- Home

- »

- Medical Devices

- »

-

U.S. External Ventricular Drain Market, Industry Report, 2030GVR Report cover

![U.S. External Ventricular Drain Market Size, Share & Trends Report]()

U.S. External Ventricular Drain Market Size, Share & Trends Analysis Report By Application (Traumatic Brain Injury, Subarachnoid Hemorrhage), By Patient Type (Pediatric, Adult), By End-use, By Country (South, West, Midwest), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-264-4

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Healthcare

U.S. External Ventricular Drain Market Trends

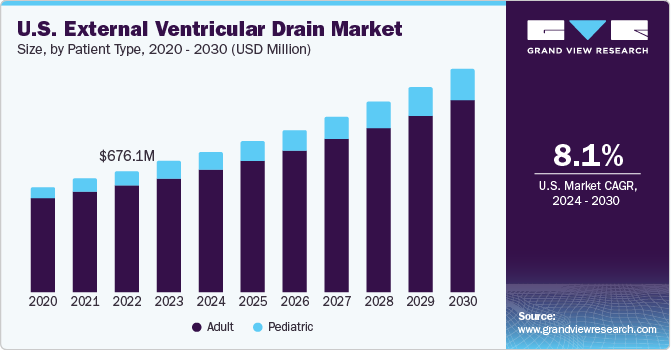

The U.S. external ventricular drain market size was estimated at USD 724.7 million in 2023 and is projected to grow at a CAGR of 8.10% from 2024 to 2030. Rising incidence of neurological disorders and traffic accidents resulting in Traumatic Brain Injuries (TBIs) is a major driving force behind the growth of the External Ventricular Drain (EVD) market in the U.S. For instance, as per the CDC, the U.S. recorded more than 69,000 traumatic brain injury (TBI)-related fatalities in 2021. That’s about 190 TBI-related deaths every day. Furthermore, an increase in novel product launches by the industry’s key players is a major factor further contributing to market growth.

Rise in the geriatric demographic, prone to neurological challenges such as stroke, aneurysm, hydrocephalus, and Traumatic Brain Injury (TBI), is driving the expansion of the market. The untreated progression of these conditions could escalate Intracranial Pressure (ICP), posing a significant threat to lives. With the aging population, there is an anticipated surge in demand for neurosurgical interventions, with procedures like global external ventricular drain market operations expected to be among the most frequently performed neurosurgical procedures. For instance, as per the reports published by the National Library Of Medicine in 2023, approximately around 15% of the global population suffer from neurological disorders, which causes physical and cognitive disabilities. Conditions such as cerebrospinal fluid (CSF) outflow obstruction are associated with intracranial hypertension, marked by an Intracranial Pressure (ICP) exceeding 20 mmHg.

Advancements in EVD technologies result from ongoing R&D. These developments involve functionality, material, and design enhancements. The increasing popularity of portable medical devices is driving a trend toward more compact and less invasive EVD devices. Advance designs aim to enhance patient comfort, reduce complications, and simplify the setup and monitoring process for medical staff. Integrating advanced monitoring and control systems allows real-time tracking of ICP & CSF drainage. For instance, the article published by the National Library of Medicine and the Association of Military Surgeons U.S. in 2023 demonstrated the outcomes of the novel Stopcock Position Sensor (SPS), which can enhance acquired brain injury tracking. The EVD drained the CSF fluid for 94.52% of the entire patient monitoring period (16.98 hours), according to the SPS's precise annotation of the ICP data. The goal of innovating External Ventricular Drain (EVD) technologies is to reduce the complications associated with traditional devices. This reduces the infections, bleeding, and other unfavorable outcomes. Innovative EVD technology development gives companies a competitive advantage in the marketplace, thus, driving the market growth.

Growing need for less invasive medical techniques is a key factor fueling the U.S. external ventricular drain market growth. Preference for minimally invasive procedures is increasing across diverse medical domains, including external ventricular drain neurosurgery, where the utilization of EVDs is prevalent. Patients prefer minimally invasive procedures owing to various advantages, including quicker recovery times, reduced pain, and a decreased risk of complications than conventional surgical methods. This growing preference for less invasive approaches has resulted in an increasing need for procedures employing devices like EVDs, allowing for smaller incisions and less disruption of tissues.

