- Home

- »

- Healthcare IT

- »

-

U.S. And Europe Digital Pathology Market Size Report, 2030GVR Report cover

![U.S. And Europe Digital Pathology Market Size, Share & Trends Report]()

U.S. And Europe Digital Pathology Market Size, Share & Trends Analysis Report By End-use (Hospitals, Diagnostic Labs), By Product (Software, Device), By Application (Disease Diagnosis, Academic Research), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-129-1

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

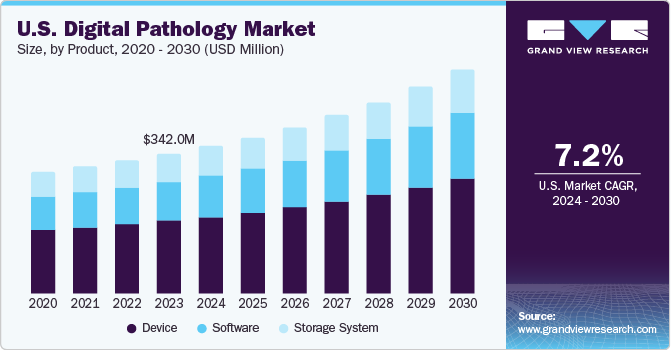

The U.S. and Europe digital pathology market size was estimated at USD 578.6 million in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 7.2% from 2023 to 2030. In the United States, the FDA has categorized digital pathology as Class II devices suitable for primary diagnosis. The increasing efforts aimed at encouraging the utilization of digital pathology as a means to elevate disease diagnosis and advance pathology practices are paving the way for promising prospects within the market throughout the nation. For instance, in May 2021,the EU initiative known as BigPicture established a research platform dedicated to advancing digital pathology, to expedite its development. This platform securely gathers digital images of tissue samples, subsequently employed to train artificial intelligence (AI) algorithms in the interpretation of these images.

Furthermore, advancements in digital imaging, high-resolution scanners, and computational analysis tools have significantly improved the quality and speed of digitizing pathology slides. This has made it feasible to create high-resolution digital images that pathologists can review remotely, thereby driving the demand for digital pathology. Also, digital pathology facilitates collaboration among pathologists and experts across different geographical locations. This allows pathologists to easily share images, consult with peers, and seek second opinions without the limitations of physical slide transportation. Furthermore, digital pathology generates large amounts of data that can be analyzed for trends, patterns, and insights.

This data-driven approach has the potential to enhance research, identify disease correlations, and improve diagnostic accuracy. In addition, the adoption of digital pathology is driven significantly by the return on investment stemming from enhancements in clinical workflows, heightened precision, and expedited decision-making processes. This impact plays a pivotal role in propelling the acceptance of digital pathology. Furthermore, the market's substantial share in the U.S. can be attributed to the presence of organizations dedicated to fostering research in digital pathology. For instance, the Centre for Medical Image Science and Visualization (CMIV) endeavors to provide research-based solutions and create sophisticated tools and visualization applications for image analysis.

The COVID-19 pandemic had a notable impact on the digital pathology market. The need for remote work and social distancing prompted a faster adoption of digital pathology solutions. Pathologists and healthcare institutions sought ways to continue their operations while minimizing physical interactions, leading to an increased interest in digital pathology systems. Also, the pandemic emphasized the value of telepathology and remote consultations as pathologists could review cases from a distance, consult with colleagues, and offer expert opinions without the need for physical presence.

This highlighted the practicality and efficiency of digital pathology solutions. While research activities were affected by lab closures, digital pathology tools enabled pathologists to collaborate on research projects remotely. This helped maintain some level of research momentum during the pandemic. As healthcare systems worldwide faced unprecedented challenges, the advantages of digital pathology, such as quicker diagnoses and improved collaboration, gained prominence, thereby leading to an increased demand for digital pathology solutions.

Product Insights

In 2022, the device segment accounted for the largest market share of 51.9 %. Devices such as high-resolution scanners and imaging systems contribute to improved diagnostic accuracy by providing detailed images of tissue samples for pathologists to analyze. Also, the automation provided by devices like slide scanners and loaders streamlines the workflow in pathology laboratories, reducing manual handling and expediting the digitization process. Furthermore, devices with integrated AI capabilities, like automated image analysis, are in demand for their potential to assist pathologists in detecting abnormalities and patterns, thereby impelling market growth. The software segment is anticipated to witness the fastest growth over the forecast period. The software solutions help manage and store vast amounts of digital images efficiently, ensuring easy retrieval and archiving.

