Mexico Clinical Trial Supplies Market Size & Outlook

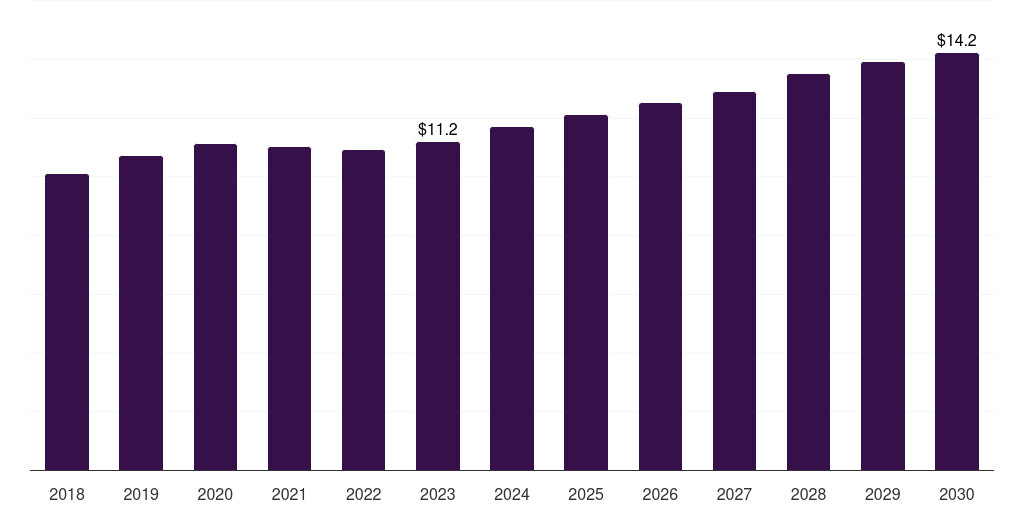

Mexico clinical trial supplies market, 2018-2030 (US$M)

Related Markets

Mexico clinical trial supplies market highlights

- The Mexico clinical trial supplies market generated a revenue of USD 11.4 million in 2023 and is expected to reach USD 14.2 million by 2030.

- The Mexico market is expected to grow at a CAGR of 3.2% from 2024 to 2030.

- In terms of segment, phase iii was the largest revenue generating phase in 2023.

- Phase I is the most lucrative phase segment registering the fastest growth during the forecast period.

Clinical trial supplies market data book summary

| Market revenue in 2023 | USD 11.4 million |

| Market revenue in 2030 | USD 14.2 million |

| Growth rate | 3.2% (CAGR from 2023 to 2030) |

| Largest segment | Phase iii |

| Fastest growing segment | Phase I |

| Historical data | 2018 - 2022 |

| Base year | 2023 |

| Forecast period | 2024 - 2030 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Phase I, Phase II, Phase III |

| Key market players worldwide | Almac Group, Catalent Inc, Waldencast PLC Class A, PCI Technology, Sharp Corp, Thermo Fisher Scientific Inc, PAREXEL, Marken, KLIFO, BioCair |

Other key industry trends

- In terms of revenue, Mexico accounted for 0.4% of the global clinical trial supplies market in 2023.

- Country-wise, U.S. is expected to lead the global market in terms of revenue in 2030.

- In Latin America, Brazil clinical trial supplies market is projected to lead the regional market in terms of revenue in 2030.

- Argentina is the fastest growing regional market in Latin America and is projected to reach USD 7.1 million by 2030.

Phase iii was the largest segment with a revenue share of 53.51% in 2023. Horizon Databook has segmented the Mexico clinical trial supplies market based on phase i, phase ii, phase iii covering the revenue growth of each sub-segment from 2018 to 2030.

Mexico is the second largest market for clinical trials after Brazil and accounts for 20.0% of total clinical trials conducted in Latin America. The rising number of clinical trials in Mexico is boosting the demand for efficient clinical trial supplies, which is attracting market players.

The primary challenge is logistics and supply chain with complicated rules pertaining to import and export permits. COFEPRIS, the ministry of health of Brazil, grants import and export license.

For certain classes of drugs and medical supplies, a permit is not required if relevant protocol is followed, however, for majority of the supplies, a permit is required. Shipments above USD 1,000 require a special permit license, which generally requires an import broker.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Clinical Trial Supplies Market Scope

Clinical Trial Supplies Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|

Mexico clinical trial supplies market size, by phase, 2018-2030 (US$M)

Mexico Clinical Trial Supplies Market Outlook Share, 2023 & 2030 (US$M)

Related industry reports

Related regional statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more