- Home

- »

- Consumer F&B

- »

-

Red Meat Market Size, Share & Growth Analysis Report 2030GVR Report cover

![Red Meat Market Size, Share & Trends Report]()

Red Meat Market Size, Share & Trends Analysis Report By Type (Beef, Pig, Sheep, Goats), By Distribution Channel (B2B, B2C), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-262-3

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Consumer Goods

Red Meat Market Size & Trends

The global red meat market size was estimated at USD 899.8 billion in 2023 and is expected to expand at a CAGR of 6.1% from 2024 to 2030. This growth can be attributed to rising demand and consumption, growing awareness about health and nutrition, global trade expansion, and innovations & diversification of red meat products. One of the major factors driving the red meat market is the global demand for red meat products. Growing populations, rising disposable incomes, urbanization trends, and changing dietary preferences have led to a surge in the demand for red meat products globally, driving market growth. As incomes rise worldwide, consumers have shown a preference for a greater variety of red meat cuts, leading to increased consumption. This trend is particularly evident in emerging economies where rising disposable incomes have fueled demand for higher-quality protein sources like red meat.

According to the U.S. Department of Agriculture (USDAR), Per capita, meat consumption in developing and emerging economies has been increasing by approximately 3% annually since the mid-1990s for beef and veal, pork, and poultry.

Growing awareness about health and nutrition has also impacted the red meat market. Consumers are increasingly seeking high-quality, lean cuts of red meat that are perceived as healthier options. Marketing efforts promoting the nutritional benefits of red meat, such as being a rich source of protein, vitamins, and minerals, have influenced consumer preferences and consumption patterns. For instance, in January 2024, Country Archer Provisions launched Ancestral Beef Blend Meat Sticks, its new line of protein-packed meat stick.

The expansion of Free Trade Agreements (FTA) has facilitated the growth of international trade in red meat products. Countries engage in import and export activities to meet domestic demand, access new markets, and capitalize on comparative advantages in production. According to the U.S. Meat Export Federation, pork exports in January 2024 amounted to 251,424 metric tons (mt), showing a 6% increase from 2023. The export value increased by 6% and reached USD 682.1 million. Nations across the world are entering into trade agreements, propelling the market. For instance, in May 2023, the UK parliament ratified the free trade agreement with New Zealand. This FTA is anticipated to boost the red meat exports of New Zealand by enabling beef and lamb to enter the UK tariff-free.

Furthermore, Manufacturers and producers in the red meat industry are focusing on product innovation and diversification to cater to evolving consumer preferences. Introduction of value-added products, convenience foods, ready-to-eat meals, and premium cuts help expand market offerings and attract a broader customer base. Innovation in processing techniques and flavor profiles also contributes to market growth. For instance, in October 2023, Hormel Foods Corporation launched the HERB-OX Cold Water Dissolve Beef Bouillon and HERB-OX Cold Water Dissolve Chicken Bouillon, the sole cold-water dissolvable products in the market, providing flavor and convenience for the cooking process of gravies, soups, stews, and more.

Market Concentration & Characteristics

Manufacturers in the red meat industry are actively engaged in various initiatives to meet evolving consumer demands and industry trends. The market is characterized by a significant level of innovation driven by technological advancements, increasing consumer demand, and favorable government policies. The industry is witnessing a surge in innovative practices aimed at enhancing product quality, and sustainability, and meeting evolving consumer preferences. Key players in the industry are investing in research and development to introduce new products, improve production processes, and address environmental concerns.

The mergers and acquisitions are in the range of low to medium in the red meat industry. Companies undergoing merger and acquisitions are seeking strategic partnerships to enhance their product portfolios, expand their industry presence, and leverage each other’s strengths. For instance, in November 2023, The Competition and Markets Authority (CMA) cleared the acquisition of Scotbeef meat plants in Bridge of Allan and Queenslie by ABP Food Group.

The global industry operates under a robust regulatory framework that encompasses federal food safety regulations, performance standards for pathogens, industry-driven incentives for enhanced food safety practices, and public disclosure of plant-specific performance data. These combined efforts contribute to maintaining high levels of regulatory scrutiny in the red meat industry to safeguard consumer health and well-being. A few regulatory authorities overseeing the industry include the Brazilian Ministry of Agriculture, Livestock and Food Supply (MAPA), Food Standards Australia New Zealand (FSANZ), United States Department of Agriculture (USDA) among others.

There are several product substitutes available in the industry such as plant-based meat, lab-grown meat, insect-based protein, mushroom-based meat alternatives, and jackfruit and seitan. These alternatives have gained popularity due to various factors such as health concerns, environmental impact, and ethical considerations.

