- Home

- »

- Beauty & Personal Care

- »

-

Baby Powder Market Size & Share Report, 2021-2028GVR Report cover

![Baby Powder Market Size, Share & Trends Report]()

Baby Powder Market Size, Share & Trends Analysis Report By Product (Talc-based, Talc-free), By Distribution Channel (Online, Offline), By Region (Asia Pacific, North America, Europe), And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-727-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2021 - 2028

- Industry: Consumer Goods

Report Overview

The global baby powder market size was valued at USD 1.09 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 5.6% from 2021 to 2028. The market is driven by the changing consumer preferences towards organic personal care products coupled with a rise in disposable income levels. Over the past few months, the pandemic has paused the demand for products in many sectors owing to disruptions in the supply chain, a drop in sales revenue, and the closure of several businesses across several industries. Factors, such as unemployment and financial insecurity, have shifted consumers’ preference towards major life events, such as childbirth and marriage.

According to the U.S. Centers for Disease Control and Prevention, the birth rate decreased by 4% during the pandemic. Companies in the market are innovating and introducing organic products to garner attention from the consumers. Owing to the pandemic, several consumers are opting for baby care products enriched with essential oils and natural ingredients. For instance, Bey Bee, a startup based in Gurgaon, India is offering safe and affordable baby care products in the Indian market.

Product Insights

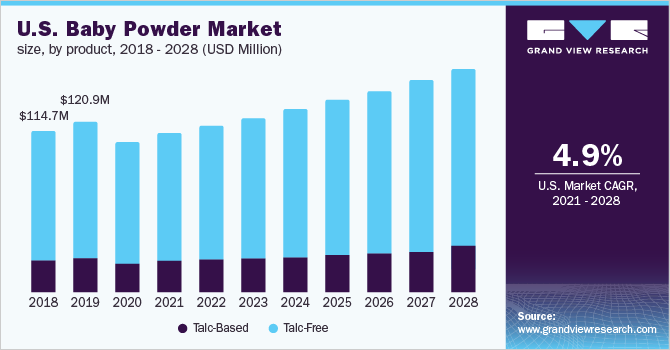

Based on the product, the market is segmented into talc-based and talc-free baby powder. The talc-free segment accounted for the largest revenue share of 75% in 2020 due to the high demand for organic baby care products. Cornstarch-based baby powders have a high demand as several consumers are opting for natural ingredients. The use of cornstarch acts as a carrier for active ingredients to penetrate the skin, thereby providing nourishment to the baby’s skin.

Several businesses in the industry are launching innovative products in the organic category. Amyris, Inc. in the U.S. launched “Baby Cream to Powder”, a product, which is an alternative to talc-based powders. Companies in the market are providing products composed of cornstarch and essential oils, such as lavender, almond, and olive oils, for improved skin nourishment. Also, more than 170 groups from 51 countries are calling against the usage of talc-based powders, thereby boosting the demand for natural ingredients.

Regional Insights

In 2020, Asia Pacific accounted for the largest revenue share of over 35%. Growing awareness towards personal hygiene coupled with demand for baby care products, such as diapers and strollers, is supporting the market growth in the region. Stable increase in birth rate, rising middle-class population, and high purchasing frequency of baby care products are also driving the market growth.

The high demand for baby care products is supported by a rise in online purchases. Key players, such as Moms Co., have partnered with e-commerce giants, such as Amazon, to increase their online presence. Moreover, Godrej Consumer Products has entered into the baby care industry.

Distribution Channel Insights

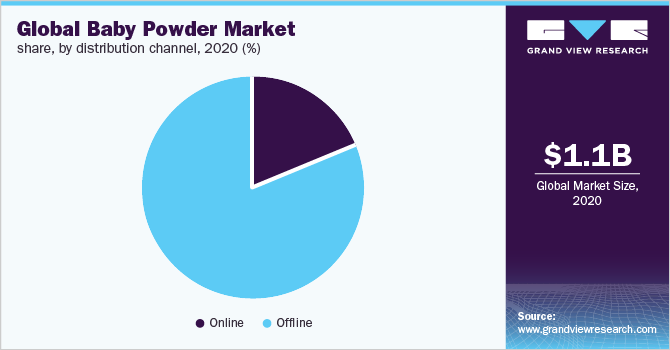

On the basis of distribution channels, the global market is sub-segmented into online and offline. The offline distribution channel segment accounted for the largest revenue share of 82.1% in 2020. The availability of a wide range of personal care products, such as cosmetics and foods, under a single retail store offers convenience to the consumers.

Baby powder is also increasingly sold in medical and local grocery stores. Several key players in the market offer baby care products based on their relevance. In Europe, Johnson & Johnson invested close to 33 million for the construction of a distribution center, and the opening of the center has streamlined the distribution network in the region.

Key Companies & Market Share Insights

The global market is highly competitive and characterized by the presence of several established players. Companies in the market are increasingly focusing on launching new products made with cornstarch and other essential oils owing to the high demand for organic personal care products. The pandemic has increased the demand for baby hygiene products, thereby driving the market. In January 2020, Moms & Co. launched a digital initiative to increase sales of its baby and pregnancy care products. Furthermore, the Himalaya Drug company has inaugurated mom and baby stores in Bengaluru. This move is expected to help the company gain a significant share in the Indian market. Some of the key players in the global baby powder market are:

-

Johnson & Johnson

-

Pigeon Corp.

-

Prestige Consumer Healthcare

-

KCWW

Baby Powder Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 1.60 billion

Revenue forecast in 2028

USD 1.69 billion

Growth rate

CAGR of 5.6% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2018

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, and region

Regional scope

North America; Europe; Asia Pacific; Central and South America; and MEA

Country scope

U.S.; U.K.; France; China; India; Brazil; South Africa

Key companies profiled

Johnson & Johnson; Pigeon Corp.; Prestige Consumer Healthcare; KCWW

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global baby powder market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2028)

-

Talc-based

-

Talc-free

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2028)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

-

Europe

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global baby powder market size was estimated at USD 1.09 billion in 2020 and is expected to reach USD 1.60 billion in 2021

b. The global baby powder market is expected to grow at a compound annual growth rate of 5.6% from 2021 to 2028 to reach USD 1.69 billion by 2028.

b. The Asia Pacific dominated the baby powder market with a share of 35.46% in 2020. Growing awareness towards personal hygiene coupled with demand for baby care products such as diapers and strollers is supporting the growth of the baby powder market in the region.

b. Some key players operating in the baby powder market include Johnson& Johnson; Pigeon Corporation; Himalaya Drug company, Prestige Consumer Healthcare; and KCWW.

b. The baby powder market is driven by changing consumer preferences towards organic personal care products coupled with rising disposable income.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."