- Home

- »

- Electronic Devices

- »

-

Power Management System Market Size, Share Report 2030GVR Report cover

![Power Management System Market Size, Share & Trends Report]()

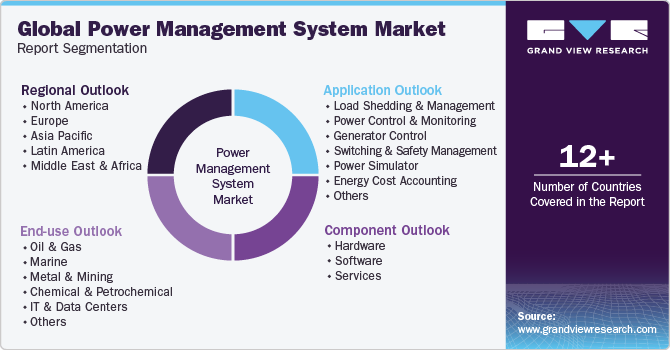

Power Management System Market Size, Share & Trends Analysis Report By Component, By Application (Load Shedding & Management, Power Control & Monitoring, Generator Control), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-263-7

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Semiconductors & Electronics

Power Management System Market Trends

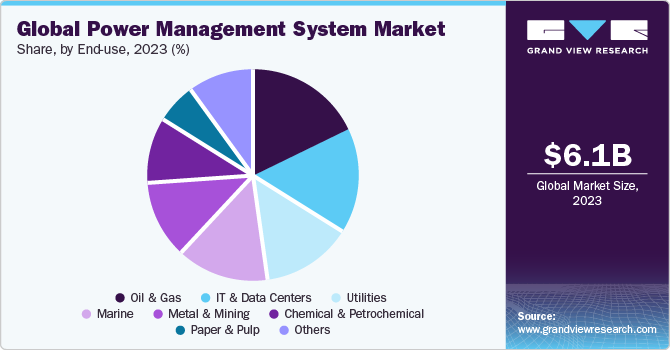

The global power management system market size was estimated at USD 6.13 billion in 2023 and is expected to grow at a CAGR of 6.9% from 2024 to 2030. Factors such as the increasing importance of energy efficiency across industries and growing environmental sustainability awareness drive the demand for power management systems. Moreover, the rising adoption of sustainable and renewable energy sources, such as solar and wind power, presents significant growth opportunities for the market as it requires advanced power management systems to integrate and manage fluctuating renewable energy inputs.

Businesses and consumers seek solutions that optimize energy consumption, reduce waste, and lower operational costs. Regulatory initiatives promoting energy-efficient practices further boost the adoption of power management systems. The systems also include real-time monitoring, predictive analytics, and intelligent control, which enable energy efficiency goals. The Energy Efficiency 2023 report by the International Energy Agency highlights a significant increase in global energy efficiency policies in response to the energy crisis that started due to Russia's invasion of Ukraine. Since 2020, there has been a 45% rise in investments in energy efficiency. In 2022, 75% of global energy demand countries improved their energy efficiency policies or introduced new policies.

There is a growing expectation for uninterrupted power supply to ensure the continuous operation of businesses and homes. However, severe storms, aging infrastructure, complex electrical distribution systems, and expanding distributed energy networks increase the risk of grid instability and power disruptions. To address such issues, IoT-enabled sensors, electrical meters, smart breakers, and other intelligent equipment are needed to monitor electrical conditions continuously. Combining digital technologies with power management systems enhances efficiency, reduces downtime, and enables speedy decision-making processes.

The COVID-19 pandemic had a negative impact on the power management system market. During the pandemic, power management requirements experienced setbacks due to lockdowns and changes in electricity demand and consumption. During the lockdown, there was a decrease in electricity demand due to the closure of many services and industries. However, there was an increase in residential use, which partially compensated for this decline. As a result of these changes, there was a shift towards renewable energy sources in all major regions due to the decreased demand for electricity, the lower operating costs of renewables, and regulations prioritizing their access to the grid. A study conducted by Stanford University revealed that during the initial phase of the COVID-19 pandemic in April 2020, electricity consumption decreased by 7.6 percent worldwide. This drop was more significant and faster than the 7% fall observed during the 2008 global financial crisis.