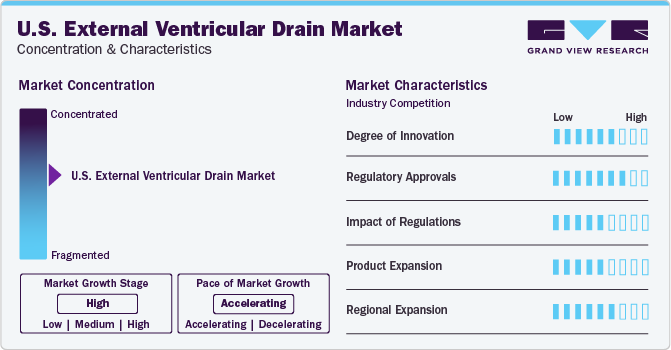

Market Concentration & Characteristics

The market growth stage is high and the pace of growth is accelerating. It is characterized by increasing cases of neurological disease, technological advancements coupled with increasing regulatory approval for novel product launches.

Key strategies implemented by players and government entities in the U.S. market are expansion, acquisitions, partnerships, collaboration, and other strategies. In January 2023, Natus Medical Incorporated announced the completion of the acquisition of Micromed Holding SAS. The merged organization united cutting-edge neurodiagnostic and neuromonitoring solutions, along with experienced teams, to provide an expanded portfolio of products, services, and global support to customers.

The market's growth is significantly propelled by the positive clinical outcomes for the use of EVD catheter sets in hydrocephalus management. For instance, in July 2023, Integra LifeSciences Holdings Corporation announced positive clinical and economic outcomes for the Codman Bactiseal External Ventricular Drain (EVD) catheter set's use in hydrocephalus management among aneurysmal subarachnoid hemorrhage (aSAH) patients. As a result of such activities in the industry, the demand for EVD will increase in various healthcare settings which is expected to drive the market growth.

Key strategies implemented by players in the market are new product launches, expansion, acquisitions, partnerships, and other strategies. For instance, in March 2022, Integra LifeSciences introduced NeuraGen 3D Nerve Guide Matrix, a resorbable implant designed for mending peripheral nerve discontinuities. NeuraGen 3D is tailored for mid-gap nerve repair and crafted to establish an enhanced environment, potentially facilitating more comprehensive functional recovery compared to the use of hollow nerve conduits alone.

External ventricular drainage setsincluding catheters, drainage bags, tubing, and connectors are some of the devices used for EVD procedures. There is an increased emphasis on employing biocompatible materials to reduce the risk of adverse reactions. Moreover, an emerging trend includes incorporating antimicrobial properties into materials to mitigate infections associated with medical devices. The preferred materials for medical devices are those that can endure various sterilization methods.

The regulation of medical devices in the U.S., including External Ventricular Drains (EVDs), is centrally overseen by the U.S. FDA. Manufacturers are generally required to secure FDA approval or clearance before they can market their EVD devices in the U.S. Certain EVD devices, particularly those deemed high-risk, may necessitate Pre-market Approval (PMA). During the PMA process, a comprehensive evaluation of clinical and scientific data is conducted to assess the safety & effectiveness of the device. On the other hand, lower-risk EVD devices may require 510(k)-clearance, wherein the manufacturer demonstrates the device's substantial equivalence to an already legally marketed device. This clearance process is typically faster than the PMA pathway.

The U.S. EVD market is significantly impacted by regulations that govern the medical device industry. These regulations, which are primarily overseen by the FDA, aim to ensure the safety, effectiveness, and quality of medical devices, including EVDs. Compliance with these regulations involves rigorous testing, documentation, and reporting, which can increase the time and cost of bringing new EVD products to market. Additionally, changes in regulations can impact market dynamics, affecting product development, marketing, and sales strategies. As a result, companies operating in this market must stay abreast of regulatory changes and adapt their strategies accordingly to maintain competitiveness and ensure patient safety.

Companies are actively acquiring development-stage firms to broaden their service portfolios, catering to a larger patient base. Major companies may acquire smaller firms to strengthen their market position, expand product portfolios, or gain access to new technologies. For instance, in January 2023, Natus Medical Incorporated announced the completion of the acquisition of Micromed Holding SAS. The merged organization united cutting-edge neurodiagnostic and neuromonitoring solutions, along with experienced teams, to provide an expanded portfolio of products, services, and global support to customers.

The U.S. External Ventricular Drain (EVD) market exhibits high concentration, with a select few companies dominating due to factors like brand recognition, expansive distribution networks, and substantial R&D investments. This concentration fosters intense competition, driving innovation and premium pricing strategies. However, regulatory changes and disruptive technologies may influence market dynamics in the future.

Companies in the market are strategically focusing on regional expansion to capitalize on emerging opportunities and broaden their market presence. This entails establishing a stronger footprint in key geographical areas through partnerships, acquisitions, and localized marketing strategies. Moreover, by tailoring their products and services to meet regional healthcare needs, EVD firms aim to enhance accessibility and responsiveness, ensuring a more comprehensive and effective market penetration. Thus, regional expansion serves as a critical factor for industry leaders to tap into diverse markets, address specific healthcare demands, and ultimately drive sustained growth.

