- Home

- »

- Healthcare IT

- »

-

Disease Management Apps Market Size & Share Report 2030GVR Report cover

![Disease Management Apps Market Size, Share & Trends Report]()

Disease Management Apps Market Size, Share & Trends Analysis Report By Platform Type (iOS, Android), By Device (Smartphone, Tablet), By Indication (Obesity, Cardiovascular Issues), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-057-4

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Disease Management Apps Market Trends

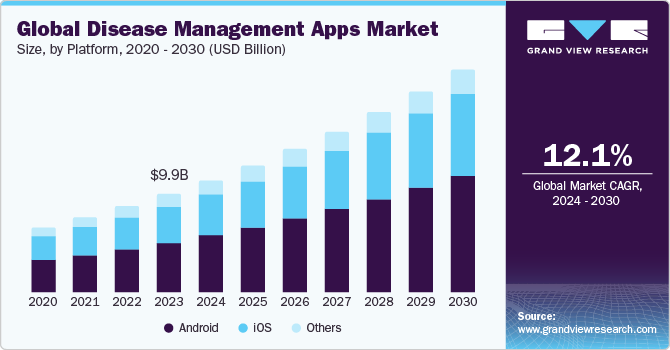

The global disease management apps market size was estimated at USD 9.94 billion in 2023 and is projected to grow at a CAGR of 12.1% from 2024 to 2030. The increasing prevalence of chronic disorders coupled with rising consumer awareness about healthy lifestyles is the major factor driving the market. Moreover, the increasing usage of disease management applications in monitoring disease status and symptoms monitoring is another factor facilitating the market growth. In addition, an integration of healthcare with information technology solutions and a rising number of market participants launching apps for management of chronic conditions like heart conditions and diabetes is further augmenting market growth.

The increasing promotion to adopt disease management applications by the government and private organizations owing to certain advantages offered by these apps in monitoring and improving health is projected to facilitate market uptake in coming years. For instance, CDC mobile app is a great application for managing conditions at home and is available on Android and iOS platforms. In 2023, the Global Observatory for eHealth was created by the World Health Organization (WHO) to monitor the advancements in mHealth on a global scale.

Moreover, increasing number of disease monitoring applications and continuous improvements in the apps’ quality by the developers is another factor projected to cater to market uptake in coming years. For instance, in March 2023, Philips launched Philips Virtual Care Management, offering a wide range of adaptable solutions and services to assist healthcare systems, healthcare providers, insurance companies, and employers in effectively engaging with and supporting patients from remote locations.

Moreover, the increasing interest of users to use disease management apps is projected to upsurge the adoption of these apps. Moreover, increasing recommendations from healthcare professionals to use digital applications for better patient care is another factor accelerating the demand for disease management apps.

Furthermore, the integration of telemedicine and telehealth into disease management apps is gaining higher traction thereby allowing patients to connect with health professionals remotely. Market participants are integrating machine learning and AI into their mHealth applications to provide personalized recommendations and improve health outcomes. Additionally, they are incorporating wearable technology such as smartwatches and fitness trackers into disease management applications to gain detailed insights into patients' health. For instance, in November 2022, H2o Therapeutics received 510(k) marketing clearance from the U.S. FDA for its prescription mobile application Parky for management of Parkinson’s disease. This app monitors the disease symptoms in real time using an apple watch.

The growing personalized healthcare with disease management apps tailoring interventions based on individual health profiles leads to more effective disease management. Disease management apps are enhancing patient engagement reminders for medication or appointments and tracking tools for monitoring symptoms or progress. These apps empower individuals to take an active role in managing their health conditions, leading to better adherence to treatment plans and improved health outcomes. The ability of these apps to deliver personalized recommendations and support fosters a stronger connection between patients and their healthcare providers.

