- Home

- »

- Medical Devices

- »

-

Colposcope Market Size, Share And Trends Report, 2030GVR Report cover

![Colposcope Market Size, Share & Trends Report]()

Colposcope Market Size, Share & Trends Analysis Report By Modality (Optical, Video), By Application (Pelvic, Oral), By Portability (Handheld, Stationary), By End-use (Hospitals, Diagnostic Centers, Gynecology Clinics), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-589-2

- Number of Report Pages: 170

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Colposcope Market Size & Trends

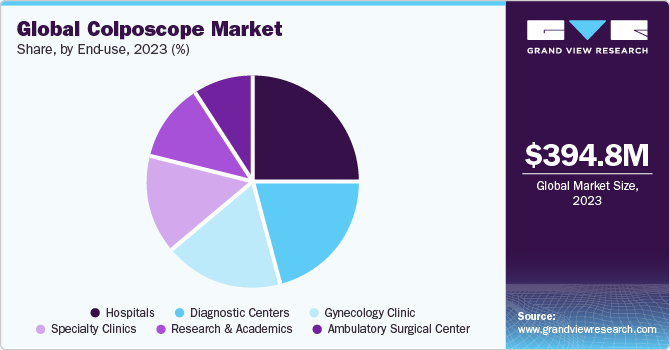

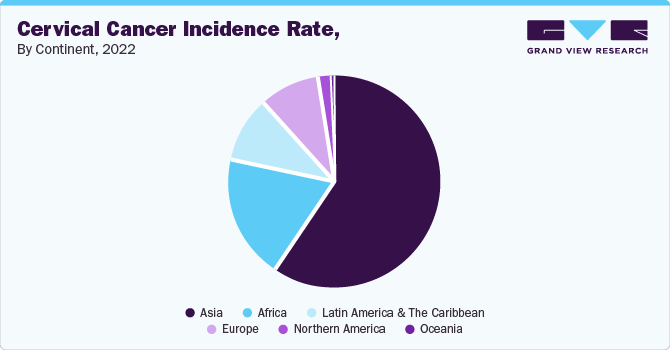

The global colposcope market size was estimated at USD 394.82 million in 2023 and is anticipated to grow at a CAGR of 4.60% from 2024 to 2030. Factors such as the rise in the prevalence of cervical cancer and the high demand for early diagnostic techniques are expected to boost market growth. According to a report published by the World Health Organization (WHO), cervical cancer is the fourth most common cancer among women globally. According to the International Agency for Research on Cancer, in 2022, about 662,301 new cases of cervical cancer were diagnosed globally, and 348,874 deaths occurred in the same year due to the disease. In addition, by 2027, the incidence of cervical cancer is expected to increase to 1,948,521.

Colposcopy is a highly efficient method for the early detection of lesions and the selection of biopsy locations, owing to its accuracy, versatility, user-friendliness, and non-invasive nature. It further allows for a magnified evaluation of the cervix and lower genital tract for dysplastic or malignant epithelial lesions. Gynecological examinations were subjected to a time-consuming and inconvenient clinical experience for decades, including outmoded equipment and uncomfortable visits. However, there have been significant technological advancements in this field in recent years. For instance, in February 2022, an Indian gynecologist, Dr. Anupama Bhute Anand developed an integrated colposcope called SINDICOLPO, which has compatibility with Android phones.

Major market players have been adopting advanced technologies by integrating various digital platforms with colposcope equipment. The integration is expected to introduce high-resolution imaging devices that are most likely to replace traditional colposcopes, influencing the market dynamics. Increasing awareness and adoption of preventive healthcare and disease screening programs are expected to propel market growth. For instance, in April 2021, as part of China's efforts to protect women's health, more than 120 million cervical cancer screenings were conducted for free. Improved image quality is expected to improve diagnostic precision in the early stages of cervical cancer. This can help with a faster diagnosis and treatment. Thus, the growing usage of colposcopy for diagnosing various diseases is expected to contribute to market growth.

Market Concentration & Characteristics

The industry is growing at a moderate pace and has seen significant innovation, characterized by technological advancements that have led to more accurate and efficient imaging results, ultimately improving treatment planning. Technological advancements include digital imaging and integration, video colposcopy, and green filter technology.

