- Home

- »

- Next Generation Technologies

- »

-

Automotive TIC Market Size, Share & Growth Report, 2030GVR Report cover

![Automotive TIC Market Size, Share & Trends Report]()

Automotive TIC Market Size, Share & Trends Analysis Report By Service Type (Testing, Inspection, Certification), By Sourcing Type (In-house, Outsourced), By Application (Vehicle Inspection, ADAS Testing), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-164-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Automotive TIC Market Size & Trends

The global automotive TIC market size was valued at USD 32.48 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 10.7% from 2023 to 2030. The industry's expansion is fueled by the increasing complexity of automotive technologies, including electronic systems and advanced materials testing for safety and reliability. Governments worldwide are enforcing stringent regulations for automotive safety and emissions and ensuring compliance through testing, inspection, and certification (TIC) services. The rising demand for electric vehicles (EVs) globally is driving environmental concerns and government spending to the need for specialized TIC services due to the unique safety and performance considerations of EVs. Additionally, the emergence of connected cars and autonomous driving technologies, reliant on communication networks and advanced sensors, emphasizes the essential role of TIC companies in validating their performance and safety.

Automotive TIC providers play a vital role in ensuring the safety, reliability, and interoperability of connected vehicles and their technologies. TIC companies assist in identifying and addressing cybersecurity vulnerabilities in connected vehicles, implementing protective measures, and certifying the effectiveness of cybersecurity solutions. They verify the seamless communication of connected vehicles with each other and infrastructure, addressing challenges to ensure safe and efficient operations. Additionally, TIC services extend to assessing and certifying the performance and safety of Advanced Driver Assistance Systems (ADAS), autonomous driving capabilities, EV batteries, and charging infrastructure components.

The growth of the market is driven by the heightened focus of governments worldwide on imposing stringent regulatory standards in the automotive industry. TIC companies are growing as governments increasingly raise safety standards, necessitating rigorous testing and certification of advanced safety features such as airbags, seatbelts, and electronic stability control. Additionally, TIC firms are evaluating and certifying vehicle emissions systems to align with evolving environmental regulations aimed at facilitating cleaner and more sustainable transportation. The regulatory landscape for connected vehicles and autonomous driving technologies introduces a new dimension, prompting governments to develop new standards.

The COVID-19 pandemic has affected the market. The initial outbreak in 2020 triggered widespread disruptions in the global automotive industry, marked by factory closures, supply chain interruptions, and a decline in vehicle demand. These challenges have affected the market, with providers needing help in conducting testing and certification activities. Travel restrictions, the shift to remote work arrangements, and limited access to testing facilities created limitations for TIC companies.

Service Type Insights

The testing segment led the market in 2022, accounting for over 74% share of the global revenue. The segment's growth is primarily due to its crucial role in ensuring the safety and quality of automotive products. Vehicles are subjected to diverse safety standards, necessitating thorough testing to identify and address potential defects. Consumers' demand for high-quality vehicles further emphasizes the significance of testing in meeting performance expectations. The increasing complexity of automotive technologies, including advanced driver-assistance systems (ADAS), autonomous driving features, and electric vehicles, requires specialized capabilities in testing to assess and ensure product quality and safety comprehensively.

The certification segment is predicted to foresee significant growth in the forecast years. The growth is attributed to increasing regulatory requirements worldwide, particularly in the areas of automotive safety, emissions, and cybersecurity. Governments' stringent regulations are expected to drive a heightened demand for certification services, ensuring vehicles comply with these evolving standards. Furthermore, the surge in the development of autonomous vehicles is contributing to the growth of the certification segment, as these advanced vehicles require extensive certification to guarantee their safety and reliability. For instance, in November 2023, Jios Aerogel, a prominent provider of critical components in electric vehicle batteries, obtained certification for its automotive quality management system (QMS) in its Singapore-based operations. This achievement is anticipated to enhance product and service quality, lower costs, and elevate customer satisfaction for the company.

