- Home

- »

- Medical Devices

- »

-

LED Oral Care Kits Market Size And Share Report, 2030GVR Report cover

![LED Oral Care Kits Market Size, Share & Trends Report]()

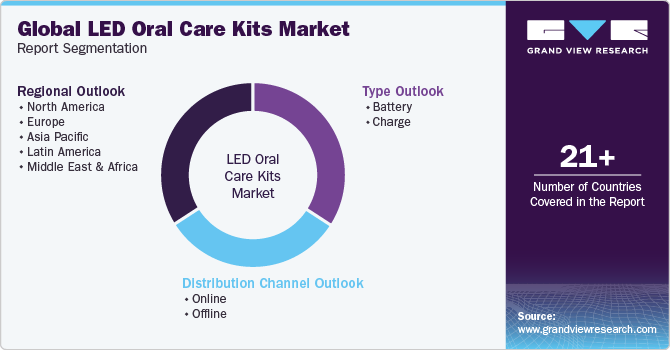

LED Oral Care Kits Market Size, Share & Trends Analysis Report By Type (Battery, Charge), By Distribution Channel (Online, Offline), By Region (North America, Europe), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-184-7

- Number of Report Pages: 30

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

LED Oral Care Kits Market Size & Trends

The global LED oral care kits market size was estimated at USD 883.5 million in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.2% from 2024 to 2030. Continuous technological advancements in the dental industry and an increase in public awareness of oral care are factors contributing to market growth. Major players such as Colgate-Palmolive Company and Procter & Gamble have implemented numerous initiatives to spread public awareness regarding oral care both for children and adults, which is leading to a surge in the demand for LED oral care kit products. In addition, rising number of dental disorders and growing consumer demand for dental treatment are some factors contributing to the market's growth.

LED oral care kits market encountered difficulties in 2020 as the COVID-19 pandemic disrupted the regular flow of oral care services, introducing uncertainties in the healthcare sector. A published Global Oral Health Status Report by the World Health Organization in November 2022 discloses a significant oral disease burden, impacting (45% or 3.5 billion people worldwide). Alarmingly, three-quarters of those affected reside in low- and middle-income countries. The report notes a substantial increase of 1 billion cases of oral diseases over the past 30 years, highlighting the pervasive lack of access to preventive and treatment measures. This presents an inducing growth driver for the LED oral care kits market, indicating a rising demand for oral health solutions, to address the expanding global need for effective preventive and treatment interventions.

The rise in prevalence of dental caries is another important driver impacting the demand for LED oral care kits. Tooth decay commonly occurs among children due to unhealthy food habits and lack of oral hygiene. Hence, the young population is more prone to dental caries. According to a recent study, nearly 50% of preschool children throughout the world have dental caries. As a result, the need for effective oral care products for dental caries in children is increasing. Consulting a dentist helps choose appropriate oral care products, which increases the demand for these products. Moreover, every year, nearly 15% of the edentulous population opts for dentures, as stated by the American College of Prosthodontists. They also estimated that around 23 million older adults are completely edentulous. Hence, the geriatric population is considered another driver impacting the demand for oral care products, thereby supporting the growth of the market.

Market Concentration & Characteristics

The LED oral care kits market is characterized by a high degree of innovation, witnessing continuous development, and the introduction of new technologies and methods. In response to the increasing demand, market players are actively investing in innovative products to stay current on advancements in the LED oral care kits market.

Several market players such as Colgate-Palmolive, Glo Science, Auraglow, and P&G are involved in merger and acquisition activities. Through M&A activity, these companies expand their geographic reach and enter new territories.

Supportive government policies to improve awareness and oral hygiene are bound to favor market growth. However, stringent regulations related to manufacturing and labelling of products may limit the growth of the market over the forecast period.

LED oral care kits face an internal substitution threat. For instance, enhanced plaque reduction by water flossers as compared to traditional floss can increase its adoption and limit the market of traditional floss. Furthermore, product substitution is easy for consumers in the consumer goods industry due to the wide range of alternatives available to them.

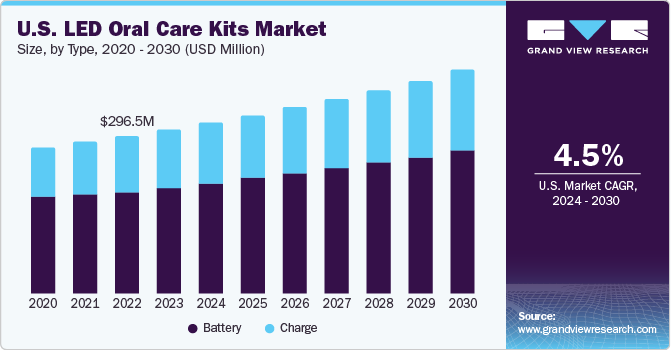

Type Insights

Battery segment accounted for the largest revenue share of 65.04% in 2023. Based on type the industry is segmented into battery and charge. Battery accounted for the largest market share as they are reasonable and there is a presence of key players like Colgate Palmolive and P&G. Batter-operated LED oral care kits operate by mixing the bleaching ability of peroxide teeth whitening agents which break down the chemical structure of stains with the help of LED light. The LED oral care kits are proving to be effective as light devices speed up the chemical reactions that remove the stains from teeth.

The charge segment is estimated to register the fastest CAGR over the forecast period. Factors such as an increase in demand for chargeable LED oral care devices, technological advancements in these devices, a surge in public awareness towards LED oral care, long-term usage of chargeable LED oral care devices, and an increase in a number of people influenced by social media are the major factors driving the growth of market during the forecast period.

