U.S. Ambulatory Surgery Centers Market Size & Outlook

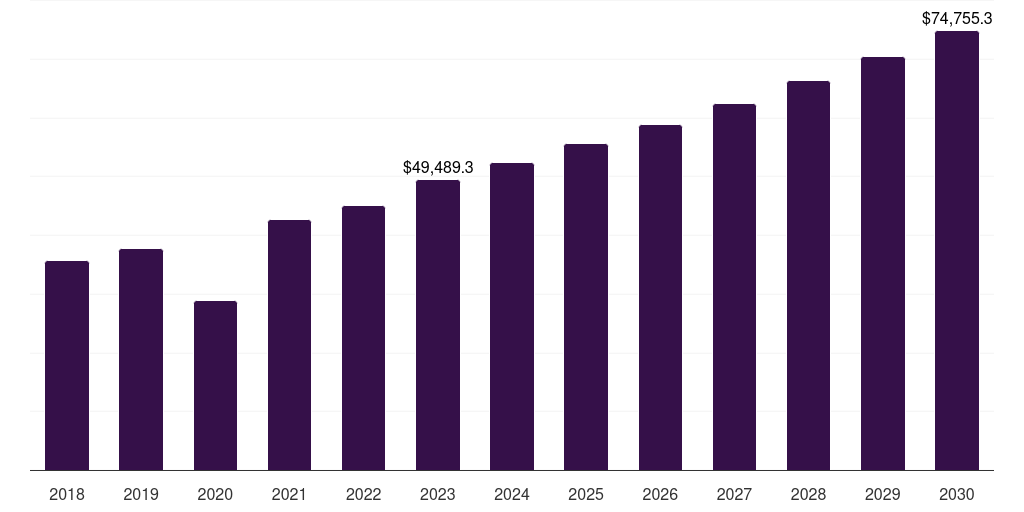

U.S. ambulatory surgery centers market, 2018-2030 (US$M)

Related Markets

U.S. ambulatory surgery centers market highlights

- The U.S. ambulatory surgery centers market generated a revenue of USD 49,489.3 million in 2023 and is expected to reach USD 74,755.3 million by 2030.

- The U.S. market is expected to grow at a CAGR of 6.1% from 2024 to 2030.

- In terms of segment, orthopedics was the largest revenue generating application in 2023.

- Otolaryngology is the most lucrative application segment registering the fastest growth during the forecast period.

Ambulatory surgery centers market data book summary

| Market revenue in 2023 | USD 49,489.3 million |

| Market revenue in 2030 | USD 74,755.3 million |

| Growth rate | 6.1% (CAGR from 2023 to 2030) |

| Largest segment | Orthopedics |

| Fastest growing segment | Otolaryngology |

| Historical data | 2018 - 2022 |

| Base year | 2023 |

| Forecast period | 2024 - 2030 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Orthopedics, Pain Management/Spinal Injections, Gastroenterology, Ophthalmology, Plastic Surgery, Otolaryngology, Obstetrics/Gynecology, Dental, Podiatry, Other Applications |

| Key market players worldwide | Community Health Systems Inc, Pediatrix Medical Group Inc, UnitedHealth Group Inc, Surgery Partners Inc, Prospect Medical Holdings, Inc., Eifelhoehen Klinik |

Other key industry trends

- In terms of revenue, U.S. accounted for 36.7% of the global ambulatory surgery centers market in 2023.

- Country-wise, U.S. is expected to lead the global market in terms of revenue in 2030.

- In North America, U.S. ambulatory surgery centers market is projected to lead the regional market in terms of revenue in 2030.

- Canada is the fastest growing regional market in North America and is projected to reach USD 7,974.2 million by 2030.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Ambulatory Surgery Centers Market Scope

Ambulatory Surgery Centers Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|

U.S. ambulatory surgery centers market outlook

The databook is designed to serve as a comprehensive guide to navigating this sector. The databook focuses on market statistics denoted in the form of revenue and y-o-y growth and CAGR across the globe and regions. A detailed competitive and opportunity analyses related to ambulatory surgery centers market will help companies and investors design strategic landscapes.

Orthopedics was the largest segment with a revenue share of 27.05% in 2023. Horizon Databook has segmented the U.S. ambulatory surgery centers market based on orthopedics, pain management/spinal injections, gastroenterology, ophthalmology, plastic surgery, otolaryngology, obstetrics/gynecology, dental, podiatry, other applications covering the revenue growth of each sub-segment from 2018 to 2030.

The U.S. accounted for the largest share in the global ambulatory surgery centers market. Ambulatory healthcare is an increasingly vital source of healthcare services, boosting the U.S. market by providing advantages such as lower costs—as compared to hospital care services—and a favorable reimbursement scenario.

According to an article published by Advameg, Inc., the cost for ambulatory surgeries is estimated to be 30% to 60% lower than identical surgeries performed in an inpatient hospital setting. Accessibility is another aspect promoting the growth of ambulatory healthcare care services.

Various collaborations and joint ventures are likely to propel growth of the market. For instance, in March 2015, Tenet Healthcare Corporation and USPI entered into a joint venture to own 244 ambulatory surgery centers, 20 imaging centers, and 16 short-stay surgical hospitals across 29 states.

Reasons to subscribe to U.S. ambulatory surgery centers market databook:

-

Access to comprehensive data: Horizon Databook provides over 1 million market statistics and 20,000+ reports, offering extensive coverage across various industries and regions.

-

Informed decision making: Subscribers gain insights into market trends, customer preferences, and competitor strategies, empowering informed business decisions.

-

Cost-Effective solution: It's recognized as the world's most cost-effective market research database, offering high ROI through its vast repository of data and reports.

-

Customizable reports: Tailored reports and analytics allow companies to drill down into specific markets, demographics, or product segments, adapting to unique business needs.

-

Strategic advantage: By staying updated with the latest market intelligence, companies can stay ahead of competitors, anticipate industry shifts, and capitalize on emerging opportunities.

Target buyers of U.S. ambulatory surgery centers market databook

-

Our clientele includes a mix of ambulatory surgery centers market companies, investment firms, advisory firms & academic institutions.

-

30% of our revenue is generated working with investment firms and helping them identify viable opportunity areas.

-

Approximately 65% of our revenue is generated working with competitive intelligence & market intelligence teams of market participants (manufacturers, service providers, etc.).

-

The rest of the revenue is generated working with academic and research not-for-profit institutes. We do our bit of pro-bono by working with these institutions at subsidized rates.

Horizon Databook provides a detailed overview of country-level data and insights on the U.S. ambulatory surgery centers market, including forecasts for subscribers. This country databook contains high-level insights into U.S. ambulatory surgery centers market from 2018 to 2030, including revenue numbers, major trends, and company profiles.

Partial client list

U.S. ambulatory surgery center asc market size, by application, 2018-2030 (US$M)

U.S. Ambulatory Surgery Centers Market Share, 2023 & 2030 (US$M)

Related regional statistics

No records

No related regions found.

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more