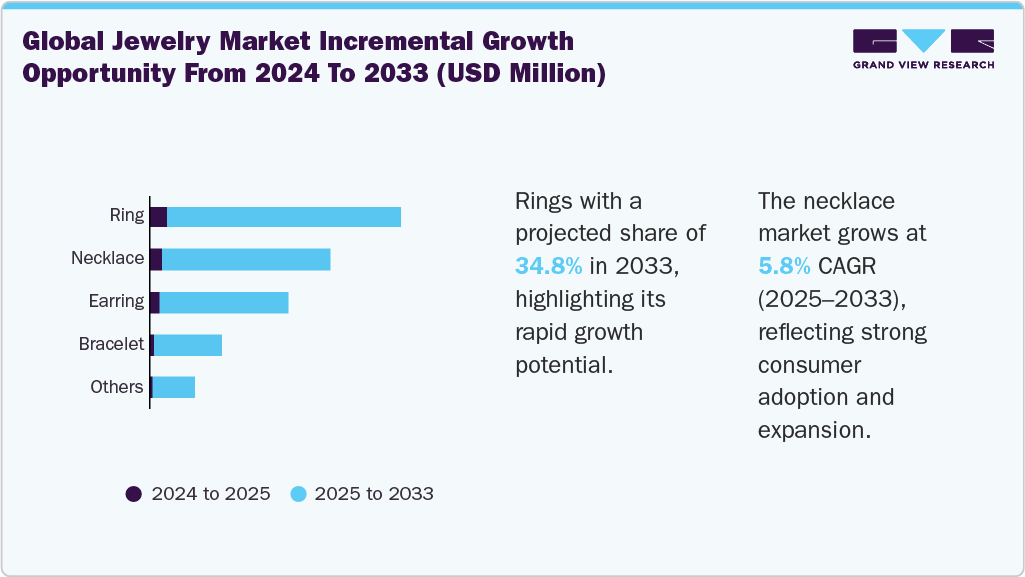

The rings accounted for the largest share of 33.8% of the global revenue in 2024. The global jewelry industry, especially for rings, is influenced by multiple key drivers such as increasing disposable income, rising demand for luxury and customized pieces, and the deep-rooted cultural importance of rings in engagements, weddings, and other milestones. A growing shift toward sustainable and ethically sourced materials is also playing a major role in shaping consumer choices. Moreover, global fashion trends, celebrity endorsements, and the rapid growth of online retail platforms are enhancing product visibility and accessibility, fueling sales and expanding the market worldwide.

The necklace market is projected to grow at the fastest CAGR of 5.8% from 2025 to 2033. The segment’s growth is propelled by shifting fashion preferences, a growing appetite for statement and personalized pieces, and increasing disposable incomes across emerging and developed markets. Cultural traditions and gifting practices, particularly during holidays, weddings, and milestones, continue to drive demand worldwide. For instance, a survey published by YouGov in June 2025, about 33% of men in the UK purchased necklaces & chains for themselves. The rapid expansion of e-commerce platforms and the influence of social media and influencer marketing have significantly boosted the visibility and appeal of designer and customized necklaces. Additionally, modern consumers are placing greater emphasis on sustainability and ethical sourcing, prompting brands to adopt transparent and responsible practices in their supply chains.

Material Insights

The gold jewelry market segment accounted for the largest revenue share of 54.9% in 2024. The growth is driven by its long-standing status as a symbol of wealth, cultural heritage, and enduring elegance. Consumers across regions are increasingly attracted to a mix of traditional and modern gold designs, with strong demand for yellow, white, and rose gold variations. Gold jewelry also benefits from its dual role as both a fashion accessory and a form of investment, especially in times of economic uncertainty. Countries with rich traditions in gold craftsmanship, such as India, China, and Italy, play a major role in shaping global demand. Furthermore, contemporary trends such as layering, minimalist styling, and personalized touches have heightened the appeal of lightweight and versatile gold jewelry worldwide.

The diamond jewelry market is projected to grow at the fastest CAGR of 5.3% from 2025 to 2033. The growth is fueled by its strong association with luxury, romance, and enduring value. Engagement rings, wedding bands, and milestone gifts continue to be primary demand drivers, supported by universal cultural traditions and emotional significance. Advances in diamond cutting, grading, and certification technologies have enhanced product transparency and boosted consumer confidence. Additionally, the rising popularity of lab-grown diamonds, especially among younger, sustainability-minded consumers, is reshaping the market landscape. According to the Plumb Club’s 2023 survey, about 17% of respondents preferred purchasing lab-grown diamonds, while 33% favored receiving lab-grown diamonds. Moreover, the presence of prestigious global brands, coupled with the growing demand for bespoke and personalized designs, further elevates the appeal of diamond jewelry across both premium and accessible segments worldwide.

