- Home

- »

- Healthcare IT

- »

-

Digital Health For Cardiovascular Market Size Report, 2030GVR Report cover

![Digital Health For Cardiovascular Market Size, Share & Trends Report]()

Digital Health For Cardiovascular Market Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By End-use (Patients, Providers, Payers), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-265-2

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The global digital health for cardiovascular market size was estimated at USD 35.3 billion in 2023 and is expected to grow at a CAGR of 22.2% from 2024 to 2030. The increasing prevalence of cardiovascular diseases (CVDs), the rapid advancement in healthcare technology along with, rising healthcare expenditure coupled with growing demand for remote patient monitoring services, advancing healthcare IT infrastructure, improved internet connectivity, and increasing accessibility of virtual care with digital tools are driving the adoption of digital technologies for the cardiovascular health market. Digital tools in cardiovascular health include wearables for heart rate and blood pressure monitoring, ECG apps, and platforms for tracking cardiovascular health metrics to prevent and manage heart conditions.

The future of cardiovascular disease management lies at the intersection of healthcare and digital innovation. From telemedicine and artificial intelligence to mobile health applications and blockchain technology, emerging trends in digital health are revolutionizing how cardiovascular diseases are prevented, diagnosed, and treated. By harnessing the power of digital solutions, healthcare providers can deliver more personalized, efficient, and accessible care to patients with cardiovascular conditions. Hence, the digital health industry experienced a significant boost in terms of revenue and is expected to grow lucratively in upcoming years, thereby maintaining exponential growth during the forecast period.

The global burden of CVDs is increasing, driven by the aging population, sedentary lifestyles, and unhealthy diets. The British Heart Foundation's July 2022 report highlighted that 7.6 million people in the UK lived with heart and circulatory diseases in 2021, of which 4 million were men and 3.6 million were women. Therefore, the high prevalence of heart disease is likely to boost the need for digital health tools, accompanied by wearables for heart rate and blood pressure monitoring, contributing to market growth over the forecast period. In another instance, a March 2022 research article published by Current Cardiology reported that the adoption of telehealth in the outpatient cardiology setting, when combined with regular telehealth monitoring, was beneficial to those at higher risk of cardiovascular diseases. Such advances and studies showcase the growing importance and adoption of digital and telehealth monitoring platforms over the forecast period.

Government initiatives and collaborations with global manufacturers are significantly driving market growth. For instance, in February 2024, in a collaborative effort to transform cardiovascular patient care, Lupin Digital Health, India's leading evidence-based cardiology Digital Therapeutics (DTx) platform, collaborated with the American College of Cardiology (ACC) to launch India's inaugural Digital Therapeutics Certificate tailored for cardiologists, marking a significant milestone in the field.

Moreover, rising government support through funding and seeking grant applications for telehealth services is also promoting growth. For instance, in March 2024, the United States Department of Agriculture (USDA) spent USD 60 million on telemedicine infrastructure and remote learning to improve health outcomes and education. Through the Distance Learning and Telemedicine (DLT) program, the USDA financed a few projects in rural regions to help individuals by offering healthcare education and grants to purchase telemedicine interactive telecommunications distance learning technology.

Artificial intelligence also plays a pivotal role in enhancing diagnosis, treatment planning, and overall patient outcomes. Its applications range from image analysis for cardiovascular disease detection and diagnosis to predictive analytics for early risk assessment and intervention, as well as personalized treatment planning based on individual patient data. In addition, AI technology is streamlining administrative tasks and augmenting clinical decision-making through real-time data analysis. While its integration into cardiology is still in its nascent stages, the potential advantages are substantial, promising heightened accuracy, efficiency, and, ultimately, improved patient outcomes.

Health-related mobile smartphone applications have led to easy management of daily activities by making it convenient to track overall health. Some companies are developing applications for remote cardiac monitoring. For instance, in March 2024, Wellysis, a subsidiary of Samsung, collaborated with Artella Solutions (ARTELLA) to introduce a remote cardiac monitoring service. This partnership focuses on offering the FDA-cleared S-Patch electrocardiogram monitoring solution from ARTELLA across ten states in the U.S. Through this alliance, Wellysis, and ARTELLA aim to provide an unmatched end-to-end cardiac monitoring service, starting in Texas.

