- Home

- »

- Advanced Interior Materials

- »

-

U.S. And Mexico Metal Stamping Market Size, Report, 2030GVR Report cover

![U.S. And Mexico Metal Stamping Market Size, Share & Trends Report]()

U.S. And Mexico Metal Stamping Market Size, Share & Trends Analysis Report By Process (Blanking, Bending), By Application, By Thickness, By Press Type, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-915-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Market Size & Trends

The U.S. and Mexico metal stamping market was estimated at USD 63.45 billion in 2024 and is projected to grow at a CAGR of 4.2% from 2025 to 2030. Growing demand from various industries such as Electric Vehicles (EVs), industrial machinery, and consumer appliances are the key growth drivers for the market. Consumer appliances are witnessing growth owing to rapid technological advancements. Rising preference towards precise metal components in the industry is benefitting metal stamping demand.

Factors such as growing demand for smartphones, artificial intelligence, reducing prices of electronics, and replacement cycles are expected to augment the growth of the consumer appliances industry, and thus, drive demand for metal stamping across the forecast period.

Drivers, Opportunities & Restraints

The U.S. and Mexico markets are driven by the increasing demand for electric vehicles (EVs) and investments in advanced manufacturing. Automakers are expanding their production capabilities to meet the demand for lightweight components used in EVs. For instance, in August 2023, Magna International invested USD 790 million to build three factories to manufacture battery enclosures for Ford’s electric vehicles, supporting increased EV production and North American supply chain expansion.

Technological advancements, particularly in additive manufacturing, offer lucrative opportunities by enabling the production of smaller, complex geometries with reduced waste and labor costs. This innovation aligns with manufacturers' goals of enhancing production efficiency while adhering to environmental standards. Moreover, Mexico’s growing role in the global automotive supply chain presents significant growth potential, given the country’s emphasis on trade agreements and favorable manufacturing conditions. The region's proximity to the U.S. market also creates cross-border synergies for automotive and industrial component production, encouraging further investments and joint ventures.

The market faces several challenges, including the availability of alternative processes and materials. Technologies like 3D printing are increasingly being adopted in industries traditionally dominated by stamping, potentially limiting market expansion. While operations have rebounded, fluctuating raw material prices, especially for metals like steel and aluminum, continue to present risks to profitability and long-term growth for manufacturers across both countries.

Process Insights

The segment has been dominating the market for many years owing to its cost-effective and quick ways to produce identical parts in large volumes. These advantages made blanking a preferred choice in end-use industries such as aerospace, automotive, and household appliances where mass production takes place. Embossing is the second-most vital process segment of the market. Embossing in automotive metal stamping is expected to witness high growth owing to the large-scale manufacturing of automotive components.

The application of laser embossing for engraving patterns and dates on automotive parts and license plates is anticipated to boost growth in this segment throughout the forecast period. This technique is used in the manufacturing of precision parts that require finer polished surface finishes. The coining market is expected to witness growth owing to the increasing complexity of vehicle designs. The process consistently provides accurate bends, does not require expensive machinery or hardened surfaces, and can resist impact and abrasion.

Thickness Insights

This segment dominates due to the widespread use of thin metal sheets in the automotive, consumer electronics, and packaging industries, where lightweight materials are prioritized. For example, automotive components like body panels and brackets use thinner sheets to reduce vehicle weight and improve fuel efficiency, aligning with growing EV production trends. Additionally, thin metal is essential for electronics casings, with companies shifting towards compact designs.

The thicker metal sheets segment is growing rapidly, particularly for structural parts and heavy-duty applications such as chassis components in trucks and industrial machinery. The rise of infrastructure projects and renewable energy installations in both countries is driving demand for thick metal stamping. For instance, solar panel mounts and wind turbine brackets require durable stamped components, supporting this segment's rapid expansion.

Press Type Insights

Mechanical presses are widely used in high-volume production environments, such as automotive manufacturing. Their ability to perform repetitive operations efficiently makes them ideal for stamping components like metal housings and fasteners. Mechanical presses are preferred for continuous stamping processes, ensuring lower operational costs.

Servo presses, driven by energy-efficient and programmable motors, are the fastest-growing press type. They offer high precision, reduced noise, and flexibility in production settings, making them popular for EV components and customized automotive parts. The increasing focus on sustainable manufacturing and energy savings is boosting the demand for servo presses.

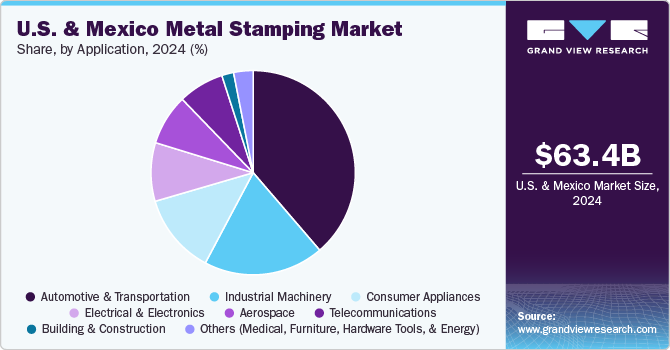

Application Insights

The metal stamping process is used to manufacture numerous automotive parts including body panels, tops, chassis, hubcaps, moldings, trim pieces, brake components, and interior and exterior lighting components. Rising emphasis on lowering vehicle weight is anticipated to augment the demand for metal stamped parts in the automotive industry over the coming years. Furthermore, industrial machinery constitutes an integral part of the market. Metal stamping is used for producing numerous products such as brackets, electrical housings, and interior components, which find application in industrial machinery.