To expand their customer base and gain a larger market share, major players in the industry are continuously working to improve their product offerings. This involves upgrading their products, exploring acquisitions, obtaining government clearances, and engaging in important cooperation activities. For instance, in May 2021, CooperSurgical acquired OBP Medical, which includes its single-use lighting vaginal speculums, anoscopes, and laryngoscopes. CooperSurgical's focus on creating significant solutions that meet providers' demands is highlighted by this acquisition.

This market has achieved a high degree of innovation, owing to remarkable technological advancements that have positioned them at the forefront of medical diagnostics.

Companies that manufacture colposcope are undertaking merger and acquisition activities. This strategic approach seeks to improve technological capabilities, expand market reach, and maintain competitiveness. In October 2022, Aspen Surgical Products, Inc. completed the acquisition of Symmetry Surgical from RoundTable Healthcare Partners, marking Aspen's 15th acquisition overall and its sixth in this line. This strategic move enhances Aspen's extensive portfolio by integrating more clinically favored brands, broadening its reach into appealing adjacent sectors, and introducing new commercial skills and market access through a nationwide direct-sales network that spans both acute and non-acute care settings.

Regulatory bodies, including the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), play a pivotal role in shaping the development and deployment of medical colposcopes. Their regulations guarantee the safety and efficacy of these medical devices for patient application, encompassing the entire spectrum from their design and production to their implementation in clinical environments.

New product launches by manufacturers to stay competitive in the market and the growing demand and adoption of colposcope is an important factor driving market growth. For instance, in July 2021, DYSIS Medical Inc. announced the launch of DYSIS View-a compact and portable colposcope that uses the company's cutting-edge computer-aided cervical mapping technology, helping healthcare professionals to clearly detect cervical abnormalities.

The colposcope devices industry is witnessing growth across various regions, propelled by a range of factors unique to each geographical area. This growth is being fueled by heightened awareness of cervical cancer screening initiatives, advancements in colposcope technology, and the expansion of healthcare infrastructure within developing economies.

Modality Insights

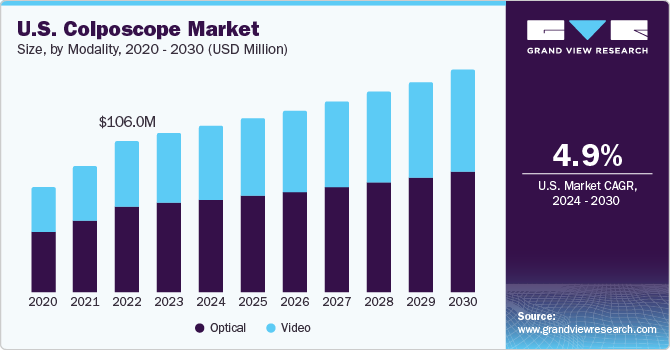

The optical colposcope segment dominated the market in 2023 with the largest revenue share in 2023. The optical colposcope is a traditional colposcope with three parts: the head, which holds the optics; the light source; and the body, which can be portable or non-portable. The adoption of the optical colposcope is high in developing countries. High affordability and low maintenance are key driving factors in this segment.

The video colposcope segment is anticipated to witness the fastest CAGR of 5.27% during the forecast period. Video modality provides visual clarity and motion pictures that help in accurate diagnosis. Video colposcopes can autofocus the image if kept 25-30 cm from the object. With video colposcopy, patients spend significantly less time in the exam room than in a conventional optical colposcopy-based exam. In addition, this system stores data, which can later be played or recalled on a screen. Thus, all these factors are expected to boost the segment growth during the forecast period.

End-use Insights

The hospital segment held the largest revenue share of 24.92% in 2023. Hospitals are well-equipped with the necessary instruments to screen the cervix to detect any precancerous and cancerous growth, thus leading to a large number of patients visiting hospitals. The rising acceptance rate for technologically advanced biopsy and the use of colposcopes for early diagnosis of cervical cancer are factors likely to drive segment growth.

