- Home

- »

- Beauty & Personal Care

- »

-

Baby Care Products Market Size Report, 2021-2028GVR Report cover

![Baby Care Products Market Size, Share & Trends Report]()

Baby Care Products Market Size, Share & Trends Analysis Report By Product (Baby Skin Care, Baby Toiletries/Hair Care), By Distribution Channel (Hypermarket & Supermarket, Specialty Store), By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-704-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2019

- Forecast Period: 2021 - 2028

- Industry: Consumer Goods

Report Overview

The global baby care products market size was valued at USD 18.17 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 4.3% from 2021 to 2028. The market has been witnessing rapid growth as consumer preferences are shifting towards high-quality, utility-driven, and premium baby products. Moreover, there has been an increasing focus on vegan, paraben, and synthetic-free products due to the rising levels of awareness regarding the harmful effects of synthetic products. The COVID-19 pandemic has disrupted the supply chain and influenced consumers’ shopping patterns. According to the annual report published by Johnson & Johnson Consumer Inc., the baby care segment observed a decline of 9.4% in 2020, in comparison to 2019. The company reported the decline due to the COVID-19, SKU rationalization, and other factors. Whereas Kimberly-Clark (KCWW) observed an increase in the sales of its baby and child care products in 2020.

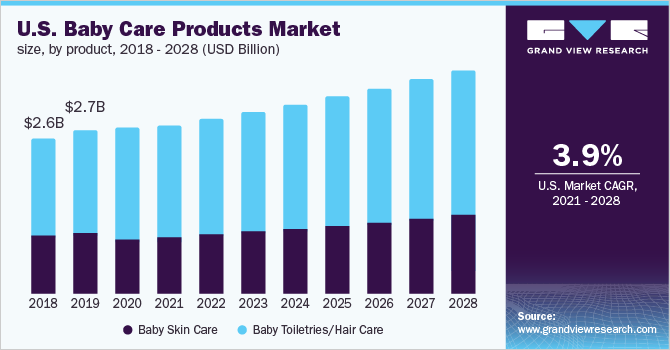

The demand for baby care products is rapidly increasing in the U.S. owing to the rising concerns related to the safety and wellness of infants. An increasing number of parents are seeking hygienic and moisture-based products, such as wipes and creams, to prevent skin infections and treat diaper rashes. Furthermore, parents are spending more on infant care since after the pandemic. For instance, according to the figures published on Move.org in April 2021, parents in the District of Columbia are spending 26.3% of their income on infant care, followed by 24.4% in Massachusetts, 21.9% in Indiana, and 21.3% in New York as of March 2021.

Increasing participation of women in the workforce, the evolving parenting preferences, growing independence, and spending capacity across the globe are expected to boost the overall market growth. According to an article published on CNBC LLC in January 2020, American parents with children under the age of five are spending over USD 42 billion on early child care and education.

Owing to the growing concerns regarding infants’ delicate and sensitive skin, a growing number of parents are opting for baby care products, such as body washes, diaper creams, and baby wipes, which are made from plant-based and organic ingredients. Moreover, these products offer numerous benefits that help in treating skin allergies, discomfort, rashes, and other similar skin-related issues. Such instances are likely to significantly boost the market growth over the forecast period.

Increasing investments in the research & development of products, coupled with the growing trend of natural, organic ingredient-based baby care products, have encouraged manufacturers to introduce new products through popular supermarkets and specialty stores. For instance, in August 2021, prominent baby care brand Baby Dove collaborated with Walmart to launch its new line of shampoo, conditioner, baby wash, and skin cream for infants’ delicate skin and multiracial babies. Such product offerings are expected to positively influence market growth.

Product Insights

Baby toiletries/hair care held the largest revenue share of over 65.0% in 2020 and is expected to maintain its lead over the forecast period. Baby shampoos, conditioners, washes, and wipes are among the most used items as these are frequently applied on infants’ skin. Apart from benefits such as instant hydration and refreshed skin, these products are easy-to-use and are a hassle-free and quick solution for combating issues related to dryness, infections, and diaper rashes.

The skin care segment is projected to register the fastest CAGR of 5.1% from 2021 to 2028. The segment includes various types of moisturizers, face creams, powders, and massage oils. Several informed parents are preferring to shop for products that contain antioxidants, anti-bacterial, and antifungal properties that are beneficial for sensitive skin.

In the baby toiletries/hair care segment, the body wash segment held the largest share of over 30.0% in 2020 and is expected to witness significant growth from 2021 to 2028. Body washes have been gaining popularity across the globe, especially in the Asia Pacific and North America, due to the rapidly increasing population in these regions, which is encouraging an increasing number of consumers to opt for baby care products for their infants.

