- Home

- »

- Medical Devices

- »

-

Pharmaceutical CRO Market Size And Share Report, 2030GVR Report cover

![Pharmaceutical CRO Market Size, Share & Trends Report]()

Pharmaceutical CRO Market Size, Share & Trends Analysis Report By Type (Drug Discovery, Pre-Clinical, Clinical), By Molecule Type (Small Molecules, Large Molecules), By Service, By Therapeutic Areas, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-470-0

- Number of Report Pages: 231

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Pharmaceutical CRO Market Size & Trends

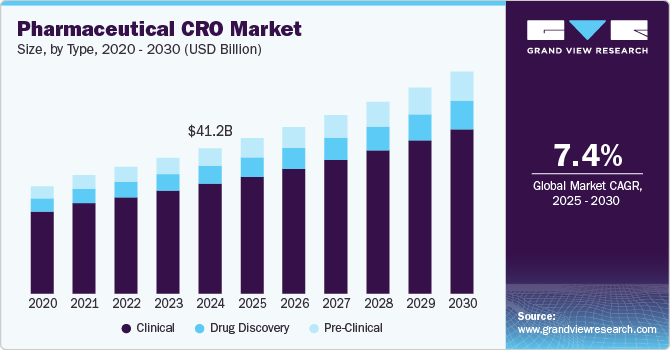

The global pharmaceutical CRO market size was estimated at USD 41.22 billion in 2024 and is projected to grow at a CAGR of 7.39% from 2025 to 2030. The growth of the market is mainly due to increasing research and development costs, growing complexity of clinical trials, including the need for advanced technologies and more rigorous regulatory requirements. Growing complexity and costs of drug development process has led to an increasing trend towards outsourcing these activities to CROs to reduce overhead and access specialized expertise, thereby streamlining the development process.

Moreover, significant shifts toward biologics and personalized medicine are also contributing to the market growth as it requires specific expertise and technologies. This trend is boosting the demand for specialized services that CROs offer, such as biomarker analysis and advanced data management. According to an article published by Thermo Fisher Scientific Inc. in July 2023, approximately 75% of clinical trials are carried out by contract research organizations (CROs). This emphasizes the significant value and reliance that sponsors place on the services provided by these organizations.

In addition, technological advancements in data analytics, artificial intelligence, and clinical trial management systems have enhanced the CRO capabilities. These technologies improve efficiency and data quality, leading to faster trial timelines. For instance, in February 2024, oracle published an article stating that CROs are actively using their software to keep pace with competitive pressures and changing market requirements. Oracle’s Clinical One platform is driving the growth in the pharmaceutical CRO market, as new entrants such as Advanced Medical Services GmbH and Firma Clinical are using this platform to enhance their service offerings and improve efficiency in conducting clinical trials. This initiative not only equips CROs with the tools needed to better serve their clients but also positions them at the forefront of the rapidly changing clinical trial landscape

Several pharmaceutical companies are increasingly adopting a strategic approach to outsourcing non-core functions, which enables them to concentrate on their core competencies such as drug discovery and development. By partnering with Contract Research Organizations (CROs), these companies can access specialized expertise and resources that are critical for conducting clinical trials and navigating complex regulatory processes. This collaboration allows pharmaceutical firms to enhance operational efficiency and reduce costs associated with in-house R&D. For instance, in December 2023, the FDA approved two groundbreaking treatments—Casgevy and Lyfgenia. These treatments mark a significant milestone as the first cell-based gene therapies suggested for the treatment of sickle cell disease in patients aged 12 & older. Such factors are anticipated to drive the market.

Market Concentration & Characteristics

CROs are increasingly adopting advanced technologies such as artificial intelligence, machine learning, and data analytics to enhance trial design, patient recruitment, and data management. These innovations improve efficiency and accuracy in clinical trials.

Several companies are seeking to consolidate their operations with CROs to enhance competitiveness and market share. This has led to significant M&A activity, allowing larger firms to expand their service offerings and geographical reach.

Regulatory agencies, such as the FDA and EMA, impose strict guidelines on clinical trial design, conduct, and reporting. CROs must ensure that their processes comply with these regulations to avoid penalties and ensure that trial data is accepted for approval.

CROs are broadening their service portfolios to include a wider range of capabilities, such as regulatory consulting, biostatistics, pharmacovigilance, and real-world evidence generation. This diversification allows them to meet the comprehensive needs of pharmaceutical companies throughout the drug development lifecycle.

