Middle East & Africa Cycling Wear Market Size & Outlook

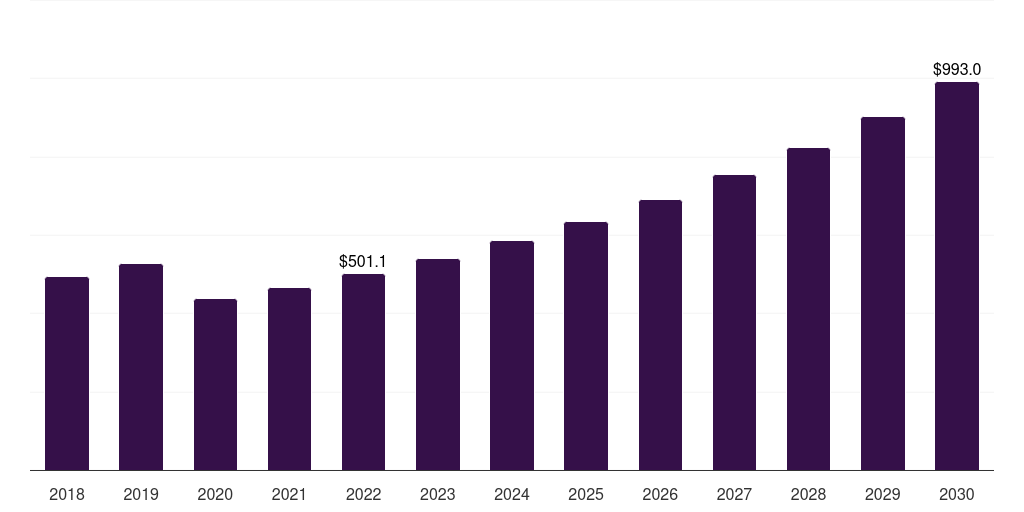

Middle East & Africa cycling wear market, 2018-2030 (US$M)

Related Markets

MEA cycling wear market highlights

- The MEA cycling wear market generated a revenue of USD 501.1 million in 2022.

- The market is expected to grow at a CAGR of 8.9% from 2023 to 2030.

- In terms of segment, cycle wear apparel was the largest revenue generating product in 2022.

- Cycle wear accessories is the most lucrative product segment registering the fastest growth during the forecast period.

- Country-wise, Saudi Arabia is expected to register the highest CAGR from 2023 to 2030.

MEA data book summary

| Market revenue in 2022 | USD 501.1 million |

| Market revenue in 2030 | USD 993.0 million |

| Growth rate | 8.9% (CAGR from 2022 to 2030) |

| Largest segment | Cycle wear apparel |

| Fastest growing segment | Cycle wear accessories |

| Historical data covered | 2018 - 2021 |

| Base year for estimation | 2022 |

| Forecast period covered | 2023 - 2030 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Cycle wear apparel, Cycle wear accessories, Cycle wear shoes |

| Key market players worldwide | Lumiere, Giro Sport, Castelli Cycling, Rapha, Champion System, United Apparel, ASSOS of Switzerland, Endura, Isadore, 2XU |

Other key industry trends

- In terms of revenue, MEA region accounted for 8.2% of the global cycling wear market in 2022.

- Globally, Europe is projected to lead the regional market in terms of revenue in 2030.

- Asia Pacific is the fastest growing regional market and is projected to reach USD 3,101.8 million by 2030.

Cycle wear apparel was the largest segment with a revenue share of 58.91% in 2022. Horizon Databook has segmented the Middle East & Africa cycling wear market based on cycle wear apparel, cycle wear accessories, cycle wear shoes covering the revenue growth of each sub-segment from 2018 to 2030.

Although older Arabs often consider cycling to be a form of transport only for the poor, an increasing number of younger Arabs have come to realize the environmental and health benefits of cycling, as well as its potential as an easier and more convenient mode of commuting. From Morocco to Syria, there have been group set-ups that arrange mass bicycle rides, offer free repairs, and campaign for more room on the road.

With ample oil money and a hunger to host prestigious sports events, governments of countries such as UAE and Qatar are becoming a big part of pro cycling. A new initiative was announced by Sheikh Hamdan, the Crown Prince of Dubai in 2020. Under this initiative, Dubai, the largest city in the UAE, aims to become a friendlier place for cyclists as a part of Dubai Vision 2021. Earlier in 2020, Dubai’s public transport authority unveiled a fleet of nearly 800 payas-you-go bicycles and run-in partnership with Careem, a Dubai-founded ride-sharing app that was bought by Uber in 2019.

Key Regions: U.S. , UK , Japan , Brazil , South Africa

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Cycling Wear Market Scope

Cycling Wear Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|

MEA cycling wear market size, by country, 2018-2030 (US$M)

Middle East & Africa Cycling Wear Market Outlook Share, 2022 & 2030 (US$M)

Related regional statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more