- Home

- »

- Plastics, Polymers & Resins

- »

-

Recyclable Thermosets Market Size And Share Report, 2030GVR Report cover

![Recyclable Thermosets Market Size, Share & Trends Report]()

Recyclable Thermosets Market Size, Share & Trends Analysis Report By Product (UPR, Epoxy, Phenol Formaldehyde, Polyurethane), By Application (Construction, Energy And Power, Automotive, Electrical And Electronics), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-475-5

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Recyclable Thermosets Market Trends

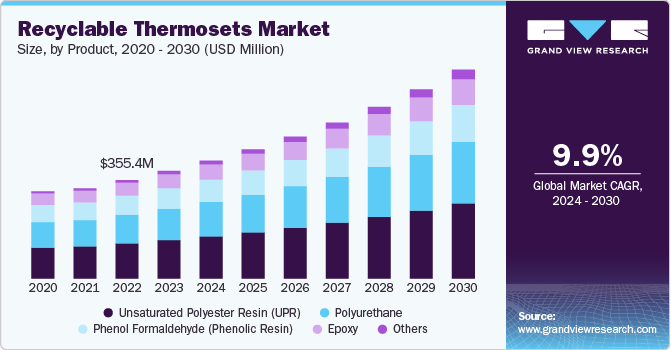

The global recyclable thermosets market size was estimated at USD 388.54 million in 2023 and expected to expand at a CAGR of 9.99% from 2024 to 2030. Rising demand for sustainable materials is driven by industries seeking eco-friendly alternatives that reduce waste and lower carbon emissions, aligning with global sustainability goals. Stringent environmental regulations further push manufacturers to adopt recyclable thermosets, while advancements in recycling technologies are making it more feasible to process and reuse these traditionally non-recyclable materials.

The recyclable thermosets market is witnessing a growing trend towards circular economy initiatives. Companies are increasingly focusing on developing thermoset materials that can be recycled and reprocessed without losing their structural integrity. This shift is driven by stringent environmental regulations and the rising demand from industries such as automotive, construction, and aerospace, which are under pressure to reduce their carbon footprints. Technological advancements in chemical recycling methods have also made it more feasible to break down cross-linked thermosets, making these materials more attractive for sustainable manufacturing practices.

Drivers, Opportunities & Restraints

One of the primary drivers of the recyclable thermosets market is the rising demand for lightweight, durable, and sustainable materials across key industries such as automotive, construction, and electronics. Thermosets are known for their superior heat resistance, chemical stability, and mechanical strength, making them ideal for high-performance applications. With increasing regulatory pressure on manufacturers to adopt eco-friendly practices and reduce waste, recyclable thermosets provide a valuable solution that balances performance with environmental responsibility. The ability to reuse thermosets through innovative recycling processes is further driving demand in industries looking to enhance sustainability while maintaining product quality.

The market for recyclable thermosets presents a significant opportunity for innovation in material science, particularly in the development of new resins and curing technologies. As industries continue to transition towards greener solutions, there is a growing need for thermoset materials that can be easily recycled without compromising their properties. Companies that invest in R&D to create more efficient and scalable recycling methods will be well-positioned to capitalize on this demand. In addition, partnerships with industries focused on sustainability, such as electric vehicles and renewable energy, offer avenues for expanding the application of recyclable thermosets in emerging sectors.

Despite the promising outlook, the recyclable thermosets market faces challenges due to the high costs and complexity associated with recycling processes. Unlike thermoplastics, thermosets are cross-linked polymers that cannot be remelted and reshaped, making recycling a more technically challenging and expensive process. Current chemical recycling methods require significant investment in infrastructure and technology, which can deter smaller companies from entering the market. In addition, the scalability of these processes remains limited, preventing widespread adoption and limiting the market’s growth potential in the short term.

Product Insights & Trends

Based on product, the unsaturated polyester resin (UPR) segment led the market with a revenue share of 35.67% in 2023 owing to the growing demand for renewable energy solutions, particularly in the wind energy and solar power sectors. As the shift towards sustainable energy sources accelerates, there is an increasing need for lightweight, durable materials that can withstand harsh environmental conditions while being environmentally friendly. UPRs, known for their excellent mechanical properties and corrosion resistance, are being utilized in manufacturing components such as wind turbine blades and solar panel supports. This trend not only enhances the performance and longevity of renewable energy installations but also aligns with the broader goals of reducing reliance on fossil fuels and minimizing the environmental impact of energy production.

