- Home

- »

- Medical Devices

- »

-

Continuous Glucose Monitoring Devices Market Report, 2033GVR Report cover

![Continuous Glucose Monitoring Devices Market Size, Share & Trends Report]()

Continuous Glucose Monitoring Devices Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Standalone, Integrated), By Connectivity, By Indication, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: 978-1-68038-875-6

- Number of Report Pages: 195

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Continuous Glucose Monitoring Devices Market Summary

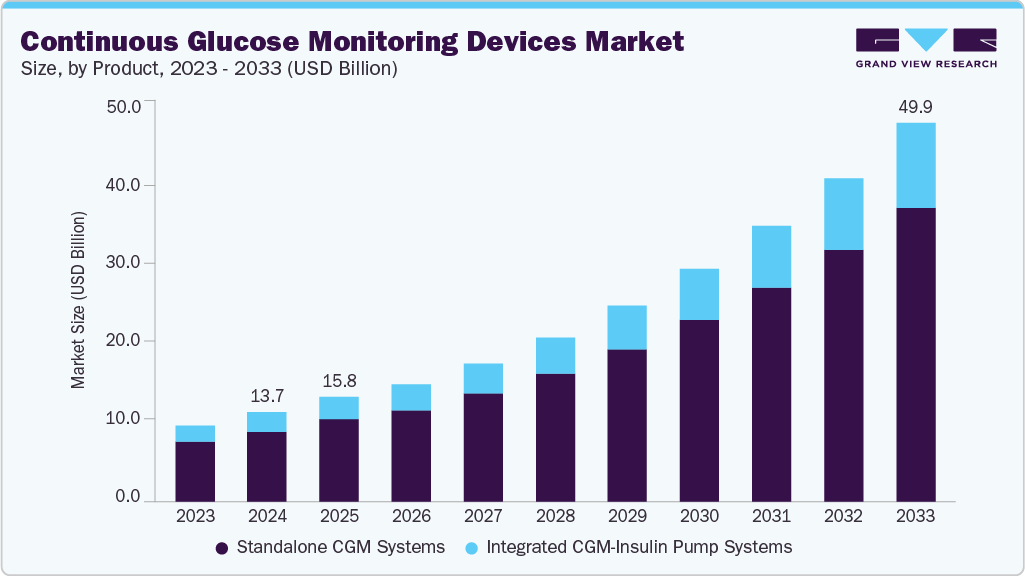

The continuous glucose monitoring devices market size was estimated at USD 13.66 billion in 2024 and is projected to reach USD 49.87 billion by 2033, growing at a CAGR of 15.44% from 2025 to 2033. This growth is attributed to clinical needs, technological innovation, and shifting care models.

Key Market Trends & Insights

- North America dominated the continuous glucose monitoring (CGM) devices market with the largest revenue share of 56.8% in 2024.

- The continuous glucose monitoring (CGM) devices industry in the U.S. is expected to grow at a significant CAGR over the forecast period.

- By product, the standalone CGM devices segment led the market with the largest revenue share of 78.3% in 2024.

- By connectivity, the bluetooth segment accounted for the largest market revenue share in 2024.

