- Home

- »

- Medical Devices

- »

-

Proton Therapy Systems Market Size & Share Report, 2030GVR Report cover

![Proton Therapy Systems Market Size, Share & Trends Report]()

Proton Therapy Systems Market Size, Share & Trends Analysis Report By Product (Equipment, Services), By Type (Single-Room System, Multi-Room System), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-499-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Proton Therapy Systems Market Trends

The global proton therapy systems market size was valued at USD 749.5 million in 2023 and is projected to grow at a CAGR of 7.3% from 2024 to 2030. The factors driving market growth include rising cancer incidences, the rising number of proton therapy centers, and higher efficiency offered by the systems for the treatment.

According to the World Health Organization (WHO), cancer is the leading cause of death, accounting for 10 million deaths worldwide. In 2022, about 9.7 million lives were lost due to cancer, and 20 million new cancer cases were registered. Such rising incidences drive the market growth for better treatment alternatives. This rising prevalence of cancer cases is also adding to the market growth.

The rise in cancer patients is steering better treatment alternatives such as proton therapies. Proton therapy is developing globally with high efficacy, reduced radiation to healthy tissues, and affordable single-room centers. For instance, according to the National Association of Proton Therapy report published in January 2024, the proton therapy application to treat complex conditions such as breast cancer therapy increased from 1.7% to 9.2%, head and neck cancer saw an increase in from 5.9% to 14.5% and gastrointestinal tumors increased from 3.2% to 7.0%.

The treatment of cancer includes proton therapy and radiation therapy. Radiation treatment is a commonly used treatment option for cancer but also has potential side effects, such as damage to healthy cells, fatigue, and hair loss, according to the National Cancer Institute published in January 2022. However, proton therapy uses high energy beams instead of X-rays to treat cancers more effectively as the system uses energy beams to attack the cancer cells, causing less damage to the nearby organs, cells, and tissues. This makes the treatment more efficient and safer than radiation and, hence, is expected to drive market growth.

Product Insights

Equipment dominated the market and accounted for a share of 87.3% in 2023. The factors attributing to the growth of this segment include the adoption of proton therapy, as it offers effective treatment without damaging healthy cells, and technological advancements. The treatment can be provided to the patient only through equipment as it is built of various components such as an accelerator, an energy selection system, and a beam transport system, required to treat the patient. In addition, various companies are innovating advanced systems. For instance, OncoRay launched a whole-body MRI-based proton therapy system in January 2024. Such innovations are further expected to drive segment growth.

The services segment is expected to register the fastest CAGR over the forecast period. The rise in cancer incidences and increased demand for equipment and installations are attributed to the segmental growth. This increasing demand is leading to emerging clinics and hospitals offering professional services. For instance, Hong Kong Sanatorium & Hospital (HKSH) Medical Group opened a new proton therapy center in December 2022, located in HKSH Eastern Medical Centre, offering treatment rooms and advanced technology proton therapy systems. Such emerging hospitals and therapy centers are promoting market growth in the services segment.

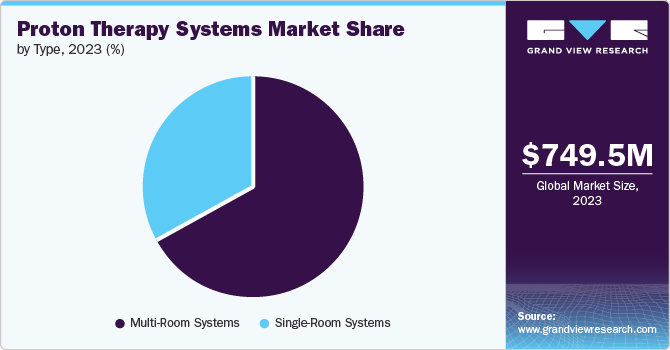

Type Insights

The multi-room systems accounted for the largest market revenue share of 67.4% in 2030. The multi-room systems can generate beams that can be delivered to different rooms at the same time. This sharing enables multiple patients’ treatment simultaneously during one treatment cycle of the course. This process is considered time-saving and effective, which increases its demand, driving the market growth.

