UK Cycling Wear Market Size & Outlook, 2022-2030

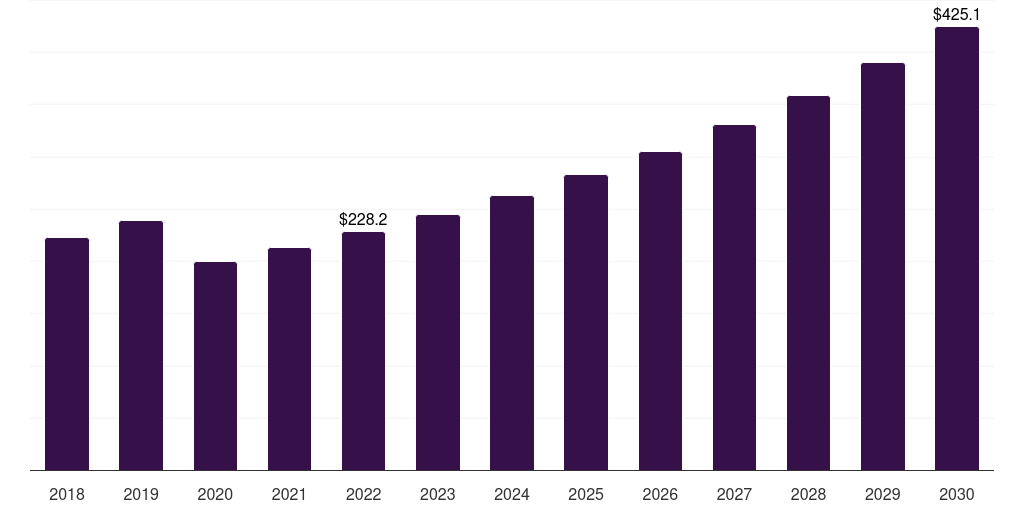

UK cycling wear market, 2018-2030 (US$M)

Related Markets

UK cycling wear market highlights

- The UK cycling wear market generated a revenue of USD 228.2 million in 2022 and is expected to reach USD 425.2 million by 2030.

- The UK market is expected to grow at a CAGR of 8.1% from 2023 to 2030.

- In terms of segment, cycle wear apparel was the largest revenue generating product in 2022.

- Cycle wear accessories is the most lucrative product segment registering the fastest growth during the forecast period.

Cycling wear market data book summary

| Market revenue in 2022 | USD 228.2 million |

| Market revenue in 2030 | USD 425.2 million |

| Growth rate | 8.1% (CAGR from 2022 to 2030) |

| Largest segment | Cycle wear apparel |

| Fastest growing segment | Cycle wear accessories |

| Historical data | 2018 - 2021 |

| Base year | 2022 |

| Forecast period | 2023 - 2030 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Cycle wear apparel, Cycle wear accessories, Cycle wear shoes |

| Key market players worldwide | Lumiere, Giro Sport, Castelli Cycling, Rapha, Champion System, United Apparel, ASSOS of Switzerland, Endura, Isadore, 2XU |

Other key industry trends

- In terms of revenue, UK accounted for 3.7% of the global cycling wear market in 2022.

- Country-wise, U.S. is expected to lead the global market in terms of revenue in 2030.

- In Europe, Germany cycling wear market is projected to lead the regional market in terms of revenue in 2030.

- UK is the fastest growing regional market in Europe and is projected to reach USD 425.2 million by 2030.

Cycle wear apparel was the largest segment with a revenue share of 59.29% in 2022. Horizon Databook has segmented the UK cycling wear market based on cycle wear apparel, cycle wear accessories, cycle wear shoes covering the revenue growth of each sub-segment from 2018 to 2030.

Cycling is one of the most popular forms of exercise across the U.K as adults enjoy cycling than running, playing football and strength training. Average monthly online search volumes for mountain bikes were six times higher during the coronavirus lockdown (May 2020 compared with May 2019).

Cycling is most popular among those aged 45–54 as 17.3% of people in this age group said cycling was one of their preferred forms of exercise, according to a tredz survey conducted in the year 2021 in U.K. Mountain bikes are the most popular style of bikes, receiving a whopping 2.4 million online searches a year. Giant Bikes is the U.K.’s most popular bike brand in terms of average monthly searches over the past year, being searched for approximately 43,400 times a month.

This was followed extremely closely by Trek bikes, which was searched for an average of 43,300 times a month. Cube, Raleigh, and Specialized made the top 5 most searched-for bike brands. This growing inclination toward mountain or trail biking has created a significant opportunity for the cycling wear market in the U.K.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Cycling Wear Market Scope

Cycling Wear Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|

UK cycling wear market size, by product, 2018-2030 (US$M)

UK Cycling Wear Market Outlook Share, 2022 & 2030 (US$M)

Related regional statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more