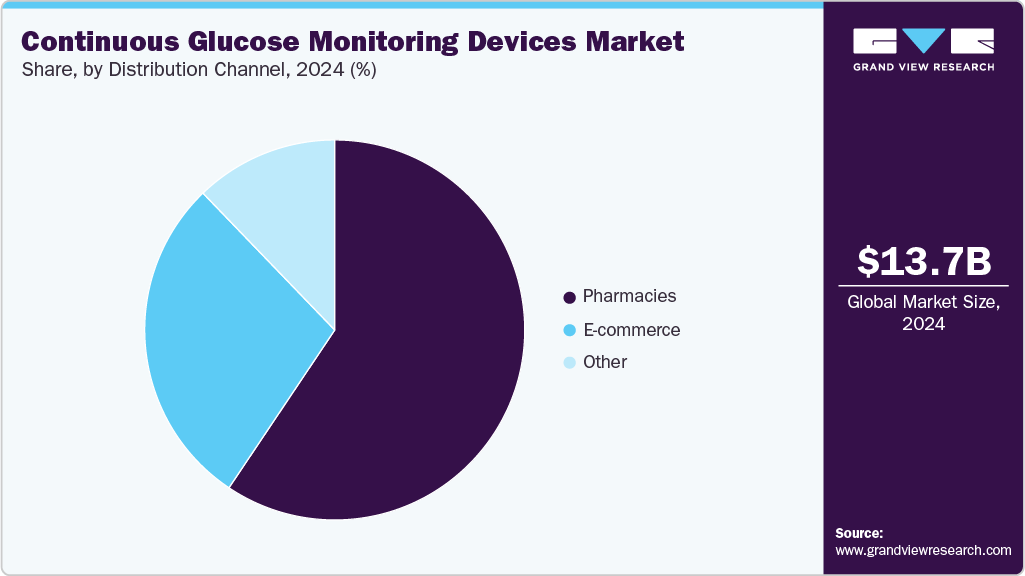

- Based on distribution channel, the pharmacies & e-commerce segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 13.66 Billion

- 2033 Projected Market Size: USD 49.87 Billion

- CAGR (2025-2033): 15.44%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Another primary factor for market growth is the rising global prevalence of diabetes, which has intensified the demand for more efficient and real-time glucose monitoring solutions. Traditional blood glucose testing is often invasive, intermittent, and inconvenient, prompting both patients and providers to adopt CGM systems for better glycemic control and improved quality of life. According to the International Diabetes Federation (IDF), as of 2024, there are approximately 589 million adults living with diabetes worldwide.

Global Diabetes Prevalence, 2024, Age [20-79]

Country

2024 (In Mn)

North America and the Caribbean

56m

South and Central America

35m

Europe

66m

Southeast Asia

107m

Western Pacific

215m

Middle East & North Africa

85m

Africa

25m

Total

589m

Source: International Agency for Research on Cancer (IARC), GVR Analysis

CGM devices are minimally invasive and offer an easy and effective way to manage diabetes. They can also detect drastic changes in blood glucose levels, thereby preventing hypoglycemic conditions. The CGM devices facilitate the analysis of blood glucose levels at different time intervals with the help of a sensor. Respective readings fed into diabetes management software through a wireless network allow patients to understand the disease, thereby helping to manage the condition effectively. Smoking, obesity, physical inactivity, high blood pressure, and high cholesterol are the common risk factors associated with diabetes complications. For instance, in January 2024, Medtronic received CE Mark approval in Europe for its MiniMed 780G system with Simplera Sync, a next-generation, minimally invasive CGM sensor that integrates fully with its automated insulin delivery pump.

The continuous glucose monitoring (CGM) devices industry is also witnessing a shift toward the increasing demand for personalized, real-time diabetes care. Unlike traditional fingerstick glucose monitoring, CGM devices offer continuous insights into glucose trends, helping patients and healthcare providers make proactive decisions. For instance, in August 2024, Abbott and Medtronic announced a global partnership to integrate Abbott’s FreeStyle Libre CGM technology with Medtronic’s automated insulin delivery systems. This was a critical step towards simplifying diabetes management and reducing the burden of constant self-monitoring. According to key personnel at Abbott Laboratories’ Diabetes Care Division,

“Libre technology has set the standard for accurate, accessible, easy-to-use, and reliable continuous glucose monitoring. Connecting this CGM built for Medtronic's insulin delivery systems and algorithms makes it easier for people to spend less time thinking about their diabetes and more time living.”

