Brazil Clinical Trial Supplies Market Size & Outlook

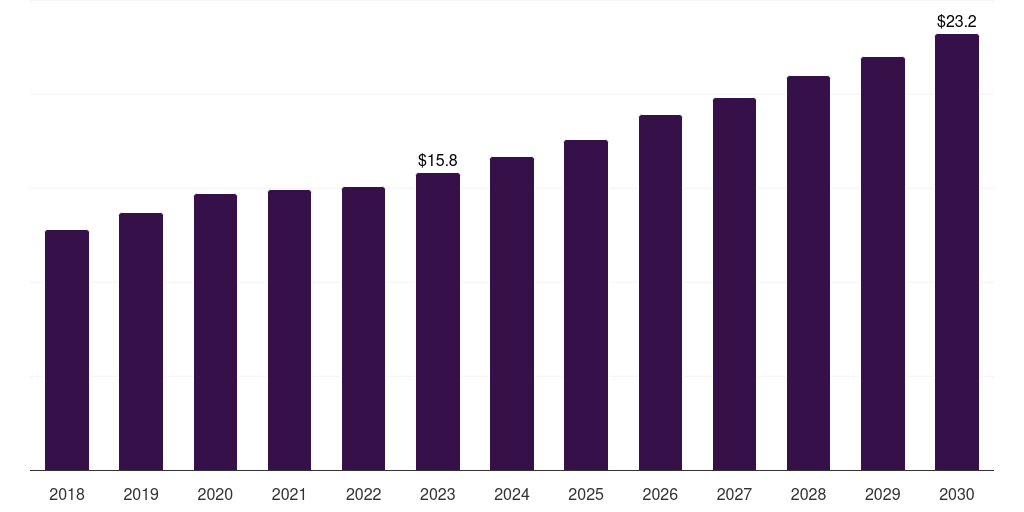

Brazil clinical trial supplies market, 2018-2030 (US$M)

Related Markets

Brazil clinical trial supplies market highlights

- The Brazil clinical trial supplies market generated a revenue of USD 15.9 million in 2023 and is expected to reach USD 23.2 million by 2030.

- The Brazil market is expected to grow at a CAGR of 5.5% from 2024 to 2030.

- In terms of segment, phase iii was the largest revenue generating phase in 2023.

- Phase I is the most lucrative phase segment registering the fastest growth during the forecast period.

Clinical trial supplies market data book summary

| Market revenue in 2023 | USD 15.9 million |

| Market revenue in 2030 | USD 23.2 million |

| Growth rate | 5.5% (CAGR from 2023 to 2030) |

| Largest segment | Phase iii |

| Fastest growing segment | Phase I |

| Historical data | 2018 - 2022 |

| Base year | 2023 |

| Forecast period | 2024 - 2030 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Phase I, Phase II, Phase III |

| Key market players worldwide | Almac Group, Catalent Inc, Waldencast PLC Class A, PCI Technology, Sharp Corp, Thermo Fisher Scientific Inc, PAREXEL, Marken, KLIFO, BioCair |

Other key industry trends

- In terms of revenue, Brazil accounted for 0.6% of the global clinical trial supplies market in 2023.

- Country-wise, U.S. is expected to lead the global market in terms of revenue in 2030.

- In Latin America, Brazil clinical trial supplies market is projected to lead the regional market in terms of revenue in 2030.

- Argentina is the fastest growing regional market in Latin America and is projected to reach USD 7.1 million by 2030.

Phase iii was the largest segment with a revenue share of 53.46% in 2023. Horizon Databook has segmented the Brazil clinical trial supplies market based on phase i, phase ii, phase iii covering the revenue growth of each sub-segment from 2018 to 2030.

Brazil accounts for 30.0% of the total trials conducted in Latin America owing to low cost, ease in patient recruitment, and presence of a diverse patient population. Changing regulation and logistics are primary challenges for biopharmaceutical companies and CROs, which is restraining entry into this market.

The regulatory approval process is stringent, as it involves approval of two entities Comissao Nacional de Etica em Pesquisa (CONEP) and Agência Nacional de Vigilancia Sanitaria (ANVISA). Recent regulatory changes in 2016 are expected to accelerate approval process, which may encourage biopharmaceutical and clinical trial supplies players to enter the market.

In 2015, Marken, a global supply chain solution provider, established its largest depot in Brazil, which is expected to support growing number of clinical trials in Brazil. Increasing investment by market players in Brazil is a clear indication of growing opportunities, and the trend is expected to continue, thereby contributing to the growth of clinical trial supplies market.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Clinical Trial Supplies Market Scope

Clinical Trial Supplies Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|

Brazil clinical trial supplies market size, by phase, 2018-2030 (US$M)

Brazil Clinical Trial Supplies Market Outlook Share, 2023 & 2030 (US$M)

Related industry reports

Related regional statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more