Distribution Channel Insights

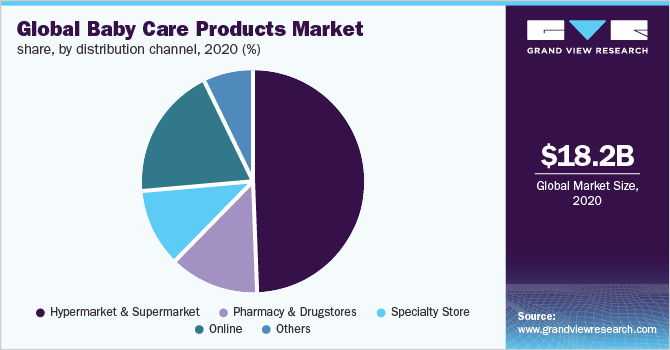

The hypermarket and supermarket captured the largest revenue share of over 45.0% in 2020. These stores offer significant advantages to consumers, such as freedom of selection, lower prices, and high visibility of international brands, which makes them a suitable platform for all customer groups to purchase baby care products.

The specialty store segment is projected to register the fastest CAGR of 4.9% from 2021 to 2028. Some customers choose to buy baby products from these stores because of the ease of purchase, extensive network, and the ability to purchase the same products on a regular basis. Moreover, these stores take advantage of the popularity of niche products, like organic, natural, and herbal items.

The online segment is projected to witness significant growth from 2021 to 2028. The online sales of baby care products are estimated to witness growth during the forecast period. Prominent e-commerce giants such as Amazon and Walmart are the leading online retailers of baby care products.

Regional Insights

Asia Pacific held the largest share of over 40.0% in 2020 and is expected to witness the fastest growth over the forecast period. According to the National Statistics Bureau of China, over 17 million infants were born in 2016. Similarly, as per the UN report, the population of India is 1.37 billion and is projected to grow over 270 million by 2050. These indicators will drive the adoption of baby care products in the region.

Central and South America is expected to expand at a CAGR of 4.4% from 2021 to 2028. Manufacturers in this region are engaged in the development of baby care products that contain a mixture of natural and organic ingredients, in an attempt to tap into new customer demographics.

North America is expected to observe considerable growth from 2021 to 2028. The presence of well-established product manufacturers in North America, such as Unilever, Kimberly-Clark (KCWW), and Johnson & Johnson Consumer Inc., along with the growing infrastructure facilities for retailers, is expected to support the demand for baby care products.

Key Companies & Market Share Insights

The market is characterized by the presence of a few established players and new entrants. Companies along with prominent retailers have been expanding their product portfolios by incorporating new and innovative baby care products to widen their consumer base. For instance, in September 2021, Coty Inc. collaborated with a popular brand Kylie Baby in order to launch a vegan, cruelty-free, and gluten-free range of baby products including shampoos, conditioners, and lotions. The products are marketed at the brand’s direct-to-consumer website. In 2020, the most recognized brands of Johnson & Johnson- Aveeno Baby and Johnsons Baby reported an increase of 3.7% in sales of baby care products to consumers specifically in the U.S., in comparison to 2019.

With a shifting focus on natural ingredients, product manufacturers are coming up with cotton-based baby care products. For instance, in October 2018, Johnson & Johnson Consumer Inc. launched a new line of cotton-infused newborn wash and shampoo and lotion under its ‘Cotton Touch’ line. Some prominent players in the global baby care products market include: -

-

Johnson & Johnson

-

Procter & Gamble (P&G)

-

Kimberly-Clark (KCWW)

-

Honasa Consumer Pvt. Ltd.

-

The Himalaya Drug Company

-

Citta World

-

Sebapharma GmbH & Co. KG

-

Beiersdorf

-

California Baby

- Unilever

Baby Care Products Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 18.35 billion

Revenue forecast in 2028

USD 25.43 billion

Growth Rate

CAGR of 4.3% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; France; China; India; Brazil; South Africa

Key companies profiled

Johnson & Johnson; Procter & Gamble (P&G); Kimberly-Clark (KCWW); Honasa Consumer Pvt. Ltd.; The Himalaya Drug Company;Citta World;Sebapharma GmbH & Co. KG;Beiersdorf; California Baby;Unilever

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global baby care products market report on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2028)

-

Baby Skin Care

-

Baby Moisturizer

-

Baby Face Cream

-

Baby Massage Oil

-

Baby Powder

-

Diaper Rash Cream

-

-

Baby Toiletries/Hair Care

-

Shampoo

-

Conditioner

-

Hair Oil

-

Baby Body Wash

-

Baby Wipes

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2028)

-

Hypermarket & Supermarket

-

Pharmacy & Drugstores

-

Specialty Store

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global baby care products market size was estimated at USD 18.2 billion in 2020 and is expected to reach USD 18.35 billion in 2021.

b. The global baby care products market is expected to grow at a compound annual growth rate of 4.3% from 2021 to 2028 to reach USD 25.4 billion by 2028.

b. Asia Pacific dominated the baby care products market with a share of 44.5% in 2020. Rapid urbanization and the growing middle-class population in countries across the regions such as India is one of the key factors driving this segment.

b. Some key players operating in the baby care products market include Johnson & Johnson, Procter & Gamble (P&G), Kimberly-Clark (KCWW), The Himalaya Drug Company, Beiersdorf, and Unilever.

b. The baby care products market has been witnessing rapid growth as consumer preferences are shifting towards high-quality, utility-driven, and premium baby products. Moreover, there has been an increasing focus on vegan, paraben, and synthetic-free products due to the rising levels of awareness regarding the harmful effects of synthetic products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."