Patients with diabetes are increasingly seeking tools that provide real-time data to prevent both hyperglycemic and hypoglycemic events. CGMs provide this data by measuring interstitial glucose levels daily and at night, offering alerts and predictive analysis that allow for timely interventions. This is especially important in insulin-dependent populations such as those with Type 1 diabetes or advanced Type 2 diabetes.

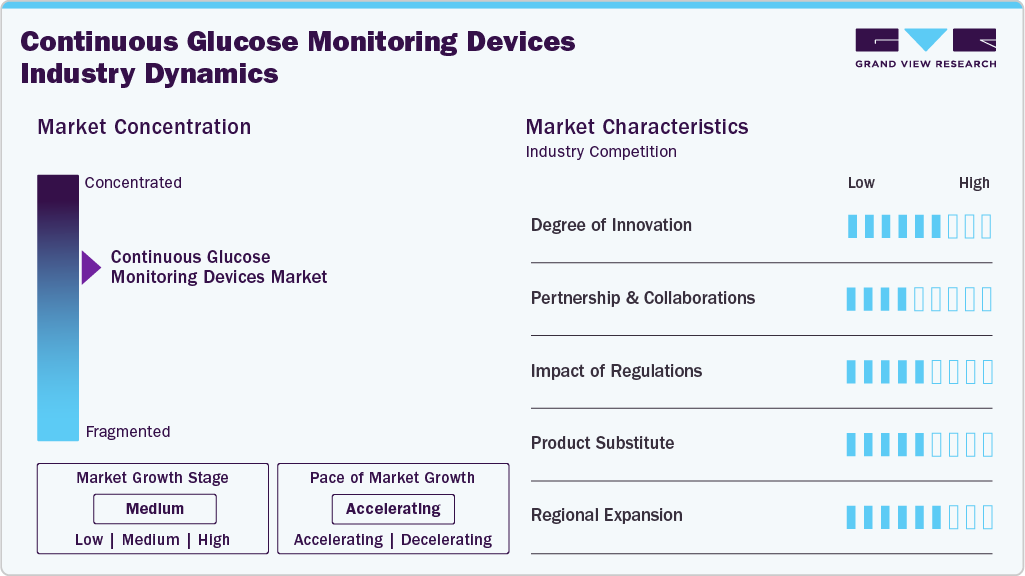

Market Concentration & Characteristics

The continuous glucose monitoring (CGM) devices industry witnesses’ significant industry concentration, with key players focusing on expansion and product differentiation. DexCom, Inc., Abbott Laboratories, and Medtronic plc hold significant market share. The market is characterized by steady growth driven by increasing diabetes cases, technological advancements, and a focus on patient safety and real-time data monitoring.

The continuous glucose monitoring (CGM) devices industry experiences a high degree of innovation, primarily driven by continuous advancements aimed at improving accuracy, user comfort, wear duration, and connectivity. Innovations such as factory-calibrated sensors, real-time mobile app integration, and non-invasive sensing technologies have significantly improved usability and patient adherence. Major players like Dexcom and Abbott have introduced next-generation sensors (G7 and Libre 3) that are smaller, faster, and more discreet, while others like Senseonics are pushing boundaries with implantable CGM systems.

Industry leaders are increasingly partnering with insulin pump manufacturers, digital health platforms, and pharmaceutical companies to build integrated diabetes care ecosystems. A major example is the 2024 partnership between Abbott and Medtronic, aimed at integrating Abbott’s FreeStyle Libre CGM sensors into Medtronic’s insulin delivery systems. This initiative enhances interoperability and user flexibility. Similarly, tech collaborations with Apple, Fitbit, and cloud-based platforms have enabled real-time remote glucose monitoring, improving both user experience and clinical decision-making.

Regulatory oversight plays a pivotal role in shaping the continuous glucose monitoring (CGM) devices industry, given the clinical implications of continuous glucose data. In regions like the U.S. and Europe, strict regulatory pathways (FDA, CE Mark) ensure product safety, accuracy, and reliability. Recent policy shifts have also expanded access, such as Medicare’s 2023 coverage for CGMs in non-insulin-treated Type 2 diabetes, significantly broadening the eligible user base. While regulatory hurdles can delay time-to-market, they reinforce trust and help high-quality manufacturers secure a competitive advantage through regulatory differentiation.

