- Home

- »

- Plastics, Polymers & Resins

- »

-

High Heat Foam Market Size, Share & Trends Report, 2030GVR Report cover

![High Heat Foam Market Size, Share & Trends Report]()

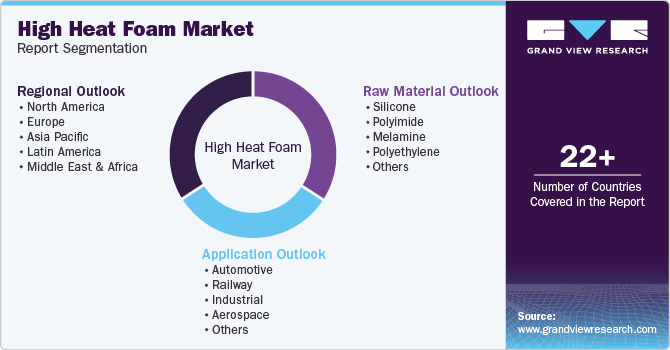

High Heat Foam Market Size, Share & Trends Analysis Report By Raw Material (Silicone, Polyimide, Melamine), By Application (Automotive, Railway, Industrial, Aerospace), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-008-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

High Heat Foam Market Size & Trends

The global high heat foam market size was valued at USD 11.1 billion in 2023 and is projected to grow at a CAGR of 6.7% from 2024 to 2030. This growth is attributed to the increase in its adoption as an alternative for metals in the automotive or aerospace industries; simultaneously, the ecological advantages lead to the demand for high-heat foam. In addition, key companies' continuous advancements and innovations in foam making to attain quality and multiple utilization in several industries further boost the market.

The growing awareness of environmental benefits associated with foam insulation contributes to market expansion. Technological advancements further enhance the performance and applications of high heat foams, making them more appealing across various sectors, including construction and electronics. In addition, the market is also experiencing growth in demand across different industries because of its thermal insulation, heat management, and fire resistance characteristics. Hence, various types of foams and resins are made according to the requirements of different applications. Furthermore, with the growth in building and construction activities worldwide, the demand for high-heat foams rises for various applications involving acoustic and thermal insulation and energy efficiency maintenance.

Moreover, the high demand from different countries aligns with rising manufacturers' intentions toward industrial, automotive, and aerospace industry applications. Moreover, public and private investments in technologically innovative and advanced products and customer awareness of the use of environment-friendly and energy-efficient products are projected to lead to global market growth over the forecast period.

Raw Material Insights

Silicone dominated the market and accounted for the largest revenue share of 34.5% in 2023. This growth is attributed to features such as heat resistance and thermal stability. Silicone foams are toxin-free, unlike polyurethane, which is vulnerable to toxicity during heat decomposition. Silicone-based foams are increasingly used for insulation across various industries, increasing demand and market growth.

Polyimide is expected to grow at a CAGR of 7.2% over the forecast period. It is an ultra-high-performance thermoset polymeric foam with imide rings in the leading chains in severe temperatures. It has developed to respond to the rising necessities of high-tech sectors, including sensors, aerospace, weaponry, microelectronics, and other industries. However, with an equal strength-to-weight ratio, no alternate material can compete with the properties of foams; they are irreplaceable in different applications, such as electronics, packaging, transportation, building, clothing, aerospace, marine, etc.

Application Insights

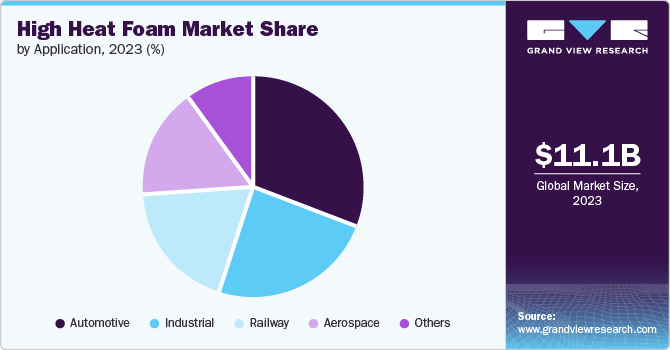

The automotive application segment led the market and accounted for the largest revenue share of 31.2% in 2023. This growth is attributed to the increasing demand for lightweight materials as alternatives to metals to enhance fuel efficiency and reduce emissions. Furthermore, high-heat foams provide excellent thermal insulation, protecting sensitive components from engine heat. Environmental regulations promoting energy efficiency further boost their adoption. The rise in electric vehicle production also contributes to the demand, as manufacturers seek materials that improve performance while meeting sustainability goals.

