- Home

- »

- Beauty & Personal Care

- »

-

Hand Sanitizer Market Size, Share & Trends Report, 2030GVR Report cover

![Hand Sanitizer Market Size, Share & Trends Report]()

Hand Sanitizer Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Gel, Foam, Wipes), By Distribution Channel (Hypermarket & Supermarket, Convenience Store), By Region, And Segment Forecast

- Report ID: GVR-3-68038-249-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Hand Sanitizer Market Summary

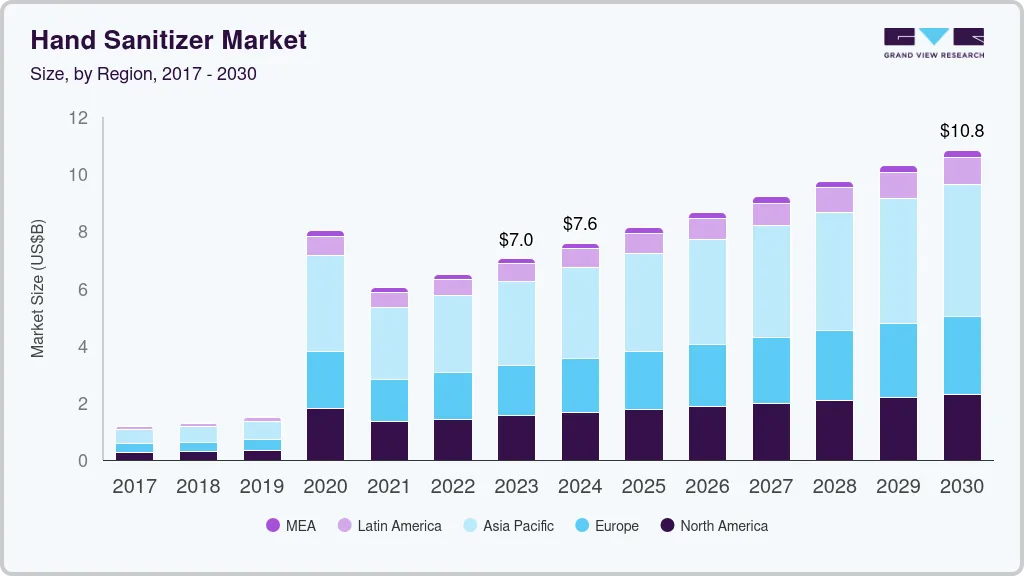

The Global Hand Sanitizer Market size was estimated at USD 7.04 billion in 2023 and is projected to reach USD 10.84 billion by 2030, growing at a CAGR of 6.1% from 2024 to 2030. Rising global awareness regarding sanitation and personal hygiene is expected to drive the product demand as it is an antiseptic solution, which is used as an alternative to soap and water.

Key Market Trends & Insights

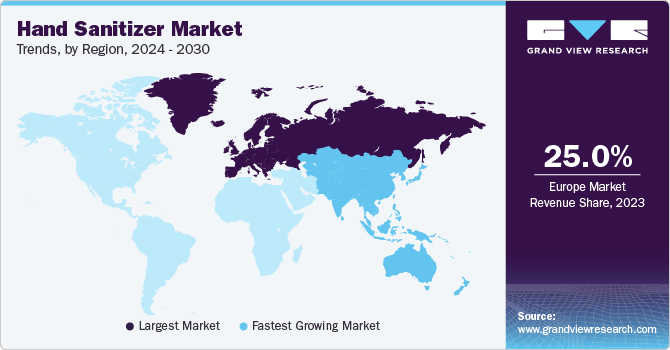

- The Europe hand sanitizer market accounted for a revenue share of 25% in 2023.

- By product, the gel-based hand sanitizer segment held the largest share of 46.4% in 2023.

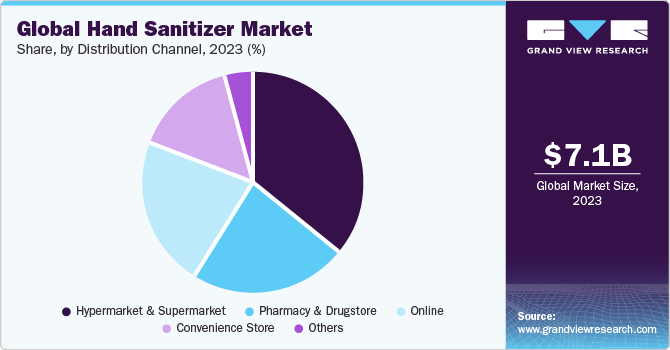

- By distribution channel, the hypermarket & supermarket segment accounted for the largest share of 37.7% of the global revenue in 2023.