While CGMs offer superior insight and convenience, they face partial competition from traditional blood glucose meters (BGMs), particularly in price-sensitive and emerging markets. However, the substitute threat is declining as CGMs become more affordable, receive broader insurance coverage, and demonstrate better outcomes in glycemic control.

The continuous glucose monitoring (CGM) devices industry is witnessing significant regional expansion, particularly in emerging economies where surgical volumes are rising and healthcare infrastructure is improving. Similarly, increasing regulatory compliance and hospital facility requirements are expected to drive demand. In addition, multiple companies are working together to expand the accessibility and adoption of CGM devices and technologies across regions. For instance, in November 2024, Dexcom led a $75 million Series D round for ŌURA and forged a tech partnership to integrate Dexcom’s CGM data (including OTC Stelo) with the ŌURA Ring. This was done to help consumers improve their metabolic health by integrating DexCom CGM data with vital signs, sleep, stress, heart health, and activity data from the Oura Ring.

Product Insights

The standalone CGM devices segment led the market with the largest revenue share of 78.3% in 2024. This is attributed to factors such as their widespread adoption across both insulin-dependent and non-insulin-dependent diabetic populations and their compatibility with a broad range of digital health platforms and mobile applications. Unlike integrated CGM-insulin pump systems, which are often limited to Type 1 diabetics or intensive insulin users, standalone CGMs can be prescribed for a wider patient base, including those managing Type 2 diabetes through oral medications or lifestyle interventions. For instance, in April 2025, DexCom, Inc. received the U.S. FDA clearance for its next-generation G7 15‑Day CGM. This version of the G7 model allows the device 15 days for people aged 18 years and older.

The adoption of integrated-CGM insulin pump systems in the CGM devices market is witnessing significant growth, driven by the rising demand for automated, closed-loop diabetes management solutions. These systems combine real-time glucose monitoring with insulin delivery, allowing for dynamic insulin adjustments based on sensor readings, substantially reducing the need for manual intervention. The market is witnessing a shift from standalone CGM use toward hybrid closed-loop systems due to their ability to maintain tighter glycemic control, minimize hypoglycemic events, and improve overall quality of life. For instance, in December 2023, Insulet Corporation’s Omnipod 5, a tubeless automated insulin delivery (AID) system, was fully commercially integrated with the DexCom G7 CGM in the U.S.

Connectivity Insight

The bluetooth segment accounted for the largest market revenue share in 2024, as CGM sensors are equipped with Bluetooth chips. The patient hovers the recording device over the sensor, and detailed information on the blood glucose levels is transferred via Bluetooth into the device. Further, the information is displayed on the reading device. The data may or may not be shared via 4G network to be saved in the monitor center database. CGM manufacturers mainly outsource these chips to provide precise and accurate data captured from the sensor. Companies like Nordic Semiconductors, Renesas Electronics, Onsemi, and others develop these chips for CGM devices. The chip is replaced every 14 days as the sensors need to be changed.

The near-field communication (NFC) segment is anticipated to witness at the fastest CAGR during the forecast period. This is driven by its ease of use, cost-effectiveness, and widespread smartphone compatibility. Unlike Bluetooth or cellular-based systems, NFC allows users to retrieve glucose data simply by bringing a reader or smartphone close to the CGM sensor, eliminating the need for continuous wireless transmission. This method reduces power consumption and makes devices more affordable, an appealing factor in emerging markets and among non-insulin-dependent Type 2 diabetics.

