- Home

- »

- Medical Devices

- »

-

Laboratory Products And Services Outsourcing Market Report, 2030GVR Report cover

![Laboratory Products And Services Outsourcing Market Size, Share & Trends Report]()

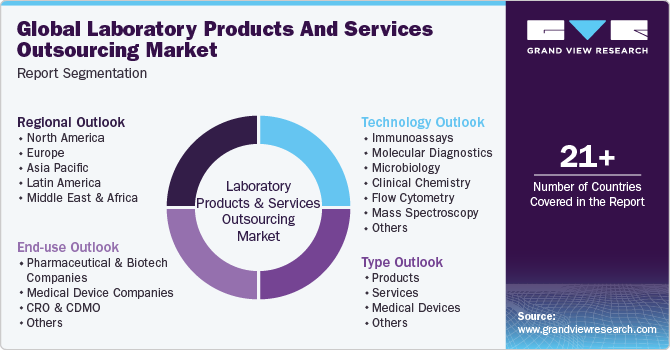

Laboratory Products And Services Outsourcing Market Size, Share & Trends Analysis Report By Type (Products, Services), By Technology (Molecular Diagnostics, Immunoassays), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-264-5

- Number of Pages: 250

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Healthcare

Market Size & Trends

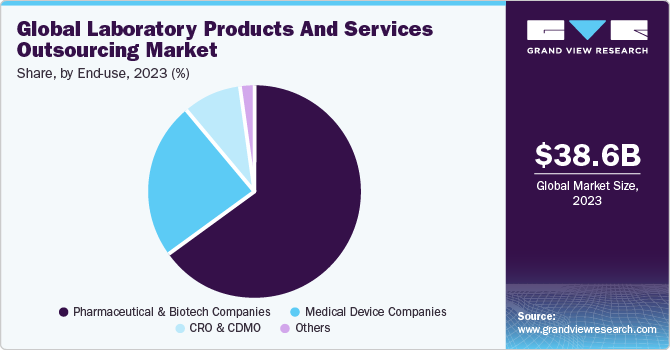

The global laboratory products and services outsourcing market size was estimated at USD 38.56 billion in 2023 and is projected to grow at a CAGR of 8.21% from 2024 to 2030. Growth in the market can be attributed to the rising need to outsource product manufacturing and services to curb cost pressures. Moreover, growing number of clinical trials, adoption of personalized medicine & novel therapeutics, and rising R&D investment in the healthcare industry are boosting the product demand. In addition, technological advancements in medical equipment are among the key factors driving market growth.

A growing number of clinical trials fuels the growth of the market. According to the WHO article published in 2023, the U.S. witnessed a substantial total of 168,520 clinical trials, with Canada closely following with 34,041 reported trials. This highlights a significant reliance on external resources across North America for laboratory services and products. An increasing number of clinical trials leads to growing demand for outsourced solutions in research and development efforts, thereby driving the expansion of the market.

Increasing adoption of personalized medicine and novel therapeutics is boosting the growth of the market. According to the Personalized Medicine at FDA article, in 2022, the U.S. Food and Drug Administration (FDA) granted 12 innovative personalized medicines, marking a significant milestone in the expansion of targeted treatments. This approval also included broadening the indications for numerous existing personalized therapies and introducing two novel siRNA therapies. Additionally, the FDA offered crucial guidance on the development of gene and cell-based therapies while simultaneously granting approval for the use of five such therapies. Moreover, the FDA's approval of several new diagnostic indications in 2022 supported more precise and targeted treatment decisions for various health conditions, thereby driving the demand for laboratory products and services outsourcing.

In 2023, the momentum behind personalized medicine continued to flourish as it claimed over one-third of new FDA drug approvals for the fourth consecutive year. This trend was particularly evident in the rare disease arena, where the number of approved treatments more than doubled from the previous year. In 2023, the FDA recognized 16 new personalized treatments designed to treat rare disease patients, a significant leap from the six approved in 2022. These approvals encompassed a diverse range of conditions, including seven cancer drugs and three treatments for other diseases and conditions.

