China Blood Testing Market Size & Outlook, 2025-2030

Related Markets

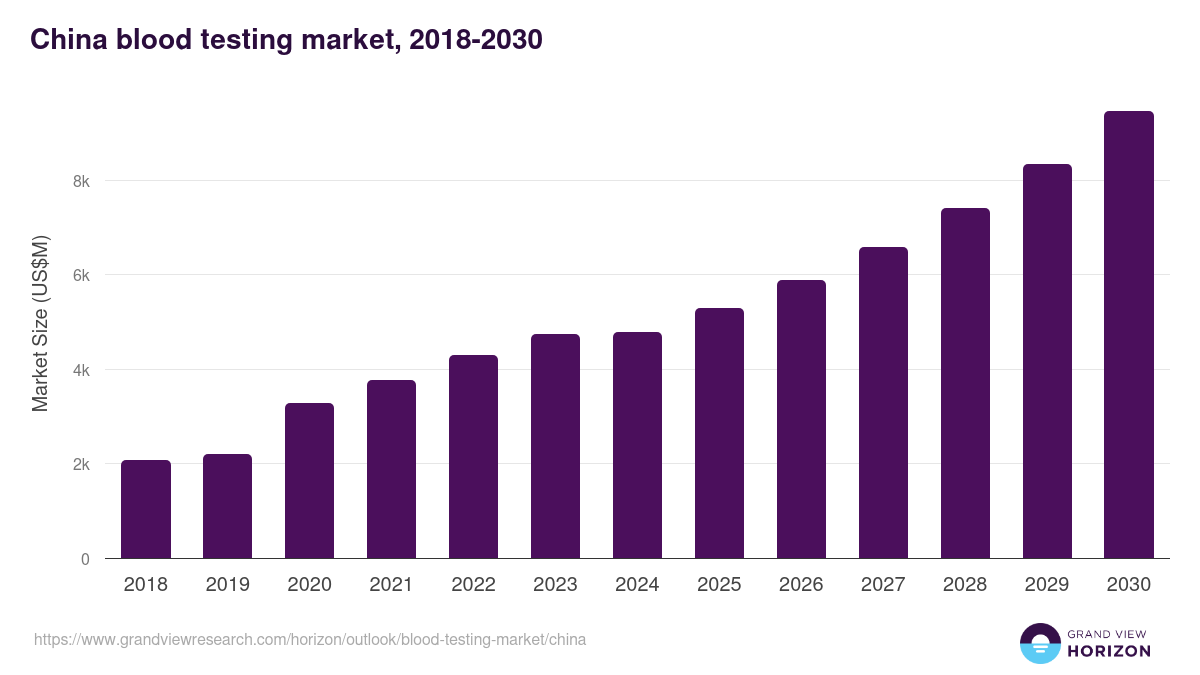

China blood testing market highlights

- The China blood testing market generated a revenue of USD 4,797.9 million in 2024 and is expected to reach USD 9,469.0 million by 2030.

- The China market is expected to grow at a CAGR of 12.3% from 2025 to 2030.

- In terms of segment, glucose testing was the largest revenue generating test type in 2024.

- Glucose testing is the most lucrative test type segment registering the fastest growth during the forecast period.

Blood testing market data book summary

| Market revenue in 2024 | USD 4,797.9 million |

| Market revenue in 2030 | USD 9,469.0 million |

| Growth rate | 12.3% (CAGR from 2025 to 2030) |

| Largest segment | Glucose testing |

| Fastest growing segment | Glucose testing |

| Historical data | 2018 - 2023 |

| Base year | 2024 |

| Forecast period | 2025 - 2030 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Glucose testing, A1C testing, Direct LDL testing, Lipid panel testing, Prostate-specific antigen testing, COVID-19 testing, BUN testing, Vitamin D testing, Thyroid-stimulating hormone testing, Serum Nicotine / Cotinine testing, High sensitivity CRP testing, Testosterone testing, ALT testing, Cortisol testing, Creatinine testing, AST testing, Other blood tests |

| Key market players worldwide | Abbott Laboratories, Roche Holding AG ADR, Bio-Rad Laboratories Inc, BioMerieux SA, Quest Diagnostics Inc, Biomerica Inc, Becton Dickinson & Co, Siemens Healthineers AG ADR, Danaher Corp, Trinity Biotech PLC ADR |

Other key industry trends

- In terms of revenue, China accounted for 5.0% of the global blood testing market in 2024.

- Country-wise, U.S. is expected to lead the global market in terms of revenue in 2030.

- In Asia Pacific, China blood testing market is projected to lead the regional market in terms of revenue in 2030.

