- Home

- »

- Plastics, Polymers & Resins

- »

-

Reinforced Plastics Market Size, Share, Growth Report, 2030GVR Report cover

![Reinforced Plastics Market Size, Share & Trends Report]()

Reinforced Plastics Market Size, Share & Trends Analysis Report By Type (Carbon Fiber, Glass Fiber, Aramid Fiber), By Application (Automotive, Building & Construction, Aerospace & Aviation, Wind Energy), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-453-4

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Reinforced Plastic Market Size & Trends

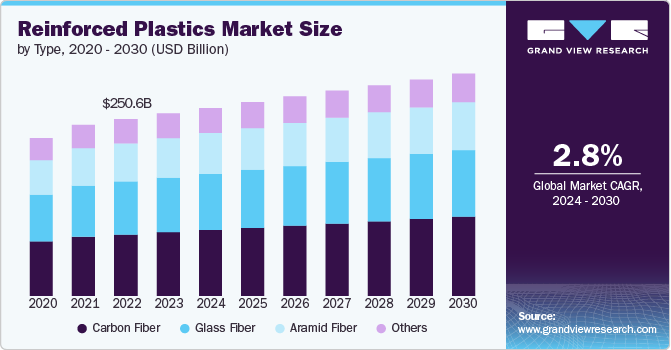

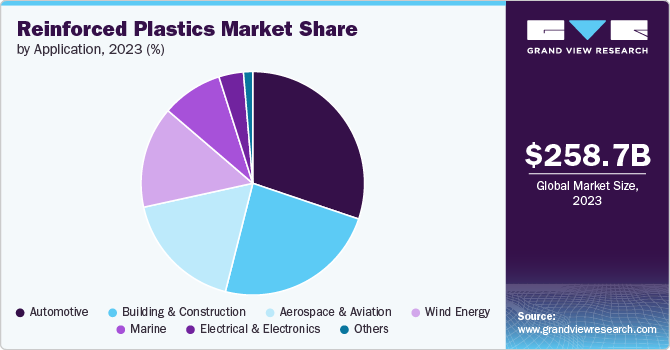

The global reinforced plastics market size was estimated at USD 258.67 billion in 2023 and is projected to grow at a CAGR of 2.8% from 2024 to 2030. Rising demand from automotive and wind energy sectors, owing to the shifting consumer preference towards sustainable solutions to tackle the global warming and climate change is driving the market.

In the reinforced plastic market, a key trend is the increasing use of bio-based and recycled fibers as reinforcements. As sustainability becomes a priority across industries, manufacturers are shifting towards eco-friendly alternatives, such as natural fibers (like hemp, flax, and jute) and recycled carbon fibers, to reduce environmental impact. This trend is particularly gaining traction in the automotive and construction sectors, where reinforced plastics are used for lightweight, durable components. The development of bio-composites aligns with the growing demand for sustainable materials, and this trend is expected to influence the future landscape of reinforced plastics.

Drivers, Opportunities & Restraints

The growing demand for lightweight materials in the automotive and aerospace industries is a major driver for the reinforced plastic market. Reinforced plastics offer high strength-to-weight ratios, making them ideal for reducing vehicle weight and improving fuel efficiency. As industries focus on enhancing performance while meeting stringent environmental regulations, the adoption of reinforced plastics in components such as panels, bumpers, and structural parts has accelerated. This need for durable yet lightweight materials is expected to continue driving demand, particularly as electric vehicle (EV) production increases globally.

The renewable energy sector presents a significant growth opportunity for the reinforced plastic market. As wind energy becomes a larger part of the global energy mix, the demand for reinforced plastics in the production of wind turbine blades is growing rapidly. The lightweight and durable nature of these materials makes them ideal for manufacturing large, efficient blades that can withstand harsh environmental conditions. With the global push towards clean energy, the market for reinforced plastics in renewable energy infrastructure, particularly wind energy, is expected to expand, offering new avenues for manufacturers.

The reinforced plastic market faces challenges that could hinder its growth despite its potential. One key constraint in the reinforced plastic industry is the high cost of raw materials, particularly carbon fiber and glass fiber reinforcements. While reinforced plastics offer superior strength and durability, the cost of these advanced materials can be prohibitive for certain industries, limiting their widespread adoption. Additionally, the energy-intensive manufacturing processes involved in producing reinforced plastics further add to the cost. This poses a challenge, especially for smaller companies or industries with tight budget constraints, as they may opt for less expensive alternatives, slowing market growth.