The diagnostic center segment is expected to be the fastest-growing segment during the forecast period. The growing patient population with cervical cancer allows clinicians to provide stand-alone outpatient diagnostic centers. Diagnostic centers also work to differentiate their service offerings, quality, and test accuracy by focusing on brand building through online marketing initiatives. Healthcare camps, advertising campaigns, and preventive and wellness test packages are all part of their campaigning. Thus, the aforementioned factors are contributing to segment growth.

Application Insights

The pelvic examination segment dominated the market in 2023 with the largest revenue share and is expected to grow at the highest CAGR of 4.77% during the forecast period. This is due to the increasing cases of gynecological disorders. Colposcopy helps identify the problem more clearly when Pap smear results are abnormal. Pelvic colposcopy examinations analyze the inflammation, infection, cancerous changes, and traumatic injuries in the vagina and cervix. Due to its high negative predictive value, colposcopy is a useful cervical cancer screening method.

The oral examination segment is expected to grow at a significant rate from 2024 to 2030 owing to the increasing prevalence of premalignant lesions and oral cancers globally. The condition is fatal, and delayed treatment leads to a high morbidity rate. According to the Global Cancer Observatory, oral cavity cancer accounted for 188,438 deaths in 2022. However, oral cancer can be treated if diagnosed early. Studies suggest that a colposcope is more efficient in detecting oral lesions than other methods.

Portability Insights

The stationary colposcope segment dominated the market in 2023 with the largest revenue share. In developing countries, where the adoption of new technology is slower, stationary colposcopes are in high demand. The market is predicted to grow due to constant technological advancements such as high-quality digital images, improved magnification, and HD camera technology. This technology has added a new variable that can be utilized for efficient diagnosis.

The handheld colposcope segment is estimated to register the fastest CAGR of 5.13% during the forecast period. The portability, ease of use, and compact nature of handheld colposcopes have increased their acceptance in smaller clinics. In addition, handheld colposcope systems can be carried around in the hospital and to a patient’s home. It permits gynecological examinations at any location, thereby increasing access for patients. The demand for handheld colposcopes is anticipated to increase, especially in point-of-care, home care, and emergency care settings, attracting new market players.

Regional Insights

North America dominated the market in 2023 with the largest revenue share of 34.48%, owing to an increase in the prevalence of cervical cancer and a rise in healthcare expenditure. Factors such as the adoption of colposcope equipment, easy access to healthcare technologies, and significant distribution channels are expected to boost market growth. According to the Centers for Medicare and Medicaid Services, the U.S. government spent nearly USD 4.5 trillion on healthcare in 2022, accounting for approximately 17.3% of the total GDP.

Continent

Incidence rate

Asia

397,082

Africa

125,699

Latin America and the Caribbean

63,171

Europe

58,219

Northern America

15,654

Oceania

2,476

U.S. Colposcope Market Trends

The colposcope market in the U.S. held the largest revenue share of North America in 2023. The market growth is due to increasing awareness of colposcopy procedure advantages, the existence of a robust healthcare system, supportive reimbursement frameworks, and positive healthcare regulatory changes.

Europe Colposcope Market Trends

The colposcope market in Europe held a significant market share in 2023. The growth of the Europe market is influenced by the rising occurrence of conditions like uterine fibroids, cervical cancer, and irregular vaginal bleeding, the availability of numerous major players, and the launch of technologically advanced products in Europe.

The UK colposcope market is expected to grow during the forecast period. The rising government healthcare spending and higher disposable income are some of the factors contributing to the growth of the UK market.

The colposcope market in France is expected to from 2024 to 2030 due to the increasing number of hospitals and surgeries in the country. According to Expatica, in December 2021, there were around 1,400 hospitals in France.

The Germany colposcope market is expected to grow over the forecast period. This can be attributed to the presence of a well-established healthcare system in the country, including trained staff & medical facilities, and high adoption of technologically advanced products.

Asia Pacific Colposcope Market Trends

The colposcope market in Asia Pacific is estimated to witness the fastest CAGR during the forecast period, owing to a large patient pool and the growing need for technologically advanced and cost-effective healthcare solutions. Furthermore, market expansion in this region is aided by increased hospitalizations and significant developments in the clinical development framework of developing economies.