Distribution Channel Insights

The jewelry sales through the offline retail stores accounted for the largest share of around 84.3% of the global revenue in 2024. In the global jewelry market, offline retail channels such as jewelry stores, department stores, and hypermarkets continue to play a crucial role due to their ability to deliver personalized service, hands-on product evaluation, and immediate purchase gratification. Jewelry stores offer a high-end shopping experience with expert guidance, tailored recommendations, and access to exclusive or custom collections. Meanwhile, department stores and hypermarkets serve the mass-market segment by providing a wide range of affordable fashion jewelry in convenient locations. According to the data published in November 2024, 70% of the D2C jewelry brands operate both offline and online, but the offline stores receive 20% more conversions compared to the online stores. These physical retail outlets also benefit from longstanding consumer trust, brand recognition, and the tactile experience that remains important for many jewelry buyers worldwide. According to the Gem and Jewellery Export Promotion Council (GJEPC) data published in January 2023, Indian jewellery brand Tanishq, part of the Tata Group, has inaugurated its seventh boutique store in the UAE.

The jewelry sales through the online retail stores are projected to grow at the fastest CAGR of 7.9% from 2025 to 2033. Online retail channels are experiencing significant growth in the global jewelry market, fueled by increasing internet penetration, mobile commerce, and evolving consumer preferences. Shoppers worldwide are drawn to the convenience of browsing and purchasing jewelry online, along with access to a broader range of styles, brands, and price points. Digital platforms offer features such as virtual try-ons, high-resolution imagery, customization options, and real-time customer reviews, which collectively elevate the online shopping experience. Global brands such as Swarovski, Cartier, and Tiffany & Co. offer virtual try-ons for their jewelry collection by integrating AR (augmented reality) technology, offering an innovative experience for consumers. Furthermore, e-commerce provides a vital platform for independent designers and niche labels to reach international audiences, challenging traditional retail models and reshaping the global jewelry landscape.

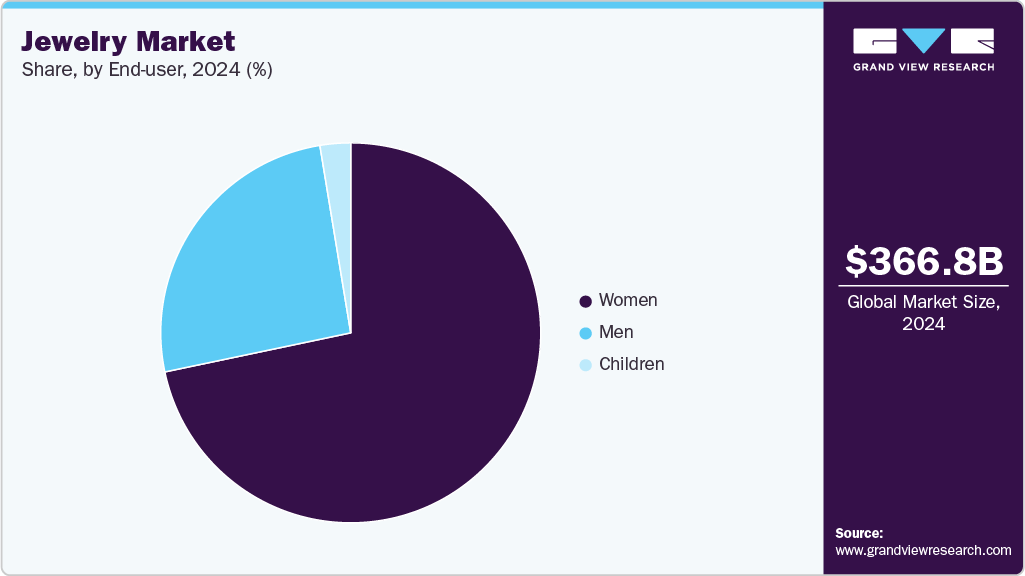

End-user Insights

The women’s jewelry market accounted for the largest share of around 71.7% of the revenue in 2024. Women continue to be the primary consumer segment in the global market, driving demand across luxury, fashion, and daily wear categories. Jewelry is widely purchased for self-adornment, special occasions, cultural traditions, and gifting purposes. Globally, popular choices include rings, earrings, necklaces, bracelets, and bangles, with preferences varying by region and lifestyle. Design trends span from timeless classics to bold, modern styles, reflecting diverse cultural influences and personal aesthetics. Growing awareness around ethical sourcing, sustainability, and the desire for personalized pieces are shaping purchasing decisions, reinforcing women's influence on global jewelry trends. For instance, according to the data published in July 2024, about 58% of women wish to receive jewelry as a gift, fueling the market growth.