Industrial applications are expected to grow at a CAGR of 7.2% over the forecast period. High-temperature foam insulation is used in industrial applications as it is lightweight, non-flammable, thermal, and acoustic, and it is ideal for high-temperature resistance requirements. In addition, it is used in furnace applications in various industries, such as petrochemicals, iron and steel, ceramics, and powder metallurgy.

Regional Insights

The North America high-heat foam market is expected to grow significantly owing to its significant uses in various applications such as industrial and aerospace. In addition, high heat foam serves as an effective alternative to metals, offering ecological benefits and energy efficiency. Furthermore, rising awareness of environmental advantages, such as reduced energy consumption, further fuels market expansion.

U.S. High Heat Foam Market Trends

The growth of the high-heat foam market in the U.S. is driven by the innovation of electric vehicles, which is expected to continue to gain momentum in the coming years, especially in developed countries such as the U.S. In addition, several government programs and initiatives are promoting a shift away from fossil fuels owing to environmental concerns. Furthermore, the prominent companies in the market and increasing demand for lightweight vehicles to improve automobile fuel efficiency are driving the market.

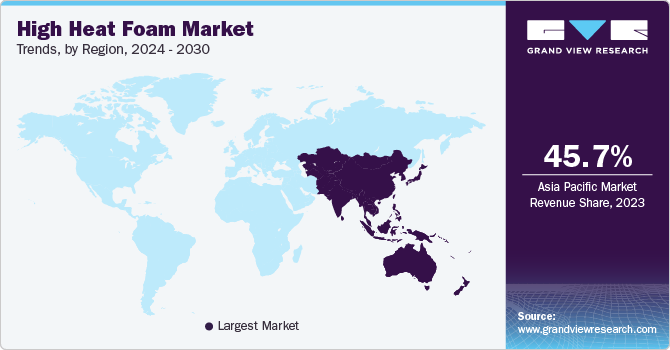

The Asia Pacific high heat foam market dominated the global market and accounted for the largest revenue share of 45.7% in 2023. This growth is driven by robust industrialization, developments in the aerospace and automotive industries, and evolution in construction activities. In addition, technological advancements, increased usage in the automotive industry as a metal alternative, and ecological benefits further fuel the market’s growth in the region. Furthermore, there is a rising demand for bio-based foams and innovations in manufacturing processes.

China High Heat Foam Market Trends

The high heat foam market in China led the Asia Pacific market with the largest revenue share of 41.4% in 2023. China is the world's largest production hub among developed nations and has the fastest-growing economies. The manufacturing sector is one of the critical contributions to the nation's economy. Furthermore, China is the world's biggest producer of automobiles. The automobile industry conducts timely research for product development, focusing on making products to ensure fuel economy and reduce emissions.

India high heat foam market is expected to grow substantially over the forecast years. This growth is attributed to the extensive use of high-heat foams in sports and leisure applications. In addition, constant population growth, increasing disposal income, and growing industrialization and automobile sector are expected to open new avenues in the region.

Middle East & Africa High Heat Foam Market Trends

The high heat foam market in the Middle East and Africa (MEA) is expected to grow at a CAGR of 7.0% over the forecast years. This growth is primarily driven by the region's rising construction and automotive industries. Increasing investments in infrastructure development, particularly in countries such as Saudi Arabia and the UAE, are fueling demand for high heat foam insulation to improve energy efficiency in buildings. Furthermore, the rising demand for lightweight and fuel-efficient vehicles in the automotive sector is propelling the adoption of high heat foam as a replacement for heavier materials. However, the market faces high processing costs and fluctuating raw material prices.