Many CROs are focusing on expanding into emerging markets in Asia and Latin America. These regions offer cost-effective solutions, growing patient populations, and increasing demand for clinical trials, making them attractive for pharmaceutical sponsors seeking to diversify their trial locations.

Type Insights

The clinical segment dominated the market with a share of 75.60% in 2024. The growth of the segment is mainly due to increasing demand for clinical trials, stringent regulatory environment, and shift towards patient-centric approach. CROs are incorporating technologies and methodologies that enhance patient engagement and retention, further strengthening their role in the clinical segment. For instance, in August 2024, Worldwide Clinical Trials, a global contract research organization (CRO) which develops tailored solutions for advancing new therapies announced to adopt Clinical Trial Management System (BSI CTMS) for conducting clinical trials.

The pre-clinical segment is projected to witness a fastest growth during the forecast year due to increased demand for early-stage research, technological advancements, the rise of biologics, collaborations with emerging companies, and heightened regulatory scrutiny. Moreover, the growing demand for personalized medicines has necessitated the need for extensive pre-clinical testing to ensure safety and efficacy. This trend is contributing to the segment’s market growth.

Molecule Type Insights

Small molecule segment dominated the pharmaceutical CRO’s market in 2024. There have been significant advancements in small molecule drug development. Small molecules account for 69.14% of all pharmaceutical drugs and are used to treat a range of conditions, including migraines, fever, diabetes, cancer, and other prevalent diseases. The widespread use of small-molecule drugs for treating these common conditions is driving the segment’s market growth.

The large molecule segment is anticipated to register a CAGR of 7.91% during the forecast period. This growth can be attributed to the increased number of large molecule drug approvals, especially from the U.S. Food and Drug Administration. According to the data published by NCBI, in February 2024, the FDA approved 55 drugs in 2023, out of which 17 were large molecule drugs. In addition, the increasing incidence of infectious diseases is driving the demand for new therapeutic solutions & fueling higher capital investments by pharmaceutical & biotech companies to develop new drugs. These investments facilitate partnerships with outsourcing firms to reduce drug development costs.

Service Insights

The clinical monitoring segment dominated the market with a share in 2024. Clinical monitoring is crucial for ensuring the integrity and compliance of clinical trials. It oversees the clinical trial conduct, verify data accuracy, and ensures adherence to regulatory standards, making it an important component of the drug development process. In January 2024, ICON plc announced of offering clinical trial services to BioNTech and Pfizer investigational COVID-19 vaccine programme. The company has implemented extensive remote clinical monitoring and source data verification which has highlighted the growing reliance on technology in clinical trials.

The regulatory/medical affairs segment is projected to witness considerable growth from 2025 to 2030. This rapid expansion in outsourcing for regulatory affairs is driven by increasing R&D activities, clinical trial applications, product registrations, and drug pipelines. The increasing need for approval of new products, ensuring compliance, and maximizing efficiency is anticipated to further support the growth of this segment. In addition, CROs specializing in regulatory services are actively pursuing expansion strategies to enhance their market presence. For example, in September 2022, PharmaLex GMBH, a provider of regulatory services globally, announced the opening of a new office in Beijing, China, allowing clients access to a team of experts in pharmaceutical and biopharmaceutical regulatory affairs in the region.

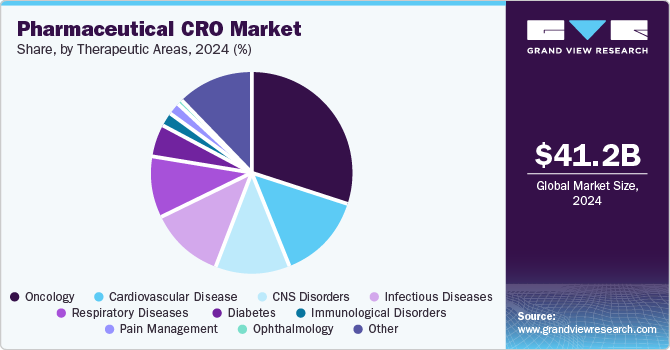

Therapeutic Areas Insights

The oncology segment dominated the market with a share of 30.66% in 2024. The growth of the segment is mainly due to increasing prevalence of cancer which requires effective and safe treatment options. According to the data published by American Cancer Society in January 2023, approximately 2,001,140 new cancer cases would be registered in the U.S. in 2024. Thus, increasing cases of cancer would increase the demand for better treatment options which will further boost the research and development activities by the pharmaceutical companies. Merck is constantly working towards developing new cancer therapies and expand its existing oncology product portfolio. Thus, the aforementioned factors would contribute to the segment’s market growth.