The end-user concentration in the industry is generally low. The industry typically caters to a wide range of consumers, including individual households, restaurants, food service providers, and other entities. Due to the diverse nature of the consumer base and the varying preferences and demands of different end users, the industry does not exhibit high concentration among a few dominant buyers. Instead, there is a dispersion of demand across various segments and regions, leading to a more decentralized end-user landscape

Type Insights

Pigs accounted for a revenue share of 55.3% in 2023. Pork is the culinary name for the meat of the pig. Consumer preferences are shifting towards convenient and processed foods, driving an increased demand for pork meat due to its nutritional advantages like high protein content, vitamins, and satiety. Pork products are favored by fitness enthusiasts and athletes for muscle-building purposes. According to the World Population Review, the pork consumption in 2024 is at 112.6 kilotons, and is expected to increase to 129 kilotons by 2031.

Furthermore, the growth of the retail industry, including various sales channels such as hypermarkets, supermarkets, convenience stores, and online platforms, has facilitated easy access to packaged pork meat and products for consumers. This expansion has increased sales opportunities and market reach for pork products. For instance, in January 2024, ALDI announced the introduced Crispy Pork Protein Crisps to its protein range and its availability in stores.

Beef is expected to grow at a CAGR of 5.7% from 2024 to 2030 owing to the shifting consumer preferences towards animal-based protein products. The market is also experiencing a steady rise in demand for beef products like steaks, ground cuts, and similar items, particularly among younger consumers who prefer burgers and rolls made from these offerings. For instance, in March 2023, JBS U.S.A. introduced Pound of Ground Crumbles frozen uncooked ground beef, a pioneering dinner solution that can be cooked directly from frozen without the need for thawing or advance planning.

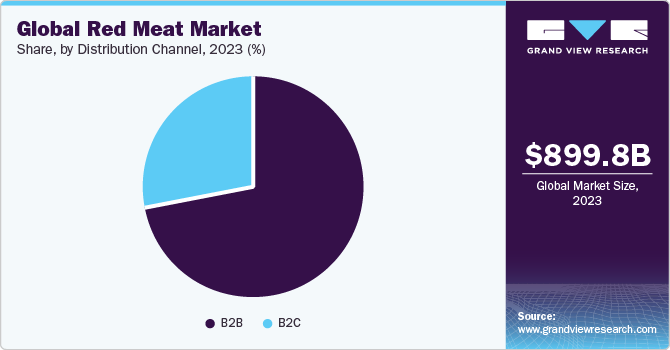

Distribution Channel Insights

B2B distribution channel accounted for a revenue share of 71.5% in 2023. Utilizing B2B distribution channels allows red meat producers to expand their market reach beyond local boundaries. Red meat offers versatility in the food processing & food service industry, as it can be used in a wide range of products such as sausages, burgers, meatballs, meatloaf, and ready-to-eat meals. Its adaptability allows manufacturers to create diverse and innovative products to meet consumer demand.

The B2C distribution channel is expected to grow with a CAGR of 6.6% from 2024 to 2030. This can be attributed to consumers increasingly seeking convenience and a seamless shopping experience. The B2C distribution channel allows consumers to purchase red meat products directly from retailers, online platforms, or specialty stores, catering to their preferences and needs. Moreover, the growth of e-commerce platforms has revolutionized the way consumers shop for red meat products. Online retail channels offer a wide range of options, convenience, and often competitive pricing, driving more consumers toward purchasing red meat products online. According to an article by Ziffity, around 60% of meat consumers have made purchases of meat products through online channels. Of this group, 30% of all meat consumers (equivalent to 53% of those who buy meat online) prefer to buy the majority of their meat products online

Regional Insights

The red meat market in North America accounted for a revenue share of 26.6% in 2023. The demand for red meat, particularly beef, in North America plays a significant role in driving the market. Beef has a significant role in the traditional American diet, with popular dishes such as meatloaf, steaks, and hamburgers often highlighting beef as the primary ingredient. Consumer preferences for specific types of red meat, cuts, and quality attributes impact production, pricing, and market trends. In November 2023, Del Taco introduced three fresh Shredded Beef Birria options nationwide in the U.S. These new offerings consist of Two Shredded Beef Birria Tacos, Shredded Beef Birria Quesadilla, and Shredded Beef Birria Ramen.

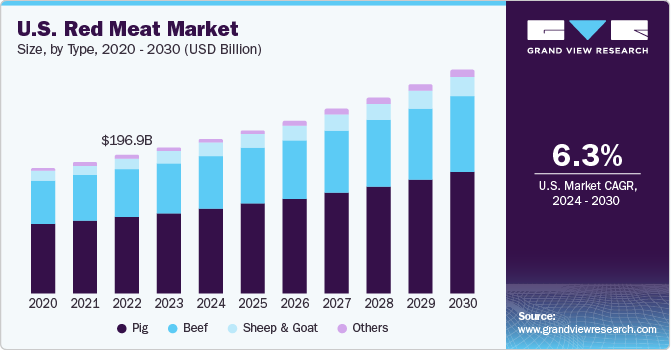

U.S. Red Meat Market Trends

The U.S. red meat market is expected to grow at a CAGR of 6.3% from 2024 to 2030. This can be attributed to the increasing consumption and demand for meat in the region. According to an article by TheWorldCounts, meat consumption in the U.S. accounted for 124 kilos per person per year. Moreover, increasing trade is driving the market. According to the U.S. Meat Export Federation, in January 2024, U.S. pork exports to South Korea surged by 53% compared to the previous year, reaching 20,727 metric tons. The export value also witnessed a significant increase of 51%, amounting to $67.6 million.

