UK Squalene Market Size & Outlook, 2021-2030

Related Markets

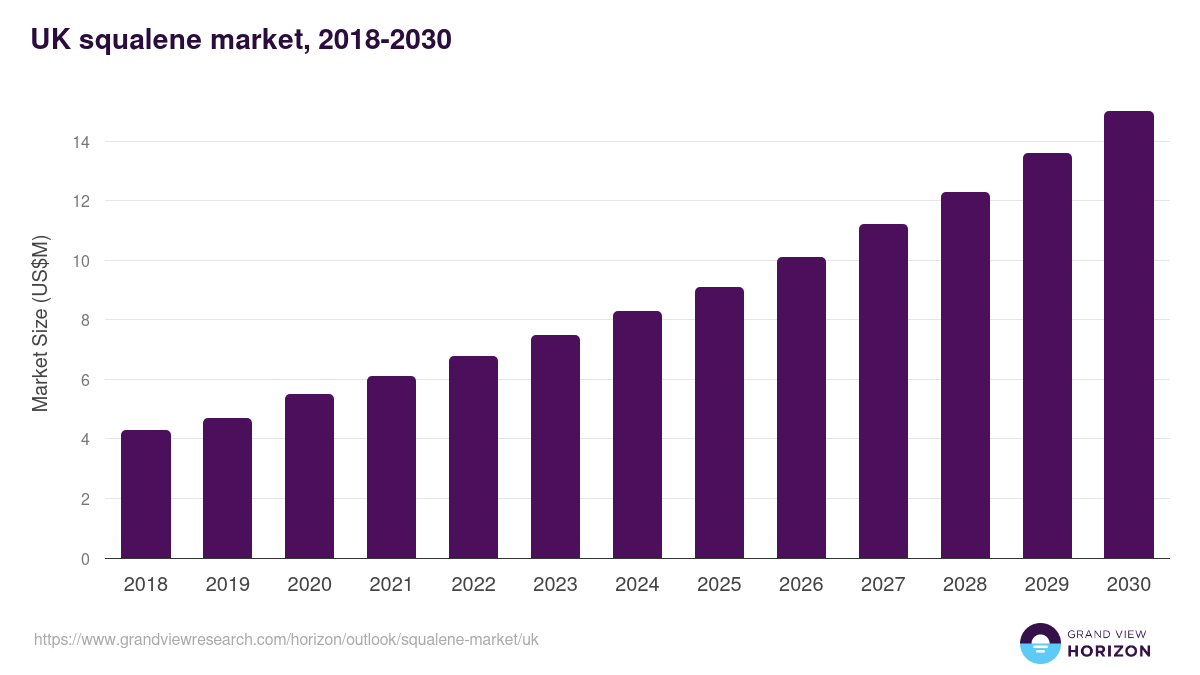

UK squalene market highlights

- The UK squalene market generated a revenue of USD 6.1 million in 2021 and is expected to reach USD 15.0 million by 2030.

- The UK market is expected to grow at a CAGR of 10.5% from 2022 to 2030.

- In terms of segment, plants was the largest revenue generating source in 2021.

- Synthetic is the most lucrative source segment registering the fastest growth during the forecast period.

Squalene market data book summary

| Market revenue in 2021 | USD 6.1 million |

| Market revenue in 2030 | USD 15.0 million |

| Growth rate | 10.5% (CAGR from 2022 to 2030) |

| Largest segment | Plants |

| Fastest growing segment | Synthetic |

| Historical data | 2018 - 2020 |

| Base year | 2021 |

| Forecast period | 2022 - 2030 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Animal, Plants, Synthetic |

| Key market players worldwide | Amyris, Sophim, Kuraray Co Ltd, Croda International PLC, Arbe Robotics Ltd |

Other key industry trends

- In terms of revenue, UK accounted for 5.0% of the global squalene market in 2021.

- Country-wise, U.S. is expected to lead the global market in terms of revenue in 2030.

- In Europe, Germany squalene market is projected to lead the regional market in terms of revenue in 2030.

- Portugal is the fastest growing regional market in Europe and is projected to reach USD 1.1 million by 2030.

Plants was the largest segment with a revenue share of 80.33% in 2021. Horizon Databook has segmented the UK squalene market based on animal, plants, synthetic covering the revenue growth of each sub-segment from 2018 to 2030.

In the UK plant-based squalene accounted for the largest market share of 78.24% in terms of volume in the year 2021. The rise in demand for plant-based squalene can be attributed to the initiatives undertaken by the country to conserve different species of sharks.

Among all plantbased squalene sources such as rice bran oil, olive oil, and amaranth oil, Olive oil is witnessing the highest demand in the UK for the manufacturing of squalene utilized in various end-use industries such as personal care products & cosmetics, nutraceuticals, and pharmaceuticals.

The UK is the largest consumer of olive oil in Europe. It witnessed olive oil imports of approximately 90,000 tons in 2020 owing to the surged demand for olive oil from consumers in the country. The demand for olive oil is also continuously rising in the country as it is used for manufacturing squalene.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Squalene Market Scope

Squalene Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|---|---|---|---|

| Arbe Robotics Ltd | View profile | 137 | 107 HaHashmonaim Street, Yafo, Tel Aviv, Israel | https://www.arberobotics.com |

| Sophim | View profile | 11-50 | Peyruis, Provence-Alpes-Cote d'Azur, France, Europe | http://www.sophim.com/ |

| Amyris | View profile | 1001-5000 | Emeryville, California, United States, North America | http://amyris.com |

| Croda International PLC | View profile | 5852 | Cowick Hall, Snaith, Goole, East Yorkshire, United Kingdom, DN14 9AA | https://www.croda.com |

| Kuraray Co Ltd | View profile | 13161 | Ote Center Building,1-1-3, Otemachi, Chiyoda-ku, Tokyo, Japan, 100-8115 | http://www.kuraray.co.jp |

UK squalene market size, by end use, 2018-2030 (US$M)

UK Squalene Market Outlook Share, 2021 & 2030 (US$M)

Related statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more