U.S. Wax Melts Market Size & Outlook, 2023-2030

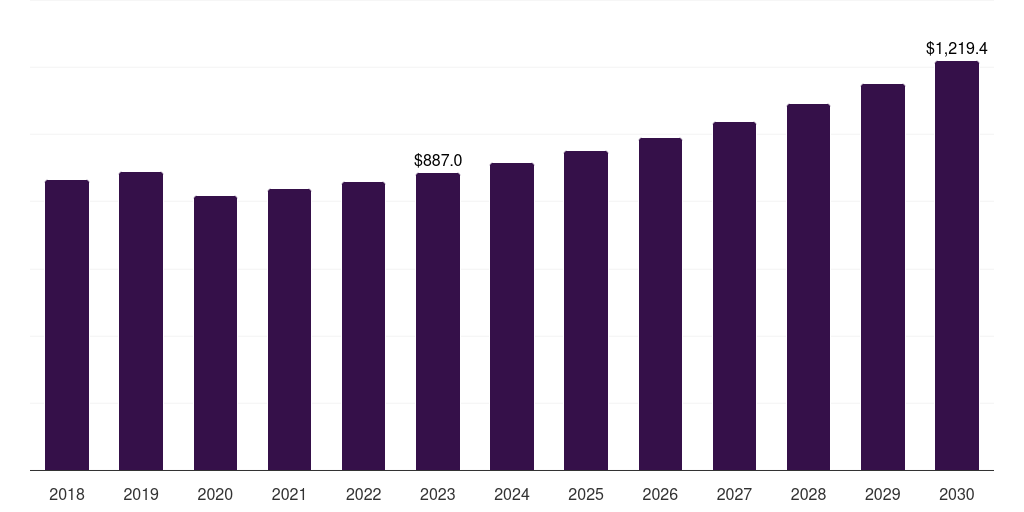

U.S. wax melts market, 2018-2030 (US$M)

Related Markets

U.S. wax melts market highlights

- The U.S. wax melts market generated a revenue of USD 887.0 million in 2023 and is expected to reach USD 1,219.4 million by 2030.

- The U.S. market is expected to grow at a CAGR of 4.7% from 2024 to 2030.

- In terms of segment, paraffin was the largest revenue generating product in 2023.

- Palm Wax is the most lucrative product segment registering the fastest growth during the forecast period.

Wax melts market data book summary

| Market revenue in 2023 | USD 887.0 million |

| Market revenue in 2030 | USD 1,219.4 million |

| Growth rate | 4.7% (CAGR from 2023 to 2030) |

| Largest segment | Paraffin |

| Fastest growing segment | Palm Wax |

| Historical data | 2018 - 2022 |

| Base year | 2023 |

| Forecast period | 2024 - 2030 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Paraffin, Soy Wax, Palm Wax, Beeswax, Others (Stearin, Rapeseed Wax, Coconut Wax) |

| Key market players worldwide | East Coast Candles, Yankee Candle Company, Michaels Stores, Scentsy, Bridgewater Candle Company, Bramble Bay, Talley Group, Stora Enso Oyj Ordinary Shares - Class R, SC Johnson, NEST New York |

Other key industry trends

- In terms of revenue, U.S. accounted for 25.5% of the global wax melts market in 2023.

- Country-wise, U.S. is expected to lead the global market in terms of revenue in 2030.

- In North America, U.S. wax melts market is projected to lead the regional market in terms of revenue in 2030.

- Canada is the fastest growing regional market in North America and is projected to reach USD 333.5 million by 2030.

Paraffin was the largest segment with a revenue share of 31.72% in 2023. Horizon Databook has segmented the U.S. wax melts market based on paraffin, soy wax, palm wax, beeswax, others (stearin, rapeseed wax, coconut wax) covering the revenue growth of each sub-segment from 2018 to 2030.

Key market participants in the U.S. are diversifying their product offerings and experimenting with various wax blends and essential oils. In June 2021, the Candle-lite Company, a U.S.-based company, launched CBD-infused candles and wax melts under their Essential Elements brand.

Kroger Family of Stores became the first retailer to feature these products in their stores. This product line includes 100% pure CBD oil along with essential oils and a natural wax blend. This product launch marks the first mass-produced line of CBD candles and wax melts nationally in Food/Drug/Mass, offering up to 110 hours of burn time and cruelty-free, hand-poured production in the U.S.

This variety appeals to a broader consumer base, including those seeking the benefits of CBD over and above traditional fragrances. Innovations in product formulations contribute to market expansion, attracting new customers who are interested in unique and wellness-oriented home fragrance options such as new fragrances in wax melts and CBD oil-infused wax melts.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Wax Melts Market Scope

Wax Melts Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|

U.S. wax melts market size, by product, 2018-2030 (US$M)

U.S. Wax Melts Market Outlook Share, 2023 & 2030 (US$M)

Related regional statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more