India Cycling Wear Market Size & Outlook, 2022-2030

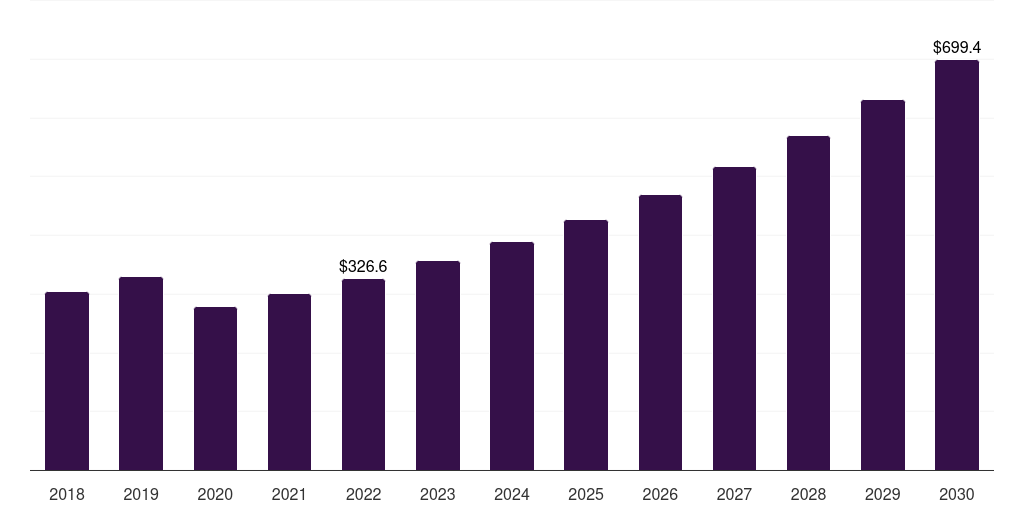

India cycling wear market, 2018-2030 (US$M)

Related Markets

India cycling wear market highlights

- The India cycling wear market generated a revenue of USD 326.7 million in 2022 and is expected to reach USD 699.4 million by 2030.

- The India market is expected to grow at a CAGR of 10% from 2023 to 2030.

- In terms of segment, cycle wear apparel was the largest revenue generating product in 2022.

- Cycle wear shoes is the most lucrative product segment registering the fastest growth during the forecast period.

Cycling wear market data book summary

| Market revenue in 2022 | USD 326.7 million |

| Market revenue in 2030 | USD 699.4 million |

| Growth rate | 10% (CAGR from 2022 to 2030) |

| Largest segment | Cycle wear apparel |

| Fastest growing segment | Cycle wear shoes |

| Historical data | 2018 - 2021 |

| Base year | 2022 |

| Forecast period | 2023 - 2030 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Cycle wear apparel, Cycle wear accessories, Cycle wear shoes |

| Key market players worldwide | Lumiere, Giro Sport, Castelli Cycling, Rapha, Champion System, United Apparel, ASSOS of Switzerland, Endura, Isadore, 2XU |

Other key industry trends

- In terms of revenue, India accounted for 5.3% of the global cycling wear market in 2022.

- Country-wise, U.S. is expected to lead the global market in terms of revenue in 2030.

- In Asia Pacific, China cycling wear market is projected to lead the regional market in terms of revenue in 2030.

- India is the fastest growing regional market in Asia Pacific and is projected to reach USD 699.4 million by 2030.

Cycle wear apparel was the largest segment with a revenue share of 58.34% in 2022. Horizon Databook has segmented the India cycling wear market based on cycle wear apparel, cycle wear accessories, cycle wear shoes covering the revenue growth of each sub-segment from 2018 to 2030.

In recent years, India has undergone a nationwide effort to encourage and promote green transport and cycling plays an integral role in curbing air pollution and reducing traffic congestion. From bike sharing to cycle lanes and constructing the best cycling routes, there are many initiatives under way across the country. For instance, Kohima is one of the 25 cities pioneering a shift to green transportation in a federal cycling initiative launched during the COVID-19 pandemic.

This boosted an interest in cycling and overall bike sales in India rose due to public transport curbs. Considering the burgeoning demand for bicycles, manufacturers have introduced hundreds of brands with different styles in India, such as Road, Hybrid, MTBs, Fat Bikes, and e-bikes.

There is no dearth of choices in bicycles available for the Indian cyclist, including high-end imported bicycles. Fueled by growing demand and increased supply, the price points are competitive due to which, market players face stiff competition. All of these factors are strengthening the growth of the cycling wear market in India.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Cycling Wear Market Scope

Cycling Wear Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|

India cycling wear market size, by product, 2018-2030 (US$M)

India Cycling Wear Market Outlook Share, 2022 & 2030 (US$M)

Related regional statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more