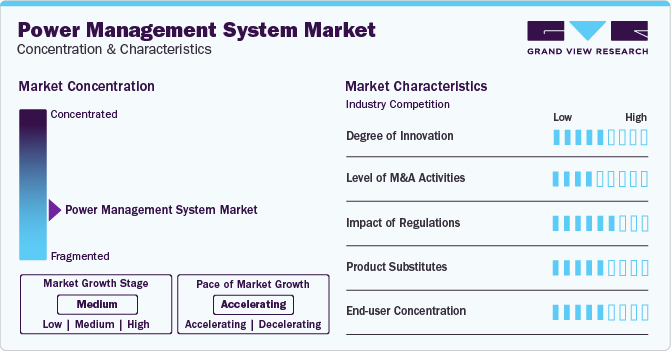

Market Concentration & Characteristics

The power management system market growth stage is medium, and the pace is accelerating. The increasing digitalization and development of smart infrastructure are driving the adoption of power management systems. As more industries integrate Industry 4.0 and smart technologies, there is a growing need for smart power solutions that connect seamlessly with devices, sensors, and automation systems. Power management systems offer real-time data analytics and remote monitoring, thus driving the market's growth. Combining digital technologies with power management systems enhances efficiency, reduces downtime, and enables speedy decision-making processes.

Several companies are introducing new solutions to cater to the demand in the market. For instance, in December 2023, Eaton, a U.S.-based intelligent power management company, launched G4, a new rack power distribution unit (PDU) that offers an innovative solution for data centers and edge facilities. The G4 PDU can handle various equipment and facility types, allowing data center operators to use a single PDU across multiple locations. This feature saves time, reduces costs, and simplifies power management.

The power management system market is fragmented, featuring several global and regional players. The market players are investing in research & development (R&D) to develop advanced solutions and gain a competitive edge. Moreover, they are entering into partnerships and mergers & acquisitions as the market is characterized by innovation, disruption, and rapid change.

In August 2023, General Electric, a U.S.-based high-tech industrial company, announced the acquisition of Greenbird Integration Application AS, a Norwegian data integration platform provider company that specializes in working with utilities. This acquisition demonstrates GE's commitment to investing in technologies that help accelerate the development of a sustainable energy grid. The strategy aimed to accelerate the development of GridOS, a software portfolio exclusively designed for a clean energy grid.

Component Insights

The hardware segment led the market with the largest revenue share of 70.8% in 2023 and is expected to continue to dominate the industry over the forecast period. The demand for power management systems is rising due to the increasing adoption of automation in various industries. Sensors, meters, and controllers are essential hardware components in automation systems. Governments worldwide are implementing regulations and initiatives to promote energy efficiency and reduce carbon emissions, increasing the demand for power management systems. Also, the hardware segment in the power management system market is expected to grow due to the increasing adoption of automation in the industry, such as using Artificial Intelligence (AI), the Internet of Things (IoT), and cloud platforms.

The software segment is anticipated to witness the fastest CAGR during the forecast period. The software segment is expected to grow due to the adoption of automation in the industry, IoT, and cloud platforms worldwide. Software in power management systems is used for various applications, such as performance monitoring, load profiling and scheduling, outage scheduling, maintenance and inspection, optimal power flow, automatic generation control and dispatch, data security, and others. The software can also be used for supervisory control and data acquisition (SCADA), advanced distribution management solutions (ADMS), outage management systems (OMS), generation management systems (GMS), and others.

Application Insights

The load shedding & management segment held the largest revenue share in 2023. Load shedding and management in a power system involve various strategies and technologies that help balance the supply and demand of electricity. It is used during periods of high demand or when the system is unstable. The process includes temporarily disconnecting some loads from the grid to prevent a complete blackout and maintain system stability. Load shedding refers to reducing total electricity consumption for a specific site, while load shifting involves using the same amount of power at different times. Controlled brownouts are intentional reductions or cuts of power to prevent supply failure. Load shifting helps integrate irregular renewable energy sources by linking energy consumption with high-generation periods.

The European Union (EU) aims to reduce final energy consumption by at least 11.7% compared to projected energy use for 2030. On July 25, 2023, the EU completed the legislative process to strengthen the Energy Efficiency Directive. The new legislation, with the updated binding target, was enforced in all EU countries on October 10, 2023. The goal of this target is to lower the EU's final energy consumption by 11.7% by the year 2030, as compared to the estimated energy usage for 2030, based on the 2020 reference scenario.