The polyurethane (PU) segment is expected to grow at a significant rate over the forecast period. The segment is driven by the growing renovation and remodeling activities in both residential and commercial sectors. As homeowners and businesses increasingly invest in updating their spaces to improve aesthetics and functionality, there is a heightened demand for versatile, high-performance materials that can withstand wear and tear while being sustainable. Polyurethanes are favored for their exceptional insulation properties, durability, and flexibility, making them ideal for applications such as flooring, coatings, and furniture.

Application Insights & Trends

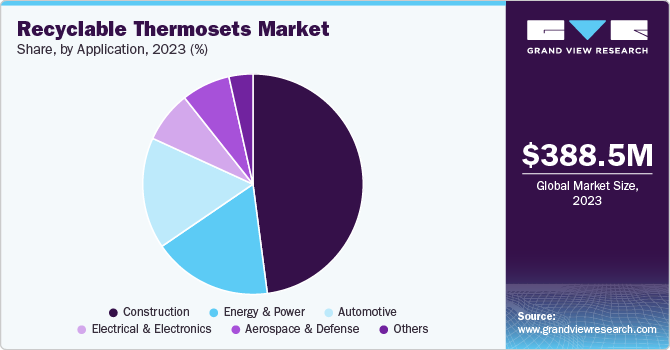

Based on application, the construction segment dominated the market with the largest revenue share of 47.92% in 2023, driven by the increasing focus on green building practices and sustainable construction materials. As architects, builders, and developers prioritize energy efficiency and environmental responsibility, there is a rising demand for materials that not only meet stringent performance standards but also contribute to the overall sustainability of construction projects. Recyclable thermosets, such as those used in structural components, insulation, and coatings, provide exceptional durability, thermal resistance, and fire retardancy, making them suitable for a wide range of applications.

The energy & power segment is poised to grow at a significant rate from 2024 to 2030. This can be attributed to increasing adoption of advanced materials in the development of high-performance electrical components. As the demand for efficient energy generation and transmission escalates, there is a need for materials that can withstand extreme conditions while offering excellent electrical insulation and mechanical strength. Recyclable thermosets, particularly those formulated for applications such as electrical enclosures, circuit boards, and transformers, provide superior thermal stability and resistance to chemicals, making them ideal for use in both renewable energy systems and traditional power generation.

Regional Insights & Trends

In North America, the recyclable thermoset market is significantly influenced by stringent environmental regulations and a strong emphasis on sustainability among consumers and businesses. With initiatives such as the U.S. Green Building Council's LEED certification and various state-level mandates encouraging the use of sustainable materials, there is an increasing adoption of recyclable thermosets in construction, automotive, and aerospace applications. The region's robust research and development infrastructure also supports innovation in recyclable thermoset formulations, making them an attractive choice for industries seeking to enhance their environmental performance.

U.S. Recyclable Thermosets Market Trends

The U.S. market for recyclable thermosets is driven by the growing demand for lightweight and high-performance materials in the automotive sector, particularly with the rise of electric vehicles (EVs). As automakers focus on reducing vehicle weight to improve energy efficiency and range, recyclable thermosets are becoming increasingly popular for applications such as body panels and interior components.

Asia Pacific Film Market Trends

Asia Pacific dominated the global recyclable thermosets market and accounted for largest revenue share of 60.66% in 2023, owing to rapid urbanization and increasing infrastructure development, particularly in countries such as India and Indonesia. As these nations experience significant economic growth, there is a surge in demand for durable construction materials and high-performance composites that can withstand the rigors of modern infrastructure. In addition, government initiatives promoting sustainable practices and the use of eco-friendly materials are encouraging manufacturers to invest in recyclable thermosets, further bolstering market growth in this dynamic region.

The recyclable thermoset market in China is driven by the government's aggressive push towards green manufacturing and sustainability in industrial practices. With initiatives like the "13th Five-Year Plan" emphasizing ecological development and waste reduction, Chinese manufacturers are increasingly adopting recyclable thermosets in construction, automotive, and electronics to align with these national objectives.