Sourcing Type Insights

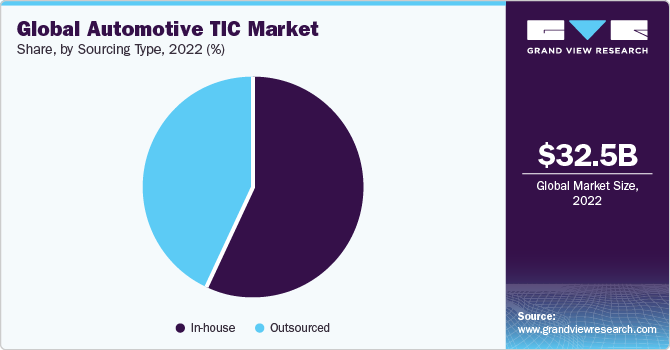

The in-house segment led the market in 2022, accounting for over 56% of global revenue. This dominance is attributed to the on-site availability, enabling immediate access to testing facilities and personnel for decision-making. In-house testing provides companies the flexibility to recruit and train specialized testing personnel directly, ensuring a highly skilled workforce tailored to specific needs. Thus, companies can establish personalized testing procedures aligned with unique product requirements.For instance, in October 2023, Volvo Car Corporation opened a new software testing center in Sweden to expand its integrated software testing capabilities. This investment would let Volvo Car Corporation substantially focus on software development, with the center dedicated to testing various software components, such as infotainment systems, driver assistance systems, and autonomous driving systems.

The outsourced segment will witness significant growth in the coming years. The cost-effectiveness of outsourcing drives this growth, as outsourcing providers often leverage specialized expertise and offer testing services at a lower cost per unit compared to maintaining in-house capabilities. Outsourcing enables companies to focus on their core competencies and strategic initiatives, redirecting resources from managing testing and inspection activities internally. Additionally, outsourcing provides access to a diverse pool of specialized testing and inspection expertise, ensuring that products undergo evaluation by qualified professionals.

Application Insights

The vehicle inspection segment held the largest revenue share of over 21% in 2022. The segment's growth is driven by the escalating demand for vehicle inspections mandated by regulatory bodies, fleet managers, and consumers. Vehicle inspections play a vital role in ensuring safety and compliance with emissions and safety standards, providing reassurance to both buyers and sellers of used vehicles. Moreover, there is a rise in remote inspections, offering convenience and flexibility for both vehicle owners and inspectors. Advanced technology has enhanced the accuracy and reliability of remote inspections, enabling inspectors to utilize digital tools and engage with owners through video calls and messaging apps, providing a comprehensive evaluation of the vehicle's condition in real-time.

The advanced driver assistance systems (ADAS) testing segment is estimated to grow significantly over the forecast period. This growth is propelled by the increased adoption of ADAS in new vehicles, driven by both stringent safety regulations and consumer demand for advanced technology. The rising complexity of ADAS systems, featuring an expanding range of features, necessitates more comprehensive and stringent testing procedures to ensure functionality and safety. The segment is further evolving with advances in testing technologies, including simulation and emulation, facilitating more efficient and cost-effective testing processes for ADAS systems. In April 2023, dSPACE GmbH collaborated with the Korea Transportation Safety Authority (KOTSA) to introduce an innovative approach for testing advanced driver assistance systems (ADAS) during periodic inspections. The approach relies on vehicle-in-the-loop (VIL) technology, enabling the simulation of driving scenarios within a controlled environment.

