- Home

- »

- Medical Devices

- »

-

Japan Contract Development & Manufacturing Organization Market Report 2030GVR Report cover

![Japan Contract Development Manufacturing Organization Market Size, Share & Trends Report]()

Japan Contract Development Manufacturing Organization Market Size, Share & Trends Analysis Report By Product Type (API, Drug Product), By Workflow (Clinical, Commercial), By Application (Oncology, Hormonal, Glaucoma), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-985-5

- Number of Pages: 127

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Japan CDMO Market Size & Trends

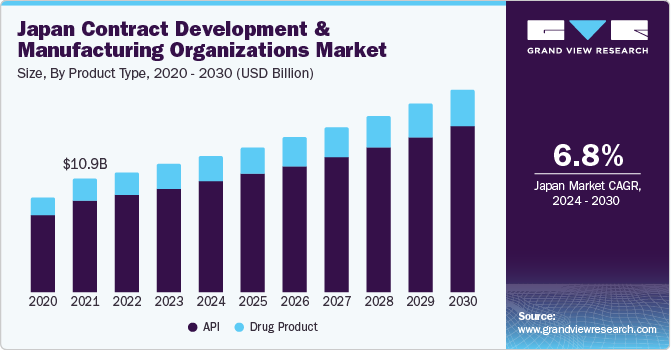

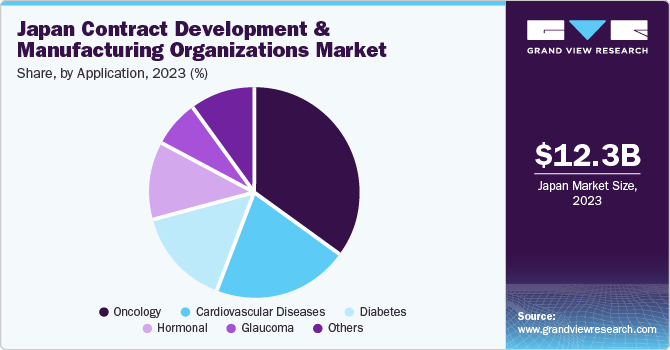

The Japan contract development and manufacturing organizations market size was estimated at USD 12.3 billion in 2023 and is expected to grow at a CAGR of 6.8% from 2024 to 2030. The increasing demand for biopharmaceuticals, the burden of diseases, and the rising geriatric population are some of the key growth drivers. Growing investments by various Contract Development and Manufacturing Organizations (CDMOs) for facility and service expansion are likely to boost the market growth over the forecast period.

The biopharmaceutical industry's margins also shrunk due to rising pricing pressure, regulatory challenges, and patent expiration. Contract services were viewed as a "strategic competitive weapon" by biopharmaceutical and pharmaceutical companies because they assisted in overcoming these issues. These services save their customers money and time, which could be efficiently utilized in operating and managing a manufacturing and research facility.

The COVID-19 pandemic significantly affected the industry in Japan. According to the World Health Organization (WHO), by September 2022, 20,488,312 cases of COVID-19 were reported in the country. The pandemic increased the demand for vaccines to prevent the disease in the country. However, despite a rise in the demand for COVID-19 vaccines, the rollout of vaccines was slow compared to other countries. Many CDMOs in Japan expanded their facilities to increase their capacity during the pandemic.

Contract manufacturing enables low-cost product development, reducing a product's overall manufacturing cost. Furthermore, outsourcing services aid in the removal of trade barriers and the entry of firms into foreign markets. Due to these benefits, several companies have chosen to outsource biopharmaceutical manufacturing rather than investing in production equipment or hiring skilled labor.

Market Concentration & Characteristics

The market is characterized by a moderate-to-high degree of innovation, including rapid advancements. Japan's strong focus on innovation and technology adoption enables CDMOs to leverage advanced manufacturing processes, automation, and digitalization to enhance efficiency and quality control. Furthermore, increasing demand for personalized medicine presents opportunities for CDMOs to develop tailored treatments and therapies that cater to individual patient needs, leveraging advancements in biotechnology and data analytics.

The market is also characterized by the leading players with moderate levels of merger and acquisition (M&A) activity and product launches. Market players like Lonza, CMIC HOLDINGS Co., LTD., CordenPharma International, Laboratory Corporation of America, Cambrex Corporation, Bushu Pharmaceuticals, and others are involved in research expenditures, new product launches, and merger and acquisition activities. For instance, in January 2022, Lonza launched Ylok Technology, which is used for the design and discovery of bispecific antibodies. The technology was developed to reduce the cost and time associated with the development of bispecific antibodies. Such strategic activities as M&A, expansions, partnerships, and collaboration are aimed at increasing companies’ competitiveness and expanding their geographic reach to help enter new territories.