The annual report titled "Personalized Medicine at FDA: The Scope & Significance of Progress in 2023" highlights the strides made by diagnostics and biopharmaceutical companies in introducing innovative tests and treatments to market, enhancing the efficiency and efficacy of medical interventions by precisely targeting treatments to individual patients when needed. This continued progress emphasizes the crucial role of laboratory products and services outsourcing in supporting the development and delivery of personalized medicine.

Market Concentration & Characteristics

The laboratory products and services outsourcing market growth stage is medium and its growth is anticipated to accelerate. Key drivers include technological advancements, evolving regulatory landscapes, and the globalization and outsourcing of product processes. These factors offer distinct advantages, allowing organizations to access specialized capabilities and optimize operational efficiency.

The market exhibits a high degree of innovation, with continuous advancements in technology and processes. These innovations drive efficiency and specialization, enabling providers to offer innovative solutions to meet evolving client needs and industry standards.

Regulations have a high impact on the market, influencing compliance requirements, quality standards, and market entry barriers. Adherence to regulatory frameworks shapes operational practices, service offerings, and strategic decisions, impacting market dynamics and competitiveness.

The level of M&A (mergers and acquisitions) activities in the market is high, with periodic consolidation and strategic partnerships reshaping the competitive landscape. M&A transactions driven by expansion into new markets, diversification of service portfolios, and efforts to achieve economies of scale. For instance, In October 2023, Labcorp acquired Baystate Health, Inc.’s outreach laboratory business, including laboratory service centres in Massachusetts. This acquisition was aimed at improving the efficiency of routine & specialty lab testing.

Service expansion in the market is medium, with providers diversifying offerings to meet evolving client needs and market demands. This expansion includes the introduction of new testing methodologies, enhanced analytical capabilities, and expanded geographical coverage to cater to a broader client base. Additionally, providers increasingly offer value-added services such as consulting, regulatory compliance support, and data analytics to differentiate themselves in the competitive landscape.

The market is experiencing significant regional expansion, with providers strategically expanding their presence to new geographic areas. This expansion allows them to tap into emerging markets, capitalize on the growing demand for laboratory services, and establish a broader client base. Additionally, it facilitates closer proximity to clients, enabling faster response times and more personalized service delivery.

Type Insights

The product segment led the market and accounted for 62.2% of the global revenue in 2023. Products encompass several equipment and disposables such as test tubes and pipettes, reagents, chemicals, and other essential supplies necessary for conducting experiments and analysis. Advancements in scientific research necessitate precise and efficient laboratory operations, fueling the need for general, analytical, clinical, support, and specialty equipment. This demand for advanced instrumentation, coupled with the requirement for precise chemical analysis and medical diagnostics, contributes to the dominance of equipment outsourcing in the market. For instance, in April 2024, Thermo Fisher Scientific launched the ENERGY STAR specialized TSX Universal Series ULT Freezers. These state-of-the-art freezers provide enhanced temperature control and faster recovery times, ensuring optimal sample preservation.

The service segment is anticipated to grow at the fastest CAGR over the forecast period. The increasing complexity of drug development processes and the stringent regulatory requirements necessitate specialized expertise and advanced analytical capabilities, driving demand for bioanalytical testing services. Sub-categories such as ADME, PK, PD, bioavailability, and bioequivalence testing are essential for evaluating the safety and efficacy of pharmaceutical compounds. Despite notable progress in drug discovery and development, the failure rate remains substantial, with approximately 90% of drug candidates failing during clinical trials. This failure rate stems from multiple factors, including insufficient clinical efficacy, unmanageable toxicity, unfavorable drug-like properties, and inadequate strategic planning, thus, contributing to the growth of this segment.

Technology Insights

The molecular diagnostics segment accounted for the largest market share in 2023. Advancements in molecular biology techniques and the adoption of personalized medicine approaches further boost the demand for molecular diagnostic services. Advancements in molecular diagnostics have revolutionized disease detection, offering rapid and precise results. According to NCBI article published in April 2023, techniques such as quantitative PCR and digital PCR enable automated detection and quantification of pathogens. Methods including high-resolution melting and Loop-Mediated Isothermal Amplification provide fast genotyping and screening. Recombinant Polymerase Amplification allows on-site pathogen detection and Nucleic Acid Sequence-Based Amplification offers high selectivity for RNA viruses. Solid-Phase and Liquid-Phase Chips provide high-throughput screening, and Next-Generation Sequencing detects emerging pathogens with unparalleled sensitivity. Third-Generation Sequencing offers real-time field analysis, but with limited throughput and higher costs. These innovations have transformed disease surveillance, paving the way for future diagnostic advancements and global preparedness against infectious diseases.