The immunology segment is projected to witness CAGR of 5.73% from 2025 to 2030. The rising focus on immunotherapy as a promising treatment option for various diseases, including cancer and autoimmune disorders, has led to a surge in the development and regulatory approval of immunotherapeutic drugs. Furthermore, advancements in immunology research have resulted in the development of innovative cell and gene therapies and biologics, which is further contributing to the market growth.

Regional Insights

North America pharmaceutical CRO market is witnessing robust growth owing to the factors such as enhanced regulatory landscape, increasing number of clinical trials, growing number of pharmaceutical companies and availability of skilled workers in the region. Moreover, the region has a highly developed healthcare infrastructure with significant investment in research and development activities further contributing to the market growth.

U.S. Pharmaceutical CRO Market Trends

The Pharmaceutical CRO Market in the U.S. is anticipated to experience significant growth owing to the presence of leading market players and growing investment in biopharmaceutical research. The presence of leading pharmaceutical companies, coupled with a supportive regulatory environment from agencies like the FDA has accelerated the drug development processes in the country. Additionally, the U.S. market has wide range of population that facilitates comprehensive clinical trials, allowing for more extensive data collection and quicker results.

Europe Pharmaceutical CRO Market Trends

The Europe Pharmaceutical CRO Market is anticipated to grow over the forecast period owing to growing demand for specialized services in areas such as precision medicine, biologics, and cell and gene therapies. CROs are increasingly adopting advanced technologies, including artificial intelligence and real-world evidence, to enhance trial design and patient recruitment. Moreover, the rise of decentralized clinical trials is transforming traditional methodologies, allowing for greater patient access and participation.

The UK Pharmaceutical CRO Market is projected to witness fastest growth in the coming years. The growth in the region is mainly due to the presence of several academic and research institutes which are constantly working towards research and development activities by entering into the partnership with pharmaceutical companies. Moreover, the government’s support for biotechnology and life sciences through funding initiatives and favorable regulatory frameworks is attracting both domestic and international CROs.

The Pharmaceutical CRO Market in Germany is expected to grow at a considerable rate over the forecast period. The country has a well-established regulatory framework and a skilled workforce, which are essential for conducting high-quality clinical trials. In addition, Germany's focus on precision medicine and biopharmaceuticals is driving demand for specialized CRO services.

Asia Pacific Pharmaceutical CRO Market Trends

Asia Pacific dominated the market and accounted for a 46.40% share in 2024 and is driven by increasing investments in research and development, a growing number of clinical trials, and the rising prominence of biopharmaceuticals. The region offers a diverse patient population, which is beneficial for clinical studies, alongside cost-effective operational advantages that attract global pharmaceutical companies. According to the data published by CMIC HOLDINGS Co., LTD., in July 2023, the region has remained a hub for clinical trials in recent years. Despite the challenges posed by the pandemic, clinical trials in the Asia Pacific countries have increased by 10% over the past five years.

Japan dominated the Pharmaceutical CRO Market owing to advanced technological capabilities and stringent regulatory standards. The country has several multinational pharmaceutical companies focusing on innovation in drug development which is driving demand for specialized CRO services. Moreover, the country’s aging population has also created an opportunity for clinical trials, particularly in areas such as oncology and chronic diseases.

Pharmaceutical CRO Market in China is projected to witness considerable growth during the forecast period owing to growing government support and increasing investment in research and development activities in the country. China has a vast patient pool, which facilitates faster recruitment for clinical trials further contributing to the country’s market growth. According to the data published by S&P Global in April 2021, the Chinese contract research organizations have experienced a surge in demand from domestic clients prioritizing innovation and growth.

India Pharmaceutical CRO Market is projected to growth significantly in the coming years. The country offers competitive pricing for clinical trials and has a rapidly growing number of skilled professionals in the life sciences sector. Moreover, regulatory improvements and government support for biotechnology is further enhancing the demand for pharmaceutical companies who are conducting clinical trials.

MEA Pharmaceutical CRO Market Trends

The MEA Pharmaceutical CRO Market is projected to grow at a lucrative rate owing to growing focus towards improving healthcare infrastructure and rising investments in clinical research. Governments in the region are prioritizing the development of the healthcare sector, which includes initiatives to enhance regulatory frameworks and streamline the approval process for clinical trials.

The Saudi Arabia Pharmaceutical CRO Market is projected to witness the fastest growth rate owing to growing government support such as increasing investment in the country’s healthcare infrastructure as part of its Vision 2030 initiative. This includes enhancing regulatory frameworks to ensure compliance with international standards, which is crucial for attracting foreign investment and improving local manufacturing capabilities.

