U.S. Pet Snacks And Treats Market Size & Outlook

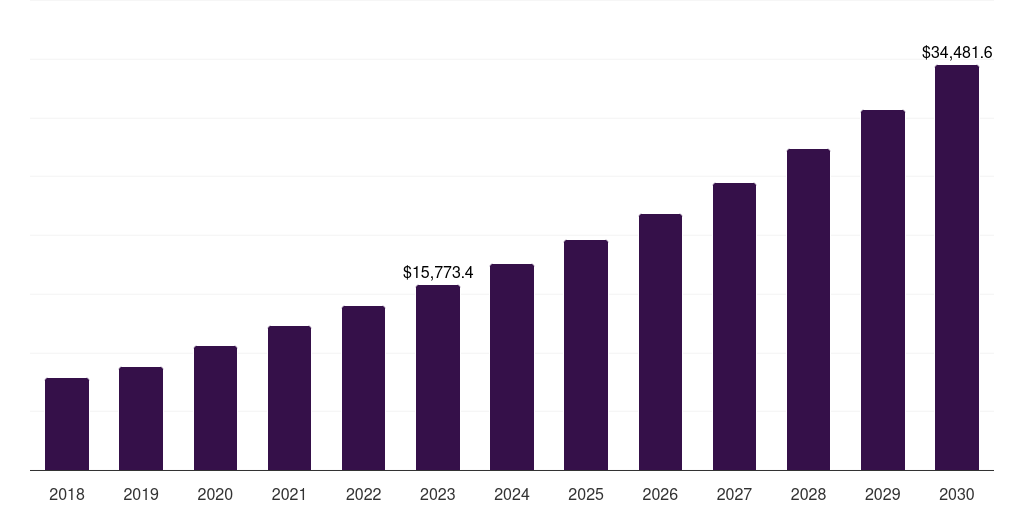

U.S. pet snacks and treats market, 2018-2030 (US$M)

Related Markets

U.S. pet snacks and treats market highlights

- The U.S. pet snacks and treats market generated a revenue of USD 15,773.4 million in 2023 and is expected to reach USD 34,481.6 million by 2030.

- The U.S. market is expected to grow at a CAGR of 11.8% from 2024 to 2030.

- In terms of segment, eatables was the largest revenue generating product in 2023.

- Chewables is the most lucrative product segment registering the fastest growth during the forecast period.

Pet snacks and treats market data book summary

| Market revenue in 2023 | USD 15,773.4 million |

| Market revenue in 2030 | USD 34,481.6 million |

| Growth rate | 11.8% (CAGR from 2023 to 2030) |

| Largest segment | Eatables |

| Fastest growing segment | Chewables |

| Historical data | 2018 - 2022 |

| Base year | 2023 |

| Forecast period | 2024 - 2030 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Eatables, Chewables |

| Key market players worldwide | Mars Group Holdings Corp, Nestle SA, JM Smucker Co, General Mills Inc, Colgate Palmolive, Nestle Purina Petcare, Spectrum Brands Holdings Inc, Wellness Pet Company, VAFO Group |

Other key industry trends

- In terms of revenue, U.S. accounted for 43.4% of the global pet snacks and treats market in 2023.

- Country-wise, U.S. is expected to lead the global market in terms of revenue in 2030.

- In North America, U.S. pet snacks and treats market is projected to lead the regional market in terms of revenue in 2030.

- Canada is the fastest growing regional market in North America and is projected to reach USD 4,421.7 million by 2030.

Eatables was the largest segment with a revenue share of 63.93% in 2023. Horizon Databook has segmented the U.S. pet snacks and treats market based on eatables, chewables covering the revenue growth of each sub-segment from 2018 to 2030.

Recent incidents involving contamination, excessive vitamin levels, and salmonella have heightened consumer concerns, further solidifying the demand for pet food and treats made from human-grade ingredients. This shift underscores the growing insistence of pet owners on the highest quality and safety standards for the nutritional choices they make for their pets.

In 2023, Worldwide, Inc., a leader in the pet industry, introduced Treaty, a new brand dedicated to pet treats and chews. The launch took place at Super Zoo 2023, where the company presented a diverse range of consumable pet treats and chews across nine distinct product lines.

This significant move followed Worldline's strategic acquisition of Pet Factory in 2022, providing the company with a top-tier U.S.-based treat manufacturing and distribution facility. With Treatly, Worldwise leveraged its expertise in solution-based pet products, offering pet owners innovative and high-quality treats aligning with the evolving preferences in the pet care landscape.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Pet Snacks And Treats Market Scope

Pet Snacks And Treats Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|

U.S. pet snacks and treats market size, by product, 2018-2030 (US$M)

U.S. Pet Snacks And Treats Market Outlook Share, 2023 & 2030 (US$M)

Related regional statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more