U.S. Dairy Alternatives Market Size & Outlook, 2025-2030

Related Markets

U.S. dairy alternatives market highlights

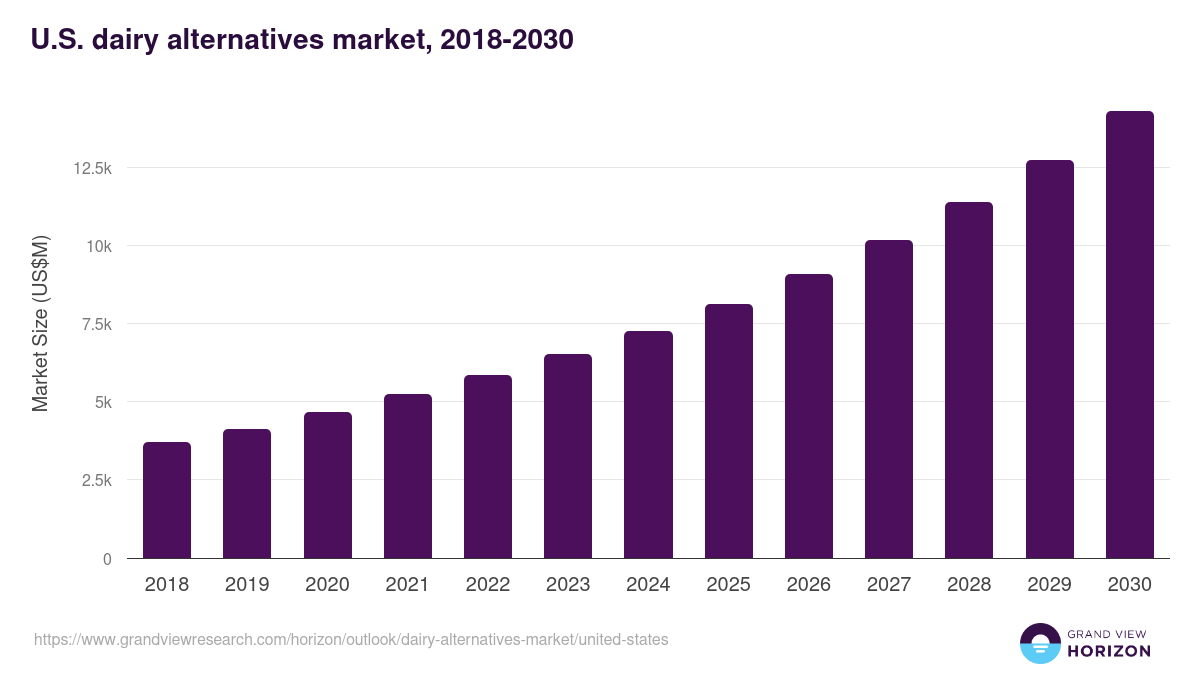

- The U.S. dairy alternatives market generated a revenue of USD 5,841.6 million in 2022 and is expected to reach USD 14,280.5 million by 2030.

- The U.S. market is expected to grow at a CAGR of 11.8% from 2023 to 2030.

- In terms of segment, almond was the largest revenue generating source in 2022.

- Almond is the most lucrative source segment registering the fastest growth during the forecast period.

Dairy alternatives market data book summary

| Market revenue in 2022 | USD 5,841.6 million |

| Market revenue in 2030 | USD 14,280.5 million |

| Growth rate | 11.8% (CAGR from 2022 to 2030) |

| Largest segment | Almond |

| Fastest growing segment | Almond |

| Historical data | 2017 - 2021 |

| Base year | 2022 |

| Forecast period | 2023 - 2030 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Soy, Almond, Coconut, Rice, Oats |

| Key market players worldwide | Archer-Daniels Midland Co, Danone SA, The Hain Celestial Group Inc, Otsuka Pharmaceutical, SunOpta Inc, Oatly Group AB ADR, Blue Diamond Growers, CP Kelco, Vitasoy International Holdings Ltd, Eden Foods, Earth's Own, Freedom Foods Group, Organic Valley, Living Harvest Foods |

Other key industry trends

- In terms of revenue, U.S. accounted for 22.5% of the global dairy alternatives market in 2022.

- Country-wise, U.S. is expected to lead the global market in terms of revenue in 2030.

- In North America, U.S. dairy alternatives market is projected to lead the regional market in terms of revenue in 2030.

- Mexico is the fastest growing regional market in North America and is projected to reach USD 1,246.7 million by 2030.

Almond was the largest segment with a revenue share of 41.2% in 2024. Horizon Databook has segmented the U.S. dairy alternatives market based on soy, almond, coconut, rice, oats covering the revenue growth of each sub-segment from 2018 to 2030.

The Dairy Farmers of America, which represents more than 30% of the milk producers in the United States revealed that drop in milk sales resulted in $1.45 decrease in the average milk price on account of the rise of soy, oat, nut and other milk alternatives at grocery stores, coffee shops, and others across the country.

According to the United States National Library of Medicine, more than 65% of the people are less able or unable to digest lactose after infancy and the percentage is much higher in few ethnic and racial groups which are anticipated to surge the demand for plant-based milks over the coming years.

The U.S. is one of the key markets for dairy alternatives and is expected to grow at a significant rate owing to rising demand for healthy food and beverages among millennials coupled with the shift in preference toward organic foods and naturally-derived ingredients.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Dairy Alternatives Market Scope

Dairy Alternatives Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|---|---|---|---|

| Living Harvest Foods | View profile | 251-500 | Portland, Oregon, United States, North America | http://www.worldpantry.com |

| Earth's Own | View profile | 251-500 | Vancouver, British Columbia, Canada, North America | https://earthsown.com/ |

| Organic Valley | View profile | 501-1000 | La Farge, Wisconsin, United States, North America | https://www.organicvalley.coop |

| Eden Foods | View profile | 51-100 | Clinton, Michigan, United States, North America | http://www.edenfoods.com |

| Freedom Foods Group | View profile | 501-1000 | Taren Point, New South Wales, Australia, Oceania | https://ffgl.com.au/ |

| Blue Diamond Growers | View profile | 1001-5000 | Sacramento, California, United States, North America | https://bluediamondgrowers.com/ |

| Oatly Group AB ADR | View profile | 1493 | Ångfärjekajen 8, Malmo, Sweden, 211 19 | https://www.oatly.com |

| CP Kelco | View profile | 1001-5000 | Atlanta, Georgia, United States, North America | https://www.cpkelco.com |

| Otsuka Pharmaceutical | View profile | 251-500 | Tokyo, Tokyo, Japan, Asia | https://www.otsuka.co.jp/en/ |

| Archer-Daniels Midland Co | View profile | 41802 | 77 West Wacker Drive, Suite 4600, Chicago, IL, United States, 60601 | https://www.adm.com |

| Vitasoy International Holdings Ltd | View profile | 6534 | Number 1 Kin Wong Street, Tuen Mun, New Territories, Hong Kong, Hong Kong, | https://www.vitasoy.com |

| The Hain Celestial Group Inc | View profile | 2837 | 4600 Sleepytime Drive, Co, Boulder, DE, United States, 80301 | https://www.hain.com |

| SunOpta Inc | View profile | 1174 | 7078 Shady Oak Road, Eden Prairie, MN, United States, 55344 | https://www.sunopta.com |

| Danone SA | View profile | 88843 | 17, Boulevard Haussmann, Paris, France, 75009 | https://www.danone.com |

U.S. dairy alternatives market size, by source, 2018-2030 (US$M)

U.S. Dairy Alternatives Market Outlook Share, 2024 & 2030 (US$M)

Related statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more