South Africa Dairy Alternatives Market Size & Outlook

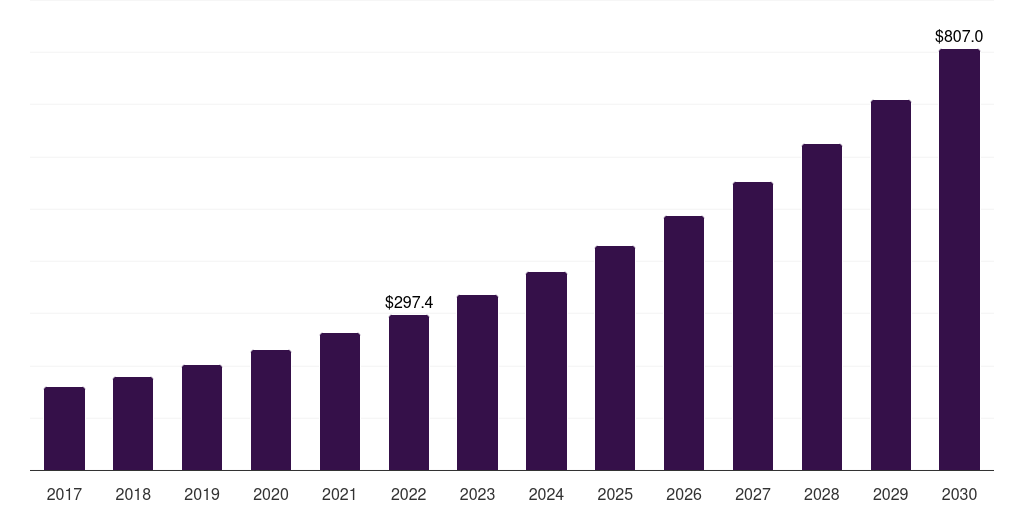

South Africa dairy alternatives market, 2017-2030 (US$M)

Related Markets

South Africa dairy alternatives market highlights

- The South Africa dairy alternatives market generated a revenue of USD 297.4 million in 2022 and is expected to reach USD 807.0 million by 2030.

- The South Africa market is expected to grow at a CAGR of 13.3% from 2023 to 2030.

- In terms of segment, soy was the largest revenue generating source in 2022.

- Almond is the most lucrative source segment registering the fastest growth during the forecast period.

Dairy alternatives market data book summary

| Market revenue in 2022 | USD 297.4 million |

| Market revenue in 2030 | USD 807.0 million |

| Growth rate | 13.3% (CAGR from 2022 to 2030) |

| Largest segment | Soy |

| Fastest growing segment | Almond |

| Historical data | 2017 - 2021 |

| Base year | 2022 |

| Forecast period | 2023 - 2030 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Soy, Almond, Coconut, Rice, Oats |

| Key market players worldwide | Archer-Daniels Midland Co, Danone SA, The Hain Celestial Group Inc, Otsuka Pharmaceutical, SunOpta Inc, Oatly Group AB ADR, Blue Diamond Growers, CP Kelco, Vitasoy International Holdings Ltd, Eden Foods, Earth's Own, Freedom Foods Group, Organic Valley, Living Harvest Foods |

Other key industry trends

- In terms of revenue, South Africa accounted for 1.1% of the global dairy alternatives market in 2022.

- Country-wise, U.S. is expected to lead the global market in terms of revenue in 2030.

- In Middle East & Africa, South Africa dairy alternatives market is projected to lead the regional market in terms of revenue in 2030.

- South Africa is the fastest growing regional market in Middle East & Africa and is projected to reach USD 807.0 million by 2030.

Soy was the largest segment with a revenue share of 38.63% in 2022. Horizon Databook has segmented the South Africa dairy alternatives market based on soy, almond, coconut, rice, oats covering the revenue growth of each sub-segment from 2017 to 2030.

South Africa is expected to be a potential market for the dairy alternatives owing to the rising consumer demand for plant based food and beverages. Rising consumer awareness towards health in the region has resulted in the demand for low calorie milk products, which is likely to open new avenues for the soymilk, almond milk and other dairy alternative products over the next eight years.

The market is expected to grow at a significant rate owing to increasing consumer awareness regarding the nutritional benefits offered by these products than their dairy counterparts. Dairy alternatives are lactose free products and are highly preferred by customers with lactose intolerance problems.

Ability of soymilk to replace cow milk in household and commercial applications to produce various food products, snacks and beverages is expected to drive the industry growth over the forecast period. About 80% of the South African consumers suffer from lactose intolerance.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Dairy Alternatives Market Scope

Dairy Alternatives Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|

South Africa dairy alternatives market size, by source, 2017-2030 (US$M)

South Africa Dairy Alternatives Market Outlook Share, 2022 & 2030 (US$M)

Related regional statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more