Market Size & Forecast

- 2023 Market Size: USD 7.04 Billion

- 2030 Projected Market Size: USD 10.84 Billion

- CAGR (2024-2030): 6.1%

- Europe: Largest market in 2023

- Asia Pacific: Fastest growing market

Moreover, it helps in preventing some of the most infectious diseases, including COVID-19, norovirus, influenza, meningitis, hand, foot, and mouth disease, pertussis (whooping cough), and methicillin-resistant staphylococcus aureus (MRSA). The COVID-19 pandemic has called for the increased use of hand sanitizers worldwide in public facilities, transportation, hospitals, nursing homes, and even common households to mitigate the virus burden.

Active ingredients, such as ethyl alcohol, used to manufacture sanitizers are recommended for use against COVID-19 viruses, which is claimed to be effective against SARS CoV-2 virus, by The United States Food and Drug Administration (FDA). Such factors are likely to boost the market growth. Health and hygiene concerns are increasing worldwide. The market has been witnessing significant developments in the industry worldwide in the wake of the pandemic. However, with supply chain disruptions and wide supply-demand gaps worldwide, the industry faced significant challenges in ramping up manufacturing capacities to help mitigate the supply shortage.

To address this supply shortage, several companies have begun leveraging their mass production capabilities to manufacture these products for their domestic markets. For instance, in April 2020 Honeywell announced the expansion of its manufacturing operations at two chemical manufacturing facilities to produce and donate hand sanitizer to government agencies in response to shortages caused by the COVID-19 pandemic. The company’s sites in Muskegon, Michigan, Seelze, and Germany, produced these products for two months, May and June 2020, for government agencies, and institutions in need. However, third-party manufacturers, or contract manufacturers, were critical to major brands in increasing their output in 2020-2021.

For instance, in April 2020, SC Johnson, a global manufacturer of household and professional cleaning and disinfecting products, converted a line reserved for testing new products to produce up to 75,000 bottles of hand sanitizer per month for health workers, first responders, and the company’s own production employees. There have been many investments done by several companies to expand their business in other markets. For instance, in April 2020, Unilever plc adapted one of its deodorant manufacturing lines in the UK to produce supplies of hand sanitizer for the Leeds Teaching Hospital NHS Trust, and the first batch of more than 700-liter sanitizer was supplied to St. James’s University Hospital.

To address concerns about the potential drying effects of alcohol-based hand sanitizers, manufacturers are incorporating natural ingredients like aloe vera into their products. This addition helps mitigate the risk of rough skin and provides a gentler and more moisturizing experience. Prominent market players are actively promoting the use of hand sanitizers through advertising, promotional campaigns, and media coverage. These efforts contribute to increased consumer awareness and adoption of hand sanitizers, allowing companies to expand their share in the global market. Hand sanitizers with pleasant fragrances gained popularity. Manufacturers frequently introduce new scent options like Black Cherry Merlot, Champagne Toast, Gingham Fresh, Japanese Cherry Blossom, and more, based on consumer preferences and market trends to provide a diverse range of choices for individuals.

Innovators and entrepreneurs across the globe are reinventing their business models in light of the coronavirus pandemic. In the craft cocktail arena, breweries and distilleries are transitioning their focus from spirits to hand sanitizers. For instance, in May 2020, Doctor Shultz’s partnered with Ilthy, a clothing brand for manufacturing and supplying hand sanitizers & face masks. Consumers are increasingly recognizing the significance of hand hygiene for their overall health and well-being, leading to a growing demand for hand sanitizers. Hand sanitizers are considered essential in preventing the transmission of contagious diseases, which is expected to drive market growth. The convenience and portability offered by hand sanitizers, along with their effectiveness in preventing various diseases, are attracting a wide consumer base and boosting sales.

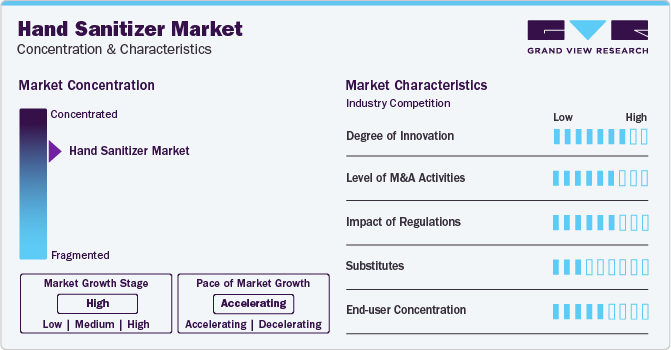

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. The hand sanitizer market is characterized by increasing adoption of healthy lifestyle among consumers.