The men’s jewelry market is projected to grow at the fastest CAGR of 4.6% from 2025 to 2033. The growth is witnessing steady growth, supported by shifting cultural attitudes and the rising popularity of jewelry as a means of self-expression. Men are increasingly embracing accessories such as rings, bracelets, necklaces, cufflinks, and chains, with designs ranging from understated minimalism to bold, statement pieces. This trend is especially prominent among younger generations across regions, who view jewelry as an extension of personal style and identity. Influences from streetwear, pop culture, and social media continue to shape demand, making men’s jewelry a dynamic and expanding segment of the global market. According to the data published in May 2024, as per a survey conducted among 1,002 men in the U.S., about 78% believe that men’s jewelry is becoming increasingly mainstream.

Regional Insights

The North America jewelry market accounted for a revenue share of 22.3% in 2024. Demand for jewelry in North America is driven by rising disposable income, evolving fashion trends, and a strong culture of gifting for occasions such as weddings, anniversaries, and holidays. Consumers are increasingly seeking personalized and ethically sourced pieces. The influence of social media and celebrity endorsements also fuels interest in both luxury and everyday jewelry. Additionally, the convenience of online shopping continues to expand market reach across demographics.

U.S. Jewelry Market Trends

The U.S. led the North America jewelry industry in 2024, holding the largest market share with 92.6% of the region’s total revenue. In the U.S., jewelry demand is fueled by high consumer spending, a strong gifting culture, and growing interest in self-expression through fashion. Personalization, sustainability, and brand storytelling are increasingly important to American buyers. The rise of e-commerce and digital marketing has also made jewelry more accessible to a wider audience. According to the data published in April 2024, an average American household spends USD 434 annually on jewelry. Furthermore, trends influenced by celebrities, social media, and seasonal promotions continue to shape purchasing behavior.

Europe Jewelry Market Trends

The jewelry industry in Europe is projected to grow at the fastest CAGR of 5.0% from 2025 to 2033. The growth is driven by a blend of tradition, fashion consciousness, and increasing preference for personalized and ethically sourced pieces. Consumers value craftsmanship and design, with a strong interest in both luxury and affordable fashion jewelry. Occasions such as weddings, anniversaries, and holidays continue to support consistent purchasing. Additionally, digital platforms and influencer marketing are expanding access and shaping modern jewelry trends across the region. According to the survey published by YouGov in June 2025, about 17% of men in the UK bought jewelry such as chains, bracelets, and earrings for themselves.

The UK jewelry market is projected to grow at the fastest CAGR of 5.7% from 2025 to 2033. Jewelry demand in the UK is influenced by a blend of tradition, modern fashion trends, and increasing interest in sustainable luxury. Consumers are drawn to both heritage brands and emerging designers that offer unique, story-driven pieces. Seasonal trends, cultural celebrations, and social events like weddings play a key role in driving purchases. Additionally, the growing popularity of customizable and gender-neutral designs is reshaping consumer preferences across age groups. According to the survey published by YouGov in June 2025, about 33% men in a survey of 1,000 British men purchased necklaces and chains jewelry for themselves.

Asia Pacific Jewelry Market Trends

The Asia Pacific led the jewelry industry and accounted for the largest revenue share of 60.2% in 2024. The region is propelled by a rising middle class, urbanization, and increasing spending on lifestyle and luxury products. The cultural importance of gold and precious stones in countries such as India and China significantly supports consistent demand. According to the data published by the World Gold Council, Gold continues to lead China’s jewelry market in 2024. Moreover, younger consumers are embracing contemporary designs, often influenced by K-pop, anime, and regional fashion trends. Rapid digitalization and mobile commerce further enhance access to both global and local jewelry brands.