The immunoassays segment is anticipated to grow at a fastest CAGR over the forecast period. Immunoassays offer high sensitivity and specificity, making them valuable tools for disease diagnosis and drug development processes. Technological advancements like multiplexing and automation have revolutionized immunoassay platforms, enabling simultaneous analysis of multiple analytes in a single sample, reducing time and costs. Multiplex immunoassays, including Luminex bead-based platforms and protein microarrays, offer high analytical accuracy in biomedical research and clinical diagnostics. Emerging technologies like organ-on-a-chip further enhance multiplexing capabilities, allowing simultaneous analysis of biomarkers with high sensitivity and minimal user intervention. Planar microarrays and suspension arrays employ traditional immunoassay methods, enabling the determination of numerous analytes from small sample volumes. Thus, aforementioned factors are driving the segmental revenue growth.

End-use Insights

Based on end-use, the market is segregated into pharmaceutical & biotech companies, medical device companies, CRO & CDMO, and others. The medical device companies segment dominated the market in 2023. Medical device companies fuel growth in lab outsourcing with increasing device demand, regulatory requirements, and the need for quality assurance. Outsourcing enables access to expertise and technologies without internal investment, meeting stringent regulatory standards while ensuring safety and efficacy.

The pharmaceutical & biotech companies segment is anticipated to grow at a fastest CAGR over the forecast period. Pharmaceutical & biotech companies drive growth in lab products and services outsourcing due to R&D focus, outsourcing trends, and demand for specialized expertise. The rising prevalence of complex diseases and personalized medicine also contribute to this segment's expansion.

Regional Insights

North America held the largest market share of 37.98% in 2023. Several factors such as technological advancements, stringent regulatory requirements, and the increasing demand for specialized services contribute to this market dominance. Additionally, the presence of leading pharmaceutical & biotechnology companies and a strong emphasis on research & development further propels market expansion. For instance, in May 2023, Charles River Laboratories introduced next generation sequencing services for bacterial identification and fungal ID. This new offering enables simultaneous sequencing of millions of DNA fragments, providing valuable insights into microbial identification for pharmaceutical and personal care manufacturers.

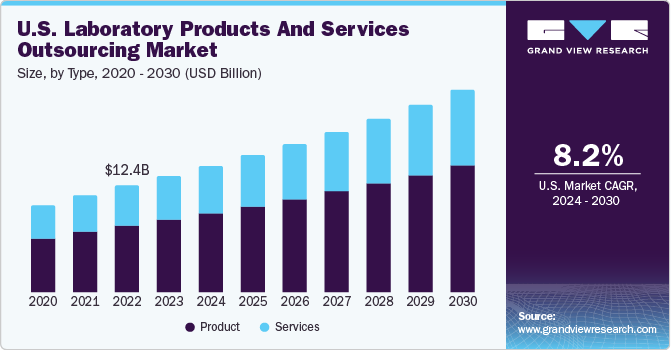

U.S. Laboratory Products And Services Outsourcing Market Trends

The market in the U.S. held the largest share in North America in 2023. This is attributable to a robust healthcare infrastructure, technological advancements, a highly skilled workforce, favorable regulatory frameworks, and the presence of leading pharmaceutical and biotechnology companies. Additionally, the increasing demand for specialized laboratory services and the growing trend of outsourcing non-core functions among healthcare industry have further solidified the country's dominance in the market.

Europe Laboratory Products And Services Outsourcing Market Trends

The market in Europe is expected to grow significantly due to technological advancements, evolving regulatory landscapes, and increasing demand for specialized services. European providers offer various laboratory solutions, including testing, research, and consulting services, with a strong focus on innovation and quality.