The manufacturing industry is adopting various automated and smart industrial solutions, which is further expected to propel segment growth. The consumer appliances segment is expected to emerge as the fastest-growing application segment of the market for metal stamping in the U.S. and Mexico. This growth is on account of the increasing utilization of lightweight metal components to improve the durability of appliances. Metal stampings are extensively used in various applications in the industry, such as dishwashers, dryers, garbage disposal units, grills, HVAC units, ovens, and refrigerators.

Regional Insights

U.S. Metal Stamping Market Trends

The metal stamping market in the U.S. has witnessed increasing demand from automotive electrical and electronics industries. This has compelled manufacturers to expand their facilities in the country. For instance, in July 2024, Ford announced an expansion of its North American production for F-Series trucks, investing in multiple facilities, including the Kansas City Assembly Plant, to support the growing demand. This initiative aims to increase capacity for electric and hybrid trucks, aligning with the company’s electrification strategy.

In addition, the Oakville Assembly Complex in Canada will transition into a fully flexible plant, producing a mix of EVs by 2025, reinforcing Ford’s commitment to sustainable production and meeting shifting market needs.

Mexico Metal Stamping Market Trends

The metal stamping market in Mexico is growing due to government incentives for construction and industrial expansion. These incentives attract foreign investment through nearshoring and tax benefits, boosting infrastructure projects. Increased construction activity and demand for stamped metal components in manufacturing support this growth. Mexico’s proximity to the U.S. enhances trade and competitiveness, while advancements in automation improve productivity and align with sustainability initiatives.

Key U.S. And Mexico Metal Stamping Company Insights

Some key players operating in the market include Martinrea International Inc. and Kapco Metal Stamping

-

Martinrea International is a Canadian-based company specializing in metal stamping, aluminum components, and complex assemblies for the automotive industry. It operates across North America, Europe, and Asia, focusing on lightweight solutions and metal-forming technologies to meet evolving automotive needs. The company is involved in key areas such as body structures, chassis systems, and fluid systems, emphasizing operational efficiency and sustainability efforts to align with shifting industry trends.

-

Kapco Metal Stamping, based in Wisconsin, is a supplier of stamped metal parts primarily serving the automotive, industrial, and consumer goods sectors. The company offers a wide range of services, including progressive stamping, fabrication, and tool building. Kapco emphasizes precision manufacturing and supports various industries by providing customized metal components, leveraging its expertise in engineering and production to meet specific client needs.

Key U.S. And Mexico Metal Stamping Companies:

- ACRO Metal Stamping

- Ford Motor Company

- Goshen Stamping Company

- Harvey Vogel Manufacturing Co.

- Kapco Metal Stamping

- Magna International Inc.

- Martinrea International Inc.

- Oberg Industries

- Pacific Metal Stampings, Inc.

- Autokiniton US Holdings, Inc.

Recent Developments

-

In January 2024, Magna International Inc. and Metalsa joined the Auto Steel Partnership, a collaborative initiative focused on advancing steel usage in automotive manufacturing. This partnership aims to enhance the sustainability and efficiency of steel in vehicle production, addressing challenges such as weight reduction and environmental impact.

-

In October 2023, Martinrea International Inc. announced a strategic relationship with Yamada Manufacturing Co., Ltd., aimed at enhancing their manufacturing capabilities and expanding their product offerings in the automotive sector. This collaboration focuses on the development of new technologies and innovative solutions to improve production efficiency and meet growing customer demands.

U.S. And Mexico Metal Stamping Report Scope

Report Attribute

Details

Market size value in 2025

USD 65.66 billion

Revenue forecast in 2030

USD 80.83 billion

Growth rate

CAGR of 4.2% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025-2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Process, application, thickness, press type, region

Country scope

U.S.; Mexico

Key companies profiled

ACRO Metal Stamping; Ford Motor Company; Goshen Stamping Company; Harvey Vogel Manufacturing Co.; Kapco Metal Stamping; Magna International Inc.; Martinrea International Inc.; Oberg Industries; Pacific Metal Stampings, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. And Mexico Metal Stamping Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. and Mexico metal stamping market report based on the process, application, thickness, press type, and country.

-

Process Outlook (Revenue, USD Million, 2018 - 2030)

-

Blanking

-

Embossing

-

Bending

-

Coining

-

Flanging

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive & Transportation

-

Industrial Machinery

-

Consumer Appliances

-

Aerospace

-

Electrical & Electronics

-

Telecommunication

-

Building & Construction

-

Others

-

-

Thickness Outlook (Revenue, USD Million, 2018 - 2030)

-

Less Than & Upto 2.5 mm

-

More Than 2.5 mm

-

-

Press Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Mechanical Press

-

Hydraulic Press

-

Servo Press

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Mexico

-

Frequently Asked Questions About This Report

b. The U.S. and Mexico metal stamping market size was estimated at USD 63.45 billion in 2024 and is expected to reach USD 65.66 billion in 2025.

b. The U.S. and Mexico metal stamping market is expected to grow at a compound annual growth rate of 4.2% from 2025 to 2030 to reach USD 80.83 billion by 2030.

b. Based on application, automotive & transportation accounted for largest share of more than 38.0% in 2024 of the overall market as it is used to manufacture numerous automotive parts including body panels and tops, chassis, hubcaps, moldings, trim pieces, engine and transmission components, brake components, and interior & exterior lighting components.

b. Some of the key vendors of the U.S. and Mexico metal stamping market are ACRO Metal Stamping, Ford Motor Company, Goshen Stamping Company, Harvey Vogel Manufacturing Co., Kapco Metal Stamping, Magna International Inc., Martinrea International Inc., Oberg Industries, Pacific Metal Stampings, Inc., among others.

b. Growing demand from various industries such as electric vehicles, industrial machinery, and consumer appliances are the key growth drivers for the metal stamping market in the U.S. and Mexico.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."