- Home

- »

- Medical Devices

- »

-

India Pharmaceutical Contract Sales Organizations Market Report 2030GVR Report cover

![India Pharmaceutical Contract Sales Organizations Market Size, Share & Trends Report]()

India Pharmaceutical Contract Sales Organizations Market Size, Share & Trends Analysis Report By Service (Personal, Non-personal Promotion), By End-use (Pharmaceutical Companies, Biopharmaceutical Companies), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-174-9

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

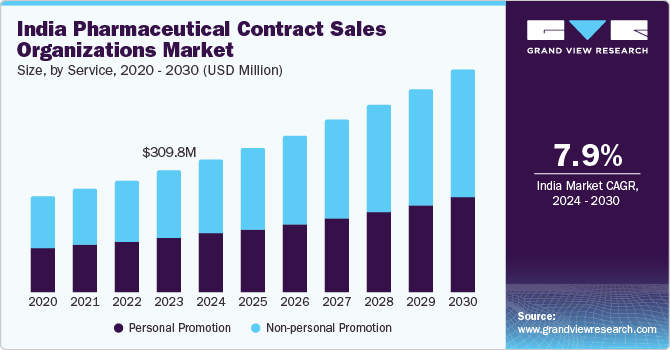

The India pharmaceutical contract sales organizations market size was estimated at USD 309.8 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.9% from 2024 to 2030. Increasing pharmaceutical outsourcing trends, pharmaceutical industry complexity, and enhanced sales force effectiveness are key factors anticipated to drive the market growth in the coming years. Pharmaceutical contract sales outsourcing firms prioritize compliance in an industry regulated by stringent regulatory standards.

These organizations dedicate resources to training their sales representatives on pertinent regulations and industry guidelines, ensuring the adoption of ethical practices.

Expanding Indian pharmaceutical market is a major factor for growth. The Indian pharmaceutical sector currently holds the third position in pharmaceutical production volume.The Indian pharmaceutical sector fulfills more than 50% of the global demand for diverse vaccines, meets 40% of the generic demand in the U.S., and contributes to 25% of the total medicine supply in the UK. The domestic pharmaceutical industry comprises a network of 3,000 drug companies and approximately 10,500 manufacturing units. Moreover, India ranks among the leading 12 global destinations for biotechnology and stands as the third-prime destination for biotechnology in the APAC region.

The landscape of pharmaceutical sales has experienced a significant shift following the impact of COVID-19, marked by the adoption of artificial intelligence tools. The capability of AI to analyze extensive datasets empowers researchers and healthcare professionals to make well-informed decisions. As the volume of data expands, it becomes crucial for medical sales representatives, healthcare professionals, and companies to adopt AI technology and harness visual analytics. This involves moving beyond AI solely as a tool for sales applications and acknowledging its potential to effectively drive sales strategies in the final stage.

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. The India market is characterized by a high degree of innovation. Advanced technologies such as artificial intelligence (AI), telemedicine and remote engagement, and digital marketing and analytics have been heavily incorporated into the sales force.

The impact on CSOs is expected to be significant due to highly stringent regulatory compliance requirements. Pharmaceutical CSOs must adhere to strict compliance standards and regulations to ensure that their activities, including sales and marketing practices, align with legal and ethical standards.

Key CSOs in market are undertaking various strategic initiatives to extend their regional presence into new geographic regions. Expanding into different regions enables CSOs to diversify their client base. Moreover, key companies in the market are involved in merger and acquisition activities. Through M&A initiatives, these players can expand their geographic reach and strengthen their market position.

End-use Insights

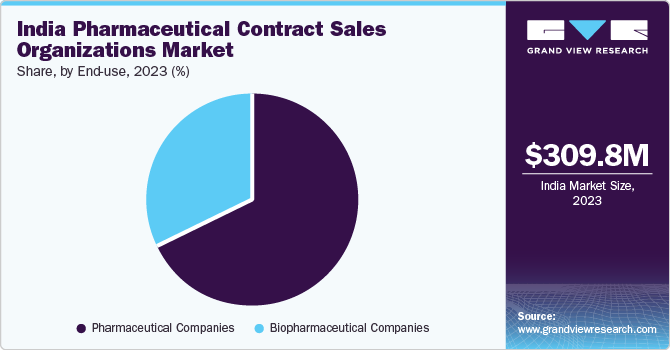

The pharmaceutical companies segment dominated the India market with the largest revenue share in 2023. This is attributed to a presence of a significant number of pharmaceutical companies in the country and strong Indian pharmaceutical industry. The pharmaceutical sector ranks among India's top ten attractive sectors for foreign investment. The country's pharmaceutical exports extend to over 200 nations worldwide, encompassing highly regulated markets such as the USA, West Europe, Japan, and Australia. India has contributed significantly to global healthcare, supplying approximately 45 tonnes and 400 million tablets of hydroxychloroquine to around 114 countries.

