- Home

- »

- Communications Infrastructure

- »

-

Europe Earphones And Headphones Market, Industry Report, 2030GVR Report cover

![Europe Earphones And Headphones Market Size, Share, & Trends Report]()

Europe Earphones And Headphones Market Size, Share, & Trends Analysis Report By Product, By Price Band, By Technology, By Distribution Channel, By Application, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-296-9

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

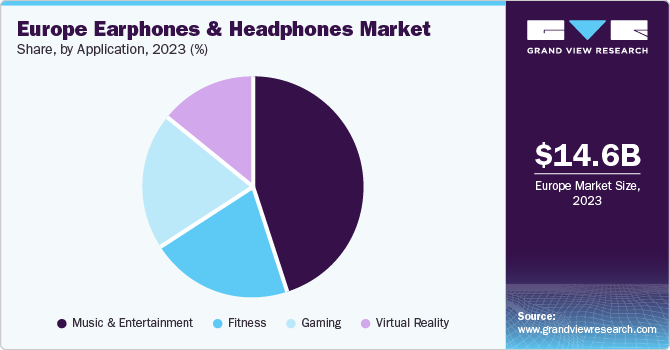

The Europe earphones and headphones market size was estimated at USD 14.6 billion in 2023 and is anticipated to grow at a CAGR of 9.4% from 2024 to 2030. The industry is anticipated to witness healthy growth, driven by the increasing adoption of advanced earphones featuring innovative noise-canceling technologies. Furthermore, the decreasing prices of wireless earphones in developing regions are expected to significantly contribute to the industry’s growth as they become more accessible and affordable for consumers.

Europeaccounted for 20.4% revenue share of the global earphones and headphones market in 2023. The sector’s ascendance is inextricably linked to the proliferation of tablets, smartphones, and other multimedia devices such as iPods and MP3 players. These devices often come equipped with basic earphones; however, the proliferation of music streaming services and video apps has created a need for consumers to upgrade to higher-quality audio products, thereby driving demand for premium earphones and headphones.

Headphones have significantly transformed from a primarily home-based audio accessory to a high-end portable audio accessory. The rapid development of wireless technologies, including SKAA, Bluetooth, Artificial Intelligence, Augmented Reality, and Wi-Fi, is expected to fuel demand. Moreover, the introduction of wireless earbuds has contributed to the growth of the wireless segment, driving sales and elevating the overall market.

The growing adoption of wireless earphones for fitness enthusiasts is also a major market driver. Manufacturers are developing innovative features, such as fitness monitoring and tracking, to cater to this demand. IPX-rated earbuds offering sweat and splash-proof protection are also gaining popularity. For instance, in April 2024, Sony launched its new Ult Power Sound range, comprising headphones and portable speakers that deliver an enhanced bass response, building on the success of its 2021 WH-XB910N headphones.

Product Insights

In 2023, headphones emerged as the dominant market segment, accounting for over 53.4% of the total revenue, driven by the growing popularity of portable devices, advancements in wireless technology, and affordable feature-rich options. The short replacement cycle and increasing adoption of wireless headphones, especially among the younger generation, are driving market growth.

On the other hand, the earphones segment is expected to experience the fastest growth with a CAGR of 10.3% over the forecast period. The increasing demand for earphones is fueled by the growing trend of on-the-go entertainment and the need for convenient and portable audio solutions. Furthermore, advancements in wireless technology and the availability of affordable and feature-rich earphones are driving their popularity, making them a sought-after accessory for consumers.

Price Band Insights

The USD 50-100 segment led the market with a share of 44.6% of the total revenue in 2023, driven by the availability of top-brand products and technological advancements catering to consumer demands for high-quality sound and style. The segment’s popularity is driven by the demand for enhanced audio quality, leading to its projected growth as the fastest-growing segment over the forecast period.

Meanwhile, the < USD 50 segment is expected to grow steadily over the forecast period, driven by affordable products with advanced features from smaller brands. Catering to cost-conscious consumers seeking quality audio without breaking the bank, this segment is poised to maintain consistent demand in the market.

Technology Insights

Wireless technology occupied the largest market share 63.7% in 2023. Wireless earbuds have boosted sales, contributing to segment growth significantly as consumers are prioritizing convenience, portability, and enhanced listening experiences. Key players are focused on innovation and differentiation to capitalize on the growing demand.

The wired technology segment in Europe’s earphones and headphones market is expected to grow lucratively over the forecast period, driven by technological advancements and consumers seeking high-quality, feature-rich wired headphones for enhanced audio experiences. Despite a shift towards wireless options, the demand for wired headphones remains strong among audiophiles and professionals.

Distribution Channel Insights

The online distribution channels segment emerged as market leader with a revenue share of 60.6% in 2023. This can be attributed to rising internet penetration and increasing e-commerce adoption. Consumers prefer online channels for convenience, accessibility, and a wide range of product options. Online sales popularity also stems from the ability to compare prices and read reviews, making it the preferred choice for consumers.

The offline distribution channels segment is projected to grow at a lucrative CAGR during the forecast period, owing to the increasing adoption of wireless audio devices. Specialized retail stores and dedicated electronics sections are emerging, allowing consumers to experience and compare products physically. Partnerships between brands and retailers will further boost offline growth, as consumers still value the hands-on shopping experience.

Application Insights

The music & entertainment segment held the largest market share, accounting for 44.9% of the total revenue in 2023. This can be attributed to the increasing adoption of music streaming services, fueled by better internet penetration and diverse subscription options. Music enthusiasts and streaming subscribers seek high-quality earphones and headphones for immersive audio experiences, driving demand.