Type Insights

The carbon fiber (CFRP) segment led the market with the largest revenue share of 34.9% in 2023, which can be attributed to the increasing demand for high-performance, lightweight materials in the aerospace and defense sectors. Carbon fiber’s exceptional strength-to-weight ratio makes it an ideal material for aircraft components, where reducing weight is critical for improving fuel efficiency and overall performance. As commercial airlines and military organizations look to enhance operational efficiency and reduce carbon emissions, CFRP is becoming a preferred choice for structural parts, such as fuselage sections, wings, and interior components. The growing focus on sustainability, combined with the need for durable, high-strength materials, is expected to continue driving the demand for CFRP in these high-tech industries.

The glass fiber (GFRP) segment is expected to grow at a significant rate over the forecast period. The segment is driven by the increasing use of durable, corrosion-resistant materials in the construction and infrastructure sectors. GFRP’s high strength, lightweight nature, and excellent corrosion resistance make it ideal for applications such as bridges, pipes, and reinforcement bars in environments where traditional materials like steel are prone to rust and deterioration. With a growing focus on infrastructure longevity and maintenance cost reduction, particularly in marine, chemical, and wastewater treatment industries, the demand for GFRP is rising. As governments worldwide invest in large-scale infrastructure projects, the use of GFRP as a reliable alternative to metal-based materials is expected to drive market growth.

Application Insights

The automotive segment dominated the market with the largest revenue share of 30.2% in 2023, driven bythe growing adoption of electric vehicles (EVs), which demand lightweight materials to enhance efficiency and battery range. Reinforced plastics, especially those made with carbon and glass fibers, are increasingly being used in EVs to replace heavier metal components in areas such as battery housings, chassis, and body panels. This weight reduction directly improves the vehicle’s energy efficiency, allowing for longer driving ranges on a single charge. As automakers accelerate the production of EVs to meet both consumer demand and regulatory emission targets, the demand for reinforced plastics is expected to grow, driven by the need for high-performance, lightweight materials.

The building & construction segment is poised to grow at the fastest rate from 2024 to 2030. This can be attributed to the increasing demand for durable, lightweight, and corrosion-resistant materials in modern infrastructure projects. Reinforced plastics, particularly those using glass fiber, are being widely adopted in construction applications such as roofing panels, cladding, and reinforcements for bridges and tunnels. These materials offer significant advantages over traditional construction materials like steel and concrete, including better weather resistance, reduced maintenance needs, and longer service life. As urbanization accelerates and governments invest in sustainable infrastructure, reinforced plastics are becoming essential in meeting the need for cost-effective and resilient construction solutions.

Regional Insights

In North America, the Reinforced Plastics market is driven by the growing adoption of advanced materials in aerospace and defense sectors. With a focus on improving performance, fuel efficiency, and durability, the use of reinforced plastic in aircraft components, military vehicles, and defense infrastructure is on the rise. The material’s high strength-to-weight ratio offers a competitive advantage in these sectors, where reducing weight without compromising structural integrity is critical.

U.S. Reinforced Plastics Market Trends

In the U.S., the Reinforced Plastic market is primarily driven by the increased focus on energy-efficient construction and infrastructure projects. As the country prioritizes green building practices and retrofits older infrastructure, reinforced plastics are being used to replace heavier, more maintenance-prone materials. These plastics provide long-term durability and are resistant to corrosion, making them an attractive choice for water treatment facilities, bridges, and public infrastructure, where maintenance costs need to be minimized over time.

Europe Reinforced Plastics Market Trends

In Europe, the Reinforced Plastic market is propelled by stringent environmental regulations and the push for lightweight, sustainable materials in the automotive industry. With the region leading the global shift towards electric and fuel-efficient vehicles, reinforced plastics are being adopted to reduce vehicle weight and improve energy efficiency. Additionally, Europe’s strong focus on renewable energy, particularly in wind turbine manufacturing, is driving the demand for reinforced plastics in the production of large, durable blades, which are critical for enhancing energy output and turbine performance.