Indication Insight

The Type 1 diabetes segment accounted for the largest market revenue share in 2024, and is expected to grow at a significant CAGR during the forecast period. People suffering from Type 1 diabetes (T1D) are the primary users of CGM devices, owing to their lifelong requirement for insulin and the critical need to tightly regulate glucose levels. CGMs offer real-time data, trends, and automated alerts. According to the CDC, approximately 1.7 million adults aged 20 years or older, or 5.7% of all U.S. adults with diagnosed diabetes, reported having type 1 diabetes and using insulin. T1D management demands frequent blood glucose monitoring and precise insulin dosing. Real-time CGM data is integral to achieving glycemic targets and reducing acute complications.

The Type 2 segment is expected to grow at the fastest CAGR during the forecast period. A combination of rising disease prevalence, expanded clinical use cases, and broader reimbursement policies supports CGM adoption among non-insulin-using T2D patients. Regulatory changes have further accelerated this trend. In 2023, Medicare expanded coverage for CGM devices to include people with Type 2 diabetes who are not on insulin, recognizing their benefits in proactive disease management. In addition, the launch of over-the-counter CGM devices like Dexcom’s Stelo has opened the door for widespread consumer access without prescriptions, especially for those with early-stage or prediabetic conditions.

Distribution Channel Insights

The pharmacies segment accounted for the largest market revenue share in 2024, which is driven by their accessibility, trusted role in chronic disease management, and evolving business models that now support prescription and over-the-counter (OTC) CGM product sales. Partnerships between CGM manufacturers and national pharmacy chains further reinforce the dominance of this channel. For instance, companies like DexCom, Inc. and Abbott have partnered with CVS Health, Walgreens, and Walmart to offer their devices in-store and through online prescription services.

The e-commerce segment is expected to grow at the fastest CAGR of 15.68% during the forecast period. The expansion of direct-to-consumer (DTC) offerings and recent regulatory approvals enable over-the-counter (OTC) sales of CGM devices online. Furthermore, the shift towards virtual healthcare and remote patient monitoring has validated e-commerce as a viable and trusted channel. CGM manufacturers have responded by investing in robust online ecosystems that support product education, purchasing, and subscription-based delivery models. For instance, DexCom, Inc. offers Stelo through a monthly subscription model online, giving users a recurring, low-friction experience that aligns with consumer expectations in other health tech sectors.

Regional Insights

North America dominated the continuous glucose monitoring (CGM) devices market with the largest revenue share of 56.8% in 2024, driven by the increasing prevalence of diabetes, rising adoption of CGM devices, technological advancements, and the presence of key companies. In addition, the efforts taken by the federal government to manage the disease at a larger level are fueling market growth. For instance, in February 2024, Canada’s federal government announced Bill C-64, which aims to establish a Canada-wide diabetes device fund to support access to CGMs and other essential diabetes supplies.

U.S. Continuous Glucose Monitoring (CGM) Market Trends

The continuous glucose monitoring (CGM) devices market in the U.S. accounted for the largest market revenue share in North America in 2024, driven by a large diabetic population and favorable reimbursement policies. According to the National Diabetes Statistics Report 2022 by the CDC, over 130 million adults in the U.S. are either suffering from diabetes or have prediabetes. The high per capita income and increasing healthcare spending are among the key factors likely to drive market growth.

U.S. Diabetes Prevalence from 2021-2050, Age [20-79]

Year

Number of People Suffering from Diabetes (In Million)

2000

15.3

2011

23.7

2024

38.5

2050

43.0

Source: International Diabetes Federation (IDF), GVR Analysis

The high per capita income and increasing healthcare spending are among the key factors likely to drive market growth. According to the International Diabetes Federation (IDF), diabetes caused at least USD 1 trillion in health expenditure, a 338% increase over the last 17 years. Key players in the U.S. are executing various strategies to expand their market share. For instance, Abbott Laboratories introduced a more affordable version of Libre at around USD 75 for a month’s supply (which includes two sensors lasting up to 14 days each) in May 2022. This move aims to reduce the financial burden on diabetic patients in the country.

