U.S. Hair Wigs And Extensions Market Size & Outlook

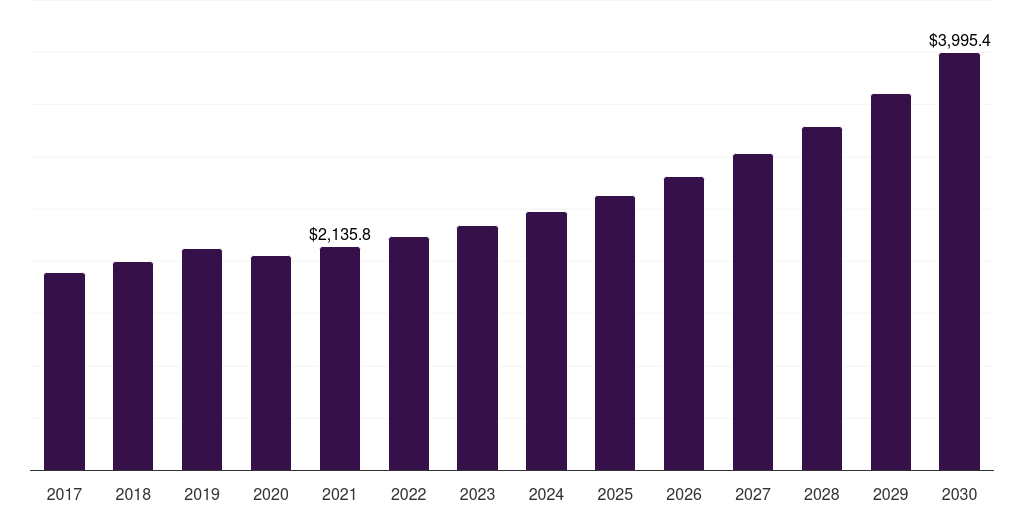

U.S. hair wigs and extensions market, 2017-2030 (US$M)

Related Markets

U.S. hair wigs and extensions market highlights

- The U.S. hair wigs and extensions market generated a revenue of USD 2,135.8 million in 2021 and is expected to reach USD 3,995.4 million by 2030.

- The U.S. market is expected to grow at a CAGR of 7.2% from 2022 to 2030.

- In terms of segment, wigs was the largest revenue generating product in 2021.

- Extensions is the most lucrative product segment registering the fastest growth during the forecast period.

Hair wigs and extensions market data book summary

| Market revenue in 2021 | USD 2,135.8 million |

| Market revenue in 2030 | USD 3,995.4 million |

| Growth rate | 7.2% (CAGR from 2021 to 2030) |

| Largest segment | Wigs |

| Fastest growing segment | Extensions |

| Historical data | 2017 - 2020 |

| Base year | 2021 |

| Forecast period | 2022 - 2030 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Wigs, Extensions |

| Key market players worldwide | Godrej, Evergreen Products Group Ltd ADR, Artnature, Dona Bela Shreds, Indique Hair, Shake-N-Go |

Other key industry trends

- In terms of revenue, U.S. accounted for 34.8% of the global hair wigs and extensions market in 2021.

- Country-wise, U.S. is expected to lead the global market in terms of revenue in 2030.

- In North America, U.S. hair wigs and extensions market is projected to lead the regional market in terms of revenue in 2030.

- Canada is the fastest growing regional market in North America and is projected to reach USD 266.6 million by 2030.

Wigs was the largest segment with a revenue share of 76.54% in 2021. Horizon Databook has segmented the U.S. hair wigs and extensions market based on wigs, extensions covering the revenue growth of each sub-segment from 2017 to 2030.

Wig manufacturers have expanded their product offerings to cater specifically to individuals with medical hair loss. This includes diverse styles, colors, and cap constructions to suit different needs and preferences. In September 2022, Nadula Hair, a manufacturer of natural and durable wig products, announced the launch of a new collection of wigs for autumn style.

The new collection of wigs is categorized based on hair texture, cap type, hair color, lace size, hair density, and hair type. The collection includes a range of colors, including burgundy wig, red wig, colored wigs, rose red highlight wig, and red-brown auburn wig.

Innovation in hair wigs, such as advanced materials, realistic designs, and improved comfort, has fueled the sales of hair wigs and extensions in the U.S. Consumers are attracted to the enhanced appearance and versatility, driving demand for these innovative products. UNice Hair, a manufacturer of high-quality and authentic designs, announced the launch of UNice Air Wigs in November 2022.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Hair Wigs And Extensions Market Scope

Hair Wigs And Extensions Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|

U.S. hair wigs and extensions market size, by product, 2017-2030 (US$M)

U.S. Hair Wigs And Extensions Market Outlook Share, 2021 & 2030 (US$M)

Related regional statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more