U.S. Hereditary Testing Market Size & Outlook, 2025-2033

Related Markets

U.S. hereditary testing market highlights

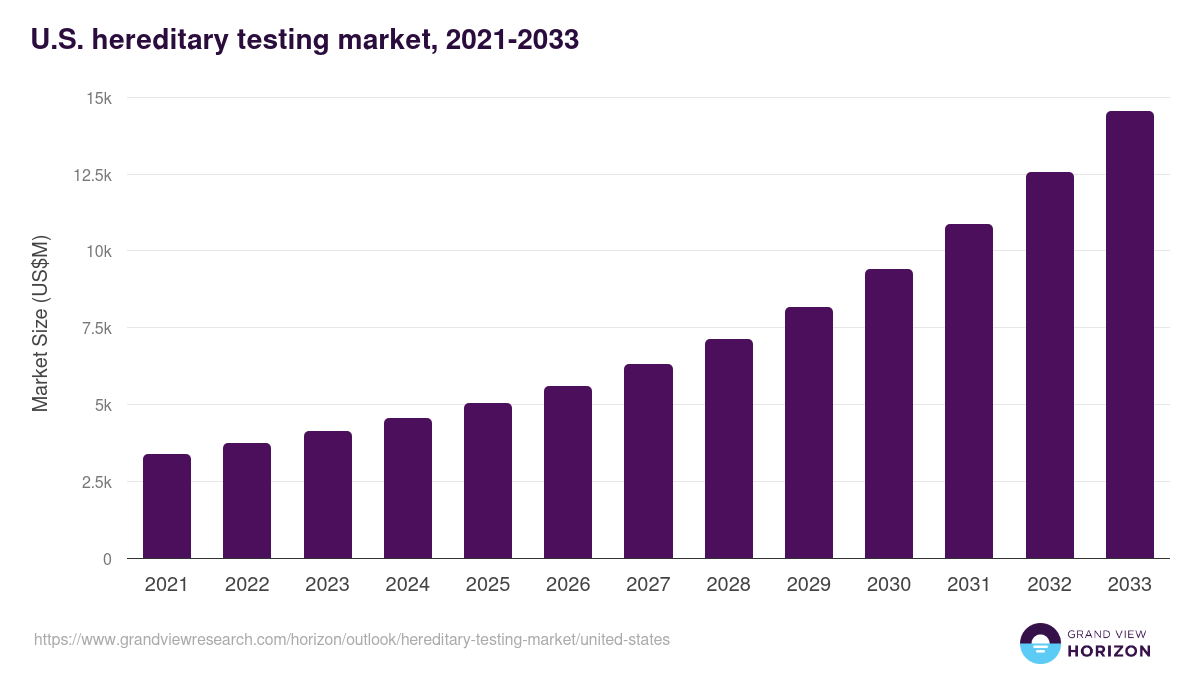

- The U.S. hereditary testing market generated a revenue of USD 4,553.1 million in 2024 and is expected to reach USD 14,545.3 million by 2033.

- The U.S. market is expected to grow at a CAGR of 14.2% from 2025 to 2033.

- In terms of segment, hereditary non-cancer testing was the largest revenue generating disease type in 2024.

- Hereditary Non-cancer Testing is the most lucrative disease type segment registering the fastest growth during the forecast period.

Hereditary testing market data book summary

| Market revenue in 2024 | USD 4,553.1 million |

| Market revenue in 2033 | USD 14,545.3 million |

| Growth rate | 14.2% (CAGR from 2025 to 2033) |

| Largest segment | Hereditary non-cancer testing |

| Fastest growing segment | Hereditary Non-cancer Testing |

| Historical data | 2021 - 2023 |

| Base year | 2024 |

| Forecast period | 2025 - 2033 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Hereditary Cancer Testing, Hereditary Non-cancer Testing |

| Key market players worldwide | Myriad Genetics Inc, Invitae Corp, Illumina Inc, Natera Inc, Labcorp Holdings Inc, Roche Holding AG ADR, Quest Diagnostics Inc, CooperSurgical, Agilent Technologies Inc, Thermo Fisher Scientific Inc, Twist Bioscience Corp, Sophia Genetics SA, Fulgent Genetics Inc, MedGenome, Centogene NV Ordinary Shares, The Cooper Companies Inc |

Other key industry trends

- In terms of revenue, U.S. accounted for 28.2% of the global hereditary testing market in 2024.

- Country-wise, U.S. is expected to lead the global market in terms of revenue in 2033.

- In North America, U.S. hereditary testing market is projected to lead the regional market in terms of revenue in 2033.