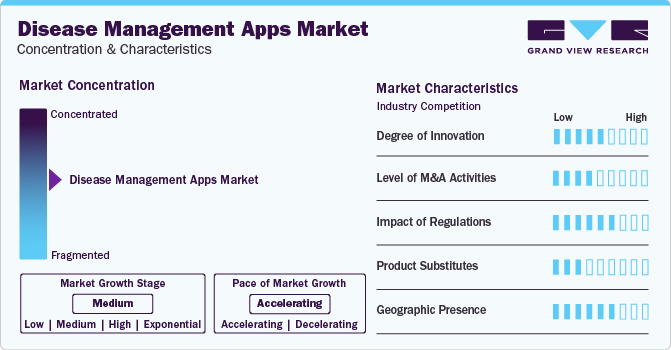

Market Concentration & Characteristics

The disease management apps industry exhibits a moderate level of concentration. Characteristics include rapid technological advancements, such as the integration of artificial intelligence (AI) and machine learning (ML), remote monitoring, wearable integration, gamification, and interoperability. The industry showcases continuous innovation and expansion fueled by rising healthcare expenditure and the growing prevalence of chronic diseases and the growing adoption of digital health solutions.

The industry is characterized by a high degree of innovation, with technological advancements and companies consistently developing products that enhance efficiency and safety. Innovations such as artificial intelligence (AI) algorithms for predictive analytics, integration with wearable devices for real-time health monitoring, and telemedicine features for remote consultations have revolutionized the way patients interact with their healthcare providers and manage their diseases. These innovations enhance the user experience and enable healthcare professionals to deliver more personalized care and interventions.

Regulations significantly impact the industry by ensuring patient safety, product quality, and efficacy.Regulatory bodies such as the Food and Drug Administration (FDA) in the U.S. have specific guidelines that developers must adhere to when creating healthcare-related apps. In 2022, the FDA has revised its recommendations on medical equipment to align with updated regulations. This revision integrates the last decree "Classification Regulations for Medical Devices to Comply with the Medical Software Provisions in the 21st Century Cures Act" (86 FR 20278), released in May 2021, and the final directive "Clinical Decision Support Software," issued in September 2022.

Mergers and acquisitions are rising in the market due to the need for research and development, reflecting the industry's dynamic nature. Companies are leveraging M&A activities to innovate and offer advanced solutions that meet the evolving needs of healthcare professionals. For instance, in February 2024, DarioHealth acquired Twill to enhance its mental health capabilities and increase revenue.The company announced that the deal establishes a comprehensive digital health offering to tackle mental well-being, maternal health, and expensive chronic conditions.

Companies have developed personalized apps that cater to specific patient needs. Many companies are adopting various strategies, which include collaboration, product expansion, and partnerships, to strengthen their market position. For instance, in February 2023, Dawn Health signed a partnership agreement with Novartis to develop a platform for managing chronic conditions.The platform is likely to feature symptom monitoring, mobile apps for patients, clinical decision support, virtual clinic services, and digital biomarkers for specific diseases and conditions.

The industry is experiencing robust global expansion due to increasing healthcare expenditure, technological advancements, and growing awareness about chronic disease and their management. Disease management apps play a crucial role in providing remote monitoring tools, medication reminders, and symptom tracking capabilities, reducing the necessity for frequent in-person consultations with healthcare providers.

Platform Insights

The Android segment dominated the market with the largest revenue share of around 50.0% in 2023 and is anticipated to grow at the fastest CAGR over the forecast period.The growth is attributed to the rising numbers of Android users especially in developing countries and rising penetration of telemedicine in countries including China and India. In addition, technological advancements in Android apps, convenience of usage, and rising awareness of digital health among people are expected to further fuel segment uptake in the coming years.

The iOS segment held the second-largest revenue in the market. This is owing to the increasing penetration of Apple products in developed as well as developing economies, increasing demand for smart medical devices incorporated with health apps, and higher standards of privacy and curated content in iOS platforms. Moreover, higher product downloads and rising product introductions for iOS platforms are other factors pushing the global market forward. For instance, in June 2023 Apple introduced a new health feature in watchOS 10, iOS 17, and iPadOS 17, expanding into two impactful areas and providing innovative tools and experiences across platforms.

Indication Insights

Based on indication, the mental health segment dominated the market with the largest share in 2023 and is anticipated to register the fastest growth rate over the forecast period. The growth is owing to the rising concerns about mental health, and significant demand for effective and efficient mental health management systems. The advantageous features of mental health applications personalized care plans, and health data analysis are responsible for the higher revenue share of the segment. Furthermore, rising urbanization, changing lifestyles, and growing demand for stress management solutions are further propelling segment uptake.

