Luxemburg Sustainable Finance Market Size & Outlook

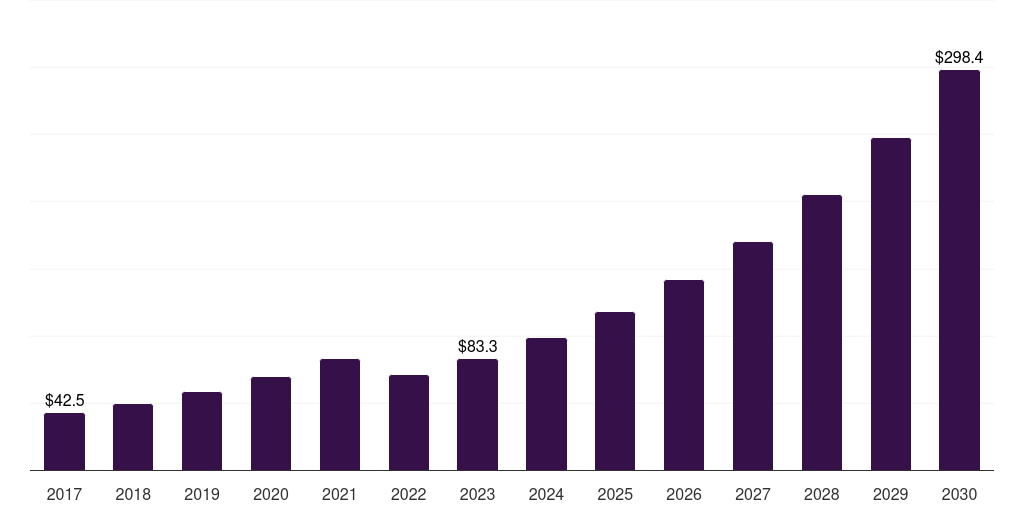

Luxemburg sustainable finance market, 2017-2030 (US$B)

Related Markets

Luxemburg sustainable finance market highlights

- The Luxemburg sustainable finance market generated a revenue of USD 83.3 billion in 2023 and is expected to reach USD 298.4 billion by 2030.

- The Luxemburg market is expected to grow at a CAGR of 20% from 2024 to 2030.

- In terms of segment, equities was the largest revenue generating asset class in 2023.

- Multi-asset is the most lucrative asset class segment registering the fastest growth during the forecast period.

Sustainable finance market data book summary

| Market revenue in 2023 | USD 83.3 billion |

| Market revenue in 2030 | USD 298.4 billion |

| Growth rate | 20% (CAGR from 2023 to 2030) |

| Largest segment | Equities |

| Fastest growing segment | Multi-asset |

| Historical data | 2017 - 2022 |

| Base year | 2023 |

| Forecast period | 2024 - 2030 |

| Quantitative units | Revenue in USD billion |

| Market segmentation | Equities, Fixed-income, Multi-asset, Alternatives |

| Key market players worldwide | BlackRock Inc, Morgan Stanley, UBS Group AG, JPMorgan Chase & Co, Franklin Growth A, State Street Corporation, Deutsche Bank AG, The Goldman Sachs Group Inc |

Other key industry trends

- In terms of revenue, Luxemburg accounted for 20.8% of the global sustainable finance market in 2023.

- Country-wise, U.S. is expected to lead the global market in terms of revenue in 2030.

- In Europe, Luxemburg sustainable finance market is projected to lead the regional market in terms of revenue in 2030.

- Germany is the fastest growing regional market in Europe and is projected to reach USD 152.9 billion by 2030.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Sustainable Finance Market Scope

Sustainable Finance Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|

Luxemburg sustainable finance market outlook

The databook is designed to serve as a comprehensive guide to navigating this sector. The databook focuses on market statistics denoted in the form of revenue and y-o-y growth and CAGR across the globe and regions. A detailed competitive and opportunity analyses related to sustainable finance market will help companies and investors design strategic landscapes.

Equities was the largest segment with a revenue share of 48.62% in 2023. Horizon Databook has segmented the Luxemburg sustainable finance market based on equities, fixed-income, multi-asset, alternatives covering the revenue growth of each sub-segment from 2017 to 2030.

- Luxemburg Sustainable Finance Asset Class Outlook (Revenue, USD Billion, 2017-2030)

- Equities

- Fixed-income

- Multi-asset

- Alternatives

- Luxemburg Sustainable Finance Offerings Outlook (Revenue, USD Billion, 2017-2030)

- Equity Funds

- Bond Funds

- ETFs/Index Funds

- Alternatives/Hedged Funds

- Luxemburg Sustainable Finance Investment Style Outlook (Revenue, USD Billion, 2017-2030)

- Active

- Passive

- Luxemburg Sustainable Finance Investor Type Outlook (Revenue, USD Billion, 2017-2030)

- Institutional Investors

- Retail Investors

Reasons to subscribe to Luxemburg sustainable finance market databook:

-

Access to comprehensive data: Horizon Databook provides over 1 million market statistics and 20,000+ reports, offering extensive coverage across various industries and regions.

-

Informed decision making: Subscribers gain insights into market trends, customer preferences, and competitor strategies, empowering informed business decisions.

-

Cost-Effective solution: It's recognized as the world's most cost-effective market research database, offering high ROI through its vast repository of data and reports.

-

Customizable reports: Tailored reports and analytics allow companies to drill down into specific markets, demographics, or product segments, adapting to unique business needs.

-

Strategic advantage: By staying updated with the latest market intelligence, companies can stay ahead of competitors, anticipate industry shifts, and capitalize on emerging opportunities.

Target buyers of Luxemburg sustainable finance market databook

-

Our clientele includes a mix of sustainable finance market companies, investment firms, advisory firms & academic institutions.

-

30% of our revenue is generated working with investment firms and helping them identify viable opportunity areas.

-

Approximately 65% of our revenue is generated working with competitive intelligence & market intelligence teams of market participants (manufacturers, service providers, etc.).

-

The rest of the revenue is generated working with academic and research not-for-profit institutes. We do our bit of pro-bono by working with these institutions at subsidized rates.

Horizon Databook provides a detailed overview of country-level data and insights on the Luxemburg sustainable finance market , including forecasts for subscribers. This country databook contains high-level insights into Luxemburg sustainable finance market from 2017 to 2030, including revenue numbers, major trends, and company profiles.

Partial client list

Luxemburg sustainable finance market size, by asset class, 2017-2030 (US$B)

Luxemburg Sustainable Finance Market Outlook Share, 2023 & 2030 (US$B)

Related regional statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more