Single-room systems are expected to grow significantly over the forecast period. The rising number of cancer incidences, low-cost equipment, and compact design are contributing to the growth of the segment. The multi-room system’s high cost, increased maintenance, and lack of sufficient space in some centers make single-room systems an attractive option. These systems use technologies such as rotational gantry and pencil beam scanning in less space. Single-room systems offer a viable option for institutions seeking to invest in particle therapy. The key players in the market, such as IBA Worldwide and Varian Medical Systems, Inc., are also driving the market growth of the segment.

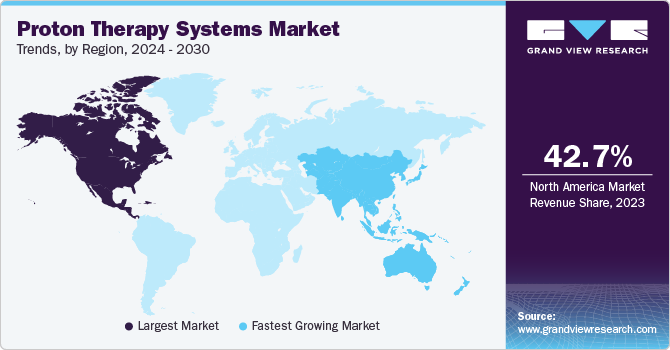

Regional Insights

North America proton therapy systems market dominated in 2023 and accounted for the market share of 42.7%. The growth can be attributed to rising cancer cases and technological advancements in the field. For instance, the government of Canada in 2021 estimated two in five Canadians to be diagnosed with cancer. Various clinics and hospitals are offering proton therapy to treat cancer in the region, such as Willis Knighton Health, Mayo Foundation for Medical Education and Research (Mayo Clinic), and Mexico City Proton Center.

U.S. Proton Therapy Systems Market Trends

The U.S. proton therapy systems market accounted for a 37.9% share of the global market in 2023. The American Cancer Society estimated 1.9 million new cancer cases in 2021. The rising cases, companies offering advanced solutions, and clinics and hospitals offering alternative treatments are the driving factors for this growth. The demand is driving companies to invest in proton therapy centers. For instance, McLaren Health Care invested in a proton therapy developer in June 2024 and held an ownership stake in Leo Cancer Care. Such investments and the increase in the number of centers are driving the market growth.

Europe Proton Therapy Systems Market Trends

Europe accounted for a significant market share in 2023 in the proton therapy systems market. The rising number of patients, companies involved in developing advanced alternatives, and government initiatives are driving market growth. For instance, according to the European Commission report published in November 2023, the European Union (EU) funded INSPIRE network is assisting European companies and research centers in collaborating in proton beam therapy. Such collaborative activities are expected to drive the growth of the market.

The rise in cancer incidences is driving an increase in proton therapy centers in Germany. Various institutes and research centers are involved in discovering advanced solutions to treat cancer. For instance, in January 2024, researchers from Dresden University Medical Center based in Germany partnered with the National Center for Radiation Research for MRI-based proton therapy of OncoRay. Various treatment centers offering proton therapy are West German Proton Therapy Center Essen (WPE), Premier Healthcare, and Heidelberg University Hospital. Such collaborations are expected to drive the region’s market growth.

Asia Pacific Proton Therapy Systems Market Trends

Asia Pacific proton therapy systems market is estimated to register the fastest CAGR over the forecast period. According to the study published in the National Library of Medicine in February 2024, about 39 proton therapy facilities are in the Asia Pacific region. This growth is attributed to the rise in population and the rising prevalence of cancer, as well as companies and research institutes involved in innovating advanced solutions. For instance, the Australian Institute of Health and Welfare estimated about a 12% increase in the population from 2024 to 2033, and cancer cases are estimated to rise by 22%.

Amidst the rising cases, various healthcare centers are emerging. For instance, The Australian Bragg Centre for Proton Therapy and Research is dedicated to offering proton beam therapy. The emergence of such centers offering advanced solutions is expected to drive market growth in the region.

