- Home

- »

- Clothing, Footwear & Accessories

- »

-

Fly Fishing Apparel and Accessories Market Report, 2030GVR Report cover

![Fly Fishing Apparel and Accessories Market Size, Share & Trend Report]()

Fly Fishing Apparel and Accessories Market Size, Share & Trend Analysis Report By Product (Apparel, Gears), By Distribution Channel (Online, Offline), By Region, and Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-046-9

- Number of Report Pages: 76

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

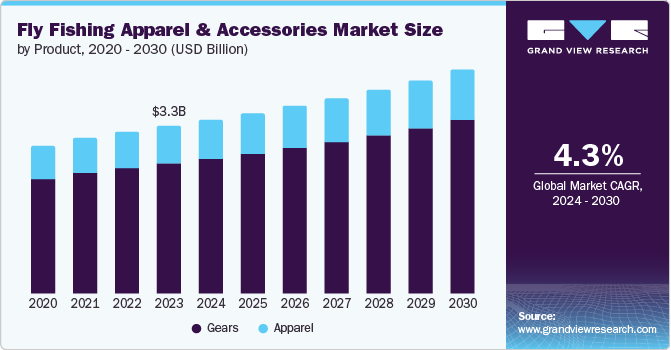

The global fly fishing apparel and accessories market size was estimated at USD 3.25 billion in 2023 and is expected to grow at a CAGR of 4.3% from 2024 to 2030. The market is primarily driven by factors such as the increasing popularity of fly fishing as a recreational activity, growing interest in eco-friendly and sustainable fishing practices, and the availability of a wide range of products catering to the diverse needs and preferences of anglers.

Fly fishing clothing and accessories are products designed to make the experience of fly fishing comfortable, convenient, and efficient. Fly fishing is gaining popularity as a recreational sport across the globe, which has created a large customer base for fly fishing clothing and accessories. In the U.S., the number of fly fishing participants has increased steadily over the past few years. Moreover, the growing participation of females in fishing sports is further projected to enhance the demand for fly fishing apparel and accessories over the forecast period. According to a 2021 report from the Recreational Boating & Fishing Foundation (RBFF) and Outdoor Foundation, 19.7 million women participated in fishing in 2020, an increase of 10% over the preceding year.

Fishing has emerged as a classic sport, thereby popularizing related tournaments and championships across the world. According to the American Sportfishing Association, around 40,000 to 50,000 fishing derbies and tournaments are organized in the U.S. annually. South Texas Angler, Texas Bass Nation South Region, Karlens Big Bass, and Rio Grande Bass Club are some of the popular tournaments that involve 12 to 30 people.

Such competitions and tournaments have significantly encouraged interest and participation in fishing. As a result, the sport is gaining high traction in countries with long coastlines, such as Australia, New Zealand, parts of the U.S. and Canada, Portugal, and Asian countries like Indonesia and Sri Lanka, which is expected to drive market growth.

This has also led to an increase in demand for fly fishing apparel for local fishing trips in Europe. In addition, there is a growing interest in sustainable and environment-friendly products for outdoor recreation activities, including fly fishing. Brands that offer eco-friendly and ethically sourced apparel may have an advantage in the market in this region, particularly among younger consumers who are more environmentally conscious.

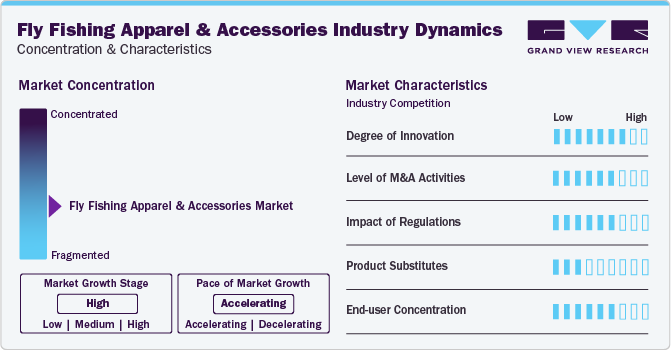

Market Concentration & Characteristics

The industry has witnessed a significant degree of innovation in recent years, characterized by the introduction of new products that are lighter, stronger, and more durable than ever before. This innovation has been primarily fueled by advancements in technology, leading to the development of new materials and designs that enhance the overall fly fishing experience. Manufacturers have focused on creating comfortable and efficient gear, such as lightweight and breathable fabrics for wading jackets, and improved rod and reel technology, catering to both experienced anglers and beginners.

