Brazil In Vivo Cro Market Size & Outlook, 2024-2030

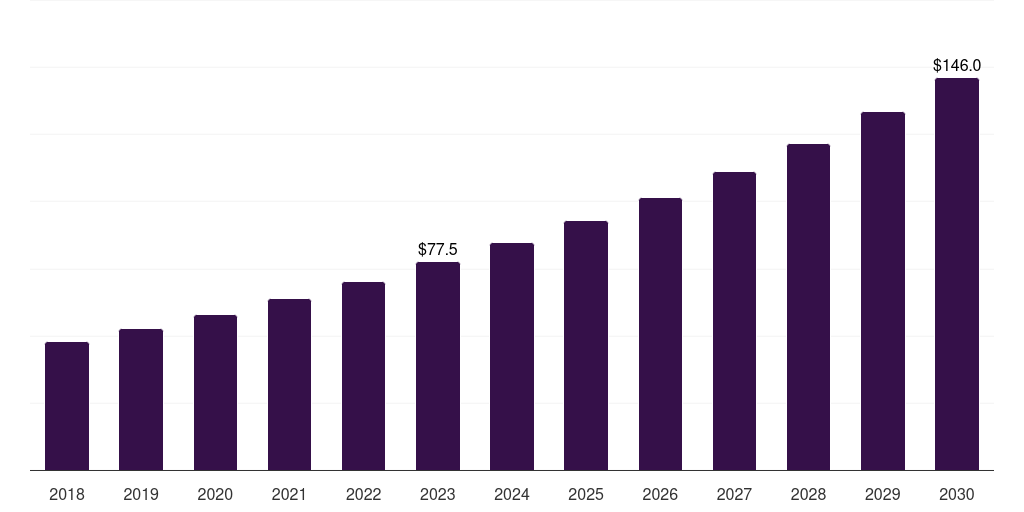

Brazil in vivo cro market, 2018-2030 (US$M)

Related Markets

Brazil in vivo cro market highlights

- The Brazil in vivo cro market generated a revenue of USD 77.5 million in 2023 and is expected to reach USD 146.0 million by 2030.

- The Brazil market is expected to grow at a CAGR of 9.5% from 2024 to 2030.

- In terms of segment, small molecule was the largest revenue generating modality type in 2023.

- Large Molecule is the most lucrative modality type segment registering the fastest growth during the forecast period.

In vivo cro market data book summary

| Market revenue in 2023 | USD 77.5 million |

| Market revenue in 2030 | USD 146.0 million |

| Growth rate | 9.5% (CAGR from 2023 to 2030) |

| Largest segment | Small molecule |

| Fastest growing segment | Large Molecule |

| Historical data | 2018 - 2022 |

| Base year | 2023 |

| Forecast period | 2024 - 2030 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Small Molecule, Large Molecule |

| Key market players worldwide | IQVIA Holdings Inc, JSR Corp, Taconic Biosciences, Evotec SE, Janvier Labs, Charles River Laboratories International Inc, Icon PLC, Labcorp Holdings Inc, PAREXEL, GemPharmatech, PsychoGenics, Biocytogen, SMO-Group |

Other key industry trends

- In terms of revenue, Brazil accounted for 1.7% of the global in vivo cro market in 2023.

- Country-wise, U.S. is expected to lead the global market in terms of revenue in 2030.

- In Latin America, Brazil in vivo cro market is projected to lead the regional market in terms of revenue in 2030.

- Brazil is the fastest growing regional market in Latin America and is projected to reach USD 146.0 million by 2030.

Small molecule was the largest segment with a revenue share of 63.61% in 2024. Horizon Databook has segmented the Brazil in vivo cro market based on small molecule, large molecule covering the revenue growth of each sub-segment from 2018 to 2030.

Local pharmaceutical and biotech companies do not have strong R&D capabilities in Brazil. The government is encouraging local pharmaceutical and biotech companies to collaborate with global companies to accelerate clinical trials in the country.

In addition, several regulatory reforms by the government to properly regulate clinical trials in the country and accelerate the approval process have attracted several international companies to invest in the country market.

For instance, in March 2015, the Brazilian regulatory agency, Agência Nacional de Vigilância Sanitária (ANVISA), introduced two resolutions that brought about changes to the submission process in Brazil. The resolutions RDC 09/2015 and RDC 10/2015 in Mexico established a procedure similar to the Investigational New Drug (IND) process used by the U.S. FDA for clinical trials involving drugs and devices, respectively.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

In Vivo CRO Market Scope

In Vivo CRO Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|

Brazil in vivo cro market size, by modality type, 2018-2030 (US$M)

Brazil In Vivo CRO Market Outlook Share, 2024 & 2030 (US$M)

Related industry reports

Related regional statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more