Middle East & Africa Factoring Services Market Size & Outlook

Related Markets

MEA factoring services market highlights

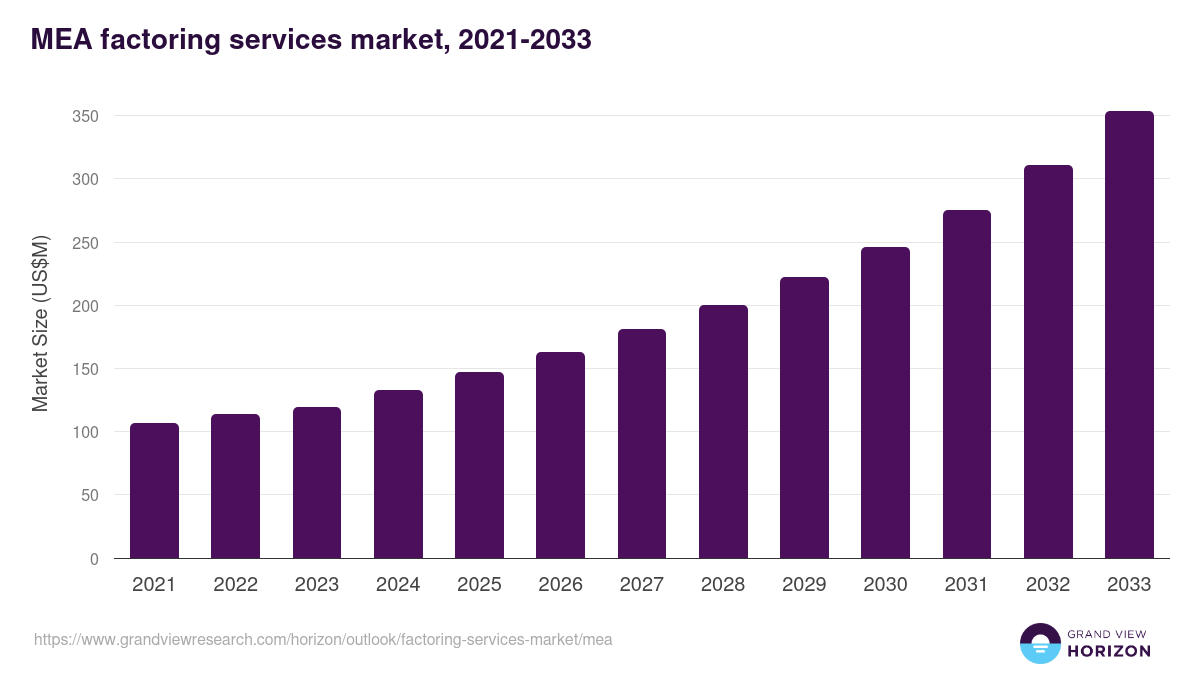

- The MEA factoring services market generated a revenue of USD 147.0 million in 2025.

- The market is expected to grow at a CAGR of 11.7% from 2026 to 2033.

- In terms of segment, manufacturing was the largest revenue generating end use in 2025.

- Healthcare is the most lucrative end use segment registering the fastest growth during the forecast period.

- Country-wise, UAE is expected to register the highest CAGR from 2026 to 2033.

MEA data book summary

| Market revenue in 2025 | USD 147.0 million |

| Market revenue in 2033 | USD 353.5 million |

| Growth rate | 11.7% (CAGR from 2026 to 2033) |

| Largest segment | Manufacturing |

| Fastest growing segment | Healthcare |

| Historical data covered | 2021 - 2024 |

| Base year for estimation | 2025 |

| Forecast period covered | 2026 - 2033 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Information Technology, Construction, Manufacturing, Transport & Logistics, Staffing, Healthcare, Others End Use |

| Key market players worldwide | Barclays PLC, BNP Paribas Act. Cat.A, China Construction Bank Corp Class H, Deutsche Bank AG, Eurobank Ergasias Services And Holdings SA, Hitachi Ltd, HSBC Holdings PLC ADR, Industrial And Commercial Bank Of China Ltd Class H, Kuke Music Holding Ltd ADR, Mizuho Financial Group Inc, Societe Generale SA, Transcontinental Realty Investors Inc |

Other key industry trends

- In terms of revenue, MEA region accounted for 3.0% of the global factoring services market in 2025.

- Globally, Europe is projected to lead the regional market in terms of revenue in 2033.