Application Insights

The traumatic brain injury segment dominated the market in 2023 and is expected to register the fastest CAGR of 9.5% during the forecast period. Growing number of brain injuries is a major factor driving the segment growth. Several reasons contribute to this increase, including the aging population, more people relying on motor vehicles, and the increasing popularity of contact sports.

For instance, as per the reports published by the National Library of Medicine in 2022, Traumatic Brain Injury can occur due to various traumas, from a basic blow to the head to a penetrating injury to the brain. Approximately 1.7 million people have experienced a TBI in the U.S. Adolescents between the ages of 15 and 19, as well as adults aged 65 and older, were particularly prone to sustaining TBIs. The rising need for external ventricular drain procedures that are less invasive is a key factor pushing the market forward.

Patient Type Insights

The adult segment dominated the market in 2023. As people age, they become more susceptible to neurological disorders like hydrocephalus, intracranial hypertension, and TBIs. In dealing with these health challenges, EVDs become essential for effective management. For instance, as per the reports of WHO, in 2022, around 80% of elderly people by 2050 will reside in countries with a low or middle income. In addition, it is anticipated that the number of persons 80 years of age or older will be around 426 million by 2050. The elderly population is also more prone to chronic health conditions that can lead to complications requiring neurosurgical interventions.

EVDs play a crucial role in addressing imbalances in cerebrospinal fluid associated with these conditions. This growing market presents an opportunity to develop devices that can enhance the care & support provided to the aging population. Moreover, growing research activities on diagnosis and surgical management, along with a new pipeline of products, are further boosting the growth of the industry.

The pediatric segment is expected to witness a growth rate of 9.6% during the forecast period. Children facing specific neurological challenges, such as congenital hydrocephalus or TBIs, can influence the demand for EVD devices customized specifically for them. The type of hospitals and healthcare facilities specializing in treating children may also play a role in determining how frequently & which devices are selected for pediatric patients.

As reported in a Pediatric Neurosurgery study, around 69,000 patients are recorded each year in the U.S. Data from the National Institute of Neurological Disorders and Stroke (NINDS) reveals that hydrocephalus affects 1-2 infants per 1,000 births. When there's a blockage in the flow of cerebrospinal fluid in the brain, doctors use an EVD device to help treat and relieve increased pressure inside the skull & manage conditions like hydrocephalus. During the forecast period, this is expected to fuel market expansion.

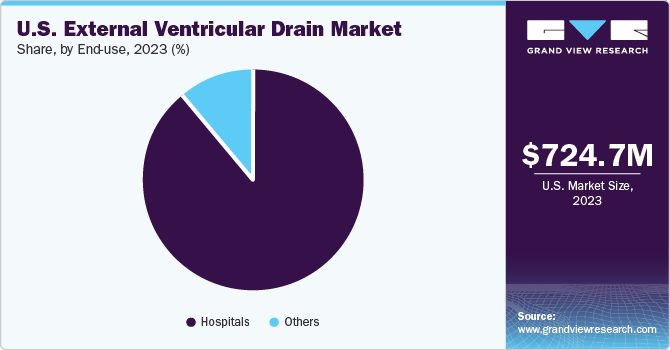

End-use Insights

Hospital segment dominated the market in 2023 and is expected to register the fastest CAGR of 8.3% during the forecast period. For the diagnosis & care of neurological disorders such as TBI Intracranial Pressure (ICP), hydrocephalus hospitals are important. They serve as the primary site for handling these disorders since they frequently have access to cutting-edge medical technology and a staff of trained healthcare specialists. Hospitals can undertake surgical procedures such as ventriculostomy.

In hospitals, EVDs are frequently used during neurosurgical procedures to regulate cerebrospinal fluid levels and ICP. Within hospital neurological units, EVDs are an integral part of specialized care tailored for patients needing neurosurgical interventions. This segment of hospitals thrives on collaboration among neurosurgeons, neurologists, and various healthcare professionals, all of whom contribute significantly to the decision-making and utilization of EVDs.

Country Insights

U.S. External Ventricular Drain Market Trends

The South region dominated the market for U.S. external ventricular drain with a revenue share in 2023. The increasing incidence of TBI drives the EVD market growth in this region. As per the reports published by the Texas Brain Injury Advisory Council in 2022, approximately 3,81,000 people in Texas suffer from TBI. Moreover, EVD devices play a crucial role in managing heightened Intracranial Pressure (ICP), a prevalent & potentially life-threatening complication associated with TBI. As the demand for EVDs rises, manufacturers are actively creating novel & innovative products to cater to the requirements of patients and healthcare providers. e.