Regional Insights

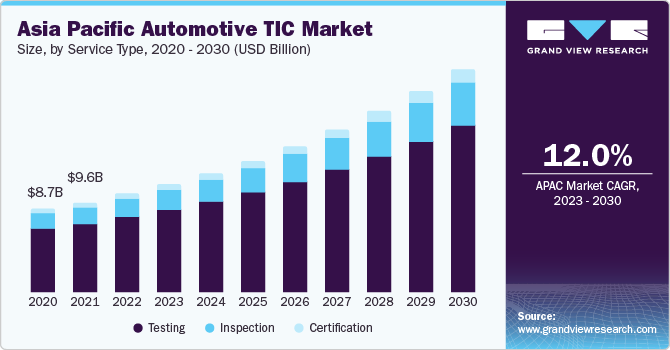

Asia Pacific held the largest share of the market in 2022, accounting for over 32%. The region's growth is attributed to the expansive and expanding automotive industry associated with stringent government regulations and a growing demand for quality and safety testing services. China is anticipated to be the largest market in the region, driven by the rapid expansion of its electric vehicles and government focus on enhancing automotive safety standards. Additionally, India and Japan are expected to witness significant growth in the market due to increasing disposable incomes and a rising demand for premium vehicles. In November 2022, SGS SA opened India's largest automotive quality testing laboratories in Pune. The facility offers an extensive range of advanced testing services with large capacities. Equipped with state-of-the-art technology, the laboratory ensures fast and accurate results, complying with JASO, ISO, CISPR, IEC Indian standards, and global OEM specifications.

The Middle East & Africa region is poised for significant growth in the market, driven by a higher demand for automotive vehicles. Governments in the region are intensifying their focus on enhancing safety and quality standards for vehicles, resulting in stricter regulations and a heightened need for TIC services to ensure compliance. Furthermore, the MEA automotive industry is increasing the outsourcing of TIC services by manufacturers to specialized providers. Thus, it has led to cost reduction, improved efficiency, and access to specialized expertise.

Key Companies & Market Share Insights

Incumbent players and startups are poised to have opportunities to gain a competitive edge in the rapidly growing and evolving automotive TIC market. Incumbents capitalize on industry expertise, invest in R&D, expand services, and explore strategic partnerships. Startups leveraging agility, focus on niche markets, introduce innovative solutions, embrace digital transformation, and pursue strategic collaborations to differentiate themselves and thrive in the evolving landscape. In June 2023, Element Materials Technology, a prominent provider of TIC services globally, acquired NCT CO., LTD., a battery testing company in South Korea. The acquisition enhances Element Materials Technology's footprint in Asia and obtains distinctive destructive battery testing capabilities for its connected technologies business in the region.

Key Automotive TIC Companies:

- Applus+

- Bureau Veritas SA

- DEKRA SE

- Element Materials Technology

- Eurofins Scientific

- Intertek Group plc

- SGS SA

- TÜV NORD GROUP

- TÜV Rheinland

- TÜV SÜD

Automotive TIC Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 35.66 billion

Revenue forecast in 2030

USD 72.51 billion

Growth rate

CAGR of 10.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, sourcing type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; Australia; South Korea; Brazil; Kingdom of Saudi Arabia (KSA); United Arab Emirates (UAE); South Africa

Key companies profiled

Applus+; Bureau Veritas SA; DEKRA SE; Element Materials Technology; Eurofins Scientific; Intertek Group plc; SGS SA; TÜV NORD GROUP; TÜV Rheinland; TÜV SÜD

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive TIC Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global automotive TIC market report based on service type, sourcing type, application, and region:

-

Service Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Testing

-

Inspection

-

Certification

-

-

Sourcing Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

In-house

-

Outsourced

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Vehicle Inspection

-

Vehicle Components

-

Interior and Exterior Materials Testing

-

Automotive Fuels, Fluids, and Lubricants

-

Homologation Testing

-

Advanced Driver Assistance Systems (ADAS) Testing

-

Durability Testing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia

-

United Arab Emirates

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive TIC market size was estimated at USD 32.48 billion in 2022 and is expected to reach USD 35.66 billion in 2023.

b. The global automotive TIC market is expected to grow at a compound annual growth rate of 10.7% from 2023 to 2030 to reach USD 72.51 billion by 2030.

b. Asia Pacific dominated the market in 2022, accounting for over 32% share of the global revenue. The region's growth is attributed to the expansive and expanding automotive industry associated with stringent government regulations and a growing demand for quality and safety testing services.

b. Some key players operating in the automotive TIC market include Applus+, Bureau Veritas SA, DEKRA SE, Element Materials Technology, Eurofins Scientific, Intertek Group plc, SGS SA, TÜV NORD GROUP, TÜV Rheinland, TÜV SÜD.

b. Key factors driving the automotive TIC market growth include the rising adoption of connected devices in the automotive industry and the rapid advancements in the automotive industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."