The obesity segment held the second-largest revenue share of the market. The growth is attributed to the high burden of obesity across the world and the availability of a large number of apps offering diet management and workout plans. According to a report from the WHO, in 2022, over 1 billion individuals globally were obese, including 650 million adults, 340 million adolescents, and 39 million children. This number is expected to rise constantly. The WHO predicts that approximately 167 million people, both adults and children, will experience declining health due to being overweight or obese by 2025. The obesity management apps help to track things such as workout tracking, and calorie intake monitoring, and provide certain guidelines for day-to-day activities. Furthermore, rising awareness about fitness, healthy eating, and high social media penetration are also augmenting demand for obesity management applications. Some of the major obesity management apps include PlateJoy, Noom, and WW app.

Device Insights

Based on devices, the smartphones segment dominated the market with the largest revenue share in 2023. The growth is attributed to the constant product developments in terms of features and functions, rising inclination for fitness tracking, health monitoring, and increasing demand for advanced products. Manufacturers have introduced smartphones to monitor certain vitals such as heart rate and breathing rate is also fueling segment uptake. Moreover, as per statistics published by the GSM Association report, The Mobile Economy 2023 reports that in 2022, over 5.4 billion people were connected to mobile services, and it is projected that the number of unique mobile subscribers will reach 6.3 billion by 2030, representing 73% of the global population. Moreover, the adoption of smartphones is steadily increasing. The Mobile Economy 2023 states that smartphone penetration stood at 76% in 2022 and is anticipated to grow to 92% by 2030.

The wearables segment is anticipated to show the fastest growth rate over the forecast period owing to increased adoption of wearable products among consumers and increased efforts from market players to introduce wearables with advanced monitoring features. For instance, companies such as Samsung, Noise, Fitbit, Fossil Group, Inc. are introducing novel wearable products.

Regional Insights

North America disease management apps market dominated the global industry and accounted for 37.9% of revenue share in 2023. Factors such as rising awareness among people to adopt mHealth & digital health applications, high internet, and smartphone penetration, rise in the geriatric population and high presence of a large number of market participants in North America are driving the regional market growth. Moreover, rising promotion by healthcare professionals to adopt digital health solutions is further escalating the adoption of disease management apps in the region.

U.S. Disease Management Apps Market Trends

The disease management apps market in the U.S. held a significant share of North America's disease management apps market in 2023. The growth is owed to the presence of many companies operating in various areas, such as mobile & network operations, healthcare management, and software development. Market players are involved in introducing innovative healthcare apps, building network infrastructure, and increasing the adoption of various mHealth apps in the U.S. For instance, in August 2023, MedWorks, a Canadian tech company, brought its health and wellness service app to the U.S., starting with Florida.

Mexico disease management apps market is subject to various legal frameworks, including the Civil Federal Code, Mexican Federal Consumer Protection Law, Data Protection Law, Mexican Code of Commerce, and multiple Mexican Official Standards. In Mexico, when digital health apps are categorized as “products,” they can be held accountable in various ways:

1) Civil liability under the Federal Civil Code allows for civil lawsuits if a person experiences personal or property harm.

2) Commercial liability under the Federal Consumer Protection Law.

3) Administrative liability under health laws and regulations.

4) Criminal liability under the Federal Penal Code.

Europe Disease Management Apps Market Trends

The disease management apps market in Europe is witnessing growth fueled by the increasing regulations built for these apps in the region. In accordance with European regulations, an application is classified as a medical device when it records and stores data intended for medical purposes such as monitoring, treatment of a medical condition, or diagnosis. This classification also encompasses medical apps utilized for gathering data in clinical trials. These medical applications must adhere to the regulatory standards outlined in the European Medical Device Directive (93/42/EEC) and necessitate a CE mark before they can be marketed within the European Union.

The UK disease management apps market growth is attributed to the rising demand for these apps by individuals in the UK. According to the third annual survey conducted in July 2023, on public attitudes toward health apps in the UK directed by the Organization for the Review of Care and Health Apps (ORCHA), a majority of 68% of individuals support the integration of digital health apps within the NHS. Additionally, ORCHA introduced the nation’s inaugural Digital Health Formulary in March 2023, enabling healthcare providers to prescribe more advanced apps for their patients securely. This unified solution can seamlessly integrate into current patient record systems, streamlining the entire process.