The West region is expected to witness a growth rate of 8.3% during the forecast period. Increased awareness within the healthcare community and the general public regarding the importance of early diagnosis & treatment for neurological conditions may influence the demand for EVD procedures. The medical device sector operates under rigorous regulations, where adhering to FDA standards and securing essential approvals can prove to be time-intensive & expensive, presenting a substantial obstacle for potential entrants. The development & production of medical devices, particularly those incorporating advanced technologies like EVDs, require considerable financial investments. Hence, the increasing healthcare infrastructure and better healthcare facilities are expected to boost the market growth for EVD devices in this region.

Key U.S. External Ventricular Drain Company Insights

The U.S. EVD market trends are influencing the strategies of industry leaders, who are heavily investing in research and development to address various non-traumatic hydrocephalus conditions. This focus on innovation is driven by the shift towards user comfort through technological advancements and the introduction of innovative products. Intense competition characterizes the EVD industry, not just between established companies but also from early-stage entities, universities, and research institutions. Key international players are expanding their commercial resources in emerging markets, bolstering sales organizations, and seizing commercial opportunities.

Additionally, companies are investing in technologies, systems, and processes to improve the overall customer experience, reflecting a commitment to meet evolving healthcare needs. For instance, integrating wireless technologies for monitoring and transmitting data from EVD devices to external systems could enable real-time surveillance of crucial metrics, such as intracranial pressure. These capabilities empower healthcare providers to make informed decisions promptly during patient care. These innovative technologies drive the market growth positively over the forecast period.

Key U.S. External Ventricular Drain Companies:

- Medtronic

- Integra LifeSciences

- Natus Medical Incorporated

- SOPHYSA

- Neuromedex

Recent Developments

-

In March 2023, Natus Medical Incorporated announced the completion of the acquisition of Micromed Holding SAS. The merged organization united cutting-edge neurodiagnostic and neuromonitoring solutions, along with experienced teams, to provide an expanded portfolio of products, services, and global support to customers.

-

In July 2023, Integra LifeSciences recently showcased encouraging clinical and financial outcomes related to the Codman Bactiseal External Ventricular Drain (EVD) catheter set in the management of hydrocephalus resulting from aneurysmal Subarachnoid Hemorrhage (aSAH).

-

In April 2022, Medtronic and GE Healthcare have announced a collaborative initiative focused on meeting the unique needs and healthcare requirements of Ambulatory Surgery Centers (ASCs) and OfficeBased Labs (OBLs) and also enhancing the peripheral vascular and cardiology procedures.

U.S. External Ventricular Drain Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 778.4 million

Revenue forecast in 2030

USD 1.2 billion

Growth rate

CAGR of 8.10% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Application, patient type, end-use, counrty

Key companies profiled

Medtronic; Integra LifeSciences; Natus Medical Incorporated; SOPHYSA; Neuromedex

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. External Ventricular Drain Market Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. external ventricular drain market report based on application, patient type, end-use, and country:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Traumatic Brain Injury

-

Subarachnoid Hemorrhage

-

Intracerebral Hemorrhage

-

Other Non-traumatic Hydrocephalus Conditions

-

-

Patient Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Pediatric

-

Adult

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Others (Ambulatory Surgical Centers, Long Term Care Facilities, Emergency Facilities)

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

South

-

West

-

Midwest

-

Northeast

-

Frequently Asked Questions About This Report

b. The U.S. external ventricular drain market size was estimated at USD 724.7 million in 2023 and is expected to reach USD 778.42million in 2024.

b. The U.S. external ventricular drain market is expected to grow at a compound annual growth rate of 8.10% from 2024 to 2030 to reach USD 1.2 billion by 2030.

b. Traumatic brain injury segment dominated the U.S. external ventricular drain market with a share of 35.92% in 2023. Growing number of brain injuries is a major factor driving the segment growth. Several reasons contribute to this increase, including the aging population, more people relying on motor vehicles, and the increasing popularity of contact sports.

b. Medtronic, Integra LifeSciences, Natus Medical Incorporated, SOPHYSA are the key players. Key players are expanding their commercial resources in emerging markets, bolstering sales organizations, and seizing commercial opportunities. Additionally, companies are investing in technologies, systems, and processes to improve the overall customer experience, reflecting a commitment to meet evolving healthcare needs.

b. Rising incidence of neurological disorders and traffic accidents resulting in Traumatic Brain Injuries (TBIs) is a major driving force behind the growth of the External Ventricular Drain (EVD) market in the U.S. Furthermore, an increase in novel product launches by the industry’s key players is a major factor further contributing to market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."