Solutions like telepathology software are in demand for their role in facilitating remote consultations, second opinions, and collaborations among pathologists. Also, these solutions seamlessly integrate with electronic health records (EHRs) and enable comprehensive patient data exchange and informed decision-making, thereby driving the segment growth. Furthermore, government initiatives to constantly encourage the adoption of advanced pathology software and recommend them as a standardized approach are factors expected to boost demand. For instance, in November 2018, the UK Government and Philips consortium co-invested in digital pathology to accelerate the development of novel artificial intelligence software to support cancer diagnostics, which will be led by Philips and the NHS.

Application Insights

In 2022, the academic research segment accounted for the majority of the market share of 45.8%, due to the high adoption of digital pathology in various research studies, such as tumor morphological research. Numerous academic research institutions are joining forces with digital pathology providers to integrate this technology into their research endeavors. For instance, in November 2022, the University Medical Center Utrecht entered into a collaboration with Paige to integrate their application into clinical environments. This partnership also encompasses the undertaking of a clinical health economics study, designed to expedite the reimbursement process and promote the broad adoption of AI applications within the realm of pathology. The disease diagnosis segment is anticipated to grow at the fastest CAGR of 7.6% from 2023 to 2030.

A rise in the prevalence of chronic illnesses and the growing emphasis placed by manufacturers on the advancement of rapid & innovative diagnostic techniques, aimed at facilitating seamless exchange of information within and between departments, are propelling the segment growth. Embracing digital technologies in the medical field contributes to the enhancement and optimization of disease diagnosis procedures, consequently bolstering treatment effectiveness. For instance, in April 2022, PreciseDx partnered with The Michael J. Fox Foundation to introduce AI-integrated digital pathology technology, designed for the early diagnosis of Parkinson's disease even before pronounced symptoms manifest in patients. Furthermore, a rising number of initiatives led by both public and private entities, including the American Society for Clinical Pathology (ASCP) and the College of American Pathologists (CAP), aimed at augmenting the quality of cancer diagnosis, is expected to drive the segment growth.

End-use Insights

In 2022, the hospital segment accounted for the largest market share of 36.7%. Hospitals are increasingly adopting digital pathology solutions to enhance their pathology departments and provide more accurate and efficient disease diagnoses. Also, hospitals benefit from streamlined workflows as digital pathology eliminates the need for physical slide handling and automates processes like slide scanning. This reduces turnaround times and enhances efficiency. Furthermore, digital pathology promotes collaboration among hospital staff, enabling pathologists, clinicians, and other specialists to collectively review cases and make well-informed treatment decisions. Moreover, many hospitals are implementing digital scanning techniques to improve patient compliance and speed diagnosis.

For instance, in March 2023, Ibex Medical Analytics, known as Ibex, secured a PathLAKE contract that encompasses the provision of AI-enhanced solutions across 25 NHS facilities to bolster cancer diagnosis efforts. This development is anticipated to significantly influence the market's trajectory in the foreseeable future. The diagnostics lab segment is expected to grow at the fastest growth rate over the forecast period. This trajectory is attributed to the amplified emphasis on facets like drug development, preclinical GLP pathology, and oncology clinical trials. In addition, the rising incidence of cancer and the integration of digital pathology within diagnostics labs are key drivers propelling market expansion.

For instance, in January 2022, Inform Diagnostics introduced FullFocus, an AI-enabled digital pathology viewer devised by Paige, within its laboratory. This strategic integration of AI tools is expected to enhance operational efficiency, streamline logistics, and expedite the attainment of prompt outcomes. Moreover, digital pathology offers opportunities for error eradication as there is a reduction in error identification due to synchronization between images and LIS. In addition, the advantage of these diagnostic laboratories is the availability of funds for innovation. The process encourages further innovation by encouraging pathologists to become specialized, giving scientists access to better resources & knowledge, and exchanging practices with wider geographies.

Regional Insights

The U.S. market held the largest share of 56.3% in 2022 and is anticipated to expand further at a considerable CAGR over the forecast period. The robust healthcare infrastructure and substantial per capita healthcare spending in the United States play a pivotal role in driving the widespread adoption of sophisticated digital pathology systems. Another catalyst for market expansion is the endorsement of AI-driven tools crafted by companies specializing in AI-infused digital pathology, aimed at detecting invasive breast cancer and skin lesions. Moreover, the presence of prominent industry frontrunners within the nation nurtures market growth by fostering the creation of inventive digital pathology solutions.

Furthermore, major players in this arena boast an extensive network of technology distributors in the U.S., a factor poised to propel market growth throughout the forecast period. Europe is expected to grow at the fastest CAGR over the forecast period. The size of the market is justified by contributions from developed European economies, such as Germany and the UK. The elevated prevalence of diverse chronic illnesses, such as cancer and cardiovascular disorders, coupled with the significant number of diagnostic imaging centers across Europe, impels the market's progression. The existence of governmental initiatives fostering ongoing research and development endeavors in digital pathology serves as an additional pivotal factor propelling market expansion.

