China Laboratory Equipment Market Size & Outlook

Related Markets

China laboratory equipment market highlights

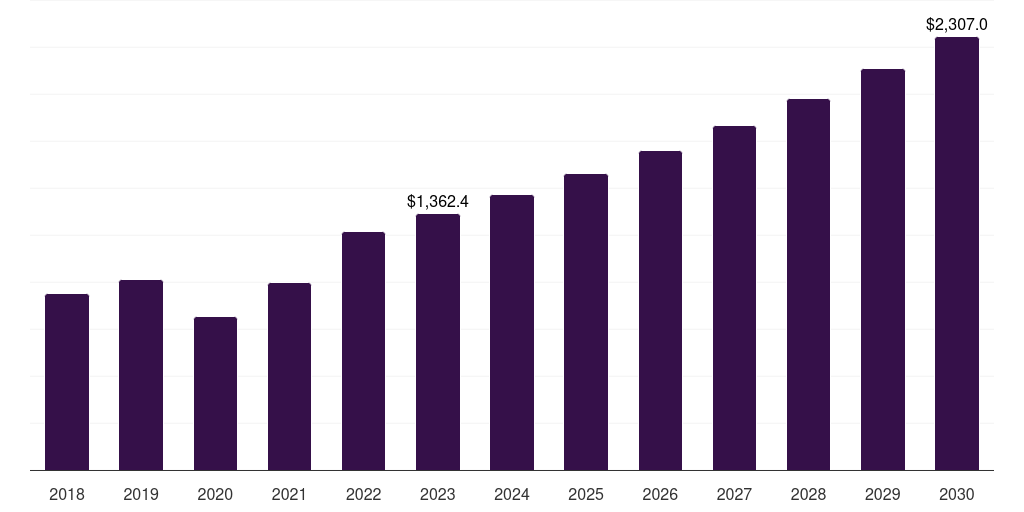

- The China laboratory equipment market generated a revenue of USD 1,362.4 million in 2023 and is expected to reach USD 2,307.0 million by 2030.

- The China market is expected to grow at a CAGR of 7.8% from 2024 to 2030.

- In terms of segment, general was the largest revenue generating product in 2023.

- Support is the most lucrative product segment registering the fastest growth during the forecast period.

Laboratory equipment market data book summary

| Market revenue in 2023 | USD 1,362.4 million |

| Market revenue in 2030 | USD 2,307.0 million |

| Growth rate | 7.8% (CAGR from 2023 to 2030) |

| Largest segment | General |

| Fastest growing segment | Support |

| Historical data | 2018 - 2022 |

| Base year | 2023 |

| Forecast period | 2024 - 2030 |

| Quantitative units | Revenue in USD million |

| Market segmentation | General, Analytical, Clinical, Support, Specialty |

| Key market players worldwide | Sartorius AG, Bio-Rad Laboratories Inc, FUJIFILM Holdings Corp, Thermo Fisher Scientific Inc, Agilent Technologies Inc |

Other key industry trends

- In terms of revenue, China accounted for 4.5% of the global laboratory equipment market in 2023.

- Country-wise, U.S. is expected to lead the global market in terms of revenue in 2030.

- In Asia Pacific, India laboratory equipment market is projected to lead the regional market in terms of revenue in 2030.

- China is the fastest growing regional market in Asia Pacific and is projected to reach USD 2,307.0 million by 2030.

General was the largest segment with a revenue share of 27.08% in 2023. Horizon Databook has segmented the China laboratory equipment market based on general, analytical, clinical, support, specialty covering the revenue growth of each sub-segment from 2018 to 2030.

According to an article published in Live Science, the Chinese government aims to build 5 to 7 high-containment labs in the country by 2025. In May 2020, Chengdu Institute of Biological Products Co, Ltd. obtained registration for 15 secondary biosafety laboratories. The development of new labs is anticipated to increase the demand for lab equipment, especially biosafety cabinets.

China is the forerunner in global COVID-19-related clinical trials. According to WHO data, as of July 2020, there were more than 820 COVID-19 clinical trials registered in the country. Moreover, nearly 40% of the global clinical trials related COVID-19 vaccine are being conducted in China.

The Chinese government is providing funds for trials and has also fast-tracked projects related to vaccine development. Such supportive government initiatives and the large number of clinical trials are anticipated to facilitate market growth, due to high laboratory work associated with trials and vaccine development.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Laboratory Equipment Market Scope

Laboratory Equipment Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|---|---|---|---|

| Bio-Rad Laboratories Inc | View profile | 8030 | 1000 Alfred Nobel Drive, Hercules, CA, United States, 94547 | https://www.bio-rad.com |

| Agilent Technologies Inc | View profile | 17700 | 5301 Stevens Creek Boulevard, Santa Clara, CA, United States, 95051 | https://www.agilent.com |

| Sartorius AG | View profile | 14338 | Otto-Brenner-Strasse 20, Gottingen, NI, Germany, 37079 | https://www.sartorius.com |

| Thermo Fisher Scientific Inc | View profile | 122000 | 168 Third Avenue, Waltham, MA, United States, 02451 | https://www.thermofisher.com |

| FUJIFILM Holdings Corp | View profile | 83784 | 7-3, Akasaka 9-chome, Minato-ku, Tokyo, Japan, 107-0052 | http://www.fujifilmholdings.com |

China laboratory equipment market size, by product, 2018-2030 (US$M)

China Laboratory Equipment Market Outlook Share, 2023 & 2030 (US$M)

Related statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more