The disease management apps market in Germany is projected to expand during the forecast period owing to a lucrative environment for safety & restricting regulations for managing digital health platforms which is propelling the disease management apps market in the country. For instance, the Digital Healthcare Act, enacted in November 2019, has significantly driven the market for disease management apps in Germany by enabling healthcare providers to issue prescriptions for digital health applications (DiGA) to patients insured under statutory health insurance. These applications must meet stringent efficacy criteria to be included in a designated directory managed by the German Federal Institute for Drugs and Medical Devices.

To further validate the effectiveness of these DiGA, a systematic review of the literature on Digital Health Applications commenced on February 4, 2023. This comprehensive review utilized reputable databases such as PubMed, Scopus, and Web of Science to identify relevant studies. The review included papers that presented data supporting applications listed in the directory while excluding duplicates and study protocols that did not provide concrete evidence. This rigorous evaluation process ensures that only effective and reliable apps are available to patients through this regulatory framework. As a result, the market for disease management apps in Germany is expected to grow significantly due to increased adoption by both patients and healthcare providers.

Asia Pacific Disease Management Apps Market Trends

The disease management apps market in Asia Pacificis expected to grow at the fastest CAGR from 2024 to 2030 owing to the increasing usage of smartphones & smart wearables and the high adoption of mHealth apps. Factors, such as increasing incidence of chronic & infectious diseases, rising healthcare expenditure, ineffective hospital service management, and a growing elderly population, are compelling governments & healthcare providers to develop new healthcare delivery models. For instance, in January 2024, JD Health introduced a new elderly care channel on its app to provide a comprehensive platform for the various healthcare needs of China's aging population.

Japan disease management apps market is expected to grow at the fastest CAGR in the region. The market is expected to expand steadily due to the ongoing advanced medical technologies in Japan. According to Vamstar article published in May 2024, Japan’s digital health sector is experiencing significant growth, with the market projected to reach USD6.15 billion by 2024. This expansion is driven by Japan’s strong technological culture, which has historically excelled in areas including electronics and robotics and is now being applied innovatively in healthcare. Leading companies such as Takeda are revolutionizing disease monitoring, as seen in their development of the “Care for One” integrated solution. This app-based technology, utilizing the Apple Watch, enables continuous symptom tracking for conditions like Parkinson’s, improving treatment precision and customization.

The disease management apps market in India holds a significant share of the Asia Pacific region. The rising use of smartphones and the launch of new healthcare management apps are expected to drive the adoption of mobile platforms for various healthcare services. For instance, in February 2024, the “Health On Us” app was introduced offering two primary services, such as care at home and care at the center. Moreover, favorable government initiatives such as Digital India and Disha are propelling the adoption of disease management apps in the country. The DISHA initiative involves the creation of a National Healthcare Authority (NeHA) and State Healthcare Authorities (SeHA). These authorities will be supported by national- and state-level executive committees to assist them in carrying out their responsibilities under the DISHA Act.

Latin America Disease Management Apps Trends

The disease management apps market in Latin America is experiencing significant growth attributed to various factors, such as the increasing startup programs in the region. For instance, JHolonIQ compiled a list called the Latin America Digital Health 50, which features startups and companies based in the region. These entities are revolutionizing health and wellness by leveraging new technologies and scientific knowledge.

Middle East & AfricaDisease Management Apps Market Trends

The disease management apps market in the Middle East & Africa is experiencing significant growth. This is driven by factors such as increasing adoption of digital technologies, a growing awareness of healthcare solutions, and efforts to improve healthcare infrastructure. Digital health is revolutionizing healthcare in MEA, facilitated by improving internet connectivity and government initiatives. Telemedicine, wearable devices, mHealth apps, and Artificial Intelligence (AI) are key trends transforming healthcare access, costs, & outcomes. Despite challenges including infrastructure, affordability, and data privacy, digital health’s potential to improve MEA healthcare is substantial.