The power control & monitoring segment is expected to witness the fastest CAGR during the forecast period. Power control and monitoring involves a network of meters connected to the internet, providing real-time data on the power system in a facility. It utilizes online software to identify potential problems in the electrical system. Power monitoring is growing due to the increasing focus on efficient power utilization and industrialization, along with the need to maximize the reliability of electricity infrastructure. The implementation of power monitoring systems has risen due to the increasing adoption of smart grid technologies and a focus on industrial development. Furthermore, the growing digitalization and cloud computing trend has become a significant commercial and industrial power monitoring and control driver.

End-use Insights

Based on end-use, the oil & gas segment held the largest revenue share in 2023 and is projected to grow at a significant CAGR over the forecast period. The increased global demand for energy has led to a rise in oil exploration and production activities in remote and challenging environments. Power interruptions during these operations can result in significant financial losses, so the industry is prioritizing advanced power management solutions. These systems ensure continuous power supply, incorporate emergency shutdown systems, adhere to regulatory standards, and reduce the industry's environmental carbon footprint by integrating renewable energy sources. Adopting advanced technologies for monitoring, analytics, and optimizing energy usage further drives the industry's continued growth in the market.

According to the U.S. Energy Information Administration (EIA), the global oil demand is expected to rise between 3% and 10% by 2030 and 6% and 42% by 2050, compared to 2022. The High Economic Growth case shows the most significant increase in global oil demand, and global oil production is set to reach approximately 120 million barrels per day by 2050.

The IT & data centers segment is expected to witness the fastest CAGR during the forecast period. The demand for digital services, cloud computing, and data storage has led to the growth of the IT & Data centers segment in the power management market. Efficient power management systems are vital for data centers to ensure a reliable power supply, optimize energy usage, and reduce operational costs. Power management solutions are also essential in achieving energy efficiency, reducing carbon footprint, and meeting environmental standards. Adopting power management technologies is vital for companies striving to enhance their corporate social responsibility.

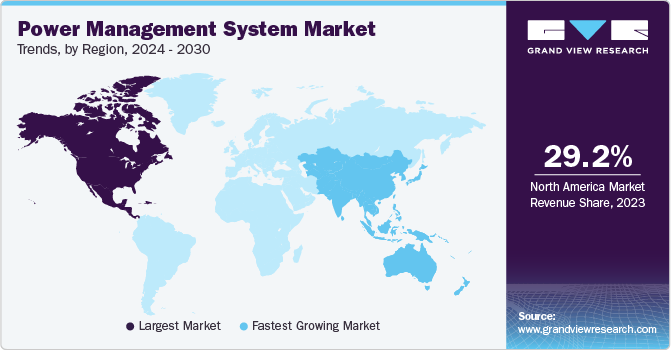

Regional Insights

North America dominated the market with a revenue share of 29.2% in 2023. The increasing use of smart grids and IoT technologies is driving the growth of power management systems, as they allow for better monitoring and control of energy consumption. The demand for IoT-enabled technology is increasing, resulting in significant investments by key players into new manufacturing plants and power management capabilities. For instance, in August 2023, Eaton announced investments of over USD 500 million in its manufacturing and operational facilities in North America to meet the increasing demand for electrical solutions.

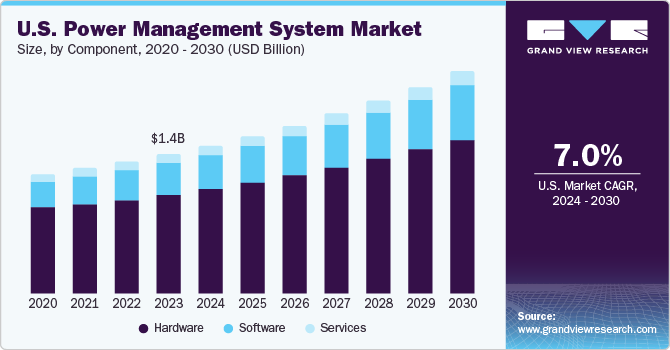

U.S. Power Management System Market Trends

The U.S. is expected to dominate the power management system market in North America and captured a share of over 20% of the global community cloud market in 2023. The demand for power management systems is rising due to the growing need for energy efficiency. The increasing focus on environmental concerns also drives the demand for these systems. The energy demand is expected to change with the growing population and rising temperatures. Climate change is increasing the frequency and severity of extreme weather events. Moreover, the investment in climate-resilient infrastructure, implementation of smart grid technologies & power management systems, and promotion of renewable energy sources would reduce the impact of severe weather conditions and drive market growth in the country.

