Brazil Newborn Screening Market Size & Outlook, 2025-2033

Related Markets

Brazil newborn screening market highlights

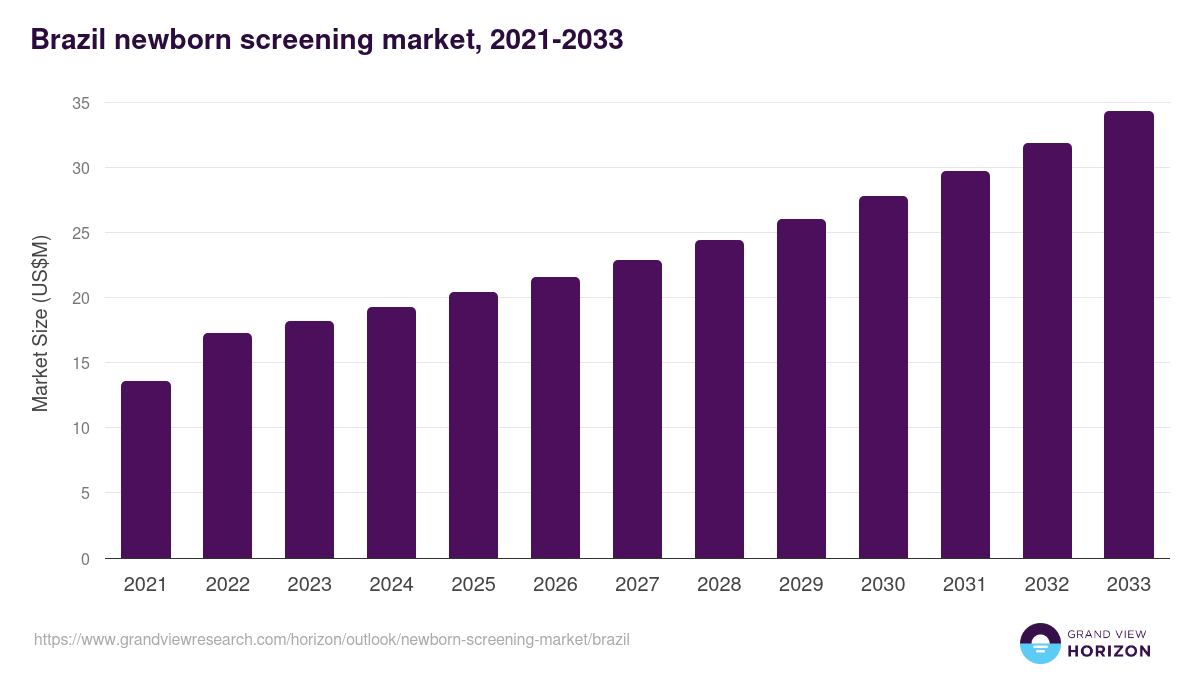

- The Brazil newborn screening market generated a revenue of USD 19.3 million in 2024 and is expected to reach USD 34.3 million by 2033.

- The Brazil market is expected to grow at a CAGR of 6.7% from 2025 to 2033.

- In terms of segment, tandem mass spectrometry was the largest revenue generating technology in 2024.

- Electrophoresis is the most lucrative technology segment registering the fastest growth during the forecast period.

Newborn screening market data book summary

| Market revenue in 2024 | USD 19.3 million |

| Market revenue in 2033 | USD 34.3 million |

| Growth rate | 6.7% (CAGR from 2025 to 2033) |

| Largest segment | Tandem mass spectrometry |

| Fastest growing segment | Electrophoresis |

| Historical data | 2021 - 2023 |

| Base year | 2024 |

| Forecast period | 2025 - 2033 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Tandem Mass Spectrometry, Pulse Oximetry, Enzyme-based Assay, DNA Assays, Electrophoresis |

| Key market players worldwide | Bio-Rad Laboratories Inc, Agilent Technologies, Agilent Technologies Inc, Covidien, Masimo Corp, Waters Corp, Natus Medical, GE HealthCare Technologies Inc Common Stock, PerkinElmer, Danaher Corp |

Other key industry trends

- In terms of revenue, Brazil accounted for 2.1% of the global newborn screening market in 2024.

- Country-wise, U.S. is expected to lead the global market in terms of revenue in 2033.

- In Latin America, Mexico newborn screening market is projected to lead the regional market in terms of revenue in 2033.

- Argentina is the fastest growing regional market in Latin America and is projected to reach USD 37.0 million by 2033.

Tandem mass spectrometry was the largest segment with a revenue share of 26.42% in 2024. Horizon Databook has segmented the Brazil newborn screening market based on tandem mass spectrometry, pulse oximetry, enzyme-based assay, dna assays, electrophoresis covering the revenue growth of each sub-segment from 2021 to 2033.

Federal law for the Newborn Screening National Program (NSNP) was implemented in 2001, making it mandatory for all hospitals and clinics. About 80% of population is covered and undergoes these tests. The conditions screened include phenylketonuria and congenital hypothyroidism. Ten of the 27 states of Brazil additionally test for sickle cell disease and hemoglobinopathies.

Brazil has over 237 screening centers for hearing loss, making it the largest in Latin America. These centers were established by the combined efforts of The Brazilian Society of Otalaryngology, The Brazilian Society of Speech Pathology, The Brazilian Society of Pediatrics, and other national level institutions.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Newborn Screening Market Scope

Newborn Screening Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|---|---|---|---|

| Covidien | View profile | 10001+ | Dublin, Dublin, Ireland, Europe | http://www.covidien.com |

| Natus Medical | View profile | 1001-5000 | San Carlos, California, United States, North America | http://www.natus.com |

| Agilent Technologies | View profile | 10001+ | Santa Clara, California, United States, North America | http://www.agilent.com |

| PerkinElmer | View profile | 10001+ | Waltham, Massachusetts, United States, North America | http://www.perkinelmer.com |

| Masimo Corp | View profile | 3796 | 52 Discovery, Irvine, CA, United States, 92618 | https://www.masimo.com |

| Waters Corp | View profile | 7900 | 34 Maple Street, Milford, MA, United States, 01757 | https://www.waters.com |

| Bio-Rad Laboratories Inc | View profile | 8030 | 1000 Alfred Nobel Drive, Hercules, CA, United States, 94547 | https://www.bio-rad.com |

| Agilent Technologies Inc | View profile | 17700 | 5301 Stevens Creek Boulevard, Santa Clara, CA, United States, 95051 | https://www.agilent.com |

| Danaher Corp | View profile | 63000 | 2200 Pennsylvania Avenue, N.W., Suite 800W, Washington, DC, United States, 20037-1701 | https://www.danaher.com |

| GE HealthCare Technologies Inc Common Stock | View profile | 51000 | 500 West Monroe Street, Chicago, IL, United States, 60661 | https://www.gehealthcare.com |

Brazil newborn screening market size, by technology, 2021-2033 (US$M)

Brazil Newborn Screening Market Outlook Share, 2024 & 2033 (US$M)

Related industry reports

Related statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more