- Home

- »

- Communications Infrastructure

- »

-

Europe Fiber Optics Market Size, Industry Report, 2030GVR Report cover

![Europe Fiber Optics Market Size, Share & Trends Report]()

Europe Fiber Optics Market Size, Share & Trends Analysis Report By Mode (Single-mode, Multi-mode, Plastic Optical Fiber), By Application (Military & Aerospace, Railway), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-287-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Europe Fiber Optics Market Size & Trends

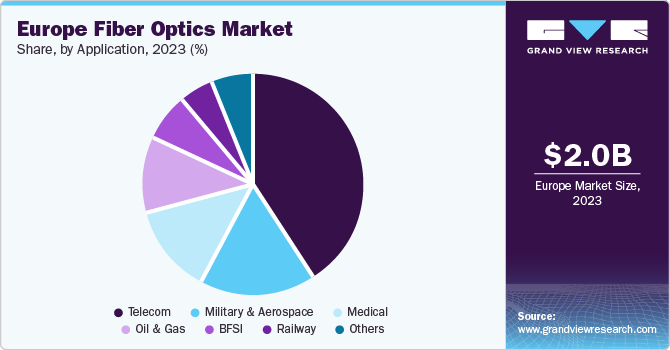

The Europe fiber optics market size was estimated at USD 2.0 billion in 2023 and is expected to grow at a CAGR of 4.3% from 2024 to 2030. Fiber optics technology has progressed swiftly due to substantial research and development work by scientists and researchers. The rapid growth of 5G networks worldwide demands a significant fiber optic infrastructure to meet the high-speed and low latency needs of 5G, driving additional expansion in the market.

Telecommunication firms are increasingly investing in fiber optic networks to address the rising need for high-bandwidth communication services, significantly impacting the market. Additionally, the growth of data centers to facilitate cloud computing and storage demands fast connectivity, highlighting the essential role of fiber optics in their infrastructure and driving market growth.

Rapid progressions in fiber optics, including enhanced capacity, better signal quality, and more effective installation techniques, are propelling market expansion by broadening the capabilities of this technology. Governments across the region are making substantial investments in broadband infrastructure and offering incentives to encourage the uptake of fiber optics. For instance, in October 2023, the UK government invested USD 5.24 billion in broadband infrastructure for Project Gigabit to reach a broader population and provide them with faster broadband access.

The COVID-19 pandemic substantially impacted the fiber optics market, affecting demand, supply chains, and industry focus. The pandemic accelerated digital transformation and the demand for high-speed internet due to increased remote work, online education, telemedicine, and streaming services. This surge in internet usage drove the demand for fiber optic installations in residential areas and data centers and as part of the infrastructure for 5G networks to support higher data volume and faster speeds.

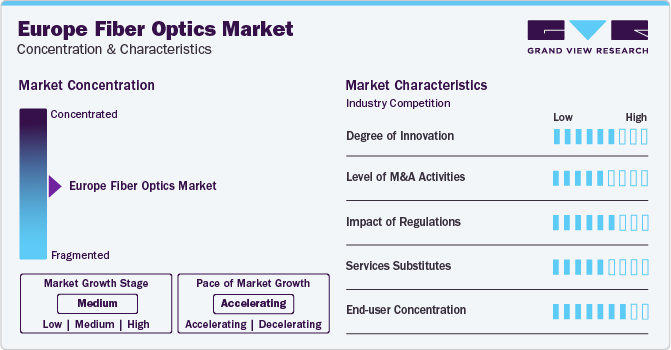

Market Concentration & Characteristics

The European fiber optics industry is significantly fragmented in nature. The industry witnesses a high level of innovation due to advancements in fiber optics technology, including introducing innovative materials, upgraded manufacturing methods, and enhanced transmission approaches, which have significantly driven innovation within the European fiber optics market. The rising demand for 5G networks necessitates robust and high-capacity fiber optic infrastructure to meet this advanced technology's increased data traffic and low latency requirements. This requirement drives innovation in the fiber optics market, emphasizing the need for denser, fiber-rich network infrastructures to support key performance indicators like lower latency, longer battery life, higher data rates, ultra-high reliability, and connectivity for more devices.

