U.S. Newborn Screening Market Size & Outlook, 2023-2030

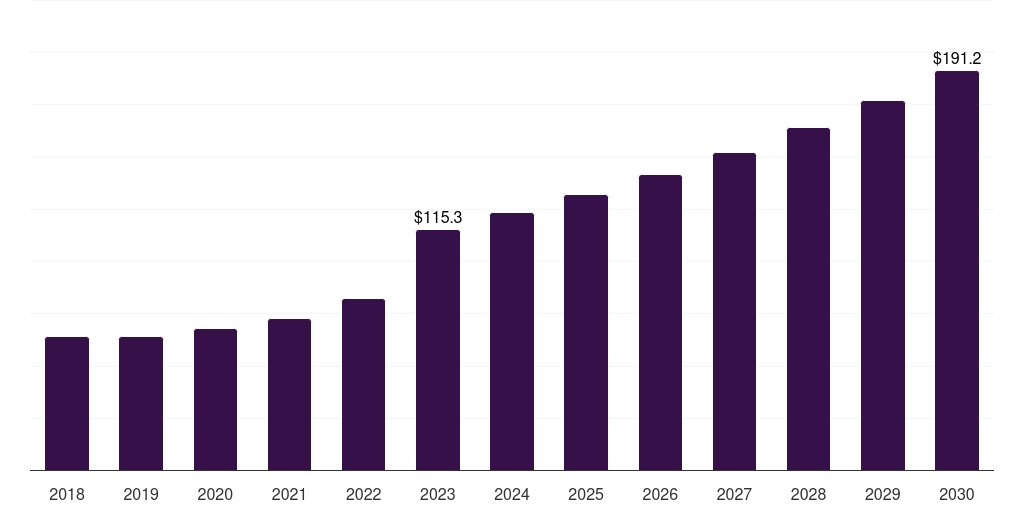

U.S. newborn screening market, 2018-2030 (US$M)

Related Markets

U.S. newborn screening market highlights

- The U.S. newborn screening market generated a revenue of USD 115.3 million in 2023 and is expected to reach USD 191.2 million by 2030.

- The U.S. market is expected to grow at a CAGR of 7.5% from 2024 to 2030.

- In terms of segment, tandem mass spectrometry was the largest revenue generating technology in 2023.

- Tandem Mass Spectrometry is the most lucrative technology segment registering the fastest growth during the forecast period.

Newborn screening market data book summary

| Market revenue in 2023 | USD 115.3 million |

| Market revenue in 2030 | USD 191.2 million |

| Growth rate | 7.5% (CAGR from 2023 to 2030) |

| Largest segment | Tandem mass spectrometry |

| Fastest growing segment | Tandem Mass Spectrometry |

| Historical data | 2018 - 2022 |

| Base year | 2023 |

| Forecast period | 2024 - 2030 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Tandem Mass Spectrometry, Pulse Oximetry, Enzyme-based Assay, DNA Assays, Electrophoresis |

| Key market players worldwide | Bio-Rad Laboratories Inc, Agilent Technologies, Agilent Technologies Inc, Covidien, Masimo Corp, Waters Corp, Natus Medical, GE HealthCare Technologies Inc Common Stock, PerkinElmer, Danaher Corp |

Other key industry trends

- In terms of revenue, U.S. accounted for 14.5% of the global newborn screening market in 2023.

- Country-wise, U.S. is expected to lead the global market in terms of revenue in 2030.

- In North America, U.S. newborn screening market is projected to lead the regional market in terms of revenue in 2030.

- Canada is the fastest growing regional market in North America and is projected to reach USD 28.0 million by 2030.

Tandem mass spectrometry was the largest segment with a revenue share of 24.54% in 2023. Horizon Databook has segmented the U.S. newborn screening market based on tandem mass spectrometry, pulse oximetry, enzyme-based assay, dna assays, electrophoresis covering the revenue growth of each sub-segment from 2018 to 2030.

Research in newborn screening technology is continuously carried on by the U.S. Developmental work on tandem mass spectrometry along with digital micro fluidics and nextgeneration sequencing for diagnosis of genetic dysfunctioning is the primary area of interest. Currently, the most frequently tested disorders are phenylketonuria and congenital hypothyroidism.

The National Birth Defects Prevention Network includes experts across the industry that work on volunteer basis to help maintain a national data and surveillance system for all the birth defect programs.

Their major focus lies on prevention of secondary disorders listed in the Recommended Uniform Screening Panel (RUSP). To raise awareness, health departments of the state have published free data and created websites that are expected to help parents to cope better with these conditions.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Newborn Screening Market Scope

Newborn Screening Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|

U.S. newborn screening market size, by technology, 2018-2030 (US$M)

U.S. Newborn Screening Market Outlook Share, 2023 & 2030 (US$M)

Related industry reports

Related regional statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more