The industry has experienced a moderate level of merger and acquisition activity in recent years, with some notable deals reshaping the industry landscape. Key players in the market have strategically pursued acquisitions to expand their product portfolios, reach new markets, and leverage synergies to drive growth. These mergers and acquisitions have also enabled companies to enhance their research and development capabilities, improve supply chain efficiencies, and capitalize on economies of scale.

Regulations have played a significant role in shaping the fly-fishing apparel and accessories industry, ensuring compliance with industry standards and consumer safety. Government initiatives and regulatory bodies have set guidelines to govern the production, distribution, and sale of fly fishing gear, emphasizing quality control and environmental sustainability practices. These regulations have influenced product development, with an increasing focus on creating eco-friendly and ethically sourced apparel to meet rising consumer demand for sustainable products.

Product substitutes in the fly fishing apparel and accessories primarily include outdoor and fishing apparel from general outdoor brands and traditional fishing gear manufacturers. Outdoor clothing companies offer versatile options that can be suitable for fly fishing activities, such as performance shirts, pants, and outerwear, providing customers with alternatives to specialized fly fishing apparel. Similarly, traditional fishing gear manufacturers produce a wide range of fishing equipment that can be used for fly fishing, including rods, reels, and accessories, offering customers different choices when selecting gear for their fishing adventures.

End user concentration in the industry tends to be varied, encompassing a diverse group of consumers ranging from seasoned anglers to recreational fishing enthusiasts. While experienced fly fishers may seek high-performance gear and specialized apparel tailored to their needs, casual fishermen and beginners might opt for more affordable and multipurpose outdoor clothing and equipment.

Product Insights

The gear segment accounted for a share of 77.2% of the global revenue in 2023. Fly fishing gear has seen significant innovation in recent years, with manufacturers introducing new products that are lighter, stronger, and more durable than before. This has helped improve the overall fishing experience for anglers and made the sport more accessible to beginners. Fly fishing gear has been gaining significant traction in recent years as there is increased interest in outdoor activities and nature-based hobbies. Also, fly fishing gear such as packs and socks are nowadays easily affordable and accessible, making it easier for beginners to indulge in fly fishing activities.

The apparel segment is projected to grow at a CAGR of 3.9% from 2024 to 2030. Companies are focusing on expanding their product lines and adopting innovative technologies to meet consumer demand for fish-hunting equipment. For instance, in March 2022, Skwala, based in Southwest Montana, announced the launch of an impressive line of apparel that includes two waders, two jackets, two insulation pieces, two sun shirts, shorts, and wading pants. Targeted advertising initiatives can help manufacturers reach specific audiences, such as avid anglers or outdoor enthusiasts, who are more likely to be interested in purchasing fishing apparel. Overall, campaigns and advertising activities can play a key role in driving demand for fishing apparel.

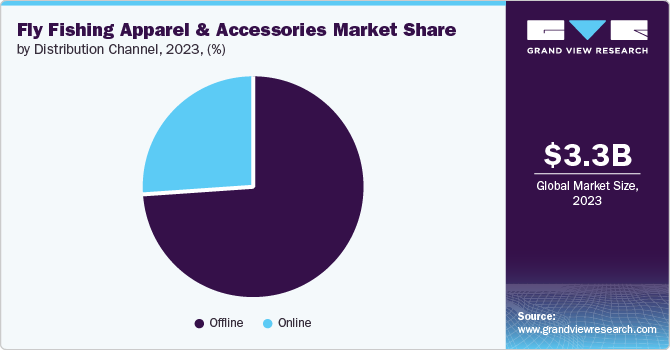

Distribution Channel Insights

The sale of fly fishing apparel and accessories through offline channels accounted for 73.5% of the global revenue in 2023. The appeal of physical stores for anglers to connect with like-minded individuals, receive personalized advice and recommendations from knowledgeable staff, and physically examine and test products before purchasing has led to the dominance of offline sales channels in the industry.