Market Concentration & Characteristics

The market growth stage is high and its growth pace is accelerating. The global market is characterized by a high degree of innovation, with new technologies and methods continually being developed and introduced by industry players to create user-friendly telehealth devices to minimize barriers for both patients and care providers in learning and adopting them. Recently, in September 2023, the American College of Cardiology and Serv Medical came into collaboration for digital care innovation. This collaboration aims at bringing cutting-edge digital technologies for enhancing healthcare outcomes and improving long-term cardiovascular care across healthcare systems and developing markets.

The market is characterized by the leading and emerging players with moderate levels of product launches and merger and acquisition (M&A) activity. Market players are involved in new product launches and merger and acquisition activities. Such strategic activities as M&A, partnership, and collaboration are increasing the competitiveness of companies and expanding their geographic reach by helping them enter new territories.

The impact of regulations in digital health for cardiovascular industry is high. The structured regulatory framework plays a significant role in fostering market growth, facilitating access, and ensuring adherence to standards. For example, in the U.S., the Food and Drug Administration (FDA) establishes guidelines for digital health across various sectors. Similarly, in Australia, the Therapeutic Goods Administration (TGA) oversees the regulation of digital health technologies across different healthcare domains. In Canada, Health Canada is responsible for supervising the regulatory framework for various digital health technologies.

Several market players are adopting geographical expansion strategies to strengthen their positions in the market. Global manufacturers such as Siemens, Phillips, AliveCor, and others are making strategic investments in digital health start-ups and have established partnerships with healthcare providers globally. Siemens Healthineers has also focused on developing innovative telehealth solutions to address the needs of patients and healthcare providers in different regions.

Component Insights

The services segment held the largest revenue share in 2023. Market participants offer their services in both bundled packages and standalone options. The increasing need for advanced software solutions and platforms, such as Electronic Medical Records (EMRs) and Electronic Health Records (EHRs), as well as the growing importance of updating and training to utilize these tools efficiently, is boosting segment growth. For instance, in January 2024, Medtronic collaborated with Cardiac design labs to launch Padma Rhythms, an electronic Loop Recorder (ELR) patch, which is aimed to uplift ELR technology across the country for long-term heart monitoring and further diagnosis in India. Furthermore, key players provide a wide array of pre- and post-installation services, which include project planning, training, implementation, and resource allocation and optimization for project success.

The software segment is anticipated to register the fastest CAGR of 23.5% over the forecast period due to the adoption of software systems by insurance payers, patients, healthcare providers, and healthcare facilities. This increasing adoption is substantially driving the growth of the software segment within the cardiovascular industry. By embracing software systems, stakeholders can streamline processes, improve communication, and enhance the overall quality of care provided, ultimately driving the growth of the software segment within the healthcare sector. Market players are introducing software solutions to diagnose various cardiovascular diseases. For instance, in 2021, Optum, a leading healthcare services provider, launched an AI-powered platform called OptumIQ that uses AI to identify patients at risk for chronic conditions and recommend interventions to improve their care. In another instance, in July 2022, Cleerly raised Series C funding for developing AI-based software for diagnosing atherosclerosis. The funding was valued at USD 192 million. Such factors are expected to improve the segment's market growth.

End-use Insights

The patient segment dominated the end-use segment with the largest market share of 34.1% in 2023, and it is anticipated to witness the fastest CAGR over the forecast period. The segment growth is fueled by the rising demand from growing emphasis on patient-centered care coupled with an increasing number of individuals seeking to manage their health more effectively. In response to these trends, companies are transforming the healthcare landscape by introducing innovative solutions such as virtual consultations and patient-care devices. For instance, BIOTRONIK’s Cardio Messenger SMART enables cardiac monitoring in patients. It receives information from the implanted device at night while the patient is asleep. These cutting-edge technologies are designed to enhance mobility, facilitate remote monitoring, and track various health parameters.

The provider segment accounted for a significant market share in the end-use segment, driven by a notable surge in the adoption of innovative technologies such as digital therapeutics and telemedicine. Healthcare providers are embracing digital solutions extensively and promptly to deliver personalized treatment plans, remote consultations, and evidence-based therapies that extend beyond conventional care. By integrating digital tools, providers can offer more personalized and accessible care, ultimately leading to enhanced patient outcomes.