Saudi Arabia disease management apps market is anticipated to expand during the forecast period due to technological innovation. The adoption of mHealth technologies in Saudi Arabia is in its nascent stage. Increasing smartphone penetration and improving internet connectivity are some of the major drivers boosting the adoption rate. According to Ubuy estimates, approximately 92% of the Saudi population either has access to or owns a smartphone. The number of smartphone users has significantly increased from 14.31 million individuals in 2013 to 33.55 million individuals in 2024.

The disease management apps market in Kuwait is expected to grow over the forecast period due to favorable investment outlook, with the country focusing on investments in the private sector. Moreover, increasing chronic diseases are driving the demand for the disease management apps market and providing significant growth opportunities for players in the country.

Key Disease Management Apps Company Insights

The market is highly competitive, with key players such as Fitbit LLC., Healthy.io.Ltd, MyFitnessPal, Inc. and others holding significant positions. The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Disease Management Apps Companies:

The following are the leading companies in the disease management apps market. These companies collectively hold the largest market share and dictate industry trends.

- Fitbit LLC.

- Healthy.io.Ltd

- MyFitnessPal, Inc.

- Noom, Inc.

- Azumio Inc.

- Medisafe

- Sleep Cycle

- Curable, Inc

- Bearable Ltd

- Omada Health Inc.

Recent Developments

-

In May 2024, the Mental Health Service Center of JD Health unveiled several AI-driven service initiatives at a conference held in Beijing. One of the new services is "Small Universe for Chatting and Healing," an AI-powered therapeutic companion designed to aid individuals. With this launch, JD Health has become the pioneering AI-driven online mental health service platform in China.

-

In December 2023, Ptar Digital Health entered a partnership with Legit.Health,an innovative artificial intelligence (AI)-based medical device software company with CE marking. This collaboration aims to revolutionize patient care and enhance patient adherence to improve the management of skin conditions.

-

In September 2023, Enovacom, a subsidiary of Orange Business, acquired NEHS Digital and Xperis to develop solutions for the healthcare sector and strengthen its position in e-health.

-

In March 2023, Google launched Open Health Stack, an open-source program for developers to build health-related apps by including strategies such as AI partnerships focusing on cancer screening

Disease Management Apps Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.30 billion

Revenue forecast in 2030

USD 22.44 billion

Growth Rate

CAGR of 12.1% from 2024 to 2030

Actual Data

2018 - 2023

Forecast Data

2024 - 2030

Report updated

June 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, device, indication, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Fitbit LLC.; Healthy.io.Ltd; MyFitnessPal, Inc.; Noom, Inc.; Azumio Inc.; Medisafe; Sleep Cycle; Curable, Inc; Bearable Ltd; Omada Health Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Disease Management Apps Market Report Segmentation

This report forecasts revenue growth at the global, regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global disease management apps market report based on platform, device, indication, and region:

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

iOS

-

Android

-

Others

-

-

Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Smartphones

-

Tablets

-

Wearables

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Obesity

-

Cardiovascular Issues

-

Mental Health

-

Diabetes

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global disease management apps market size was estimated at USD 9.94 billion in 2023 and is expected to reach USD 11.3 billion in 2024.

b. The global disease management apps market is expected to grow at a compound annual growth rate of 12.1% from 2024 to 2030 to reach USD 22.44 billion by 2030.

b. North America accounted for the largest share of the disease management apps market in 2023 with a share of 37.9% and is anticipated to dominate the global market throughout the forecast period. Factors such as rising awareness among people to adopt mhealth and digital health applications, high internet, and smartphone penetration, rise in the geriatric population, and high presence of a large number of market participants in North America are driving the regional market.

b. Some key players in the disease management apps market include Fitbit LLC., Healthy.io.Ltd, MyFitnessPal, Inc., Noom, Inc., Azumio Inc., Medisafe, Sleep Cycle, Curable, Inc, Bearable Ltd, and Omada Health Inc.

b. The increasing prevalence of chronic disorders, coupled with rising consumer awareness about healthy lifestyles, is the major factor driving the global disease management apps market. Moreover, the increasing usage of disease management applications in monitoring disease status and symptoms monitoring is another factor facilitating the global market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."