The sale of fly fishing apparel and accessories through online channels is projected to grow at a CAGR of 5.6% from 2024 to 2030. With the convenience of online shopping, more people are turning to the internet to purchase their fishing gear. Fly fishing has become increasingly popular, particularly among millennials, which has led to more people seeking out fishing equipment online.

The interest of millennials and Generation Z in fish hunting as a recreational sport is a significant factor contributing to the growth of online sales channels. The presence of online retailers such as Cabela’s, Tackle Warehouse LLC, Fishing Tackle Unlimited, and Amazon has played a crucial role in creating awareness among anglers regarding various types of fishing tackles available in the market.

Sales of fly fishing apparel and accessories through online channels are expected to witness the fastest CAGR during the forecast period. The popularity of e-commerce channels is expected to increase over the projected timeframe, compared to offline distribution channels, given the increasing number of market players marking their presence online.

Fly fishing apparel and accessories industry players have been offering customers the ability to place and track orders online on their platforms, e-commerce sites, or third-party platforms like Shopify. In this regard, the emergence of high-end online shopping platforms is expected to act as a driver for the industry in the foreseeable future.

Regional Insights

The North America fly fishing apparel and accessories market accounted for a share of 46.4% of the global revenue in 2023. Fly fishing is a popular sporting/recreational activity among Americans. The rising participation of the youth and women in outdoor activities such as recreational fishing is driving the sales of fly fishing apparel and accessories in the region. Moreover, major associations and organizations such as the American Sportfishing Association (ASA), Northwest Sportfishing Industry Association (NSIA), and American Catfishing Association (ACA) play a key role in promoting sport fishing activities in America. These have helped the recreational fishing businesses thrive in the region. In May 2022, the American Sportfishing Association (ASA) and Recreational Boating & Fishing Foundation (RBFF) launched a campaign to encourage industry leaders in the sportfishing industry, fishing communities, and young anglers to engage in fly fishing in spring and summer.

U.S. Fly Fishing Apparel and Accessories Market Trends

The fly fishing apparel and accessories market in the U.S. is projected to grow at a CAGR of 5.0% from 2024 to 2030. In the U.S., fly fishing is treated as one of the most popular and highly accessible activities. The increased participation in fishing activities among Americans has driven the sales of fishing apparel and accessories, and the market is expected to witness significant growth in the coming years. The Recreational Boating and Fishing Foundation (RBFF) and Outdoor Foundation (OF) released the 2021 Special Report on Fishing in June 2021. The report focuses on fishing participation in the U.S. in 2020. The results indicate that participation in fly fishing increased in 2020. It is estimated that there was a 42% increase of up to 7.8 million people who went fly fishing in 2020 from the 5.5 million who did so in 2010.

Europe Fly Fishing Apparel and Accessories Market Trends

The Europe fly fishing apparel and accessories market accounted for a share of 30.27% of the global revenue in 2023. The fly fishing industry in Europe is diverse, with a range of manufacturers and retailers offering products such as rods, apparel, reels, flies, etc. The U.K., Norway, Scotland, Sweden, and Iceland are some of the countries where fly fishing is particularly popular, and these markets may witness a higher demand for fly fishing apparel. Moreover, Europe is home to some popular fly fishing destinations with a wide range of fish varieties and record catches. Some well-known fishing locations are the Langa River in Iceland, the Aelva River in Norway, and the Thurso River in Scotland, which have numerous species of fish, including the Atlantic salmon, Arctic char, sea trout, and brown trout.