Europe Continuous Glucose Monitoring (CGM) Devices Market Trends

The continuous glucose monitoring (CGM) devices market in Europe is witnessing significant growth driven by a rising diabetes burden, favorable public healthcare support, digital health adoption, and demographic trends. According to the International Diabetes Federation (IDF), in 2024, the number of adults (ages 20-79 years) with diabetes in the region was 65.5 million and is expected to reach 72.4 million by 2050. Based on this, CGM devices are increasingly embraced as essential tools for long-term glucose management, particularly among individuals with Type 1 diabetes and high-risk Type 2 cases. Moreover, EU-wide regulatory alignment and cross-border collaborations under initiatives like Horizon Europe have encouraged partnerships between manufacturers, providers, and public health bodies, fostering innovation and broader patient outreach. Despite challenges around affordability and regional disparities, the European CGM market is poised for continued expansion as healthcare systems prioritize early intervention and technology-enabled chronic disease management.

The UK continuous glucose monitoring (CGM) devices market is growing steadily, supported by a strong public healthcare system, national reimbursement programs, and rising diabetes prevalence. The National Health Service (NHS) has played a pivotal role in expanding access, with CGMs now widely reimbursed for individuals with Type 1 diabetes and increasingly for high-risk Type 2 patients. Digital health integration has further accelerated adoption, as CGM data is commonly linked to NHS digital platforms and used in remote consultations. The UK government’s focus on preventive care and self-management, combined with a tech-savvy population and active clinical research ecosystem, continues to position CGMs as a key tool in modern diabetes care.

The Germany continuous glucose monitoring (CGM) devices market is among the most advanced markets in Europe, driven by strong public health insurance coverage, early adoption policies, and a well-established diabetes care infrastructure. For a long time, statutory health insurance (GKV) has reimbursed CGM devices for patients with Type 1 diabetes and selected high-risk Type 2 cases, greatly expanding access. Germany’s robust healthcare provider network and emphasis on evidence-based care have supported widespread clinical acceptance of CGMs. Additionally, the integration of CGM data into electronic health records and telemedicine platforms aligns with the country’s digital health agenda. Ongoing innovation from local and global manufacturers and Germany’s focus on chronic disease prevention continue to sustain market growth.

Asia Pacific Continuous Glucose Monitoring (CGM) Devices Market Trends

The continuous glucose monitoring (CGM) devices market in the Asia Pacific is driven by the region’s rising diabetes prevalence, increasing healthcare digitization, and improving access to advanced medical technologies. Countries such as China, India, Japan, South Korea, and Australia are witnessing strong growth due to the growing awareness of diabetes complications, urban lifestyle changes, and government initiatives promoting early diagnosis and self-monitoring.

Asia Pacific Diabetes Prevalence, 2024 Vs. 2050 (In Million)

Country

Number of Adults Suffering from Diabetes, In Million

2024

2050

China

148.0

168.3

Japan

10.8

9.4

India

89.8

156.7

Republic of Korea

5.0

5.1

Australia

1.7

2.2

Source: International Diabetes Federation (IDF), GVR Analysis

Japan and South Korea have established reimbursement frameworks for CGMs, while India and China have increasing private sector investment and digital health platform integration. With a large diabetic population and rising health consciousness, the Asia-Pacific region represents a high-growth market for CGM manufacturers seeking long-term expansion.

The China continuous glucose monitoring (CGM) devices market is driven by the country’s escalating diabetes burden, rising health awareness, and growing acceptance of digital health solutions. With approximately 148.0 million (as of 2024), living with diabetes, there is a strong push towards better disease monitoring and early intervention. Domestic companies like Sinocare and Yuwell, along with international players such as Abbott and DexCom, are expanding their footprint through e-commerce and partnerships & collaborations. For instance, in January 2024, Trinity Biotech plc announced a partnership with Bayer AG to co-develop and introduce a CGM biosensor in China and India. This collaboration aims to leverage Bayer’s regional presence and Trinity’s biosensor technology to broaden CGM access in China, which aligns with national strategies for diabetes management.