The laboratory products and services outsourcing marketin Germany held the largest share in 2023 in Europe, owing to several trends shaping the landscape. Increasing importance on precision medicine and personalized healthcare solutions is driving demand for specialized laboratory services designed for individual patient needs. Moreover, advancements in digitalization and automation are revolutionizing laboratory processes, leading to increased efficiency, accuracy, and cost-effectiveness. Additionally, a growing focus on compliance with stringent regulatory requirements, particularly in data security and quality assurance, influences service offerings and provider selection.

The UK laboratory products and services outsourcing market is anticipated to grow substantially over the forecast period. Factors such as advancements in technology, increasing demand for specialized services, and the need for cost-effective solutions are expected to fuel market expansion. Additionally, collaborations between outsourcing providers and healthcare organizations and a focus on innovation and quality are opportunistic for the market growth. With a strong healthcare infrastructure and a skilled workforce, the UK remains a key country in the global laboratory outsourcing landscape, positioned for continued growth and innovation in the coming years.

Asia Pacific Laboratory Products And Services Outsourcing Market Trends

Asia Pacific market is expected to grow at a CAGR of 8.8% over the forecast period. Sustained growth has characterized the global clinical trials landscape in the region, despite disruptions from the COVID-19 pandemic and macroeconomic factors. According to the Verdict Media Limited article published in January 2023, nearly half of the approximately 27,000 clinical trials initiated in 2021 are located in the Asia-Pacific region. The region has emerged as a hub of sustainable growth and immense future opportunity. This trend underlines the increasing importance of APAC as a preferred destination for clinical research and development, driving demand for laboratory products and services outsourcing to support these trials and meet the growing needs of the pharmaceutical and biotechnology industries in the region.

The China laboratory products and services outsourcing market held the largest share in 2023 due to high R&D infrastructure, integration of advanced technologies, and availability of expertise. Moreover, the availability of low-cost labor is one of the major factors for pharmaceutical firms across the globe to outsource laboratory products and services to China.

The laboratory products and services outsourcing market in Japan is expected to grow at a lucrative pace over the forecast period due to rising product development costs stimulating outsourcing to optimize expenses. Furthermore, continuous technological advancements in novel product development and evolving regulatory scenario is likely to propel market demand.

The India laboratory products and services outsourcing market is anticipated to grow at the fastest CAGR over the forecast period owing to its large talent pool, robust infrastructure, favorable regulatory environment, and increasing demand for advanced laboratory testing and pharmaceutical research.

Latin America Laboratory Products And Services Outsourcing Market Trends

The market in Latin America is anticipated to grow at a substantial pace over the forecast period. The growth in the region is attributed to increasing demand for outsourced laboratory services driven by the region's expanding healthcare sector, rising research & development investments, and growing adoption of advanced technologies. Additionally, favorable government initiatives and regulatory reforms to promote innovation and attract foreign investment are expected to propel market growth.

The Brazil laboratory products and services outsourcing market is anticipated to grow at a significant CAGR over the forecast period. The country's large and diverse healthcare sector, rising demand for specialized laboratory services, increasing investments in research and development, and favorable government policies aimed at promoting innovation and attracting foreign investment are driving the market growth.

MEA Laboratory Products And Services Outsourcing Market Trends

The market in MEA is expected to grow substantially over the forecast period due to the region's increasing healthcare expenditure, rising demand for pharmaceutical products, and growing emphasis on outsourcing to streamline operations and reduce costs.

The laboratory products and services outsourcing market in South Africa is anticipated to grow at the fastest CAGR over the forecast period owing to high patient population. The country's ambitious vision initiative aims to transform the healthcare sector and promote innovation and investment in pharmaceutical manufacturing.

Key Laboratory Products And Services Outsourcing Company Insights

The major players operating across the market focus on adopting in-organic strategic initiatives such as mergers, partnerships, acquisitions, etc. The prominent strategies companies adopt are service launches, mergers & acquisitions/joint ventures, mergers, partnership & agreements, expansions, and others to increase market presence & revenue and gain a competitive edge driving market growth. Increasing adoption of inorganic strategic initiatives is anticipated to boost the market share of prominent players. For instance, in March 2023, Nemera announced a partnership with Nelson Labs Europe to provide integrated services. This strategic alliance gave the company a unique advantage over pharmaceutical & biotech customers by offering drug compatibility lab testing, analytical chemistry, and expert advice.