Distribution Channel Insights

Offlinesegment accounted for the largest revenue share of 61.38% in 2023. The LED oral care kits are mostly brought through offline channels like retail stores and therefore account for a high market share. In several regions including the U.S. and Europe, governments have provided flexible working hours where departmental stores and supermarkets can operate till midnight. This provides a significant growth opportunity for various companies, to strategically place their packaging at these places.

Online segment has been anticipated to grow at the fastest rate during the forecast period, owing to sales through online channels of LED oral care kits have increased considerably in recent years. This is because online shopping for such products can provide consumers with offers like comparison shopping, wider selection, cost-effective prices, and convenience. Sales through online networks is increasing at a tremendous pace and are growing six times faster. Companies like Colgate and P&G have witnessed an increase in oral care products through online channels. In 2021, Colgate’s e-commerce sales increased by 26% globally with strong growth in North America. Moreover, online channels offer a variety of products at cost-effective price. Hence the popularity is rising.

Regional Insights

North America dominated the overall LED oral care kits market in 2023. Major factors contributing to the growth are advanced healthcare infrastructure and widespread adoption of innovative oral care products. The region's high prevalence of oral health awareness is evident in initiatives like community dental health programs. Favorable reimbursement policies, exemplified by dental insurance plans, contribute to market growth. Major market players like Colgate-Palmolive and P & G, headquartered in North America, drive technological advancements. Rising cases of dental conditions, exemplified by a surge in endodontic treatments, fuel the demand for LED oral care kits.

Asia Pacific region is expected to grow at the fastest rate during the forecast period. Surge in oral diseases and the increasing presence of prominent healthcare providers in swiftly developing economies like India and China create avenues for expansion. Furthermore, the Asia Pacific region is witnessing improvements in healthcare utilization with government support. For example, the Indian government's initiation National Oral Health Program (NOHP) serves as a significant growth driver for the LED oral care kits market. This program aims to deliver integrated and comprehensive oral health treatment within existing healthcare facilities. A public-private partnership approach is considered to enhance community-based awareness and service delivery, involving private dental colleges, dental societies, and community-based groups.

Key Companies & Market Share Insights

Colgate-Palmolive, P&G, Active Wow, and Glo Science are some of the dominant players operating in the LED oral care kits market.

-

Colgate-Palmolive Company is an American consumer goods company. The company specializes in personal care, oral care, home care, and pet nutrition products. The company operates in more than 75 countries, and its products are sold in over 200 countries and territories.

-

Procter & Gamble, also known as P&G, is an American consumer goods company. P&G’s products are available in about 180 countries worldwide. Its customers mainly include grocery stores, mass merchandisers, membership club stores, department stores, specialty beauty stores, drug stores, baby stores, distributors, e-commerce companies, and high-frequency pharmacies & stores.

Auraglow, Mysmile, and Bright White Smiles are some of the emerging market players functioning in the LED oral care kits market.

-

Auraglow is a U.S.-based teeth whitening company that offers products such as teeth whitening kits, teeth whitening gels, and electric toothbrushes.

-

Bright White Smiles is a dental products company that offers products such as LED kits, gel kits, gel refills, and accessories.

Key LED Oral Care Kits Companies:

- Colgate-Palmolive

- Glo Science

- Auraglow

- MySmile

- Snow Cosmetics LLC

- Bright White Smiles

- Starlite Smile

- Active Wow

- P&G

- ShYn

Recent Developments

-

In October 2023, Glo Science launched the GLO To Go teeth whitening pen. The company has been focusing on innovative dental products that offer effective and safe whitening results.

-

In October 2021, P&G announced the launch of its new line of eco-friendly oral care products under its Oral-B brand.

-

In February 2023, Colgate-Palmolive launched the Colgate Optic White Comfort Fit LED Teeth Whitening Kit and Colgate Optic White Express Whitening Pen which removes nearly 10 years of dental stains in just 3 days and whiter teeth in just 1 day.

LED Oral Care Kits Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 925.6 million

Revenue forecast in 2030

USD 1.25 billion

Growth rate

CAGR of 5.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Colgate-Palmolive; Glo Science; Auraglow; Mysmile; Snow Cosmetics LLC; Bright White Smiles; Starlite Smile; Active Wow; P&G; ShYn

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global LED Oral Care Kits Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global LED oral care kits market report based on type, distribution channel, and region:

-

Type Outlook (Revenue in USD Million, 2018 - 2030)

-

Battery

-

Charge

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global LED oral care kits market size was estimated at USD 883.5 million in 2023 and is expected to reach USD 925.6 million in 2024.

b. The global LED oral care kits market is expected to grow at a compound annual growth rate of 5.2% from 2024 to 2030 to reach USD 1.25 billion by 2030.

b. North America dominated the oral care kits market with a share of 38.2% in 2023. This is attributable to the advanced healthcare infrastructure, increasing awareness about oral health, and a growing demand for advanced oral care products contributing to the market's dominance.

b. Some key players operating in the LED oral care kits market are Colgate-Palmolive, Glo Science, Auraglow, Mysmile, Snow Cosmetics LLC, Bright White Smiles, Starlite Smile, Active Wow, P&G, and ShYn.

b. Key factors that are driving the LED oral care kits market are rise in the prevalence of dental disorders, increase in public awareness towards oral care, and continuous technological advancements within the dental industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."