U.S. Virtual Production Market Size & Outlook, 2026-2033

Related Markets

U.S. virtual production market highlights

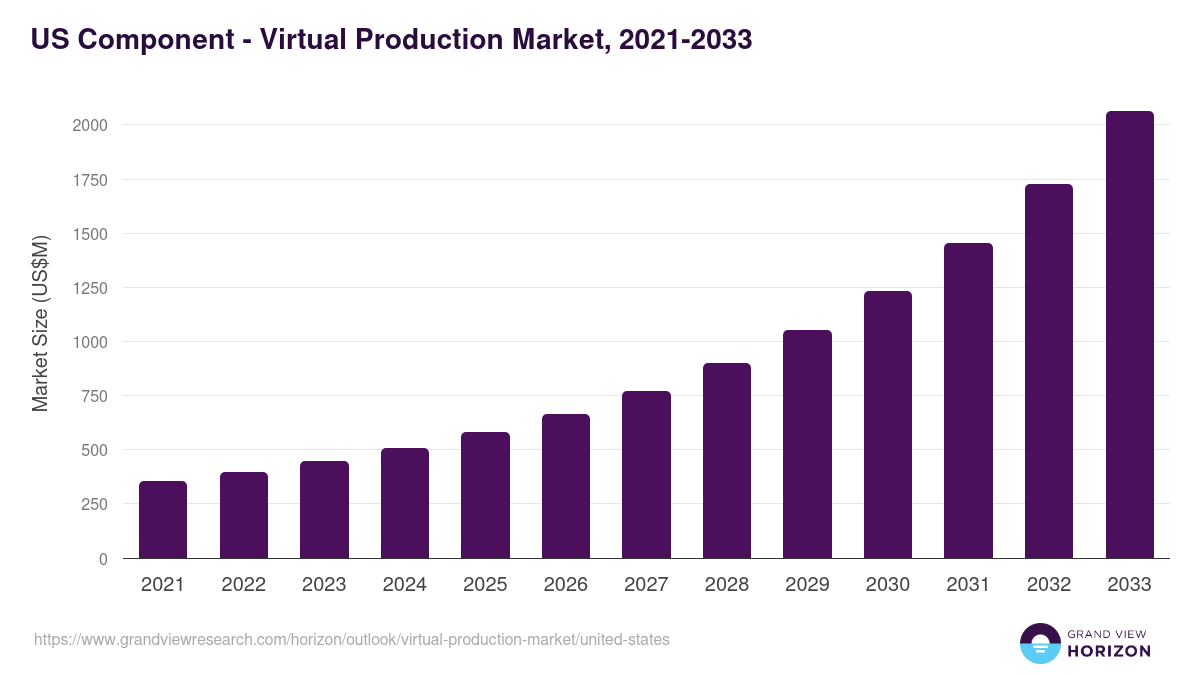

- The U.S. virtual production market generated a revenue of USD 579.9 million in 2025 and is expected to reach USD 2,063.0 million by 2033.

- The U.S. market is expected to grow at a CAGR of 17.5% from 2026 to 2033.

- In terms of segment, software was the largest revenue generating component in 2025.

- Services is the most lucrative component segment registering the fastest growth during the forecast period.

Virtual production market data book summary

| Market revenue in 2025 | USD 579.9 million |

| Market revenue in 2033 | USD 2,063.0 million |

| Growth rate | 17.5% (CAGR from 2026 to 2033) |

| Largest segment | Software |

| Fastest growing segment | Services |

| Historical data | 2021 - 2024 |

| Base year | 2025 |

| Forecast period | 2026 - 2033 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Hardware, Software, Services |

| Key market players worldwide | Adobe Inc, AGC Inc, Autodesk Inc, Epic Corp, HTC, NVIDIA Corp, The Walt Disney Co, Grom Social Enterprises Inc |

Other key industry trends

- In terms of revenue, U.S. accounted for 20.4% of the global virtual production market in 2025.

- Country-wise, U.S. is expected to lead the global market in terms of revenue in 2033.

- In North America, U.S. virtual production market is projected to lead the regional market in terms of revenue in 2033.

- Canada is the fastest growing regional market in North America and is projected to reach USD 1,364.5 million by 2033.

Software was the largest segment with a revenue share of 47.75% in 2025. Horizon Databook has segmented the U.S. virtual production market based on hardware, software, services covering the revenue growth of each sub-segment from 2021 to 2033.

Prominent technological innovation in the U.S. propels the market growth for virtual production in this region. For instance, in December 2022, the most significant LED wall virtual production stage in the U.S. was unveiled by Amazon Studios. The drum-shaped stage is 26 feet tall and 80 feet in circumference, one foot less than a Vancouver stage that is currently considered the biggest in the world.

In November 2021, Netflix, a US-based production company and subscription streaming service, purchased Scanline VFX for an unknown sum. With this acquisition, the American streaming service becomes the first to control a significant participant in the special effects sector. A US-based company called Scanline VFX engages in virtual production.

One major trend that is gaining traction in the virtual production sector is technological developments. To improve their position, major corporations involved in virtual production are concentrating on creating innovative technology solutions. For instance, the first Mobile Virtual Production SuperstudioTM was introduced by Magicbox, a US-based virtual production company, in September 2020.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Virtual Production Market Scope

Virtual Production Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|---|---|---|---|

| Grom Social Enterprises Inc | View profile | 105 | 2060 NW Boca Raton Boulevard, Suite 6, Boca Raton, FL, United States, 33431 | https://www.gromsocialenterprises.com |

| Autodesk Inc | View profile | 13700 | One Market Street, Suite 400, San Francisco, CA, United States, 94105 | https://www.autodesk.com |

| HTC | View profile | 10001+ | Taoyüan, T'ai-wan, Taiwan, Asia | http://www.htc.com |

| The Walt Disney Co | View profile | 225000 | 500 South Buena Vista Street, Burbank, CA, United States, 91521 | https://www.thewaltdisneycompany.com |

| AGC Inc | View profile | 61671 | 1-5-1, Marunouchi, Chiyoda-ku, Tokyo, Japan, 100-8405 | https://www.agc.com |

| Adobe Inc | View profile | 29945 | 345 Park Avenue, San Jose, CA, United States, 95110-2704 | https://www.adobe.com |

| NVIDIA Corp | View profile | 29600 | 2788 San Tomas Expressway, Santa Clara, CA, United States, 95051 | https://www.nvidia.com |

| Epic Corp | View profile | 2 | PO Box 11147, Newport Beach, CA, United States, 92658 |

US Component - Virtual Production Market size, 2025 - 2033 (US$M)

U.S. Virtual Production Market Outlook Share, 2025 & 2033 (US$M)

Related statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more