The biopharmaceutical companies’ segment is anticipated to witness the fastest CAGR of 8.31% in India market over the forecast period. India holds a prominent position as one of the largest providers of cost-effective drugs and vaccines globally. The India biopharmaceutical industry stands at the forefront of biosimilars, boasting the highest number of approved biosimilars in the domestic market.

Service Insights

Based on service, the market is segmented into personal promotion and non-personal promotion. The non-personal promotion segment held the largest revenue share of 56.4% in 2023.Non-personal promotion (NPP) emerges as an exceedingly efficient and economical marketing strategy for pharmaceutical companies aiming to showcase their products to the appropriate healthcare professionals precisely when needed. For instance, digital marketing allows companies to reach a broader audience with potentially lower costs.

On the other hand, personal promotion services held a significant share of the market. Personal promotion has played a vital role in brand strategy, acting as a driving force for sales. The live interaction inherent in this approach ensures that healthcare professionals (HCPs) are actively engaged with material being presented by the representative. Furthermore, pharmaceutical firms are progressively allocating resources to research and development (R&D), making effective commercial sales and marketing crucial for the overall revenue of these companies.

Key Companies & Market Share Insights

-

IQVIA Inc., ICON Plc., Indegene, and Syneos Health are some of the dominant players operating in India market.

-

IQVIA Inc. has a global presence and operates with approximately 86,000 employees in over 100 countries.

-

Syneos Health's clinical services division delivers contract research services for clinical trials to pharmaceutical and biotechnology firms. Simultaneously, the company's commercial services segment offers marketing and medical affairs support for their products.

-

Parexel International operates in three main segments: Clinical Research Services Perceptive Informatics (Perceptive), PAREXEL Consulting and Medical Communications Services.

-

QFR Solutions and Mednext Pharma Private Limited are some of the market players functioning in India market.

-

Under CSO segment, Mednext Pharma Private Limited offers marketing services, flexible and cost-effective sales team solutions, market & sales data analysis, and KOL relationship development program.

-

MakroCare is a proficient partner in regulatory consulting and clinical services, specializing in assisting the pharmaceutical, biotechnology, and medical device sectors.

Key India Pharmaceutical Contract Sales Organizations Companies:

- IQVIA

- Syneos Health

- Parexel International (MA) Corporation

- Mednext Pharma Private Limited

- Indegene

- ICON plc

- QFR Solutions

- LabCorp

- PPD (Thermo Fisher Scientific)

- Makrocare

Recent Developments

-

In September 2022, Dr. Reddy's Laboratories collaborated with IQVIA to enhance customer interaction services in India.According to the company, OCE represents IQVIA's CRM Application Suite, facilitating the digital transformation of sales and marketing operations for life sciences clients.

India Pharmaceutical Contract Sales Organizations Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 575.2 million

Growth rate

CAGR of 7.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, end-use

Key companies profiled

IQVIA; Syneos Health; Parexel International (MA) Corporation; Mednext Pharma Private Limited; Indegene, ICON plc.; QFR Solutions; LabCorp; PPD (Thermo Fisher Scientific); Makrocare

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchas options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Pharmaceutical Contract Sales Organizations Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the India pharmaceutical contract sales organizations market report based on services and end-use:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Personal Promotion

-

Promotional sales team

-

Key account management

-

Vacancy management

-

-

Non-personal Promotion

-

Medical affairs solutions

-

Remote medical science liaisons

-

Nurse (clinical) educators

-

Others

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Companies

-

Biopharmaceutical Companies

-

Frequently Asked Questions About This Report

b. The India pharmaceutical contract sales organizations market size was estimated at USD 309.8 million in 2023 and is expected to reach USD 337.5 million in 2024.

b. The India pharmaceutical contract sales organizations market is expected to grow at a compound annual growth rate of 7.9% from 2024 to 2030 to reach USD 575.2 million by 2030.

b. The non-personal promotion segment accounted for a largest revenue share of 56.4% in 2023. Non-personal promotion (NPP) emerges as an exceedingly efficient and economical marketing strategy for pharmaceutical companies aiming to showcase their products to the appropriate healthcare professionals precisely when needed.

b. Some key players operating in the India pharmaceutical contract sales organizations market IQVIA, Syneos Health, Parexel International (MA) Corporation, Mednext Pharma Private Limited, Indegene, ICON plc., QFR Solutions, LabCorp, PPD (Thermo Fisher Scientific), Makrocare.

b. Key factors that are driving the market growth include increasing pharmaceutical outsourcing trends, increased pharmaceutical industry complexity, and enhanced sales force effectiveness

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."