The industry is characterized by a high level of merger & acquisition activities as companies aim to strengthen their positions, expand their offerings, and enhance their capabilities. For instance, in November 2021, Prysmian Group acquired Swiss Omnisens S.A., a prominent company specializing in advanced fiber-optic monitoring solutions for critical infrastructures. This acquisition aims to strengthen Prysmian's value-added services, driving progress towards a digital, remote, and electrified global industrial evolution. Moreover, the end-user concentration of the industry is high as it encompasses a diverse range of divisions, such as telecommunications companies, ISPs, data center operators, government agencies, educational institutions, and healthcare organizations.

Mode Insights

The multi-mode segment led the market and accounted for the largest revenue share of 52.4% in 2023. Expanding data centers in countries like Germany, France, and the Netherlands fuels the segment's growth. These data centers often utilize multi-mode fiber optics for high-speed connections. It is also becoming a preferred communication medium for critical automotive applications due to its high bandwidth, low cost, and ability to effectively address the automotive sector's communication, lighting, and sensing needs.

Plastic optical fibers are anticipated to register the fastest CAGR over the forecast period. Plastic optical fiber (POF) is typically used for short-range communication applications and is more flexible, rugged, and easier to install optical fibers. The growing demand for smart building solutions and high-speed home networks fuels the market.

Application Insights

The telecom segment led the market and accounted for the largest revenue share in 2023. Fiber optic cables are instrumental in linking various network nodes like cell towers, data centers, and internet service providers, facilitating the transfer of large volumes of data across different sites. These cables have been pivotal in advancing high-speed internet connections and cutting-edge communication technologies such as video conferencing, online gaming, and cloud computing.

The medical segment is anticipated to register the fastest CAGR over the forecast period. The use of optical fibers by doctors for endoscopic procedures to get a clear image of the body from the inside, which helps diagnose the patient, is driving the market demand in the segment. Furthermore, fiber optics in the medical field offers significant advantages such as flexibility, small size, biocompatibility, and the ability to transmit light signals without any loss of intensity.

Country Insights

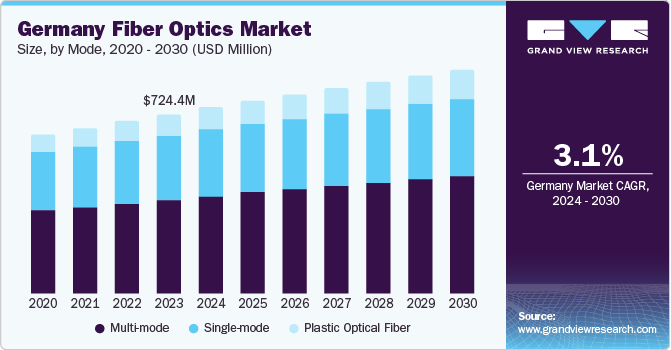

Germany's fiber optics market accounted for the largest revenue share of 36.2% in 2023. The market is experiencing significant growth due to a surge in high-speed internet demand, advancements in technology, and government initiatives, leading to a robust expansion path for the industry in the country. For instance, in March 2022, Germany's Federal Ministry for Digital Affairs and Transport (BMDV) revealed its "Gigabit Strategy," which includes critical objectives such as ensuring that a minimum of 50% of all German properties are equipped with Fiber to the Home (FTTH) networks by the end of 2025. Additionally, Germany accounted for around 7% of the global fiber optics market in 2023 and is expected to grow rapidly over the forecast period.

France's fiber optics market is anticipated to register the fastest CAGR over the forecast period. New advancements like bend-insensitive fibers and sophisticated signal processing methods in the country are facilitating the use of fiber optics in challenging environments, broadening the scope for fiber optic deployment.

Key Europe Fiber Optics Company Insights

Some of the key players operating in the market include Prysmian Group, Linden Photonics, Inc., and Nexans.