Europe Red Meat Market Trends

The red meat market in Europe is expected to grow with a CAGR of 5.7% from 2024 to 2030. Red meat, such as beef, pork, and lamb are of significance in European culinary traditions and diets. Many European countries have a long history of consuming red meat as a staple food item, leading to a consistent demand for these products. According to the European Union agricultural outlook for 2021-31 report, EU sheep meat production is anticipated to experience a slight annual growth of 0.3% from 2021 to 2031, reaching 660,000 tons by 2031. This growth will be supported by factors such as coupled income support, limited global supply, and improving prices for producers. In terms of consumption, the EU per capita intake of sheep meat is forecasted to marginally increase by 2031 to 1.4 kg per capita. This growth is attributed to the diversification of meat diets and evolving consumption patterns within the EU population.

Asia Pacific Red Meat Market Trends

Asia Pacific red meat market is anticipated to grow with a CAGR of 6.3% from 2024 to 2030. Major meat-producing countries in the Asia-Pacific region are capitalizing on export opportunities to meet global demand for red meat products. Countries like China, India, and Australia are expanding their export markets, further boosting the growth of the red meat industry. According to Meat & Livestock Australia, approximately 1.9 million tons carcass weight (cwt) of veal and beef in 2022 and exported 67% of its total production.

Key Red Meat Company Insights

Some of the key companies operating in the market include Hormel Foods Corporation, JBS Foods, W.H. Group, Tyson Foods, Inc., Kraft Heinz Company, Cargill, Incorporated, and others.

-

Hormel Foods Corporation is one of the key players in the market for 2024. The company is a well-known producer and distributor of various meat products, including red meat like pork and beef. Its red meat sector portfolio includes SPAM, bacon under the Hormel Black Label brand, and natural deli meats under the Hormel Natural Choice brand.

-

JBS Foods has a significant presence in the red meat industry, with a diverse portfolio that includes various brands under pork and beef, such as Swift, Primo, Wicked Pig, and Seven Point Australian Pork, among others.

Key Red Meat Companies:

The following are the leading companies in the red meat market. These companies collectively hold the largest market share and dictate industry trends.

- Hormel Foods Corporation

- JBS Foods

- W.H. Group

- Tyson Foods, Inc.

- Kraft Heinz Company

- Cargill, Incorporated

- ConAgra Foods Inc.

- BRF SA

- OSI Group, LLC.

- Tönnies Group

- SYSCO Corp.

- Smithfield Foods Inc.

- The Scottish Goat Meat Company

- Irish Country Meats

Recent Developments

-

In October 2023, Tonnies Holding entered into a joint venture agreement with the Dekon Group to establish slaughterhouse and butchery facilities in Sichuan, China. It invested USD 530 million, with approximately USD 158 million allocated to the slaughter and cutting center.

-

In June 2023, Walmart announced plans for its own beef processing facility for case-ready meat for its stores in Olathe, KS.

-

In April 2023, Swift Prepared Foods, a subsidiary of JBS Foods, inaugurated its latest facility - Principe Foods, specializing in the production of premium Italian meats and charcuterie.

Red Meat Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 948.2 billion

Revenue forecast in 2030

USD 1,350.2 billion

Growth rate (Revenue)

CAGR of 6.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type; distribution channel; region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S, Canada, Mexico, Germany, Italy, Belgium, France, Netherlands, China, Japan, India, Australia & New Zealand, Brazil, South Africa; Belgium; France; Netherlands

Key companies profiled

Hormel Foods Corporation; JBS Foods; W.H. Group; Tyson Foods, Inc.; Kraft Heinz Company; Cargill, Incorporated; ConAgra Foods Inc.; BRF SA; OSI Group, LLC.; Tönnies Group; SYSCO Corp.; Smithfield Foods Inc; The Scottish Goat Meat Company; Irish Country Meats

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Red Meat Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global red meat market report based on type, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Beef

-

Pig

-

Sheep & Goat

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

B2B

-

B2C

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global red meat is expected to grow at a compounded growth rate of 6.1% from 2024 to 2030, reaching USD 1,350.22 million by 2030.

b. The global red meat market size was valued at USD 899.86 billion in 2023 and is expected to reach 948.27 billion in 2024.

b. North America accounted for a revenue share of 26.8% in 2023. The demand for red meat, particularly beef, in North America plays a significant role in driving the market. Beef has a significant role in the traditional American diet, with popular dishes such as meatloaf, steaks, and hamburgers often highlighting beef as the primary ingredient.

b. The global red meat market is witnessing substantial expansion, propelled by various factors. These include heightened consumption and demand, increasing awareness of health and nutrition, the expansion of global trade, and the innovation and diversification of red meat products.

b. Some key players operating in the red meat market are Hormel Foods Corporation, JBS Foods, W.H. Group, Tyson Foods, Inc., Kraft Heinz Company, Cargill, Incorporated, and others

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."