- Asia Pacific is the fastest growing regional market and is projected to reach USD 3,587.4 million by 2033.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Factoring Services Market Scope

Factoring Services Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|---|---|---|---|

| Transcontinental Realty Investors Inc | View profile | - | 1603 Lyndon B Johnson Freeway, Suite 800, Dallas, TX, United States, 75234 | http://www.transconrealty-invest.com |

| Kuke Music Holding Ltd ADR | View profile | 108 | 4 San Jian Fang South Block, Building 96, Chaoyang District, Beijing, China, People's Republic of, 100024 | https://www.kuke.com |

| Industrial And Commercial Bank Of China Ltd Class H | View profile | 419252 | 3 Garden Road, 33rd Floor, ICBC Tower, Central, Hong Kong, Hong Kong | https://www.icbc-ltd.com |

| Eurobank Ergasias Services And Holdings SA | View profile | 10749 | 8 Othonos Street, Athens, Greece, 105 57 | https://www.eurobankholdings.gr |

| China Construction Bank Corp Class H | View profile | 376871 | No. 25, Finance Street, Xicheng District, Beijing, China, People's Republic of, 100033 | http://www.ccb.com |

| Barclays PLC | View profile | 92400 | 1 Churchill Place, London, United Kingdom, E14 5HP | https://www.barclays.com |

| HSBC Holdings PLC ADR | View profile | 221000 | 8 Canada Square, London, United Kingdom, E14 5HQ | https://www.hsbc.com |

| Societe Generale SA | View profile | 126000 | 29, Boulevard Haussmann, Paris, France, 75009 | https://www.societegenerale.com |

| Mizuho Financial Group Inc | View profile | 64402 | 1-5-5, Otemachi, Otemachi Tower, Chiyoda-ku, Tokyo, Japan, 100-8176 | https://www.mizuho-fg.co.jp |

| BNP Paribas Act. Cat.A | View profile | 182656 | 16, Boulevard Des Italiens, Paris, France, 75009 | https://group.bnpparibas |

| Deutsche Bank AG | View profile | 90130 | Taunusanlage 12, Frankfurt am Main, HE, Germany, 60325 | https://www.db.com |

| Hitachi Ltd | View profile | 322525 | 6-6, Marunouchi 1-chome, Chiyoda-ku, Tokyo, Japan, 100-8280 | http://www.hitachi.com |

Middle East & Africa factoring services market outlook

The databook is designed to serve as a comprehensive guide to navigating this sector. The databook focuses on market statistics denoted in the form of revenue and y-o-y growth and CAGR across the globe and regions. A detailed competitive and opportunity analyses related to factoring services market will help companies and investors design strategic landscapes.

Manufacturing was the largest segment with a revenue share of 31.9% in 2025. Horizon Databook has segmented the Middle East & Africa factoring services market based on information technology, construction, manufacturing, transport & logistics, staffing, healthcare, others end use covering the revenue growth of each sub-segment from 2021 to 2033.

The growing emphasis on digital transformation has led to the adoption of technology-driven platforms that simplify the factoring process, making it more accessible to a broader range of businesses.

Regulatory reforms aimed at enhancing transparency and encouraging investment in the financial sector further bolster the factoring landscape. At the same countries in MEA such as Saudi Arabia is experiencing notable growth, fueled by the Vision 2030 initiative, which seeks to diversify the economy and bolster small and medium-sized enterprises (SMEs).

This heightened emphasis on alternative financing options has resulted in increased demand for factoring, as businesses aim to enhance cash flow and effectively manage their receivables.

Reasons to subscribe to Middle East & Africa factoring services market databook:

-

Access to comprehensive data: Horizon Databook provides over 1 million market statistics and 20,000+ reports, offering extensive coverage across various industries and regions.

-

Informed decision making: Subscribers gain insights into market trends, customer preferences, and competitor strategies, empowering informed business decisions.

-

Cost-Effective solution: It's recognized as the world's most cost-effective market research database, offering high ROI through its vast repository of data and reports.

-

Customizable reports: Tailored reports and analytics allow companies to drill down into specific markets, demographics, or product segments, adapting to unique business needs.

-

Strategic advantage: By staying updated with the latest market intelligence, companies can stay ahead of competitors, anticipate industry shifts, and capitalize on emerging opportunities.

Target buyers of Middle East & Africa factoring services market databook

-

Our clientele includes a mix of factoring services market companies, investment firms, advisory firms & academic institutions.

-

30% of our revenue is generated working with investment firms and helping them identify viable opportunity areas.

-

Approximately 65% of our revenue is generated working with competitive intelligence & market intelligence teams of market participants (manufacturers, service providers, etc.).

-

The rest of the revenue is generated working with academic and research not-for-profit institutes. We do our bit of pro-bono by working with these institutions at subsidized rates.

Horizon Databook provides a detailed overview of continent-level data and insights on the Middle East & Africa factoring services market , including forecasts for subscribers. This continent databook contains high-level insights into Middle East & Africa factoring services market from 2021 to 2033, including revenue numbers, major trends, and company profiles.

Partial client list

MEA factoring services market size, by country, 2021-2033 (US$M)

Middle East & Africa Factoring Services Market Outlook Share, 2025 & 2033 (US$M)

Related industry reports

Related statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more