The continuous glucose monitoring (CGM) devices market in India is evolving rapidly due to the country’s large diabetic population, growing health awareness, and increasing adoption of digital health tools. With over 100 million people living with diabetes, there is a rising demand for more accurate, real-time glucose monitoring solutions, especially in urban areas. Patients and providers are increasingly turning to CGMs as a superior alternative to traditional glucometers, particularly for insulin users and high-risk individuals. The expansion of telemedicine, wellness apps, and virtual diabetes clinics has created new channels for CGM access, while leading hospitals and private healthcare networks are integrating CGMs into chronic care plans. Global players like Abbott, DexCom, and Medtronic are active in India, often selling via e-commerce and diagnostic partnerships, while local innovators are exploring more affordable sensor options.

Latin America Continuous Glucose Monitoring (CGM) Devices Market Trends

The continuous glucose monitoring (CGM) devices market in Latin America is driven by the increasing prevalence of diabetes, the improvement of healthcare infrastructure, and the rising awareness of advanced glucose monitoring technologies. While access has traditionally been limited due to cost and low reimbursement coverage, urban populations in countries such as Brazil, Argentina, and Colombia are beginning to adopt CGM systems more widely, particularly among patients with Type 1 diabetes and insulin-dependent Type 2 cases.

The Brazil continuous glucose monitoring (CGM) devices market is witnessing significant growth, which is supported by its sizable diabetic population, progressive regulatory environment, and expanding private healthcare sector. With approximately 16.6 million people living with diabetes, there is a growing demand for more precise and continuous glucose monitoring solutions. The Brazilian National Health Surveillance Agency (ANVISA) has approved several CGM systems, including those from Abbott and Medtronic, enabling their use across both private and selected public healthcare channels.

Middle East and Africa Continuous Glucose Monitoring (CGM) Devices Market Trends

The continuous glucose monitoring (CGM) devices market in the Middle East and Africa (MEA) is driven by the growing awareness of digital health solutions, government-led efforts to modernize chronic disease care, and the rising prevalence of diabetes cases. Diabetes rates are among the highest globally in parts of the Gulf region, including the UAE, Saudi Arabia, and Qatar, where CGM adoption is increasing due to high-income populations, advanced healthcare infrastructure, and access to private insurance.

Middle East & Africa Diabetes Prevalence, 2024 Vs. 2050 (In Million)

Country

Number of People Suffering from Diabetes, In Million

2024

2050

Saudi Arabia

5.3

9.5

UAE

1.3

1.9

Qatar

0.4

0.6

Kuwait

0.9

1.3

South Africa

2.3

3.9

Source: International Diabetes Federation (IDF), GVR Analysis

The Saudi Arabia continuous glucose monitoring (CGM) devices market is witnessing steady growth, driven by strong government investment in healthcare transformation and widespread access to modern medical technologies. With nearly 1 in 5 adults affected by diabetes, there is an urgent focus on early detection and better glycemic control, making CGMs an increasingly adopted solution. Under Vision 2030, Saudi Arabia has prioritized digital health and chronic disease prevention, encouraging hospitals and specialty clinics to incorporate CGM systems into diabetes care protocols.

Key Continuous Glucose Monitoring (CGM) Devices Company Insights

The continuous glucose monitoring (CGM) devices industry is highly competitive, with key players such as Abbott Laboratories, DexCom, Inc., and Medtronic plc holding significant positions. The major companies undertake various organic and inorganic strategies such as product introduction, collaborations, and regional expansion to serve the unmet needs of their customers.

Key Continuous Glucose Monitoring (CGM) Devices Companies:

The following are the leading companies in the global continuous glucose monitoring (CGM) devices market. These companies collectively hold the largest market share and dictate industry trends.

