China Denim Market Size & Outlook, 2022-2030

Related Markets

China denim market highlights

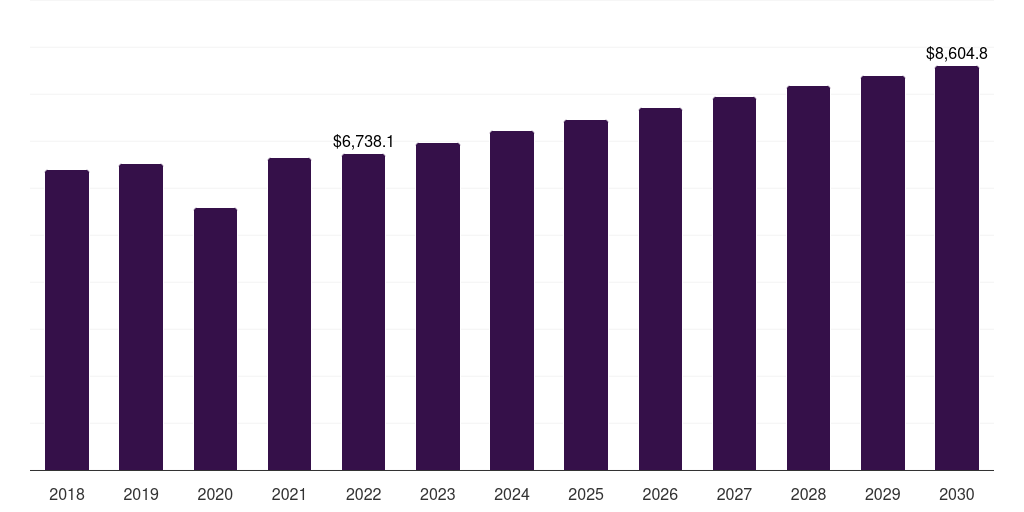

- The China denim market generated a revenue of USD 6,738.1 million in 2022 and is expected to reach USD 8,604.8 million by 2030.

- The China market is expected to grow at a CAGR of 3.1% from 2023 to 2030.

- In terms of segment, mass was the largest revenue generating category in 2022.

- Luxury is the most lucrative category segment registering the fastest growth during the forecast period.

Denim market data book summary

| Market revenue in 2022 | USD 6,738.1 million |

| Market revenue in 2030 | USD 8,604.8 million |

| Growth rate | 3.1% (CAGR from 2023 to 2030) |

| Largest segment | Mass |

| Fastest growing segment | Luxury |

| Historical data | 2018 - 2021 |

| Base year | 2022 |

| Forecast period | 2023 - 2030 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Mass, Premium, Luxury |

Other key industry trends

- In terms of revenue, China accounted for 30.4% of the global denim market in 2022.

- Country-wise, China is expected to lead the global market in terms of revenue in 2030.

- In Asia Pacific, China denim market is projected to lead the regional market in terms of revenue in 2030.

- India is the fastest growing regional market in Asia Pacific and is projected to reach USD 3,422.0 million by 2030.

Mass was the largest segment with a revenue share of 65.52% in 2022. Horizon Databook has segmented the China denim market based on mass, premium, luxury covering the revenue growth of each sub-segment from 2018 to 2030.

China is a leading producer of denim. Most of China's denim production is concentrated in the Guangdong province, which is home to several major denim mills. In recent years, China's denim industry has undergone a number of changes. The industry has become more focused on high-end denim production, and there is a growing demand for sustainable denim.

However, China's denim market growth could be hampered in the short term as China's jeans imports into the U.S. have been modest, registering a mere 6.12 percent increase in September 2022, significantly lower than the growth rate recorded in September 2021.

This slowdown in growth can be attributed to two main factors ongoing tariff costs resulting from trade tensions between the U.S. and China and the adoption of diversification strategies by companies seeking alternative sources for their jeans supply.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Denim Market Scope

Denim Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|---|---|---|---|

| KG Denim | View profile | 1001-5000 | Coimbatore, Tamil Nadu, India, Asia | https://www.kgdenim.com |

| Grupo Santana Textiles | View profile | 1001-5000 | Horizonte, Ceara, Brazil, South America | http://www.santanatextiles.com/ |

| Vicunha | View profile | 5001-10000 | Pinheiros, Sao Paulo, Brazil, South America | https://www.vicunha.com/ |

| Naveena Group | View profile | 1001-5000 | Karachi, Sindh, Pakistan, Asia | http://naveenagroup.com |

| Cone Mills | View profile | 1-10 | Greensboro, North Carolina, United States, North America | https://www.conedenim.com |

| Prosperity Textile | View profile | 1001-5000 | Guangzhou, Guangdong, China, Asia | https://www.prosperity-textile.com/ |

| Arvind | View profile | 10001+ | Ahmedabad, Gujarat, India, Asia | http://arvind.com |

| ISKO | View profile | 251-500 | Bursa, Bursa, Turkey, Europe | https://iskodenim.com |

| Raymond | View profile | 501-1000 | Mumbai, Maharashtra, India, Asia | http://www.raymondindia.com |

China denim market size, by category, 2018-2030 (US$M)

China Denim Market Outlook Share, 2022 & 2030 (US$M)

Related statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more