The rising prevalence of cancer is the primary factor for market growth in India. According to the National Centre for Disease Informatics and Research, cancer is an increasing health concern in the nation, estimating 100.4 per 100,000 people in the country. This challenge is pushing the country’s capabilities to discover advanced alternatives. For instance, Apollo Proton Cancer Center was the country's first advanced center, and it completed its second Joint Commission International (JCI) reaccreditation in June 2023. India is home to various proton therapy facilities, such as TATA Memorial Center’s National Hadron Beam Facility, BLK-Max Super Specialty Hospital, and Fortis Healthcare.

The rising cancer prevalences, increasing population, and innovations in China are driving the growth of the market. Various companies are involved in finding advanced alternatives and providing the right infrastructure to treat cancer. For instance, Shandong Proton Center completed its milestone in delivering efficient proton therapy in September 2022. In addition, the Proton Therapy System, developed by Shanghai APACTRON Particle Equipment Co., Ltd., received NMPA approval in September 2022 for marketing activities. Such new developments are expected to drive market growth.

Key Proton Therapy Systems Company Insights

Some key companies in the proton therapy systems market include IBA Worldwide, Optivus Proton Therapy, Inc., Hitachi, Ltd., and Sumitomo Heavy Industries, Ltd. Key companies are involved in strategic initiatives such as in innovating new products, collaborating with institutions and other industries, and establishing partnerships.

-

Hitachi Ltd. is a multinational company dedicated to manufacturing various electronic, communication, heavy electrical, and industrial machinery equipment. The company’s proton therapy systems provide cancer treatment using advanced technologies. The company has delivered proton therapy systems to hospitals such as the HKSH Medical Group, which are equipped with scanning technology.

-

Optivus Proton Therapy, Inc. provides healthcare services dedicated to the advancing proton therapy technology. The company offers proton therapy systems such as Conforma 3000, a sixth-generation proton beam technology, and Odessey, a treatment planning system now operating on the updated Odessey 5.0 updated version of the software.

Key Proton Therapy Systems Companies:

The following are the leading companies in the proton therapy systems market. These companies collectively hold the largest market share and dictate industry trends.

- IBA Worldwide

- Optivus Proton Therapy, Inc.

- Mevion Medical Systems

- Advanced Oncotherapy plc

- Varian Medical Systems, Inc

- ProTom International, Inc

- Hitachi, Ltd.

- Mitsubishi Corporation

- ProNova Solutions, LLC

- Sumitomo Heavy Industries, Ltd

Recent Developments

-

In January 2024, Israel-based P-cure company started building a proton therapy center to provide access to inexpensive treatment to Chinese cancer patients through its Chinese subsidiary.

-

In October 2023, Hitachi Ltd. announced the delivery of its proton therapy system to the National Cancer Center in Singapore, marking the company’s first therapy system in Southeast Asia.

-

In December 2022, IBA Worldwide signed a contract with Spain’s Ministry of Health to install 10 proton therapy systems across Spain.

Proton Therapy Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 799.4 million

Revenue forecast in 2030

USD 1.2 billion

Growth Rate

CAGR of 7.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, KSA, UAE, and South Africa

Key companies profiled

IBA Worldwide, Optivus Proton Therapy, Inc., Mevion Medical Systems, Advanced Oncotherapy, Varian Medical Systems, Inc., ProTom International, Hitachi, Ltd., Mitsubishi Corporation, ProNova Solutions, LLC, Sumitomo Heavy Industries, Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

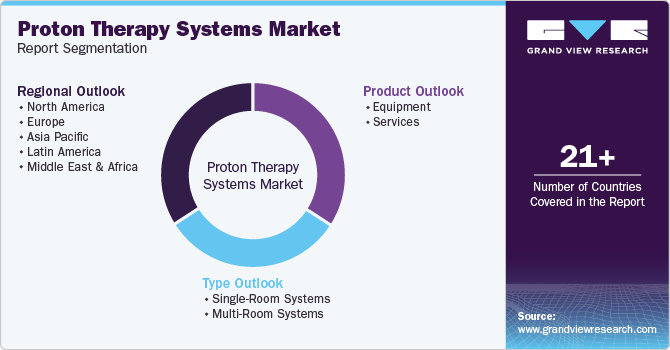

Global Proton Therapy Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global proton therapy systems market report based on product, type, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Equipment

-

Services

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Single-Room Systems

-

Multi-Room Systems

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."