- Canada is the fastest growing regional market in North America and is projected to reach USD 2,896.1 million by 2033.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Hereditary Testing Market Scope

Hereditary Testing Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|---|---|---|---|

| MedGenome | View profile | 501-1000 | Bangalore, Karnataka, India, Asia | https://diagnostics.medgenome.com |

| Twist Bioscience Corp | View profile | 919 | 681 Gateway Boulevard, South San Francisco, CA, United States, 94080 | https://www.twistbioscience.com |

| Sophia Genetics SA | View profile | 449 | La Pièce 12, Rolle, Switzerland, CH-1180 | https://www.sophiagenetics.com |

| CooperSurgical | View profile | 501-1000 | Trumbull, Connecticut, United States, North America | http://www.coopersurgical.com |

| Fulgent Genetics Inc | View profile | 1012 | 4399 Santa Anita Avenue, El Monte, CA, United States, 91731 | https://www.fulgentgenetics.com |

| Centogene NV Ordinary Shares | View profile | 493 | Am Strande 7, Rostock, MV, Germany, 18055 | https://www.centogene.com |

| Labcorp Holdings Inc | View profile | 67000 | 358 South Main Street, Burlington, NC, United States, 27215 | https://www.labcorp.com |

| Invitae Corp | View profile | 1700 | 1400 16th Street, San Francisco, CA, United States, 94103 | https://www.invitae.com |

| The Cooper Companies Inc | View profile | 15000 | 6101 Bollinger Canyon Road, Suite 500, San Ramon, CA, United States, 94583 | https://www.coopercos.com |

| Natera Inc | View profile | 3293 | 13011 McCallen Pass, Building A Suite 100, Austin, TX, United States, 78753 | https://www.natera.com |

| Myriad Genetics Inc | View profile | 2700 | 320 Wakara Way, Salt Lake City, UT, United States, 84108 | https://www.myriad.com |

| Agilent Technologies Inc | View profile | 17700 | 5301 Stevens Creek Boulevard, Santa Clara, CA, United States, 95051 | https://www.agilent.com |

| Illumina Inc | View profile | 9300 | 5200 Illumina Way, San Diego, CA, United States, 92122 | https://www.illumina.com |

| Quest Diagnostics Inc | View profile | 48000 | 500 Plaza Drive, Secaucus, NJ, United States, 07094 | https://www.questdiagnostics.com |

| Thermo Fisher Scientific Inc | View profile | 122000 | 168 Third Avenue, Waltham, MA, United States, 02451 | https://www.thermofisher.com |

| Roche Holding AG ADR | View profile | 103605 | Grenzacherstrasse 124, Basel, Switzerland, 4070 | https://www.roche.com |

U.S. hereditary testing market outlook

The databook is designed to serve as a comprehensive guide to navigating this sector. The databook focuses on market statistics denoted in the form of revenue and y-o-y growth and CAGR across the globe and regions. A detailed competitive and opportunity analyses related to hereditary testing market will help companies and investors design strategic landscapes.

Hereditary non-cancer testing was the largest segment with a revenue share of 78.83% in 2024. Horizon Databook has segmented the U.S. hereditary testing market based on hereditary cancer testing, hereditary non-cancer testing covering the revenue growth of each sub-segment from 2021 to 2033.

The U.S. is the largest market for hereditary testing, owing to easy access to newborn screening in this country. Newborn screening is one of the most successful public health programs in the U.S. According to Centers for Disease Control and Prevention (CDC), more than 4 million infants are screened, and thousands are treated early for disability and death every year in the U.S.

The participation rate of the U.S. population in newborn screening is around 95%. Early detection & diagnosis of disorders in newborns significantly improves the chances of healthy development and positive outcomes. However, overall growth in newborn screening is expected to decrease in the U.S. as compared to other countries, due to declining birthrate.

In 2018, there were 3,788,235 births, which represents a 2% decline in birthrate from 2017. Moreover, total fertility rate declined to 1,728 births per 1,000 women over their lifetimes, which represented a 2% decline from 2017.

Reasons to subscribe to U.S. hereditary testing market databook:

-

Access to comprehensive data: Horizon Databook provides over 1 million market statistics and 20,000+ reports, offering extensive coverage across various industries and regions.

-

Informed decision making: Subscribers gain insights into market trends, customer preferences, and competitor strategies, empowering informed business decisions.

-

Cost-Effective solution: It's recognized as the world's most cost-effective market research database, offering high ROI through its vast repository of data and reports.

-

Customizable reports: Tailored reports and analytics allow companies to drill down into specific markets, demographics, or product segments, adapting to unique business needs.

-

Strategic advantage: By staying updated with the latest market intelligence, companies can stay ahead of competitors, anticipate industry shifts, and capitalize on emerging opportunities.

Target buyers of U.S. hereditary testing market databook

-

Our clientele includes a mix of hereditary testing market companies, investment firms, advisory firms & academic institutions.

-

30% of our revenue is generated working with investment firms and helping them identify viable opportunity areas.

-

Approximately 65% of our revenue is generated working with competitive intelligence & market intelligence teams of market participants (manufacturers, service providers, etc.).

-

The rest of the revenue is generated working with academic and research not-for-profit institutes. We do our bit of pro-bono by working with these institutions at subsidized rates.

Horizon Databook provides a detailed overview of country-level data and insights on the U.S. hereditary testing market, including forecasts for subscribers. This country databook contains high-level insights into U.S. hereditary testing market from 2021 to 2033, including revenue numbers, major trends, and company profiles.

Partial client list

U.S. hereditary testing market size, by disease type, 2021-2033 (US$M)

U.S. Hereditary Testing Market Share, 2024 & 2033 (US$M)

Related industry reports

Related statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more