The colposcope market in China is expected to grow over the forecast period, owing to the growing prevalence of cervical cancer and the rise in the number of screening campaigns for cervical cancer conducted by the government.

The Japan colposcope market is expected to grow over the forecast period. This growth can be attributed to the growing incidence of cervical cancer in the country. A report published by the ICO Information Centre on HPV and Cancer 2021 states that cervical cancer screening coverage in Japan was 31.1% in women aged 20 and above.

Latin America Colposcope Market Trends

The colposcope market in Latin America is anticipated to undergo moderate growth from 2024 to 2030. Growing medical tourism due to affordable healthcare facilities, increasing incidence of cancer, and rising access to healthcare services are some of the major factors fueling market growth in the region.

The Argentina colposcope market is expected to grow over the forecast period. This growth can be attributed to various factors such as the increasing prevalence of cervical cancer, growing medical tourism, and the advancing healthcare system.

MEA Colposcope Market Trends

The Middle East & Africa colposcope market is anticipated to experience growth during the forecast period owing to growing healthcare expenditure and increasing accessibility to advanced medical devices in the region.

Key Colposcope Company Insights

The key players are developing advanced colposcopes to meet the growing prevalence of cervical cancer. Moreover, regional and service portfolio expansions and mergers and acquisitions are key strategies adopted by these players. Some of the major market players operating in the orthopedic imaging equipment market are Karl Kaps GmbH & Co. KG; CooperSurgical, Inc.; and DYSIS Medical Inc.

Key Colposcope Companies:

The following are the leading companies in the colposcope market. These companies collectively hold the largest market share and dictate industry trends.

- Karl Kaps GmbH & Co. KG

- CooperSurgical, Inc

- DYSIS Medical Inc

- ATMOS Medizin Technik GmbH & Co. KG

- Olympus Corporation

- McKesson Medical-Surgical Inc.

- Ecleris

- Optomic

- Seiler Instrument Inc.

- Symmetry Surgical Inc.

Recent Developments

-

In May 2023, MobileODT announced the launch of EVA App for colposcopy screening and SANE, with a simplified workflow for improved user experience.

-

In January 2022, MobileODT unveiled its latest advancement, the next-generation VisualCheck Artificial Intelligence Algorithm, marking a significant innovation in cervical cancer screening.

-

In March 2021, MobileODT announced the launch of its new generation VisualCheck Artificial Intelligence Algorithm, a groundbreaking innovation in the field of cervical cancer screening.

Colposcope Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 409.98 million

Revenue forecast in 2030

USD 537.08 million

Growth rate

CAGR of 4.60% from 2024 to 2030

Actual period

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Modality, application, portability, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Karl Kaps GmbH & Co. KG; CooperSurgical, Inc.; DYSIS Medical Inc.; ATMOS Medizin Technik GmbH & Co. KG; Olympus Corporation; McKesson Medical-Surgical Inc.; Ecleris; Optomic,; Seiler Instrument Inc.; Symmetry Surgical Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Colposcope Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global colposcope market report based on modality, application, portability, end-use, and region:

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Optical

-

Video

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Pelvic

-

Oral

-

-

Portability Outlook (Revenue, USD Million, 2018 - 2030)

-

Handheld

-

Stationary

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Centers

-

Gynecology Clinic

-

Specialty Clinics

-

Ambulatory Surgical Center

-

Research and Academics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global colposcope market size was estimated at USD 394.82 million in 2023 and is expected to reach USD 409.98 million in 2023.

b. The global colposcope market is expected to grow at a compound annual growth rate of 4.60% from 2024 to 2030 to reach USD 537.08 million by 2030.

b. Optical modality dominated the colposcope market with a share of 55.54% in 2023. This is attributable to high affordability, easy installation, and low maintenance.

b. Some key players operating in the colposcope market include Kaps GmbH & Co. KG, CooperSurgical, Inc, DYSIS Medical Inc, ATMOS Medizin Technik GmbH & Co. KG, Olympus Corporation, McKesson Medical-Surgical Inc., Ecleris, Optomic, Seiler Instrument Inc.

b. Key factors that are driving the colposcope market growth include the rising prevalence of cervical cancer and the high demand for early diagnostic techniques.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."