Regional Insights

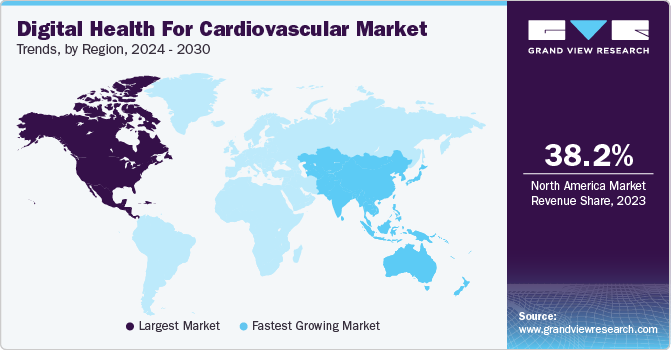

North America dominated the digital health for cardiovascular market in 2023 with a revenue share of 38.2%, which is attributed to the increasing healthcare IT expenditure for supporting digital infrastructure, growing technological advancements, and supportive government initiatives. For instance, in May 2022, the American College Of Cardiology released principles regarding support of digital health initiatives and announcing the latest scientific discoveries. In addition, factors such as the population in North America are actively embracing wearable devices for health management in conjunction with telemedicine platforms. These integrated systems play a pivotal role in enhancing patient outcomes and overall community health by facilitating early intervention. Furthermore, the abundance of smartphone-based apps designed for health monitoring purposes in the region is fueling market growth. The significant demand for home-care settings underscores the adoption of cardiovascular digital solutions in the region responsible for the industry's growth.

U.S. Digital Health For Cardiovascular Market Trends

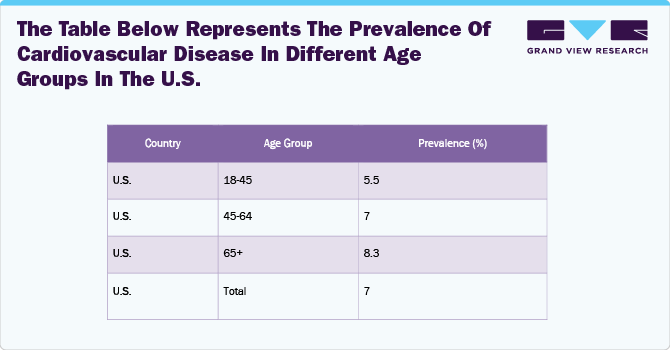

The digital health for cardiovascular market in U.S. held the largest revenue share in North America in 2023. The growth is attributed to the increasing prevalence of cardiovascular diseases. Furthermore, several market players undertake initiatives to promote applications of digital technology in the cardiology sector. For instance, in March 2022, Royal Philips unveiled the Ultrasound Workspace during the American College of Cardiology's Annual Scientific Session & Expo. Philips Ultrasound Workspace led as a vendor-neutral tool for echocardiography image evaluation and presentation, offering remote browser access. With this innovative solution, clinicians can seamlessly access integrated diagnostic workflows from the ultrasound examination area to the report room and beyond, enabling thorough examination and evaluation of echocardiogram data.

Canada digital health for cardiovascular market is estimated to witness the fastest CAGR from 2024 to 2030 in North America. The Canadian market is driven by the presence of key players and several organizations, including Digital Health Canada and Cardiovascular Network of Canada. These organizations are highly active in developing digital health solutions in neuroscience. For instance, in July 2023, the Cardiovascular Network of Canada augmented its digital health platform, VIRTUES, improving the delivery of cardiac care to patients across all regions in Canada.

Europe Digital Health For Cardiovascular Market Trends

European markets and governments mainly focus on digitalizing monitoring services linked with chronic diseases, offering solutions that would ease access to health records and avoid the repetition of unwanted prescriptions & tests. Moreover, the rising geriatric population is one of the key factors driving the demand for digital health in chronic care management, diagnostic solutions, and post-acute care management. The European healthcare market possesses a robust digital infrastructure, providing a strong foundation for developing and adopting digital health solutions. Furthermore, the increasing usage of smartphones and internet is anticipated to boost the market.

Startups with innovative business models are being established, boosting market growth. Consumer and business survey reports suggest that most German citizens are willing to spend on better healthcare and fast network infrastructure, which would create excellent growth opportunities-according to a survey of 2,500 Germans conducted by the market and opinion research institute Civey, around 31.6% of respondents reported using health apps.

The digital health for cardiovascular market in the UK holds a significant amount of share in the European market. The presence of numerous market players, continuous R&D in the cardiology field, product launches, and global funding drive the market growth in the UK. For instance, in February 2024, a groundbreaking project utilizing AI to tailor therapies for patients with cardiovascular disease was initiated in the UK and EU. The NextGen project has secured €7.6 million (USD 8.1 million) in funding from the EU’s Horizon Europe program. It will be executed by a consortium comprising 21 members, including the European Society of Cardiology.