Stringent regulatory requirements, particularly in pharmaceuticals and biotechnology, demand heightened compliance measures from CDMOs. These include adherence to Good Manufacturing Practices (GMP), stringent quality control standards, and thorough documentation practices. In addition, evolving regulatory frameworks necessitate continuous adaptation to ensure product safety, efficacy, and quality throughout the development and manufacturing processes. CDMOs must stay abreast of regulatory updates, embrace digitalization for enhanced documentation and traceability, and invest in robust quality management systems to navigate the complex regulatory landscape effectively.

The market is characterized by a moderate level of service expansion with the help of specialized expertise. CDMOs globally, including those in Japan, exhibited optimism through investments in cutting-edge technologies and facility expansions. These investments, often in collaboration with ambitious joint ventures, were pivotal in enhancing capabilities to meet the heightened demand for CDMO services amidst the global health crisis. Such advances in the near future might keep service expansion at a moderate level.

The regional expansion factor is crucial for any service provider in the market space. CDMO outsourcing facilities are expanding to accommodate this demand, equipped with state-of-the-art technology and expertise to characterize these complex therapies accurately. For instance, in June 2022, Catalent Inc. expanded its primary packaging capabilities for clinical supply at its site in Japan. The expansion included the addition of a high-speed blister packaging line.

Product Type Insights

The API segment dominated the market with a revenue share of 81.2% in 2023 and is also expected to witness the fastest CAGR of 7.0% over the forecast period. The growing burden of diseases such as cancer, diabetes, and cardiovascular disorders in Japan, initiatives by the government to improve access to generic drugs, and the high demand for biopharmaceuticals in Japan are some of the primary factors contributing to the segment growth. The CDMOs in Japan are actively trying to improve the manufacturing capacity of API to fulfill future demands. For instance, in April 2022, Sumitomo Chemical set up a new API manufacturing in Japan dedicated to manufacturing high-quality APIs and intermediates in the country. Moreover, in May 2022, Kyowa Kirin Co., Ltd., a pharmaceutical company in Japan, constructed a new biopharmaceutical API manufacturing building called the HB7 Building at its Takasaki Plant. This project aims to enhance Kyowa Kirin’s capabilities in biopharmaceutical API manufacturing. The building is set to be completed by April 2024, with operations starting in June 2024. Such initiatives by the market players have enhanced the segment growth.

The drug product segment is anticipated to register a CAGR of 5.9% over the forecast period. Based on drug products, the market is segmented into oral solid, semi-solid, liquid, and others. The oral solid dose segment accounted for the largest share of 46.8% in the market in 2023. The liquid dose segment is anticipated to experience the fastest CAGR of 8.2% from 2024 to 2030. The market is expanding due to growing market demands for biopharmaceuticals such as biologics, biosimilars, and cell and gene therapy.

Work Flow Insights

The commercial segment dominated the market with a revenue share of 88.0% in 2023. Growing demand for generic drugs in the country and a significant number of approvals for regenerative medicines and other biopharmaceutical drugs are key factors driving the demand for commercial drug CDMO services in the country. The country suffers from a high burden of chronic diseases, such as cancer, cardiovascular diseases, Alzheimer's, and others. The pandemic has improved the demand for manufacturing COVID-19 vaccines in the country. The above-listed factors are supporting the growth of the segment.

The clinical segment is expected to witness the fastest CAGR of 7.2% over the forecast period. In April 2018, Japan introduced the Clinical Trial Act owing to concerns over misconduct in clinical studies. The act emphasizes improving the quality of research. Specifically, it applies to interventional trials with unapproved or off-label medical product use or on-label medical product use sponsored by industries. The BMJ published a study regarding the impact of this act on the number of clinical trials performed in Japan between 2018 and 2020. The study used data from the University Hospital Medical Information Network Clinical Trials Registry (UMIN-CTR) and the Japan Registry of Clinical Trials (RCT). The study reported that there was a significant reduction in the number of interventional trials due to this act.

Application Insights

The oncology segment dominated the application category with a market share of 35.3% in 2023 and is also expected to register the fastest CAGR of 7.3% over the forecast period. The market for oncology is likely to expand with an increasing number of cancer cases in Japan. For instance, according to Cancer Tomorrow, cancer cases in Japan accounted for 1.03 million in 2020, and this number is expected to rise to 1.13 million by 2040. The growing number of cases in the country is expected to improve the demand for new therapeutics for treating cancer. This drives the demand for contract manufacturing and development services for cancer.

Furthermore, CDMOs are crucial in developing, manufacturing, and commercializing novel treatments like Akalux, ensuring their accessibility & availability to patients across Japan’s healthcare system. With the demand for advanced cancer therapies on the rise, CDMOs are poised to contribute significantly to the production & distribution of innovative drugs, supporting the country’s efforts to combat cancer and improve patient outcomes.