Virtual Reality (VR) is anticipated to be the fastest-growing segment with a CAGR of 10.1% over the forecast period, driven by increasing adoption of VR technology in gaming, entertainment, and other industries, and the demand for high-quality audio solutions to complement the visual experience. Key players are developing specialized VR products, propelling the segment’s growth and expected expansion in the coming years.

Country Insights

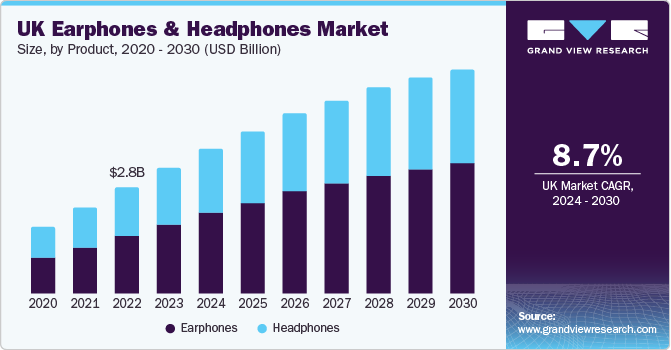

UK Earphones And Headphones Market Trends

The UK earphones and headphones market held the largest revenue share of 22.9% in 2023. The country’s thriving consumer electronics industry and the presence of prominent brands like Apple and Sony contributed to the positive market growth.

Germany Earphones And Headphones Market Trends

The growth of the Germany earphones and headphones market is driven by the country’s high disposable income and consumers’ electronics expenditure. Moreover, the rising demand for wireless earphones and headphones among young consumers significantly contributes towards market growth.

Spain Earphones And Headphones Market Trends

The Spain earphones and headphones market is expected to experience rapid growth over the forecast period, with a CAGR of 12.5% from 2024 to 2030, driven by the rising adoption of portable electronic devices such as smartphones, tablets, and laptops. As consumers in Spain increasingly use these devices for entertainment, communication, and productivity on the go, the demand for earphones and headphones has surged significantly, fueled by the need for compatible audio accessories.

Key Europe Earphones And Headphones Company Insights

The Europe earphones and headphones market is experiencing remarkable growth, fueled by a multitude of factors. The competitive landscape is characterized by intense innovation, with manufacturers continually pushing the boundaries of product development. This trend is expected to continue, driving demand for high-quality audio solutions and propelling the market’s upward trajectory.

Some key players operating in this market include Koninklijke Philips N.V.; Grado Labs; Bose Corporation; and Apple Inc.

-

Apple Inc. is a major player in the European earphones and headphones market, driven by its iconic AirPods and Beats by Dre product lines. The company’s commitment to innovation and design has made its products highly sought-after by European consumers, particularly among younger demographics.

-

Bose Corporation is a major player offering high-quality headphones and earphones that cater to both consumer and professional audio needs. Its focus on delivering immersive audio experiences has made its products popular among music enthusiasts and audiophiles.

Key Europe Earphones And Headphones Companies:

- Apple Inc.

- Bose Corporation

- Grado Labs

- Koninklijke Philips N.V.

- Logitech, Inc.

- Panasonic Corporation

- Pioneer Corporation

- Plantronics, Inc.

- Sennheiser Electronic GmbH & Co. KG

- Samsung Electronics Co., Ltd.

- Shure Incorporated

- Skullcandy, Inc.

- Sony Corporation

Recent Developments

-

In May 2024, Sonos launched its premium wireless over-ear headphones, Sonos Ace, with active noise cancellation (ANC). The headphones feature a sleek design, comfortable memory foam ear cushions, and exceptional audio quality with Bluetooth 5.4 connectivity and support for various audio codecs.

-

In January 2024, JBL unveiled the Live 3 Earbuds series, featuring the latest Smart Charging Case, True Adaptive Noise Cancelling, and Hi-Res Audio Wirelessly. The series includes three wearing styles: Buds, Beam, and Flex, offering comfort and flexibility.

-

In October 2023, Logitech launched the Zone Wireless 2, an AI-driven, two-way noise-canceling business headset with advanced noise-canceling microphones and hybrid Active Noise Cancellation.

Europe Earphones And Headphones Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 27.3 billion

Growth rate

CAGR of 9.4% from 2024 to 2030

Base year for estimation

2023

Historical Data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, price band, technology, distribution channel, application, country

Country scope

Germany; UK; France; Italy; Spain; RoE

Key companies profiled

Apple Inc.; Bose Corporation; Grado Labs; Koninklijke Philips N.V.; Logitech, Inc.; Panasonic Corporation; Pioneer Corporation; Plantronics, Inc.; Sennheiser Electronic GmbH & Co. KG; Samsung Electronics Co., Ltd.; Shure Incorporated; Skullcandy, Inc.; Sony Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Europe Earphones And Headphones Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe earphones and headphones market report based on product, price band, technology, distribution channel, application, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Earphones

-

Headphones

-

-

Price Band Outlook (Revenue, USD Million, 2018 - 2030)

-

< USD 50

-

USD 50-100

-

USD 100

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Wired

-

ANC

-

Other Wired Technologies

-

-

Wireless

-

ANC

-

Bluetooth

-

NFMI

-

Smart headphones

-

Other Wireless Technologies

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Fitness

-

Gaming

-

Virtual Reality

-

Music & Entertainment

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."