Asia Pacific Digital Health For Cardiovascular Market Trends

The digital health for cardiovascular market in Asia Pacific is estimated to witness the fastest CAGR during the forecast period. The growth of the regional market is expected to be driven by the increasing adoption of mHealth platforms and healthcare expenditure in the region. Furthermore, industry growth in the Asia Pacific region is expected to be driven by technological advancements in the field due to increased government spending on healthcare. The adoption of digital apps and platforms in the region has been boosted by the growing involvement of key market players and the emergence of niche entrepreneurial ventures in the Asia Pacific.

The China digital health for cardiovascular market is experiencing exponential growth. The growth is attributed to the increasing technological advancements, coupled with growing strategic initiatives by the key players. For instance, in February 2022, Novartis and Tencent collaborated for the further development of digital health app ‘AI Nurse’, the WeChat social media platform facilitates the management of disease progression for patients with heart failure and other cardiovascular disorders.

The digital health for cardiovascular market in Japan is expected to grow significantly, owing to technological advancements in the wearables segment for detection of heart rates. Thus, the use of wearable devices for continuous monitoring of heart rate and blood pressure is on the rise. Remote monitoring systems that allow healthcare providers to monitor patient's health data in real time are gaining popularity in the country. AI and machine learning algorithms are being used to predict cardiovascular risks and personalize treatment plans.

The India digital health for cardiovascular market is anticipated to grow significantly over the forecast period due to the presence of innovative wearable manufacturing facilities. India is one of the key countries with developments on the rise, such as increased smartphone penetration and government initiatives (such as Digital India and Disha) that are boosting the adoption of digital health for cardiovascular services in the country.

MEA Digital Health For Cardiovascular Market Trends

The advancement in digital health for cardiovascular market in the MEA region is significantly transforming the healthcare sector. Enhanced internet connectivity and supportive government initiatives are driving this change. Pivotal trends, such as telemedicine, wearable devices, mobile health applications (mHealth), and Artificial Intelligence (AI), are reshaping healthcare access, costs, and outcomes. Although challenges like infrastructure, affordability, and data privacy persist, digital health holds a promising potential to enhance healthcare in the MEA region.

Saudi Arabia digital health for cardiovascular market is on the rise, driven by the surge in smartphone penetration, improved network coverage, and the persistence of traditional medical practices among patients and healthcare professionals. To further promote digital health, the country has undertaken several initiatives. In October 2022, Saudi Arabia aimed to rank among the world's fastest-growing digital health markets and announced plans to invest USD 13.8 billion in constructing medical facilities by 2030. These efforts demonstrate the nation's commitment to fostering advancements in the digital health space and transforming the healthcare landscape.

The digital health for cardiovascular market in UAE is anticipated to grow significantly over the forecast period. Several factors are driving the growth of the market in the country. These include government support for innovative startups and substantial financial investments by the government to promote digital health initiatives. In addition, key players in the industry are actively working on developing new products to cater to the increasing demand for enhanced care and services. For instance, in March 2021, Diginova Health Solutions formed a partnership with the Finnish company Cardiolyse. This collaboration aimed to introduce Cardiolyse's award-winning cloud-based ECG (Electrocardiogram) and Heart Rate Variability (HRV) analytics platform in the UAE, further bringing innovative digital health solutions to the UAE market and enhancing heart health monitoring and prevention capabilities. Such combinations of government backing and industry innovation are propelling market growth and fostering a more advanced and accessible healthcare ecosystem.

Key Digital Health For Cardiovascular Company Insights

The players in the market are undergoing strategic initiatives such as mergers, partnerships, and collaborations to develop new digital health solutions in the cardiovascular market space. Some of the key players in the market include Epic Systems Corporation, Orange Business, GE Healthcare, Health Information Management Systems (Hims), Siemens Healthineers AG, and HeartFlow, Inc., Bardy Diagnostics, Inc., Vista AI, Viz ai are some of the emerging market players operating in the market.

Key Digital Health For Cardiovascular Companies:

The following are the leading companies in the digital health for cardiovascular market. These companies collectively hold the largest market share and dictate industry trends.

- Epic Systems Corporation

- Orange Business

- GE Healthcare

- Apple Inc.