Notably, the European Institute of Biomedical Imaging Research has allocated more than USD 66.84 million for biomedical imaging research over the past decade. Moreover, the Europe region has gained notable traction in the realm of digital pathology. This traction can be attributed to the burgeoning geriatric population base, resulting in an augmented adoption of digital pathology across European nations. The successful execution of pathology projects in this region further contributes to this momentum. In addition, Europe serves as a host to various digital pathology conferences that convene professionals, fostering collaboration and spotlighting the continuous advancements within the field of digital pathology.

Key Companies & Market Share Insights

Companies, such as Leica Biosystems Nussloch GmbH (Danaher), Olympus Corp., Hamamatsu Photonics, Inc., and F. Hoffmann-La Roche Ltd, dominated the industry with the launch of novel technologies to meet the rising demand from the end-users. For instance, in October 2021, Philips introduced its new IntelliSite, the next-generation Digital Pathology Suite, to improve diagnostic confidence and expedite pathology lab procedures. Similarly, in March 2022, Tempus Labs introduced a groundbreaking platform called Edge, designed to provide pathologists with access to evolving AI models. These models are designed to identify samples containing potentially significant biomarkers using just a single hematoxylin and eosin stain (H&E) slide. Some of the prominent players in the U.S. and Europe digital pathology market include:

-

Leica Biosystems Nussloch GmbH (Danaher)

-

Hamamatsu Photonics, Inc.

-

Koninklijke Philips N.V.

-

Olympus Corporation

-

F. Hoffmann-La Roche Ltd.

-

Mikroscan Technologies, Inc.

-

Inspirata, Inc.

-

Epredia (3DHISTECH Ltd.)

-

Visiopharm A/S

-

Huron Technologies International Inc.

-

ContextVision AB

-

Owkin

-

Lunit

-

Tempus Labs

-

DeepBio

U.S. And Europe Digital Pathology MarketReport Scope

Report Attribute

Details

Market size value in 2023

USD 609.0 million

Revenue forecast in 2030

USD 994.0 million

Growth rate

CAGR of 7.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

U.S.; Europe

Country scope

U.S.; Germany; UK; France; Italy; Spain; Russia; Switzerland; The Netherlands

Key companies profiled

Leica Biosystems Nussloch GmbH (Danaher); Hamamatsu Photonics, Inc.; Koninklijke Philips N.V.; Olympus Corp.; F. Hoffmann-La Roche Ltd.; Mikroscan Technologies, Inc.; Inspirata, Inc.; Epredia (3DHISTECH Ltd.); Visiopharm A/S; Huron Technologies International Inc.; ContextVision AB; Owkin; Lunit; Tempus Labs; DeepBio

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

U.S. And Europe Digital Pathology Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the U.S. and Europe digital pathology market report on the basis of product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Device

-

Storage System

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Discovery & Development

-

Academic Research

-

Disease Diagnosis

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Biotech & Pharma Companies

-

Diagnostic Labs

-

Academic & Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Russia

-

Spain

-

The Netherlands

-

Switzerland

-

Sweden

-

-

Frequently Asked Questions About This Report

b. The U.S. and Europe digital pathology market is expected to grow at a compound annual growth rate of 7.2% to reach USD 994.0 million by 2030

b. The U.S. and Europe digital pathology market was estimated at USD 578.6 million in 2022 and is expected to reach USD 609.0 million in 2023.

b. The U.S. held the largest U.S. and Europe digital pathology Market share of 56.3% in 2022. The robust healthcare infrastructure and substantial per capita healthcare spending in the United States play a pivotal role in driving the widespread adoption of sophisticated digital pathology systems. Furthermore, the existence of leading industry pioneers within the country is impelling the market growth.

b. Some of the major players operating in the U.S. and Europe digital pathology market are Leica Biosystems Nussloch GmbH (Danaher); Hamamatsu Photonics, Inc.; Koninklijke Philips N.V.; Olympus Corporation; F. Hoffmann-La Roche Ltd.; Mikroscan Technologies, Inc.; Inspirata, Inc.; Epredia (3DHISTECH Ltd.); Visiopharm A/S

b. Various initiatives undertaken to promote and integrate digital pathology into the healthcare systems is driving the market.In addition, the adoption of digital pathology is driven significantly by the return on investment stemming from enhancements in clinical workflows, heightened precision, and expedited decision-making processes.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."