The end -user concentration is moderate to high in this market. There is substantial demand for hand sanitizers owing to rising awareness towards personal hygiene and well being.

Currently there are numerous competitors in the market and the price control in some economies is enhancing the rivalry. Further, the are numerous products available in the market are undifferentiated, competitor rivalry is increased. Lack of differentiation or switching costs has increased the intensity of competitor rivalry in an industry. Owing to this the buyer’s base their purchasing decision purely on price or quality. Likewise, zero switching costs makes competitors play against each other and obtain a lower price.

Washing hands using water and soap is considered a better method to get rid off germs. According to Center of Disease Control & Prevention, washing hands is one of the most effective ways of preventing the spread of germs. It further, recommends using sanitizers only when soap and water are not readily available.

Product Insights

The gel-based hand sanitizer segment held the largest share of 46.4% in 2023 and is expected to maintain dominance over the coming years. Gel sanitizers are usually light and watery in the formulation and therefore have high spreadability, which allows sanitizers to easily penetrate the skin to kill most bacteria. The easy product availability and wider access to these types of antiseptic products will fuel the demand for these products in the coming years. Gel sanitizers have witnessed unprecedented demand across the globe during the coronavirus outbreak, especially in North America, Europe, and Asia Pacific.

Television news channel CNBC reported that online stocks of numerous gel hand sanitizers were sold out on Amazon, Walmart, and Walgreens in March 2020. However, the foam-based product segment is projected to register the fastest CAGR of 7.0% from 2024 to 2030. Foam-based products easily penetrate the skin and stay for longer periods. Foam-based sanitizers are easy to apply and thus provide the convenience of saving time. These products are expected to witness a rise in demand owing to their higher effectiveness against microbial germs. For instance, in March 2021, Cleancult, a non-toxic, zero waste cleaning brand launched foam-based hand sanitizer, made from fragrance-free formula and is FDA approved disinfectant and claims to kill 99.9% of germs.

Distribution Channel Insights

The hypermarket & supermarket segment accounted for the largest share of 37.7% of the global revenue in 2023 due to the increased number of these stores across various regions and the rise in the distribution of cleansers in the market. According to an article published by Consumer News and Business Channel (CNBC), in March 2020, hand sanitizer sales in the U.S. went up by 300% as compared to the same week in the year 2019. Several stores were running out of stock for hand sanitizers in the first couple of weeks of the outbreak. Supermarkets in Singapore were also out of these and other household cleaning products in March 2020, primarily owing to panic shopping or stocking up on hand sanitizers.

To discourage hoarding and put a cap on excessive buying prices were increased. For instance, in March 2020 Rotunden, a supermarket in Denmark, sold one bottle of these sanitizers at USD 4.09 and two bottles for USD 95. The online distribution channel segment is anticipated to register the fastest CAGR of 6.9% from 2024 to 2030. The segment is poised to emerge as a steady source of revenue over the forecast period. Promising growth exhibited by e-commerce platforms in emerging countries, including India and China, is compelling manufacturers to reorient their retail strategies in these countries.

Consumers were stocking up on hand sanitizers and other antibacterial products due to the coronavirus outbreak. In the U.S., the online purchase of ‘virus protection’ products, such as sanitizers, masks, gloves, and antibacterial sprays, reported an astounding 817% increase during January-February 2020, as compared to the same period the previous year. Alcohol-based hand sanitizer gels, recommended by the World Health Organization (WHO), sold out on prominent online platforms, such as Amazon, Walmart, and Walgreens, in the first couple of months of the outbreak.

Regional Insights

The Europe hand sanitizer market accounted for a revenue share of 25% in 2023. This region comprises a number of market players, which witness high penetration of different forms of hand antiseptic, such as gel-based, foam-based, sprays, and wipes. The increasing consciousness about environmental issues prompted some consumers to look for hand sanitizers with eco-friendly packaging, refillable options, or formulations that use natural and sustainable components.

Furthermore, since the COVID-19 pandemic, alcohol-based sanitizers have been witnessing tremendous demand in the region. The trend of panic shopping and hoarding of sanitizers during the pandemic resulted in a shortage of the product; thus, several local drugstores and chemical manufacturers increased their production to meet the excess demand. For instance, in April 2020, Vegamour launched its own hand sanitizer that exceeds the Centers for Disease Control and Prevention (CDC) standards for hand hygiene. The Asia Pacific hand sanitizer market is expected to be the fastest-growing regional market at a CAGR of 6.9% from 2024 to 2030. The hand sanitizer market in India is estimated to grow at a CAGR of 7.4% from 2024 to 2030. The health growth of India hand sanitizer market is mainly attributed to the increasing awareness toward hygiene and favorable government policies towards health and cleanliness.