Europe Recyclable Thermosets Market Trends

In Europe, the recyclable thermoset market is propelled by a robust regulatory framework aimed at reducing plastic waste and promoting circular economy practices. The European Union's directives on waste management and recyclability are pushing manufacturers to develop and implement recyclable materials in various industries, including construction, automotive, and consumer goods. This regulatory environment, coupled with increasing consumer awareness about sustainability, is leading to a higher adoption of recyclable thermosets, making them a preferred choice for eco-conscious companies looking to comply with stringent standards while maintaining product performance.

Key Recyclable Thermosets Company Insights

The Recyclable Thermosets market is highly competitive, with several key players dominating the landscape. Major companies include Connora Technologies, Covestro, Arkema, Aditya Birla Chemicals, BASF, Huntsman Corporation, Evonik Industries, SABIC, Kingfa Science and Technology, and Hexcel Corporation. The recyclable thermosets market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Recyclable Thermosets Companies:

The following are the leading companies in the recyclable thermosets market. These companies collectively hold the largest market share and dictate industry trends.

- Connora Technologies

- Covestro

- Arkema

- Aditya Birla Chemicals

- BASF

- Huntsman Corporation

- Evonik Industries

- SABIC

- Kingfa Science and Technology

- Hexcel Corporation

Recent Developments

-

In December 2023, team of scientists from the University of Bath and the University of Surrey made significant progress in improving the recyclability of thermoset plastics, which are traditionally difficult to recycle due to their strong, crosslinked structures. Unlike thermoplastics, which can be melted and reshaped, thermosets burn when heated, complicating recycling efforts.

-

In June 2022, Swancor introduced a new recyclable thermosetting epoxy resin called EzCiclo, aimed at addressing the environmental challenges associated with wind turbine blade disposal. Traditionally, these blades are often buried or incinerated, which raises significant environmental concerns.

Recyclable Thermosets Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 425.60 million

Revenue forecast in 2030

USD 753.44 million

Growth rate

CAGR of 9.99% from 2024 to 2030

Historical data

2018 - 2022

Base year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia, Denmark, Sweden, Norway, China; India; Japan; Australia, South Korea; Indonesia, Vietnam; Brazil; Argentina; Saudi Arabia; South Africa; UAE, Kuwait

Key companies profiled

Total Corbion, NatureWorks, BASF, Evonik Industries AG, Sulzer Ltd, Vizag chemical, Mitsubishi Chemical Corporation, Entec Polymers, Fujian Greenjoy Biomaterial Co., Ltd., Orinko Advanced Plastics Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Recyclable Thermostats Market Segmentation

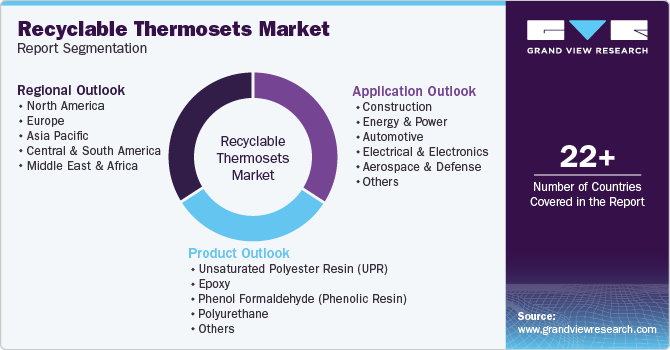

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented recyclable thermosets market report on the basis of product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Unsaturated Polyester Resin (UPR)

-

Epoxy

-

Phenol Formaldehyde (Phenolic Resin)

-

Polyurethane

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Construction

-

Energy and Power

-

Automotive

-

Electrical and Electronics

-

Aerospace and Defense

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Indonesia

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. .The global recyclable thermosets market size was estimated at USD 388.54 million in 2023 and is expected to reach USD 425.60 million in 2024.

b. .The global recyclable thermosets market is expected to grow at a compound annual growth rate of 9.99% from 2023 to 2030 to reach USD 753.44 million by 2030.

b. .Asia Pacific dominated the global recyclable thermosets market and accounted for largest revenue share of 60.66% in 2023, owing to rapid urbanization and increasing infrastructure development, particularly in countries like India and Indonesia.

b. .Some key players operating in the recyclable thermosets market include Connora Technologies, Covestro, Arkema, Aditya Birla Chemicals, BASF, Huntsman Corporation, Evonik Industries, SABIC, Kingfa Science and Technology, and Hexcel Corporation.

b. .Rising demand for sustainable materials is driven by industries seeking eco-friendly alternatives that reduce waste and lower carbon emissions, aligning with global sustainability goals.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."