- Home

- »

- Plastics, Polymers & Resins

- »

-

India Expanded Polyethylene Foam Market, Report, 2030GVR Report cover

![India Expanded Polyethylene Foam Market Size, Share & Trends Report]()

India Expanded Polyethylene Foam Market Size, Share & Trends Analysis Report By Application (Electronics Packaging, Mattresses, Insulation, Construction, Automotive), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-039-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

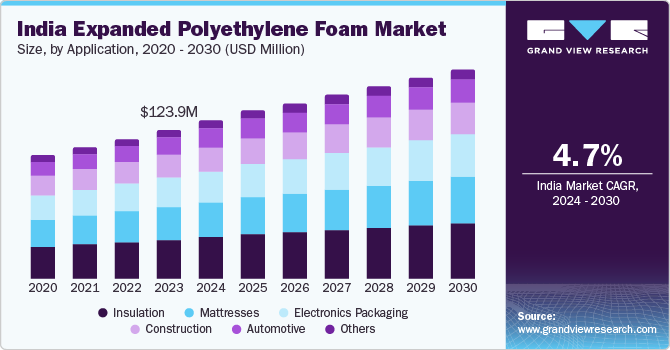

The India expanded polyethylene foam market size was valued at USD 123.9 million in 2023 and is projected to grow at a CAGR of 4.7% from 2024 to 2030. The rising popularity of EPE foams as good thermal insulation in the insulation and electronics packaging sectors is expected to propel the market growth. Additionally, the positive outlook for the automotive sector in emerging economies particularly, India as a result of urban development and new product launches is expected to promote the penetration of these products in the coming years. Expanded polyethylene (EPE) foam has a wide application due to its properties, such as resistance to moisture, excellent thermal insulation, flexible mechanical features, durability, and ease of transportation.

EPE foam is widely used in industries including construction, healthcare, packaging, and others, serving as protection for delicate objects in storage and transit by providing cushioning in packaging, reducing the risk of damage from impacts, movements, or rough treatment. The ability of these foams to resist moisture and provide thermal insulation is ideal for storing temperature-sensitive products.

The increasing need for environmentally friendly and sustainable packaging options is a major driver for the EPE foam packaging industry. The material of expanded polypropylene foam can be recycled and the volume of packaging waste produced is decreased. It offers great shock absorption and provides outstanding protection from impacts and scratches while being transported or stored.

The India Expanded Polyethylene (EPE) foam marketis expected to grow significantly during the forecast period due to the emergence of packaging industry leading to a rise of the e-commerce sector and higher demand from the manufacturing and pharmaceutical industries. EPE foam packaging finds applications in various industries including healthcare, electronics, consumer goods, automotive, food, and beverage. The growing emphasis on sustainable packaging in India, has led to a shift towards eco-friendly and biodegradable materials in the packaging industry, potentially affecting the demand for EPE foam packaging in the future.

Application Insights

The insulation segment accounted for the largest revenue share of 26.6% in 2023. EPE foam is resistant to water, oils, and numerous chemicals. The increasing use of EPM foam in roof insulation to reduce heat absorption and enhance energy efficiency is attributing the segment growth. The rising awareness of climate change and the significance of sustainable construction is driving the need for eco-friendly insulation materials.

The electronics-packaging segment is expected to grow at the fastest CAGR of 5.2% over the forecast years. EPE foam plays a vital role in safeguarding fragile electronic parts from damage during shipping and handling due to its shock-absorbing capabilities. It minimizes vibration, protecting the electronic devices from electrostatic discharge (ESD). Its lightweight decreases shipping expenses, making it a cost-effective option for packaging electronics.EPE foam can be shaped into different forms, minimizing material wastage, and maximizing packaging efficiency.

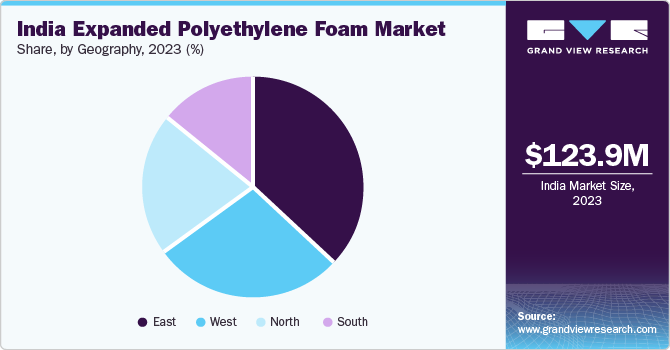

Geography Insights

In terms of region, East India dominated the market in 2023 and is expected to grow at a CAGR of 4.8% over the forecast period. The major states driving growth in East India include West Bengal, Jharkhand, and Assam. The government of India’s Make in India scheme coupled with initiatives by the regional governments is expected to attract automobile and electronics manufacturers over the forecast period.

South India accounted for USD 17.7 million in 2023 in terms of revenue and is anticipated to expand at a CAGR of 3.9% over the forecast period. Automobile manufacturing units of several companies is situated in Tamil Nadu making it an ideal market for EPE foam in South India.

Key India Expanded Polyethylene Foam Company Insights

The market is highly competitive with industry players undertaking several strategies to reinforce their competitive positions. Government policies favoring growth of the automotive, electronics, and construction industry, coupled with the demand for efficient packaging solutions, is expected to propel the market over the forecast period.

Key India Expanded Polyethylene Foam Companies:

- VENTO FOAM PVT. LTD.

- Goldcoin Foam Private Limited

- Shrinidhi Plastic Industries

- ORION PACKART

- Vraj International

- SAMEKO INDUSTRIES

- Arm Packing Solutions Private Limited

- AAKANKSHA PACKAGING

- SUPREMEPACKS PLASTIC PRIVATE LIMITED

- Kamaksha Packaging Industries

- TRS Industries LLP

View a comprehensive list of companies in the India Expanded Polyethylene Foam Market

India Expanded Polyethylene Foam Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 131.9 million

Revenue forecast in 2030

USD 173.8 million

Growth rate

CAGR of 4.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, Revenue in Million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, geography

Regional scope

India

Country scope

India

Key companies profiled

VENTO FOAM PVT. LTD.; Goldcoin Foam Private Limited; Shrinidhi Plastic Industries; ORION PACKART; Vraj International; SAMEKO INDUSTRIES; Arm Packing Solutions Private Limited; AAKANKSHA PACKAGING; SUPREMEPACKS PLASTIC PRIVATE LIMITED; Kamaksha Packaging Industries; TRS Industries LLP

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Expanded Polyethylene Foam Market Report Segmentation

This report forecasts revenue growth at country level and analyses the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India expanded polyethylene foam market report based on application and region.

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Electronics Packaging

-

Mattresses

-

Insulation

-

Construction

-

Automotive

-

Others

-

-

Geography Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

East

-

West

-

North

-

South

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."