Europe High Heat Foam Market Trends

Europe high heat foam market registered significant growth and accounted for a revenue share of 24.2% in 2023, owing to the increasing demand from the automotive and construction industries. High heat foam is an effective alternative to metals in vehicles, offering weight reduction and improved fuel efficiency. Furthermore, stringent energy efficiency regulations in the construction sector are fueling the adoption of high heat foam insulation to reduce energy consumption in buildings.

The high heat foam market in the UK is expected to grow significantly over the forecast years. This growth is attributed to important technological innovations and changes in consumer preferences. In addition, advancements in automobiles, aerospace, packaging, and industrial use are transforming operations and the use of heat foam, thereby driving the growth of the country's market.

Key High Heat Foam Company Insights

Some of the key companies in the high heat foam market include BASF SE, Rogers Corporation, Evonik Industries AG, SINOYQX, puren gmbh, UBE Corporation, Intecfoams, ARMACELL, Wacker Chemie AG, SABIC, 3M, Dow, DuPont in the market are focusing on development & to gain a competitive edge in the industry.

-

Evonik Industries AG is a specialty chemical company whose portfolio includes resins, additives, surfactants, polymers, and others. Applications are utilized in several sectors, such as paints and coatings, agriculture, renewable energy, and consumer and personal care products. The company also provides process technology, technical, logistics, utilities and waste management, and engineering services.

-

ARMACELL provides technical and innovative insulation solutions and parts to enhance energy efficiency. The company focuses on high-performance foams for lightweight applications, recycled PET products that create sustainable consumer value, and insulation materials for technical equipment.

Key High Heat Foam Companies:

The following are the leading companies in the high heat foam market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Rogers Corporation

- Evonik Industries AG

- SINOYQX

- puren gmbh

- UBE Corporation

- Intecfoams

- ARMACELL

- Waker Chemie AG

- SABIC

- 3M

- Dow

- DuPont

- Rath-Group

- Morgan Advanced Materials

- Knauf Insulation

- Grupo NUTEC

- Vitafoam Nig. PLC

- Saint-Gobain

- Stepan Company

Recent Developments

-

In June 2024, Wacker Chemie AG announced plans to enhance its European silicone specialty production by constructing a new facility in Karlovy Vary. The site is expected to commence production of room-temperature-curing high-performance silicones by late 2025 and high-consistency silicone rubber by 2028, bolstering Wacker's position as a solutions provider.

-

In April 2024, BASF, together with SABIC and Linde, initiated the first demonstration facility for sweeping electrically heated steam cracking furnaces at BASF's Verbund site in Ludwigshafen. This plant, developed over three years, will produce olefins such as ethylene and propylene while utilizing renewable electricity, potentially reducing CO2 emissions by over 90% compared to traditional methods. The regular operation of the demonstration plant is ready to be induced at BASF’s Verbund site in Ludwigshafen.

-

In April 2023, Kanthal and Rath formed a strategic partnership to expand their industrial heating technology offerings. This collaboration aims to enable sectors such as steel and petrochemicals to transition towards greener practices through their combined expertise in electric heating and high-temperature refractory products.

High Heat Foam Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.8 billion

Revenue forecast in 2030

USD 17.5 billion

Growth Rate

CAGR of 6.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Russia, Denmark, Sweden, Norway, China, India, Japan, Australia, South Korea, Indonesia, Vietnam, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

BASF SE; Rogers Corporation; Evonik Industries AG; SINOYQX; puren gmbh; UBE Corporation; Intecfoams; ARMACELL; Waker Chemie AG; SABIC; 3M; Dow; DuPont; Rath-Group; Morgan Advanced Materials; Knauf Insulation; Grupo NUTEC; Vitafoam Nig. PLC; Saint-Gobain; Stepan Company

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global High Heat Foam Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global high heat foam market report based on raw material, application, and region.

-

Raw Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Silicone

-

Polyimide

-

Melamine

-

Polyethylene

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Railway

-

Industrial

-

Aerospace

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Indonesia

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."