Europe Power Management System Market Trends

The growth of cloud computing in Europe contributes to the growth of the power management system market. It drives the demand for data centers and increases the adoption of IoT and cloud-based platforms. The rising popularity of cloud computing services in European countries has led to greater efficiency and cost-effectiveness in IT, which in turn is driving the demand for cloud-based data centers. Cloud computing impacts power management systems through data center growth while presenting opportunities for energy optimization and power management within cloud infrastructure.

The UK market is expected to grow at a significant CAGR over the forecast period. The UK's focus on electric vehicles (EVs) and the expanding EV market increased demand for power management systems. Smart power management is necessary to efficiently handle the rising electricity demand from the charging infrastructure for electric vehicles. The growth of the EV market is anticipated to create more opportunities for power management system manufacturers as the demand for energy management systems and efficient charging infrastructure is expected to grow.

Germany dominated the power management system market in Europe. The growth of renewable energy sources is expected to drive the demand for power management systems, which can optimize energy consumption based on weather forecasts. Therefore, the reduction in energy consumption and the expansion of renewable energy sources in Germany are expected to drive the country's power management system market growth. In January 2024, Germany declared plans to reduce private and public sector energy consumption by 26.5% by 2030. Reducing energy consumption requires implementing energy-efficient solutions, including adopting power management systems. Moreover, the German government aims to increase the share of renewables in electricity generation to 65% by 2030, which requires the expansion of transmission and distribution infrastructure and improvements in taxation and market regulation.

Asia Pacific Power Management System Market Trends

The Asia Pacific is anticipated to grow at the fastest CAGR of 7.7% during the forecast period. The Asia Pacific region's power management system market is increasing due to the integration of advanced power management systems that handle the variability and irregularity associated with renewable energy sources such as solar and wind. There is an increasing investment in renewable energy sources across the region due to environmental concerns and to reduce dependence on fossil fuels.

China dominated the power management system market in 2023 in the region. China's Industrial Internet of Things (IIoT) drives the power management system market significantly. The country's Industry 4.0 initiatives, centered on the digital transformation of manufacturing, rely heavily on IIoT technologies. Power management systems are essential to these initiatives, providing the necessary infrastructure for efficient and intelligent energy management in smart factories. According to the China Academy of Industrial Internet (CAII), the industrial internet in China has grown significantly in recent years and is now worth over USD 167.7 billion. In 2022, the industry witnessed an 8.7% year-on-year growth, with the added value of China's Industrial Internet reaching USD 640 billion, which accounts for 3.64% of the country's GDP.

The Japan market is expected to grow at a significant CAGR over the forecast period. The growth of the power management system market in Japan is attributed to microgrid implementation, which enhances disaster resilience, as it is prone to earthquakes and tsunamis. With its mountainous terrain and remote areas, Japan is exploring microgrid solutions to ensure a reliable power supply. Power management systems are integral to effectively operating microgrids, optimizing energy flow, and supporting decentralized energy generation in remote locations.

Middle East & Africa Power Management System Market Trends

The need for energy efficiency and grid resilience is driving investments in modernizing power distribution systems in the MEA region. With growing concerns about energy security, climate change, and natural disasters, there is a heightened focus on enhancing the efficiency, reliability, and resilience of power grids. Utilities are deploying advanced metering infrastructure (AMI), distribution automation systems, and grid monitoring technologies to optimize energy distribution, detect and respond to outages, and improve system reliability. Additionally, the adoption of distributed energy resources (DERs) such as rooftop solar panels, battery storage systems, and microgrids is decentralizing power generation and distribution, making power systems more resilient to disruptions and enabling greater energy independence for consumers and communities.

The Saudi Arabia market is expected to grow at a significant CAGR over the forecast period. The development of smart cities and smart grid adoption significantly drives the power management system market growth in Saudi Arabia. Power management systems play an essential role in the infrastructure of smart cities by ensuring that energy is used efficiently in smart buildings, transportation systems, and urban services. The country implemented a new strategy for smart cities to transform municipal and residential services into smart services using digital technologies and the Internet of Things (IoT).

Key Power Management System Company Insights

Some of the key players operating in the market include ABB, General Electric, Siemens, Eaton, Schneider Electric, Emerson Electric Co., OMRON Corporation, and others.

-

ABB's offerings include advanced grid automation technologies, substation automation solutions, SCADA systems for real-time monitoring and control, energy management systems for optimizing energy consumption, microgrid solutions for localized energy systems, digital substation technologies leveraging digital advancements, power quality solutions addressing voltage fluctuations and harmonics, as well as energy storage systems to integrate renewable sources and enhance grid stability.