Key Laboratory Products And Services Outsourcing Companies:

The following are the leading companies in the laboratory products and services outsourcing market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific

- Charles River Laboratories

- Eurofins Scientific

- Labcorp

- Quest Diagnostics

- Parexel International Corporation

- Agilent Technologies

- PerkinElmer

- Bio-Rad Laboratories

- SGS SA

- Intertek Group plc

- WuXi AppTec, Inc

Recent Developments

-

In December 2023, Quest Diagnostics introduced a test panel to detect novel psychoactive substances, encompassing 88 compounds linked to designer drugs and illicit additives.

-

In September 2023, Bio-Rad Laboratories, Inc., introduced its PTC Tempo 384 Thermal Cyclers and PTC Tempo 48/48. These innovative instruments are designed to facilitate PCR applications across various domains, including translational and basic research, process development, and quality control.

-

In July 2023, NAMSA acquired Clinical Research Institute, a German based full service Contract Research Organization (CRO). This initiative was aimed to enhance & expand CRO offerings across Europe and other markets.

-

In June 2023, Eurofins Genomics introduced its advanced IVT mRNA Synthesis service. This innovative offering is designed to address the complexities of gene expression research, providing a transformative solution to researchers in the field.

Laboratory Products And Services Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 41.81 billion

Revenue forecast in 2030

USD 67.12 billion

Growth rate

CAGR of 8.21% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific; Charles River Laboratories; Eurofins Scientific; Labcorp; Quest Diagnostics; Parexel International Corporation; Agilent Technologies; PerkinElmer; Bio-Rad Laboratories; SGS SA; Intertek Group plc Inc; WuXi AppTec, Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Laboratory Products And Services Outsourcing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global laboratory products and services outsourcing market report based on type, technology, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Products

-

Equipment

-

General

-

Analytical

-

Clinical

-

Support

-

Specialty

-

Disposables

-

Others

-

Services

-

Pharmaceutical

-

Bioanalytical Testing

-

ADME

-

PK

-

PD

-

Bioavailability

-

Bioequivalence

-

Others

-

Method Development & Validation

-

Extractable & Leachable

-

Impurity Method

-

Technical Consulting

-

Others

-

Stability Testing

-

Drug Substance

-

Stability Indicating Method Validation

-

Accelerated Stability Testing

-

Photostability Testing

-

Others

-

-

Others

-

Medical Device

-

Biocompatibility Tests

-

Chemistry Test

-

Microbiology & Sterility Testing

-

Others

-

-

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Immunoassays

-

Molecular Diagnostics

-

Microbiology

-

Clinical Chemistry

-

Flow Cytometry

-

Mass Spectroscopy

-

Chromatography

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotech Companies

-

Medical Device Companies

-

CRO & CDMO

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global laboratory products and services outsourcing market size was estimated at USD 38.56 billion in 2023 and is expected to reach USD 41.81 billion in 2024.

b. The global laboratory products and services outsourcing market is expected to grow at a compound annual growth rate of 8.21% from 2024 to 2030 to reach USD 67.12 billion by 2030.

b. North America region dominated the laboratory products and services outsourcing market with a share of 37.98% in 2023. This is attributable to high number of clinical trials, advanced healthcare infrastructure, stringent regulatory guidelines, and constant research and development initiatives.

b. Some key players operating in the laboratory products and services outsourcing market include Thermo Fisher Scientific, Charles River Laboratories, Eurofins Scientific, Labcorp, Quest Diagnostics, Parexel International Corporation, Agilent Technologies, PerkinElmer, Bio-Rad Laboratories, SGS SA, Intertek Group plc Inc, WuXi AppTec, Inc.

b. Key factors that are driving the market growth include adoption of personalized medicine, increasing outsourcing trends among pharmaceutical companies, and surge in number of clinical trials among others.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."