The UK fly fishing apparel and accessories market is projected to grow at a CAGR of 3.8% from 2024 to 2030. The improved accessibility of fishing locations in England and Scotland and the availability of quality equipment and guides for fish hunting have led to the growing popularity of fly fishing activities across the country. Furthermore, the National Angling Strategy 2019-2024 was launched in the UK to encourage more participation in angling owing to its health benefits. Trusts and organizations in the UK are focusing on partnering with fishing organizations to encourage people across the country to adopt fishing as a hobby.

The fly fishing apparel and accessories market in Germany is projected to grow at a CAGR of 4.8% from 2024 to 2030. Fly fishing is a popular outdoor activity in Germany. Furthermore, there are numerous fly fishing clubs and associations that attract anglers and fish-hunting experts every year. These clubs conduct hunting exhibitions to attract beginners to learn and improve their skills and bring a comprehensive range of fishing gear, apparel, and accessories.

Asia Pacific Fly Fishing Apparel and Accessories Market Trends

The Asia Pacific fly fishing apparel and accessories market is projected to grow at a CAGR of 3.6% from 2024 to 2030. The demand for fly fishing products has been strong in the region, driven by an increasing number of recreational anglers and rising consumer spending on the same. As the middle-income population in the Asia Pacific grows, so does the affordability of quality fly fishing gear and apparel. Apart from this, e-commerce and digital marketing have enabled manufacturers of fly fishing apparel and accessories to reach a wider regional audience.

The market for fly fishing apparel in Australia is projected to grow at a CAGR of 3.9% from 2024 to 2030. Fly fishing is a popular activity among Australians. Companies such as The Flyfisher, BWCflies, and Aussie Angler provide a wide variety of fly fishing gear such as rods, reels, hip packs, and apparel. Furthermore, offline channels such as supermarkets and retail stores also drive the market growth. In June 2022, Anaconda opened an 8,000-square-meter Anaconda Adventure HQ store in Sydney. The store provides clothing, tents, fishing gear, and water sports equipment for all age groups.

The New Zealand market for fly fishing apparel is projected to grow at a CAGR of 3.7% from 2024 to 2030. New Zealand is known for its focus on conservation and sustainable fishing practices. Fly fishing is considered a more sustainable form of fishing, increasing its popularity among anglers in the country. This, in turn, has led to an increased demand for fly fishing apparel and accessories in the country.

Central & South America Fly Fishing Apparel and Accessories Market Trends

Central & South America fly fishing apparel and accessories market is projected to grow at a CAGR of 2.5% from 2024 to 2030. Fishing has been an integral part of Central and South America’s culture and tradition for generations. Belize is Central America’s smallest and most popular country for saltwater fly fishing. The growing attraction of fly fishing and access to popular fly fishing destinations such as Belize, Costa Rica, and Guatemala has allowed domestic and international market players to introduce new fly fishing apparel and accessories in the region.

Middle East & Africa Fly Fishing Apparel and Accessories Market Trends

The Middle East and Africa fly fishing apparel and accessories market is projected to grow at a CAGR of 3.0% from 2024 to 2030. Dubai is the finest fishing operator in the region. The recreational activity of fly fishing has gained popularity among fishing and nature-loving groups in the region. Moreover, the increasing number of tourists in the region contributes to market growth.

Key Fly Fishing Apparel & Accessories Company Insights

The fly fishing apparel and accessories industry is highly competitive owing to the presence of a large number of global as well as many small- and mid-sized regional players. Companies with multiple brands and vast distribution networks hold a significant market share. The Orvis Company, Inc.; Simms Fishing Products; Patagonia, Inc.; and Redington (Far Bank Enterprises) are some major players in the global fly fishing apparel and accessories industry and have extensive product portfolios and strong distribution channels.