- China is the fastest growing regional market in Asia Pacific and is projected to reach USD 9,469.0 million by 2030.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Blood Testing Market Scope

Blood Testing Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|---|---|---|---|

| Trinity Biotech PLC ADR | View profile | 380 | IDA Business Park, Bray, County Wicklow, Dublin, Ireland, A98 H5C8 | https://www.trinitybiotech.com |

| Biomerica Inc | View profile | 62 | 17571 Von Karman Avenue, Irvine, CA, United States, 92614 | https://www.biomerica.com |

| Bio-Rad Laboratories Inc | View profile | 8030 | 1000 Alfred Nobel Drive, Hercules, CA, United States, 94547 | https://www.bio-rad.com |

| Quest Diagnostics Inc | View profile | 48000 | 500 Plaza Drive, Secaucus, NJ, United States, 07094 | https://www.questdiagnostics.com |

| Danaher Corp | View profile | 63000 | 2200 Pennsylvania Avenue, N.W., Suite 800W, Washington, DC, United States, 20037-1701 | https://www.danaher.com |

| Siemens Healthineers AG ADR | View profile | 71400 | Siemensstr. 3, Forchheim, BY, Germany, 91301 | https://www.siemens-healthineers.com |

| BioMerieux SA | View profile | 13982 | Marcy l’Etoile, Lyon, France, 69280 | http://www.biomerieux.com |

| Becton Dickinson & Co | View profile | 73000 | 1 Becton Drive, Franklin Lakes, NJ, United States, 07417-1880 | https://www.bd.com |

| Abbott Laboratories | View profile | 114000 | 100 Abbott Park Road, Abbott Park, IL, United States, 60064-6400 | https://www.abbottinvestor.com |

| Roche Holding AG ADR | View profile | 103605 | Grenzacherstrasse 124, Basel, Switzerland, 4070 | https://www.roche.com |

China blood testing market outlook

The databook is designed to serve as a comprehensive guide to navigating this sector. The databook focuses on market statistics denoted in the form of revenue and y-o-y growth and CAGR across the globe and regions. A detailed competitive and opportunity analyses related to blood testing market will help companies and investors design strategic landscapes.

Glucose testing was the largest segment with a revenue share of 20.31% in 2024. Horizon Databook has segmented the China blood testing market based on glucose testing, a1c testing, direct ldl testing, lipid panel testing, prostate-specific antigen testing, covid-19 testing, bun testing, vitamin d testing, thyroid-stimulating hormone testing, serum nicotine / cotinine testing, high sensitivity crp testing, testosterone testing, alt testing, cortisol testing, creatinine testing, ast testing, other blood tests covering the revenue growth of each sub-segment from 2018 to 2030.

China held the largest market share in 2020 owing to steady economic improvement, greater health awareness, rise in per capita disposable income, increase in healthcare expenditure, and rise in the prevalence of non-communicable diseases.

Various initiatives have been undertaken by government and nongovernment organizations to create awareness about the treatment options for these disorders. For instance, the CDC has initiated a project for reducing the consumption of sodium and tobacco to prevent COPD and cardiac disorders in China.

Governing authorities, including the State Council, have introduced policies to support the medical equipment industry of China. Engagement of companies such as Jiangsu Yuyue Medical Equipment & Supply and Hunan China Sun has intensified the competition in the country.

Reasons to subscribe to China blood testing market databook:

-

Access to comprehensive data: Horizon Databook provides over 1 million market statistics and 20,000+ reports, offering extensive coverage across various industries and regions.

-

Informed decision making: Subscribers gain insights into market trends, customer preferences, and competitor strategies, empowering informed business decisions.

-

Cost-Effective solution: It's recognized as the world's most cost-effective market research database, offering high ROI through its vast repository of data and reports.

-

Customizable reports: Tailored reports and analytics allow companies to drill down into specific markets, demographics, or product segments, adapting to unique business needs.

-

Strategic advantage: By staying updated with the latest market intelligence, companies can stay ahead of competitors, anticipate industry shifts, and capitalize on emerging opportunities.

Target buyers of China blood testing market databook

-

Our clientele includes a mix of blood testing market companies, investment firms, advisory firms & academic institutions.

-

30% of our revenue is generated working with investment firms and helping them identify viable opportunity areas.

-

Approximately 65% of our revenue is generated working with competitive intelligence & market intelligence teams of market participants (manufacturers, service providers, etc.).

-

The rest of the revenue is generated working with academic and research not-for-profit institutes. We do our bit of pro-bono by working with these institutions at subsidized rates.

Horizon Databook provides a detailed overview of country-level data and insights on the China blood testing market , including forecasts for subscribers. This country databook contains high-level insights into China blood testing market from 2018 to 2030, including revenue numbers, major trends, and company profiles.

Partial client list

China blood testing market size, by test type, 2018-2030 (US$M)

China Blood Testing Market Outlook Share, 2024 & 2030 (US$M)

Related industry reports

Related statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more