-

Prysmian Group offers various fiber optic cables, power cables, and telecom solutions for applications like telecommunications networks, data centers, and local access networks. Prysmian Group is known for its innovation, sustainability efforts, and top-notch products that provide a wide array of high-quality solutions globally.

-

Linden Photonics, Inc. offers a range of compact, durable optical fiber, hybrid, and specialty copper cables to meet the demands of high-performance applications in a small package. The company provides a wide variety of optical fibers, including lenses, prisms, mirrors, filters, and beam splitters.

Key Europe Fiber Optics Companies:

- Axjo Plastic AB

- Coherent Corp.

- Corning Incorporated

- Hexatronic Group

- Linden Photonics, Inc.

- Nexans

- Panduit Corp.

- Prysmian Group

- STL Tech

- TKH GROUP

Recent Developments

-

In September 2023, TKH GROUP opened a new optic fiber cables production facility in Rawicz, Poland, nearly doubling fiber optic cables' production capacity. The new facility in Poland provides cutting-edge production capabilities for delivering advanced fiber optic cable solutions to the European market.

-

In September 2022, Corning Incorporated inaugurated a modern optical fiber production facility in Mszczonów, Poland, to cater to the rising demand for high-speed connectivity in the European Union. This plant, among the largest in the EU, represents Corning's substantial investments in fiber and cable manufacturing to satisfy the growing requirements for cutting-edge networks.

-

In June 2020, Hexatronic Group acquired Tech Optics, a UK-based fiber optic company. The acquisition provides Hexatronic Group with a specialized fiber optic product used in applications such as defense, the oil and gas industry, and harsh environments within the defense.

Europe Fiber Optics Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 2.71 billion

Growth rate

CAGR of 4.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Mode, application, country

Country scope

Germany, UK, France

Key companies profiled

Axjo Plastic AB; Coherent Corp.; Corning Incorporated; Hexatronic Group; Linden Photonics, Inc.; Nexans; Panduit Corp.; Prysmian Group; STL Tech; TKH GROUP

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Fiber Optics Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the Europe fiber optics market report based on mode, application, and country:

-

Mode Outlook (Revenue, USD Million, 2017 - 2030)

-

Single-mode

-

Multi-mode

-

Plastic Optical Fiber

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Telecom

-

Oil & Gas

-

Material Sensing

-

High Bandwidth Communication

-

others

-

-

Military & Aerospace

-

Secure Communication

-

Weapon System

-

Surveillance System

-

Optical Computing

-

UAV

-

Military Vehicle Sensing

-

-

BFSI

-

Medical

-

Biomedical Sensing

-

Minimal Invasive Surgery

-

Imaging

-

Endoscopy

-

MRI

-

CT

-

PET

-

X-Ray

-

Others

-

-

Others

-

-

Railway

-

Railway Maintenance

-

Speed Monitoring

-

Dynamic Load Calculation

-

-

Others

-

-

Country Outlook (Revenue, USD Billion, 2017 - 2030)

-

Europe

-

Germany

-

UK

-

France

-

-

Frequently Asked Questions About This Report

b. The Europe fiber optics market size was estimated at USD 2.0 billion in 2023 and is expected to reach USD 2,103.4 million in 2024

b. The Europe fiber optics market is expected to grow at a compound annual growth rate of 4.3% from 2024 to 2030 to reach USD 2.71 billion by 2030

b. Germany's fiber optics market accounted for the largest market revenue share of 36.2% in 2023. The fiber optics market in Germany is experiencing significant growth due to a surge in high-speed internet demand, advancements in technology, and government initiatives, leading to a robust expansion path for the industry in the country.

b. Some key players operating in the Europe fiber optics market include Axjo Plastic AB; Coherent Corp.; Corning Incorporated; Hexatronic Group; Linden Photonics, Inc.; Nexans; Panduit Corp.; Prysmian Group; STL Tech; TKH GROUP

b. Factors such as rapid growth of 5G networks worldwide demands a significant fiber optic infrastructure to meet the high-speed and low latency needs of 5G, driving additional expansion in the market

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."