- Home

- »

- Advanced Interior Materials

- »

-

North America Commercial Wall Water Resistive Barrier Market, Report, 2030GVR Report cover

![North America Commercial Wall Water Resistive Barrier Market Size, Share & Trends Report]()

North America Commercial Wall Water Resistive Barrier Market Size, Share & Trends Analysis Report By Product (Mechanically Attached Sheet, Self-Adhered Sheet), By End-use (Commercial, Institutional, Industrial), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-059-5

- Number of Report Pages: 67

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

The North America commercial wall water resistive barrier market size was estimated at USD 1,837.3 million in 2023 and is expected to grow at a CAGR of 8.3% from 2024 to 2030. The market is driven by the presence of countries such as U.S. and Canada which has extreme weather conditions including heavy snowfall and rain, along with rapid urbanization, stringent building & construction regulations, and increased awareness towards energy-efficient building solutions.

Changing climatic conditions coupled with a rise in environmental imbalance due to increased carbon emissions are propelling the demand for effective heating, ventilation, and air conditioning system (HVAC) in commercial buildings. This is shaping up the adoption of water-resistant barrier products, as it helps in achieving higher energy efficiency by lowering power consumption.

A number of players with a global presence are forward integrated in the value chain enabling them to manufacture as well as directly sell their products to end users. They mainly sell their products belonging to different categories through their employees spread across different regions, as well as through different business segments. Additionally, a number of specifiers such as designers and architects directly get in contact with manufacturers to design their products based on customer requirements.

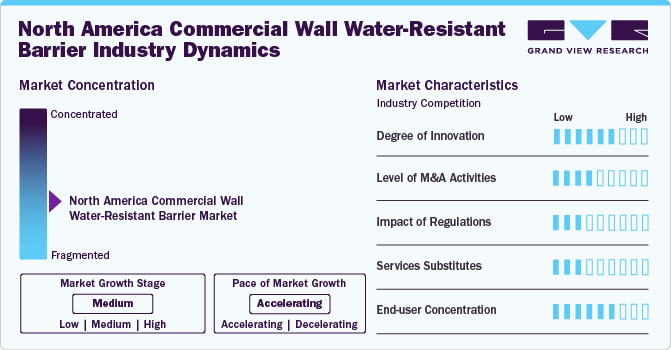

Market Concentration & Characteristics

The market growth stage is medium, and the pace of growth is accelerating. The industry tends to have a fragmented market concentration, largely due to the presence of several dominant global players who control significant portions of the market share. The market for wall water resistive barrier is characterized by the developments in technology to produce advanced products used in construction applications. The manufacturers are focusing on the procurement of high-quality raw materials and innovative designs & structure that are easier to assemble. Fast and easy installation techniques have been introduced by major players to reduce installation time.

North America commercial wall water resistive barrier industry is governed by several regulations and standards. Several states of the U.S. have relaxed the restriction on claddings suspected in the Grenfell Tower Fire; however, the investigation pertaining to the same are being carried out on a large scale. Rising government focus on improvement of green building constructions in the region is expected to have a positive impact on the market growth.

Increasing government regulations to decrease the production and usage of petroleum-based membranes is anticipated to pave the way for bio-based membranes manufactured from renewable sources which would serve as viable alternatives as compared to their synthetic counterparts. In addition, volatility in raw material prices is anticipated to force manufacturers to develop and introduce bio-based fluid applied membranes for construction applications. Thus, threat of substitutes is likely to go from medium to high over the forecast period.

Product Insights

EIFs product segment led the market and accounted for the largest revenue share of 37.9% in 2023. Exterior Insulation and Finish System (EIFS) is an exterior wall cladding that primarily uses insulation boards on the exterior sheathing of the wall with a skin or exterior plaster. Polymer-based (PB) is the most common type of EIFS used as a reinforced base coat applied to the insulation before the complete coat. EIFS wall system relies on the base coat section of the exterior layer to withstand water penetration.

The demand for fluid-applied membranes is growing at a significant rate over the forecast period. Fluid applied membrane or wraps are primarily coatings that are manufactured and applied to wall sheathings using either a roller, sprayer or trowel. These membranes need to cure for several hours to form a flexible rubber coating. Fluid applied membranes are either permeable or non-permeable to water and is most expensive type of membrane as it requires several tools for installation and an additional on-site tradesperson for membrane procurement. They offer a seamless finish and provides continuous adhesion to the substrate. These factors are expected to boost the demand for fluid applied membrane.

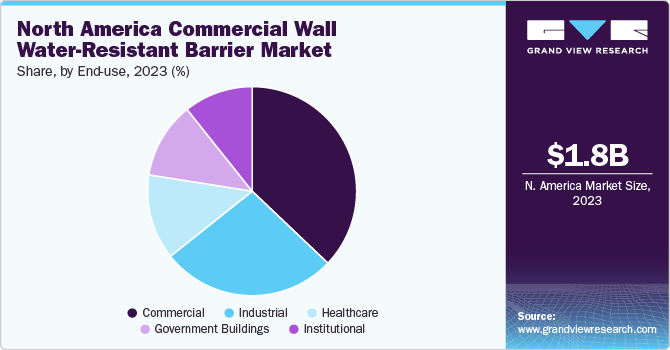

End-use Insights

The commercial end-use segment dominated the market with a revenue share of 37.1% in 2023. High compliances with the International Building Code (IBS) and increasing concerns about the declining structural integrity of commercial buildings, due to rainwater penetration and moisture ingress, have resulted in the adoption of wall water-resistive barriers. Increasing construction spending in the region is expected to propel the demand for wall water-resistive barrier products over the forecast period, as these products ensure that the exterior wall remains dry and moisture-free.