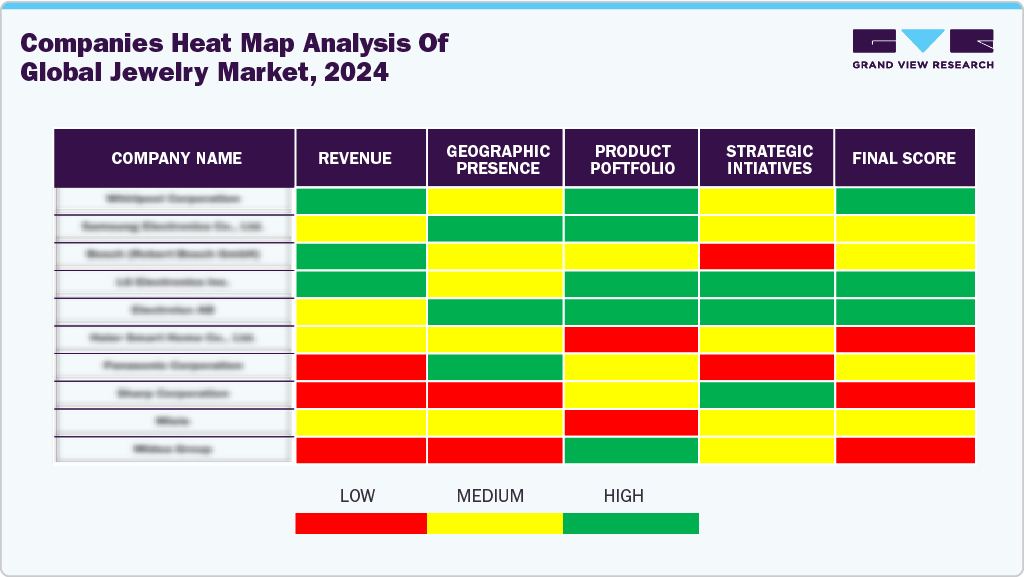

Key Jewelry Company Insights

Many brands in the global jewelry market have recognized untapped opportunities within their product portfolios and are actively working to capitalize on these gaps. This includes launching innovative designs, expanding customization options, and tailoring marketing strategies to align with evolving consumer tastes and cultural trends. By addressing niche segments and emerging preferences, these brands aim to increase their market share and strengthen their competitive positioning worldwide.

Key Jewelry Companies:

The following are the leading companies in the jewelry market. These companies collectively hold the largest market share and dictate industry trends.

- Cartier

- BVLGARI

- Damas Jewellery

- Titan Company Limited

- Malabar Gold & Diamonds.

- De Beers Group

- LVMH

- Swarovski

- Kalyan Jewellers

- Pandora

Recent Developments

-

In June 2025, De Beers introduced Ombré Desert Diamonds, its first flagship “beacon” jewelry concept in over a decade, showcasing multi-stone pieces inspired by desert hues to reignite interest in naturally colored diamonds. The company also introduced Origin, De Beers Group, a polished diamond program offering full provenance via blockchain-backed traceability, enriching consumer connection through origin, rarity, and social-impact storytelling.

-

In May 2025, Shanghai inaugurated the International Jewelry Fashion Functional Zone in Huangpu District, aiming to establish the city as a global jewelry and fashion hub. The initiative includes a comprehensive three-year development plan featuring 24 strategic tasks across six key categories, such as brand incubation, designer talent cultivation, and immersive retail experiences.

-

In December 2024, Indian jewelry brand Tanishq, part of the Tata Group, launched its largest flagship boutique in the Dubai Gold Souk Extension, spanning 5,000 sq ft and showcasing over 10,000 meticulously crafted pieces, from everyday elegance to bespoke bridal collections.

Jewelry Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 381.54 billion

Revenue Forecast in 2033

USD 578.45 billion

Growth rate

CAGR of 5.3% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, distribution channel, end-user, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Cartier; BVLGARI; Damas Jewellery; Titan Company Limited; Malabar Gold & Diamonds.; De Beers Group; LVMH; Swarovski; Kalyan Jewellers; Pandora

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Jewelry Market Report Segmentation

This report forecasts revenue growth at the global, regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global jewelry market report based on product, material, distribution channel, end-user, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Necklace

-

Ring

-

Earring

-

Bracelet

-

Others

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Platinum

-

Gold

-

Diamond

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline Retail Stores

-

Supermarkets & Hypermarkets

-

Jewelry Stores

-

-

Online Retail Stores

-

-

End-user Outlook (Revenue, USD Million, 2021 - 2033)

-

Men

-

Women

-

Children

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global jewelry market size was estimated at USD 366.79 billion in 2024 and is expected to reach USD 381.54 billion in 2025.

b. The global jewelry market is expected to grow at a compound annual growth rate (CAGR) of 5.3 % from 2025 to 2033 to reach USD 578.45 billion by 2033.

b. The ring market accounted for a revenue share of 33.8% in 2024, driven by strong demand for engagement, weddings, and fashion rings. This growth was further supported by increasing disposable incomes and a rising preference for personalized jewelry.

b. Some key players operating in the global jewelry market include Cartier, BVLGARI, Damas Jewellery, Titan Company Limited, Malabar Gold & Diamonds, and De Beers Group.

b. Key factors driving growth in the global jewelry market include increasing consumer preference for personalized and luxury jewelry, growing disposable incomes, and rising demand for branded and sustainable products. Market expansion is further supported by digital transformation in retail, global fashion trends, and the popularity of fine jewelry in special occasions such as weddings, engagements, and gifting.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.