- DexCom, Inc.

- Abbott Laboratories

- Medtronic plc

- Senseonics Holdings, Inc.

- Insulet Corporation

- Tandem Diabetes Care

- Ascenia Diabetes Care (subsidiary of PHC Holdings)

- AgaMatrix, Inc

- GlucoRx Limited

- Zhejiang POCTech Co., Ltd.

- i-SENS, Inc.

- F. Hoffmann-La Roche Ltd.

Recent Developments

-

In June 2025, U.S. Health Secretary Robert F. Kennedy Jr. announced that the Department of Health and Human Services will roll out a major federal campaign encouraging the adoption of wearable health monitors, including CGMs, under the "Making America Healthy Again" initiative. This public health push aims to reduce diabetes-related healthcare costs by promoting proactive self-monitoring through devices.

-

In September 2024, Senseonics received FDA approval for the Eversense 365, the first implantable CGM lasting up to 1 year-doubling sensor longevity compared to its predecessor. This device qualifies as an iCGM, which allows integration with integration pumps.

-

In July 2024, Medtronic plc received FDA approval for its Simplera CGM device, which is designed to connect the company’s Smart Multiple Daily Injection System with InPen.

-

In March 2024, DexCom, Inc. received the U.S. FDA approval for Stelo, an over-the-counter (OTC) CGM tailored for non-insulin-using Type 2 diabetics and wellness users. This device has a 15-day sensor life and is purchasable without a prescription.

-

In January 2024, Abbott Laboratories announced that its FreeStyle Libre 2 Plus sensor can be integrated with Tandem Diabetes Care’s Tandem t: slim X2 insulin pump users. This allows Tandem’s Control-IQ hybrid closed-loop technology to integrate with Abbott’s 15-day CGM sensor.

Continuous Glucose Monitoring (CGM) Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.81 billion

Revenue forecast in 2033

USD 49.87 billion

Growth rate

CAGR of 15.44% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, connectivity, indication, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

DexCom, Inc.; Abbott Laboratories; Medtronic plc; Senseonics Holdings, Inc.; Insulet Corporation; Tandem Diabetes Care; Ascenia Diabetes Care (subsidiary of PHC Holdings); AgaMatrix, Inc.; GlucoRx Limited; Zhejiang POCTech Co., Ltd.; i-SENS, Inc.; F. Hoffmann-La Roche Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Continuous Glucose Monitoring Devices Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global continuous glucose monitoring (CGM) devices market report based on the product, connectivity, indication, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Standalone CGM Devices

-

Devices

-

Consumables

-

-

Integrated-CGM Insulin Pump Systems

-

-

Connectivity Outlook (Revenue, USD Million, 2021 - 2033)

-

Bluetooth

-

4G/Cellular

-

Near Field Communication (NFC)

-

-

Indication Outlook (Revenue, USD Million, 2021 - 2033)

-

Type 1 Diabetes

-

Type 2 Diabetes

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmacies

-

E-commerce

-

Other

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global continuous glucose monitoring devices market size was estimated at USD 13.66 billion in 2024 and is expected to reach USD 15.81 billion in 2025.

b. The global continuous glucose monitoring devices market is expected to grow at a compound annual growth rate of 15.44% from 2025 to 2033 to reach USD 49.87 billion by 2033.

b. North America dominated the global continuous glucose monitoring devices market with a share of 56.77% in 2024. This is attributable to increasing cases of diabetes and efforts taken by the national government to manage the disease.

b. Some key players operating in the continuous glucose monitoring devices market include Dexcom, Inc., Abbott, Medtronic, Ypsomed AG, Senseonics Holdings, Inc., A. Menarini Diagnostics S.r.l., and Signos, Inc.

b. Key factors that are driving the continuous glucose monitoring devices market growth include growing cases of diabetes, coupled with the increasing adoption of continuous glucose monitoring (CGM) devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.