Asia Pacific Reinforced Plastics Market Trends

Asia Pacific dominated the global reinforced plastic market and accounted for largest revenue share of 34.5% in 2023, owing to the rapid industrialization and urbanization in countries such as China and India. The booming construction sector in these regions is seeing increased demand for reinforced plastics due to their lightweight, durable, and corrosion-resistant properties. Infrastructure projects like bridges, highways, and residential buildings are turning to reinforced plastics to enhance longevity and reduce maintenance costs, especially in environments exposed to harsh weather conditions.

The Asia Pacific region is further driven by the expansion of the automotive industry, particularly the growing production of EVs. As countries in Asia Pacific push towards greener transportation solutions, reinforced plastics are becoming integral in manufacturing lightweight automotive components to improve fuel efficiency and battery performance. The region’s large manufacturing base, combined with supportive government policies promoting sustainability, further boosts the demand for reinforced plastics.

Key Reinforced Plastics Company Insights

The Reinforced Plastic market is highly competitive, with several key players dominating the landscape. Major companies include TORAY INDUSTRIES INC, BASF, Rezplast Manufacturing Ltd, BINANI INDUSTRIES, Taishan Fiberglass Inc., Haysite Reinforced Plastics (Constantia Industries AG), REINFORCED PLASTIC INDUSTRIES, SGL Carbon SE, TEIJIN LIMITED, and Cytec Solvay Group. The reinforced plastic market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Reinforced Plastics Companies:

The following are the leading companies in the reinforced plastics market. These companies collectively hold the largest market share and dictate industry trends.

- TORAY INDUSTRIES INC

- BASF

- Rezplast Manufacturing Ltd

- BINANI INDUSTRIES

- Taishan Fiberglass Inc.

- Haysite Reinforced Plastics (Constantia Industries AG)

- REINFORCED PLASTIC INDUSTRIES

- SGL Carbon SE

- TEIJIN LIMITED

- Cytec Solvay Group

Recent Developments

-

In January 2024, Fibergrate Composite Structures, Inc. partnered with Microban to introduce a new line of fiberglass reinforced plastic (FRP) products featuring Microban's antimicrobial technology. This enhancement will be applied to various products, including molded grating, stair treads, and work platforms, as well as high-touch surfaces like guardrails and ladders.

-

In April 2022, Toyoda Gosei, a leading manufacturer of automotive parts, announced the development of a new type of plastic reinforced with cellulose nanofibers (CNF) for use in automotive parts. This innovative material combines the strength and durability of CNF with the versatility of plastic, making it an attractive choice for various automotive applications.

Reinforced Plastics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 266.71 billion

Revenue forecast in 2030

USD 314.95 billion

Growth rate

CAGR of 2.8% from 2024 to 2030

Base year

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia; Denmark; Sweden; Norway; China; India; Japan; South Korea; Australia; Indonesia, Vietnam, Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

TORAY INDUSTRIES INC; BASF; Rezplast Manufacturing Ltd; BINANI INDUSTRIES; Taishan Fiberglass Inc.; Haysite Reinforced Plastics (Constantia Industries AG); REINFORCED PLASTIC INDUSTRIES; SGL Carbon SE; TEIJIN LIMITED; Cytec Solvay Group

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Reinforced Plastics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global reinforced plastics market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Carbon Fiber

-

Glass Fiber

-

Aramid Fiber

-

Others

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Automotive

-

Building & Construction

-

Aerospace & Aviation

-

Wind Energy

-

Marine

-

Electrical & Electronics

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global reinforced plastics market size was estimated at USD 258.67 billion in 2023 and is expected to reach USD 266.71 billion in 2024.

b. The global reinforced plastics market is expected to grow at a compound annual growth rate of 2.8% from 2022 to 2030 to reach USD 314.95 billion by 2030.

b. Based on type, the carbon fiber (CFRP) segment led the market with the largest revenue share of 34.94% in 2023, which can be attributed to the increasing demand for high-performance, lightweight materials in the aerospace and defense sectors.

b. Major companies include TORAY INDUSTRIES INC, BASF, Rezplast Manufacturing Ltd, BINANI INDUSTRIES, Taishan Fiberglass Inc., and Haysite Reinforced Plastics (Constantia Industries AG)

b. Rising demand from automotive and wind energy sectors owing to the shifting consumer preference towards sustainable solutions to tackle the global warming and climate change is driving the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."