The region’s growth can be attributed to the growing awareness about hygiene in the region due to the viral infection caused by COVID-19. Moreover, companies are launching innovative and different types of personal care & hygiene products in the market stressing safety factors for consumers. For instance, in April 2020, DetectaChem, launched its own low-cost antiseptic hand-rub, which is available to purchase on the DetectaChem website. The launch was made in response to increasing community safety during the COVID-19 pandemic.

Key Companies & Market Share Insights

The global market is highly fragmented with the presence of a large number of regional and local players. The market players face intense competition, especially from the top manufacturers as they have a large consumer base, strong brand recognition, and vast distribution networks. Companies have been implementing various expansion strategies, such as partnerships and new product launches, to stay ahead of the competition.

Key Hand Sanitizer Companies:

The following are the leading companies in the personal hand sanitizer market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these hand sanitizer companies are analyzed to map the supply network.

- Reckitt Benckiser Group plc

- Procter and Gamble

- The Himalaya Drug Company

- GOJO Industries, Inc.

- Henkel AG and Company

- Unilever

- Vi-Jon

- Chattem, Inc.

- Best Sanitizers, Inc.

- Kutol

Recent Developments

-

In March 2022, PURELL® launched two innovative hand sanitizers namely, Advanced Hand Sanitizer Naturals Foam and PURELL® Advanced Hand Sanitizer 2in1 Moisturizing Foam. The company claimed that these products would kill 9.99% of most common germs that may cause illness and it will being gentle on the skin. These foam based hand sanitizers are mess-free and dries quickly.

-

In May 2020, Reckitt Benckiser Group plc. announced its partnership with the Hilton chain of hotels to launch the Hilton CleanStay initiative. Reckitt Benckiser Group plc.’s brands Lysol and Dettol will collaborate with Mayo Clinic’s Infection Prevention and Control team to enhance Hilton’s cleaning and disinfection protocols

-

In April 2020, Procter & Gamble began the production of hand sanitizers and masks for commercial customers to combat the shortage of these products during the pandemic. They are marketed under the Safeguard brand, owned by Procter & Gamble, and meet the standards and regulations set by the World Health Organization

-

In March 2020, Henkel AG & Co. launched a global solidarity program to support employees, customers, and communities affected by the pandemic. This program included the production of disinfectants at Henkel production sites and donations worth 2 million euros to the World Health Organization and United Nations Foundation COVID-19 fund and other select organizations

Hand Sanitizer Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.58 billion

Revenue forecast in 2030

USD 10.84 billion

Growth rate

CAGR of 6.1% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million/Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, Italy, France, Spain, India, China, Japan, Australia & New Zealand, Brazil, UAE, South Africa

Key companies profiled

Reckitt Benckiser Group plc; Procter and Gamble; The Himalaya Drug Company; GOJO Industries, Inc.; Henkel AG and Company; Unilever; Vi-Jon; Chattem, Inc.; Best Sanitizers, Inc.; Kutol

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Hand Sanitizer Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segment from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the hand sanitizer market on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Gel

-

Foam

-

Liquid

-

Spray

-

Wipes

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million; 2018 - 2030)

-

Hypermarket & Supermarket

-

Pharmacy & Drugstore

-

Convenience Store

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

Spain

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. Asia Pacific dominated the hand sanitizer market with a share of 41.8% in 2022. The growth of the regional market is mainly driven by the increased and frequent use of hand sanitizers, there was a rise in demand for products that were gentle on the skin and included moisturizing properties to prevent dryness and irritation.

b. Some of the key players operating in the hand sanitizer market include Reckitt Benckiser Group plc; Procter and Gamble; The Himalaya Drug Company; GOJO Industries, Inc.; Henkel AG and Company; Unilever; Vi-Jon; Chattem, Inc.; Best Sanitizers, Inc.; and Kutol

b. Key factors that are driving the hand sanitizer market growth include panic buying of the product on account of the COVID virus outbreak wherein the industry had witnessed an increase in consumption and manufacturing of the product is expected to contribute to the market growth.

b. The global hand sanitizer market was estimated at USD 6.5 billion in 2022 and is expected to reach USD 7.04 billion in 2023.

b. The global hand sanitizer market is expected to grow at a compound annual growth rate of 6.6% from 2022 to 2030 to reach USD 10.84 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.