Key Fly Fishing Apparel & Accessories Companies:

The following are the leading companies in the fly fishing apparel & accessories market. These companies collectively hold the largest market share and dictate industry trends.

- The Orvis Company, Inc.

- Simms Fishing Products

- Patagonia, Inc

- Snowbee USA

- Skwala Fishing

- Redington (Far Bank Enterprises.)

- Bassdash

- FROGG TOGGS

- Compass 360 (Slumberjack)

- 8Fans

Recent Developments

-

In January 2024, Shimano North America Fishing announced the expansion of its saltwater rod lineup with the introduction of the all-new GLF B series and the redesigned Saguaro B series.

-

In July 2023, Shimano North America Fishing introduced the latest addition to its acclaimed Curado line of low-profile baitcasting reels. The Curado 200 M was unveiled at the 2023 ICAST New Product Showcase in Orlando, Florida, showcasing its advanced reel technologies.

-

In July 2023, St. Croix Rods launched its latest rod launches for 2024 in Orlando, featuring the Mojo Bass TRIGON and Avid Inshore models. These new additions will be available to anglers starting from August 2023, offering enhanced performance and versatility for fishing enthusiasts.

Fly Fishing Apparel and Accessories Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.37 billion

Revenue forecast in 2030

USD 4.34 billion

Growth Rate (Revenue)

CAGR of 4.3% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; UK; Germany; France; China; Australia; New Zealand

Key companies profiled

Group Plc, John Sands (Australia) Ltd., The Orvis Company, Inc., Simms Fishing Products, Patagonia, Inc; Snowbee USA, Skwala Fishing, Redington (Far Bank Enterprises.), Bassdash, FROGG TOGGS, Compass 360 (Slumberjack), 8Fans

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

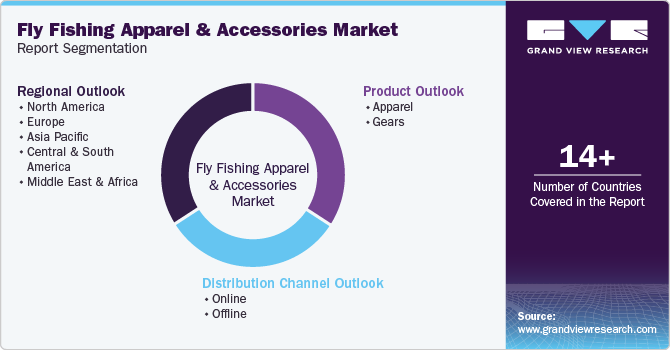

Global Fly Fishing Apparel and Accessories Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fly fishing apparel and accessories market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Apparel

-

Jackets

-

Waders

-

Hats

-

Others

-

-

Gears

-

Packs

-

Socks

-

Gloves

-

Rods, Reels, and Components

-

Lines and Leaders

-

Lures, Flies, and Artificial Baits

-

Creels, Strings, and Landing Nets

-

Others

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Australia

-

New Zealand

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global fly fishing apparel and accessories market size was estimated at USD 3.25 billion in 2023 and is expected to reach USD 3.37 billion in 2024.

b. The global fly fishing apparel and accessories market is expected to grow at a compound annual growth rate of 4.3% from 2024 to 2030 to reach USD 4.34 billion by 2030.

b. North America dominated the fly fishing apparel and accessories market with a share of 46.4% in 2023. The growth of this region is attributable to the strong fly fishing culture in the United States and Canada, increasing participation in fishing as an activity, high disposable income, and a large and growing population of outdoor enthusiasts.

b. Some key players operating in the fly fishing apparel and accessories market include Patagonia, Inc., The Orvis Company, Inc., Snowbee USA, Simms Fishing Products, FROGG TOGGS, and Redington (Far Bank Enterprises).

b. Key factors that are driving the fly fishing apparel and accessories market growth include increasing interest in fishing as a sport and leisure activity, a growing interest in sustainable fishing practices, a growing trend towards participation in outdoor activities, and an increase in tourism.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."