The industrial end-use segment is expected to witness significant growth over the forecast period, owing to the product application in various commercial industries for water holdout, drain ability, and permanence. Rising concerns toward saving building energy coupled with increasing advancement in construction to minimize the disintegration caused in internal finishes due to water intrusion in the exterior walls are expected to increase the product demand over the forecast period.

Country Insights

Commercial wall water-resistant barrier market in North America accounted for USD 1,837.3 in 2023. The commercial wall water-resistive barrier in North America is expected to be the fastest-growing market during the forecast period. Stringent government regulations for improving the overall efficiency of commercial buildings coupled with ongoing construction in the industrial and healthcare end-use segments are expected to add growth prospects for the market.

U.S. Commercial Wall Water Resistant Barrier Market Trends

The U.S. is expected to be the largest market for commercial wall water-resistant barrier products in the North American region and accounted for a revenue share of 72.4% in 2023. This market is driven by increasing construction & renovation activities of government-operated buildings and healthcare facilities in the country is further expected to add positive growth to the market during the forecast period. Quality control, ease of installation, cost, performance, and versatility are the major factors that play an important role in deciding the type of water-resistant barrier to be used in commercial buildings for a particular region.

Canada Commercial Wall Water Resistant Barrier Market

Commercial wall water-resistant barrier market in Canada is growing at a CAGR of 6.5% over the forecast period. Extreme weather conditions in the northern region of the country including Yulon and Nunavut experiences a higher colder climate as compared to the other states in the region. As a result, these Canadian provinces witness less commercial building growth when compared to the others including Ontario, British Colombia, and Manitoba.

However, these colder region experiences heavy snowfall that requires a fair share of water-resistant barrier products including rigid foam boards and self-adhered sheets. Increasing government building construction and redevelopment programs coupled with increasing investment in the construction application industry in the country is expected to rise the demand for the product during the forecast period.

Key North America Commercial Wall Water Resistive Barrier Company Insights

Some of the key players operating in the market DuPont, BASF, and INDEVCO Building Products, LLC:

-

DuPont was founded in 1802 and has headquartered in Delaware, U.S. The company operates through five business segments including electronics & imaging, nutrition & biosciences, transportation & industrial, safety & construction, and non-core. DuPont’s commercial wall water resistive barrier product portfolio includes foam-board insulation, weather barrier for commercial building envelopes, rigid board insulation.

-

INDEVCO Building Products, LLC offers products such as construction seam tape, door & window flashing, roof underlayment, non-structural rigid foam insulation, structural insulation board, lightweight structural sheathing, residential and commercial construction building wrap across North America.

VaproShield and Pecora Corporation are some of the emerging market participants:

-

VaproShield was established in 2003 and headquartered in Washington, U.S. The company designs and manufactures barrier systems for building envelopes. The water resistive barriers and air barriers manufactured are vapor permeable and high performance. The company has presence in the North American continent along with Oceania.

-

Pecora Corporation is a U.S. based company engaged in the designing and manufacturing of waterproofing, roofing and integrated air and vapor barrier systems for superior building performance.

Key North America Commercial Wall Water Resistive Barrier Companies:

- VaproShield

- Henry Company

- Pecora Corporation

- DuPont

- Georgia-Pacific Gypsum LLC

- Dow

- INDEVCO Building Products, LLC

- PROSOCO, INC.

Recent Developments

-

In May 2024, DuPont launched a breather membrane "Trifecta" under its Tyvek brand for moisture protection of external walls of high-rise buildings.

North America Commercial Wall Water Resistive Barrier Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1,974.4 million

Revenue forecast in 2030

USD 3,264.8 million

Growth rate

CAGR of 8.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in million square feet, revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America

Country scope

U.S.; Canada

Key companies profiled

VaproShield; Henry Company; Pecora Corporation; DuPont; Georgia-Pacific Gypsum LLC; Dow; INDEVCO Building Products, LLC; PROSOCO, INC.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Commercial Wall Water Resistive Barrier Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America commercial wall water resistive barrier market on the basis of product, end-use, and region:

-

Product Outlook (Volume, Million Square Feet; Revenue, USD Million, 2018 - 2030)

-

Mechanically Attached Sheet

-

Self-Adhered Sheet

-

Fluid Applied Membrane

-

Gypsum Sheathing

-

Rigid Foam Boards

-

Closed-Cell Spray Foam

-

EIFs

-

-

End-use Outlook (Volume, Million Square Feet; Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Institutional

-

Industrial

-

Government Buildings

-

Healthcare

-

-

Country Outlook (Volume, Million Square Feet; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Frequently Asked Questions About This Report

b. The North America commercial wall water resistive barrier market size was estimated at USD 1,837.3 million in 2023 and is expected to reach USD 1,974.4 million in 2024.

b. The North America commercial wall water resistive barrier market is expected to grow at a compound annual growth rate of 8.3% from 2024 to 2030 to reach USD 3,264.8 million by 2030.

b. Commercial end-use dominated the market with a share of 37.1% in 2023. High compliance with the International Building Code (IBS) and increasing concerns about the declining structural integrity of commercial buildings due to rainwater penetration and moisture ingress have resulted in the adoption of wall water-resistive barriers in commercial applications.

b. Some of the key players operating in the North America commercial wall water resistive barrier market are VaproShield, Henry Company, Pecora Corporation, DuPont, Georgia-Pacific Gypsum LLC, Dow, INDEVCO Building Products, LLC, and PROSOCO, INC.

b. The key factors that drive North American commercial wall water-resistive barrier include the presence of countries such as the U.S. and Canada, which have extreme weather conditions, including heavy snowfall and rain, along with rapid urbanization, stringent building & construction regulations, and increased awareness towards energy-efficient building solutions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."