- HEALTH INFORMATION MANAGEMENT SYSTEMS (HIMS

- Siemens Healthineers AG

- Oracle (Cerner Corporation)

- NXGN Management, LLC

- Samsung

- DOVEN

- CardiAI

- AlivCor, Inc.

- Verily Life Sciences LLC

- HeartFlow, Inc.

- Bardy Diagnostics, Inc.

- Vista AI

- Viz ai

- RSIP Vision

- Cleerly, Inc.

Recent Developments

-

In March 2024, Wellysis, aSamsung subsidiary, teamed up with Artella Solutions (ARTELLA) to unveil its remote cardiac monitoring service in the U.S. This partnership aims to offer the FDA-cleared S-Patch electrocardiogram monitoring solution from ARTELLA across ten states.

-

In March 2023, Apple Inc. unveiled its intentions to enhance AirPods by integrating health-tracking functionalities such as temperature monitoring, motion detection, and biometric sensors capable of detecting perspiration and heart rate by 2025, aiming to advance digital health.

-

In February 2023, Veradigm LLC and HealthVerity collaborated to develop real-world research and improve care for patients suffering from diabetes and cardiovascular disease.

-

In January 2023, N.V., a global medical technology company, and Masimo, a medical devices company, announced an expansion of their partnership. This expansion aims to enhance patient monitoring capabilities in home telehealth applications by integrating an advanced health-tracking watch called the Masimo W1 with Phillips's patient monitoring ecosystem. This integration is set to progress telehealth and telemonitoring.

-

In November 2022, Viz.ai revealed the introduction of a comprehensive cardiology suite aimed at accelerating and improving patient access to state-of-the-art cardiovascular treatments. The Viz Cardio Suite utilizes AI-driven disease identification, workflow streamlining, and collaboration among care teams to enhance the delivery of cardiovascular treatment with greater efficiency.

-

In April 2022, BIOTRONIK launched brand-new mobile app upgrade for users of cardiac devices to facilitate communication with medical professionals and enhance patient involvement in their treatment. The Patient App can be utilized by patients with any supported BIOTRONIK device.

-

In May 2022, AlivCor, Inc., a pioneer in personal ECG products, introduced KardiaComplete, a comprehensive heart health enterprise solution aimed at enhancing health outcomes and minimizing the expenses associated with cardiac care.

Digital Health For Cardiovascular Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 42.4 billion

Revenue forecast in 2030

USD 140.9 billion

Growth rate

CAGR of 22.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Norway; Sweden; China; India; Japan; Australia; Singapore; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Orange Business; GE Healthcare; HEALTH INFORMATION MANAGEMENT SYSTEMS (HIMS); Apple Inc.; Siemens Healthineers AG; Oracle (Cerner Corporation); NXGN Management, LLC; Samsung; DOVEN; CardiAI; AliveCor, Inc.; Verily Life Sciences LLC; HeartFlow, Inc.; Bardy Diagnostics, Inc.; Vista AI; Viz ai; RSIP Vision; Cleerly, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Health For Cardiovascular Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global digital health for cardiovascular market report based on component, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Hardware

-

Services

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Patients

-

Providers

-

Payers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Singapore

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Frequently Asked Questions About This Report

b. The global digital health for cardiovascular market size was estimated at USD 35.3 billion in 2023 and is expected to reach USD 42.4 billion in 2024.

b. The global digital health for cardiovascular market is expected to grow at a compound annual growth rate of 22.2% from 2024 to 2030 to reach USD 140.9 billion by 2030.

b. Key factors that are driving the market growth include increasing prevalence of cardiovascular diseases (CVD’s), the rapid advancement in healthcare technology along with rising healthcare expenditure coupled with growing demand for remote patient monitoring services.

b. Some key players operating in the digital health for cardiovascular market include Orange Business, GE Healthcare, HEALTH INFORMATION MANAGEMENT SYSTEMS (HIMS), Apple Inc., Siemens Healthineers AG, Oracle (Cerner Corporation), NXGN Management, LLC, Samsung, DOVEN, CardiAI, AliveCor, Inc., Verily Life Sciences LLC, HeartFlow, Inc., Bardy Diagnostics, Inc., Vista AI, Viz ai, RSIP Vision, Cleerly, Inc.

b. The patient segment accounted for the largest market share in 2023, owing to the rising demand from growing emphasis on patient-centered care coupled with increasing individuals seeking to manage their personal health more effectively.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."