Key Pharmaceutical CRO Company Insights

Key players operating in the Pharmaceutical CRO Market are undertaking various initiatives to strengthen their market presence and increase the reach of their services. Strategies such as expansion activities and partnerships are playing a key role in propelling the market growth.

Key Pharmaceutical CRO Companies:

The following are the leading companies in the pharmaceutical CRO market. These companies collectively hold the largest market share and dictate industry trends.

- Parexel International (MA) Corporation.

- ICON plc

- Laboratory Corporation of America Holdings

- Thermo Fisher Scientific Inc.

- Medpace

- IQVIA

- CTI Clinical Trial & Consulting

- WuXi AppTec

- Veeda Clinical Research

Recent Developments

-

In September 2024, ICROM s.r.l. announced the acquisition of HOLODIAG sas, a CRO dedicated to pharma solid state and crystallization processes of small molecules. This acquisition will bring a series of synergies and pool resources, resulting in significant growth in the size and capabilities of HOLODIAG SAS company.

-

In April 2024, Parexel expanded its collaboration agreement with Palantir to accelerate power clinical outcomes and clinical data delivery for patients.

-

In March 2024, PhaseV announced a partnership with oncology- & hematology-focused CRO iOMEDICO to launch a virtual analytical framework solution for pharmaceutical & biotechnology companies seeking optimization and de-risking phase 3 oncology clinical trials.

-

In February 2024, ICON plc has boosted its feasibility, protocol optimization, and patient recruitment capabilities by leveraging the TriNetX platform, which connects to EMR systems of a growing network representing over 57 million patients worldwide. This advancement will drive the pharmaceutical CRO market by improving trial efficiency, reducing costs, and enhancing recruitment strategies, making clinical studies faster and more effective.

-

In September 2023, ICON plc entered into a partnership agreement with the U.S. Biomedical Advanced Research and Development Authority (BARDA), to conduct clinical trials for next-generation COVID-19 vaccines. This will further accelerate the development and deployment of innovative vaccines.

Pharmaceutical CRO Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 44.10 billion

Revenue forecast in 2030

USD 62.99 billion

Growth rate

CAGR of 7.39% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, molecule type, service, therapeutic areas, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Norway; Sweden; India; Japan; China; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Parexel International (MA) Corporation.; ICON plc; Laboratory Corporation of America Holdings; Thermo Fisher Scientific Inc.; Medpace; IQVIA; CTI Clinical Trial & Consulting; WuXi AppTec; Veeda Clinical Research

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmaceutical CRO Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the pharmaceutical CRO market report based on, type, molecule type, service, therapeutic areas, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Drug Discovery

-

Target Validation

-

Lead Identification

-

Lead Optimization

-

-

Pre-Clinical

-

Clinical

-

Phase I Trial Services

-

Phase II Trial Services

-

Phase III Trial Services

-

Phase IV Trial Services

-

-

-

Molecule Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small Molecules

-

Large Molecules

-

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Project Management/Clinical Supply Management

-

Data Management

-

Regulatory/Medical Affairs

-

Medical Writing

-

Clinical Monitoring

-

Quality Management/ Assurance

-

Biostatistics

-

Investigator Payments

-

Laboratory

-

Patient And Site Recruitment

-

Technology

-

Others

-

-

Therapeutic Areas Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oncology

-

CNS Disorders

-

Infectious Diseases

-

Immunological Disorders

-

Cardiovascular Disease

-

Respiratory Diseases

-

Diabetes

-

Ophthalmology

-

Pain Management

-

Other

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pharmaceutical contract research organization market size was estimated at USD 41.22 billion in 2024 and is expected to reach USD 44.10 billion in 2025.

b. The global pharmaceutical contract research organization market is expected to grow at a compound annual growth rate of 7.39% from 2025 to 2030 to reach USD 62.99 billion in 2030.

b. Based on type, the clinical segment dominated the pharmaceutical CRO market and accounted for the largest revenue share of 75.60% in 2024.

b. Some key players operating in the pharmaceutical CRO market include Parexel International (MA) Corporation., ICON plc, Laboratory Corporation of America Holdings, Thermo Fisher Scientific Inc., Medpace, IQVIA, CTI Clinical Trial & Consulting, WuXi AppTec, Veeda Clinical Research.

b. Key factors that are driving the pharmaceutical contract research organization market growth include growing demand for outsourcing services across developing economies, rising focus of life sciences companies on their core competencies, demand for personalized medicine and advanced therapeutics and increasing rate of clinical research to boost demand for outsourcing services.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."