-

Eaton offers a comprehensive set of solutions for efficient and reliable power management. Their portfolio includes electrical distribution and control systems, power quality solutions including UPS systems, surge protection, backup power solutions with generators and transfer switches, and monitoring and management tools for optimizing power usage. Eaton's capability extends to energy storage solutions, microgrid implementations for localized power systems, and smart grid technologies that enhance grid efficiency.

-

Emerson Electric Co. offers solutions for electrical distribution, monitoring, and energy management, contributing to enhanced efficiency and reliability in electrical systems. Emerson's portfolio extends to critical applications with UPS systems, data center solutions encompassing precision cooling and power distribution units, and services for improving the reliability of electrical infrastructure.

-

OMRON Corporation provides equipment for monitoring electric power to aid in energy conservation, as well as sensing and control equipment for environmental monitoring in clean rooms. It includes advanced automation and control systems, such as programmable logic controllers (PLCs), human-machine interface (HMI) devices, and energy management solutions, which help optimize power consumption and improve overall efficiency.

Key Power Management System Companies:

The following are the leading companies in the power management system market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- General Electric

- Siemens

- Eaton

- Schneider Electric

- Emerson Electric Co.

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- Rockwell Automation

- Honeywell International Inc.

- Fuji Electric Co., Ltd.

- LARSEN & TOUBRO LIMITED.

- OMRON Corporation

Recent Developments

-

In October 2023, Eaton, a US-based intelligent power management company, launched the Gigabit Network Card (Network-M3), which combines cybersecurity features with connected backup power. The Network-M3 card utilizes the Eaton Gigabit Network Card technology's advanced capabilities and new innovative features to meet specific cybersecurity requirements. It offers web-based monitoring and guarded capacities and provides a vision for power usage, allowing it to monitor and control power systems better as security needs to grow.

-

In November 2022, ABB, an electrification and automation technology and solutions provider, launched ABB Ability OPTIMAX, an energy management system for hydrogen production. The software aims to reduce production costs by up to 20% for hydrogen-producing companies. ABB's OPTIMAX software supports scaling up hydrogen production capacity by 50 times and reducing the cost of producing green hydrogen by 50%. The software covers all aspects of a hydrogen plant lifecycle, from simulation and design to concurrent monitoring during operation. It measures power flows and carbon dioxide emissions, providing data to optimize energy consumption and minimize waste.

Power Management System Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.50 billion

Revenue forecast in 2030

USD 9.69 billion

Growth rate

CAGR of 6.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Netherlands; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

ABB; General Electric; Siemens; Eaton; Schneider Electric; Emerson Electric Co.; MITSUBISHI HEAVY INDUSTRIES, LTD.; Rockwell Automation; Honeywell International Inc.; Fuji Electric Co., Ltd.; LARSEN & TOUBRO LIMITED; OMRON Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Power Management System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global power management system market report based on the component, application, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Controllers

-

Sensors

-

Switches, Relays, & Gateways

-

Others

-

-

Software

-

Supervisory Control & Data Acquisition (SCADA)

-

Advanced Distribution Management Components (ADMS)

-

Outage Management Component (OMS)

-

Generation Management Components (GMS)

-

Others

-

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Load Shedding & Management

-

Power Control & Monitoring

-

Generator Control

-

Switching and Safety Management

-

Power Simulator

-

Energy Cost Accounting

-

Data Historian

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Marine

-

Metal & Mining

-

Chemical & Petrochemical

-

IT & Data Centers

-

Utilities

-

Paper & Pulp

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global power management system market size was estimated at USD 6.13 billion in 2023 and is expected to reach USD 6.50 billion in 2024

b. The global power management system market is expected to grow at a compound annual growth rate of 6.9% from 2024 to 2030 to reach USD 9.69 billion by 2030

b. North America dominated the power management system market with a market share of 29.2% in 2023. The increasing use of smart grids and IoT/AI technologies is driving the growth of power management systems, as they allow for better monitoring and control of energy consumption

b. Some key players operating in the power management system market include ABB, General Electric, Siemens, Eaton, Schneider Electric, Emerson Electric Co., MITSUBISHI HEAVY INDUSTRIES, LTD., Rockwell Automation, Honeywell International Inc., Fuji Electric Co., Ltd., LARSEN & TOUBRO LIMITED., and OMRON Corporation

b. Factors such as the increasing importance of energy efficiency across industries and growing environmental sustainability awareness drive the demand for power management systems

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."