Key Japan CDMO Company Insights

Some of the key players operating in the market include CordenPharma, Wuxi AppTec, Cambrex Corporation, Recipharm AB, Lonza, Laboratory Corporation of America Holdings, Catalent, Inc., and others. The major players operating across the Japan market are focused on the adoption of in-organic strategic initiatives such as mergers, partnerships, acquisitions, etc. For instance, in March 2022, WuXi AppTec launched Tetracycline-Enabled Self-Silencing Adenovirus (TESSA) technology to accelerate the production of adeno-associated viruses for drugs in cell and gene therapy.

Key Japan CDMO Companies:

- CordenPharma International

- WuXi AppTec, Inc.

- Cambrex Corporation

- Recipharm AB.

- Lonza

- Novo Holdings (Catalent, Inc.)

- Laboratory Corporation of America

- Pharmaceutical Product Development, Inc. (Thermo Fisher Scientific, Inc.)

- Samsung Biologics

- FUJIFILM Corporation (FUJIFILM Diosynth Biotechnologies)

- Sumitomo Chemical Company, Limited

- CMIC HOLDINGS Co., LTD.

- Bushu Pharmaceuticals Ltd.

- Nipro Corporation

Recent Developments

-

In September 2022, Lonza collaborated with a biotechnology company, Touchlight. As per the collaboration, Lonza will expand its mRNA manufacturing portfolio with addition of different sources of DNA raw material from Touchlight, known as the Touchlight doggybone DNA, which will be used in manufacturing mRNA therapies

-

In May 2022, the CMIC HOLDINGS Co., LTD. subsidiary, OrphanPacific, Inc., entered into an agreement with Immedica Pharma AB for manufacture, development, and sale of glycerol phenylbutyrate in Japan.

-

In June 2022, the Laboratory Corporation of America expanded its clinical trial laboratory presence in Japan through its collaboration with a clinical laboratory testing service provider, BML.

-

In March 2022, Sumitomo Chemical Company, Limited expanded its facility in Japan to improve its capacity for manufacturing APIs and intermediates for small-molecule drugs.

-

In April 2022, Lonza expanded the capabilities of its Cocoon platform, which is used to manufacture automated cell therapy. Cell separation, cell binding, and bead removal were all incorporated into the expanded capabilities.

Japan CDMO Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13,147.6 million

Revenue Forecast in 2030

USD 19,497.4 million

Growth rate

CAGR of 6.8% from 2024 to 2030

Historical data

2018 - 2022

Based year for estimation

2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments Covered

Product type, workflow, application

Key companies profiled

CordenPharma; Wuxi AppTec; Cambrex Corporation; Recipharm AB; Lonza; Laboratory Corporation of America Holdings; Catalent, Inc.; Thermo Fisher Scientific, Inc. (Pantheon); Samsung Biologic; FUJIFILM Corporation; NIPRO; Sumitomo Chemical Co., Ltd.; CMIC Holdings Co., Ltd.; and Bushu Pharmaceuticals Ltd

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Japan Contract Development And Manufacturing Organization Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Japan CDMO market based on product type, workflow, and application:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

API

-

Type

-

Traditional Active Pharmaceutical Ingredient (Traditional API)

-

Highly Potent Active Pharmaceutical Ingredient (HP-API)

-

Antibody Drug Conjugate (ADC)

-

Others

-

-

Synthesis

-

Synthetic

-

Solid

-

Liquid

-

-

Biotech

-

-

Drug

-

Innovative

-

Generic

-

-

Manufacturing

-

Continuous manufacturing

-

Batch manufacturing

-

-

-

Drug Product

-

Oral solid Dose

-

Semi-Solid Dose

-

Liquid Dose

-

Others

-

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical

-

Commercial

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Hormonal

-

Glaucoma

-

Cardiovascular Diseases

-

Diabetes

-

Others

-

Frequently Asked Questions About This Report

b. The Japan contract development and manufacturing organization market size was estimated at USD 12.3 billion in 2023 and is expected to reach USD 13,147.6 million in 2024.

b. The Japan contract development and manufacturing organization market is expected to grow at a compound annual growth rate of 6.8% from 2023 to 2030 to reach USD 19,497.4 million by 2030.

b. Based on product, the API segment dominated the market and accounted for the largest revenue share of 81.2% in 2023. Growing demand for new drugs in Japan and high disease are expected to support segment growth.

b. Some of the key market players operating in the Japan CDMO market are, CordenPharma; Wuxi AppTec; Cambrex Corporation; Recipharm AB; Lonza; Laboratory Corporation of America Holdings; Catalent, Inc.; Thermo Fisher Scientific, Inc. (Pantheon); Samsung Biologic; FUJIFILM Corporation; NIPRO; Sumitomo Chemical Co., Ltd.; CMIC Holdings Co., Ltd.; and Bushu Pharmaceuticals Ltd.

b. Key factors that are driving the Japan CDMO market growth include growing demand for biopharmaceuticals, high burden of diseases and rising geriatric population.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."